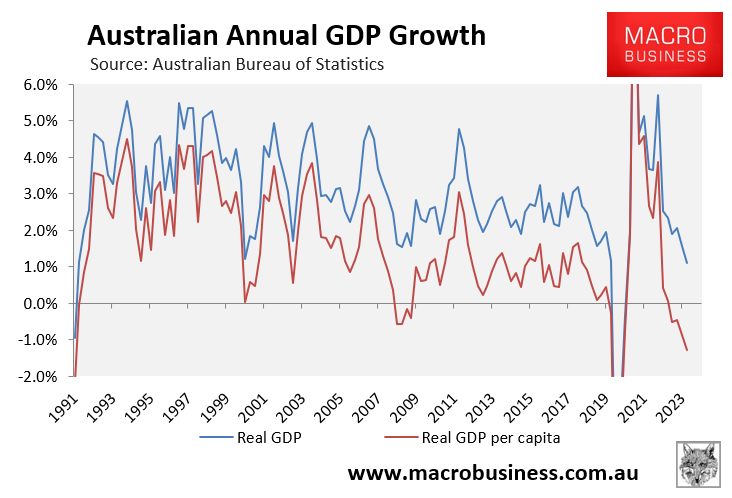

This month’s national accounts release from the Australian Bureau of Statistics (ABS) showed that growth in real GDP and per capita GDP plunged to their lowest level since the early 1990s recession:

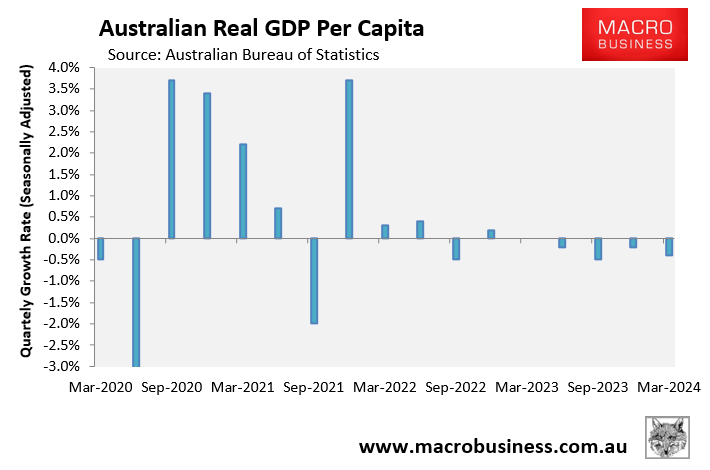

Australian per capita GDP is now tracking at late 2021 levels after falling by 1.3% year-on-year:

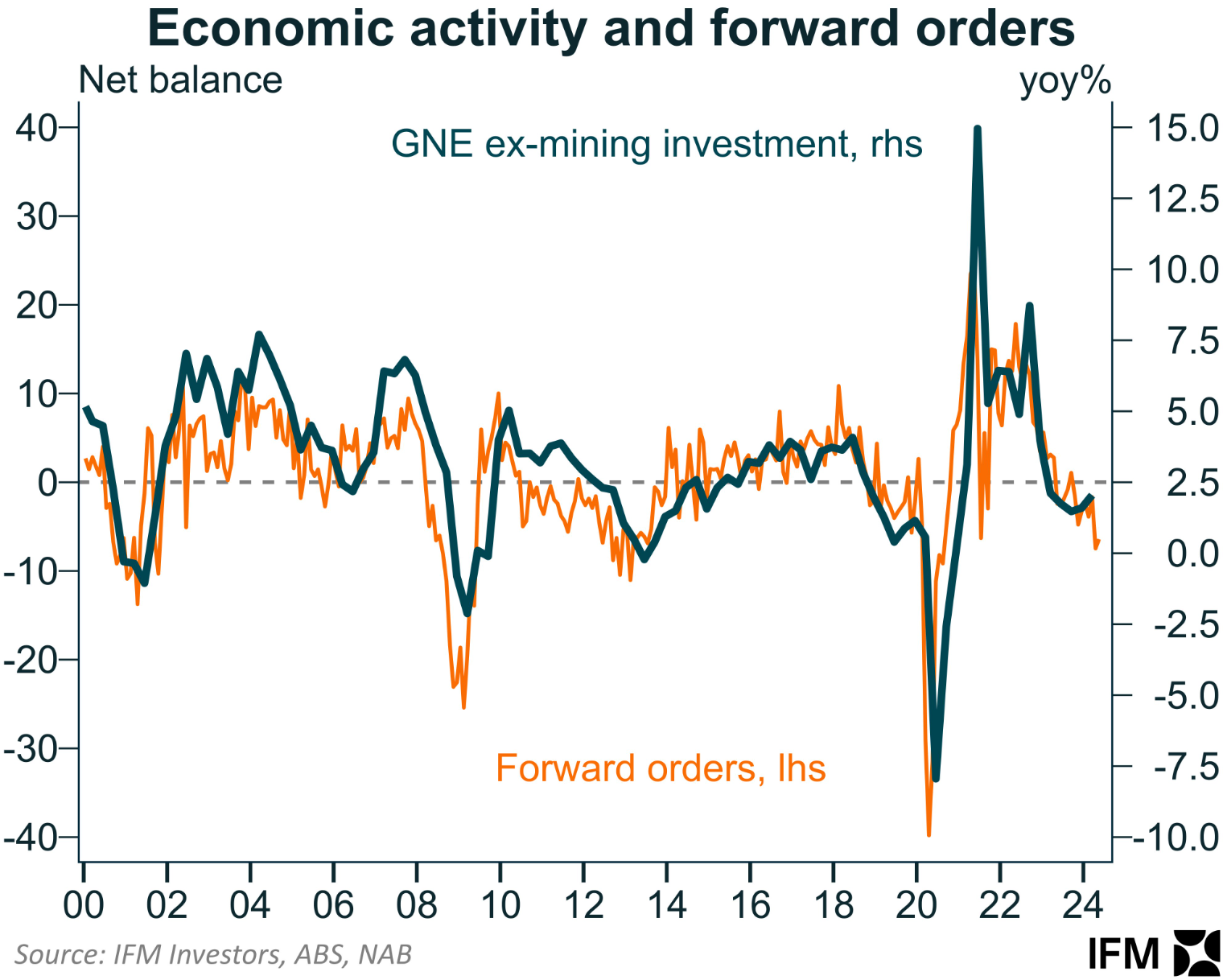

Both business confidence and conditions have eased in recent months, suggesting the weak economic activity from Q1 24 continued into Q2 24.

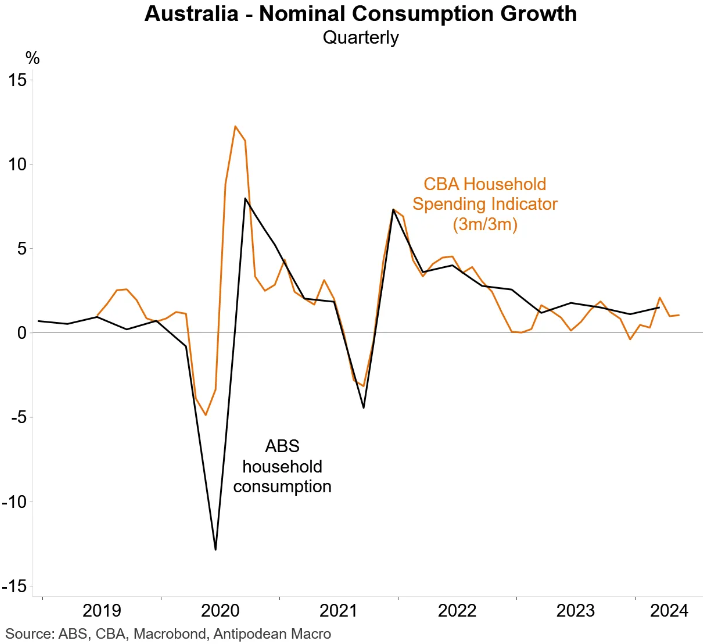

The CommBank Household Spending Insights (HSI) data did show a bounce of 1.1% in May, after a fall of 0.8% in April.

However, the data has been volatile of late due to the shift in Easter into March this year.

Looking at the average monthly increase since February indicates that the trend in household spending has been soft, averaging just 0.1% each month.

Spending on essential items has outperformed discretionary items, according to CommBank.

The next chart from Justin Fabo at Antipodean Macro plots the CommBank HSI against the ABS household consumption measure and suggests that consumption has remained weak so far this quarter:

CommBank has per capita spending tracking at 2.9% in the year to May 2024, below CPI inflation of 3.6% in Q1.

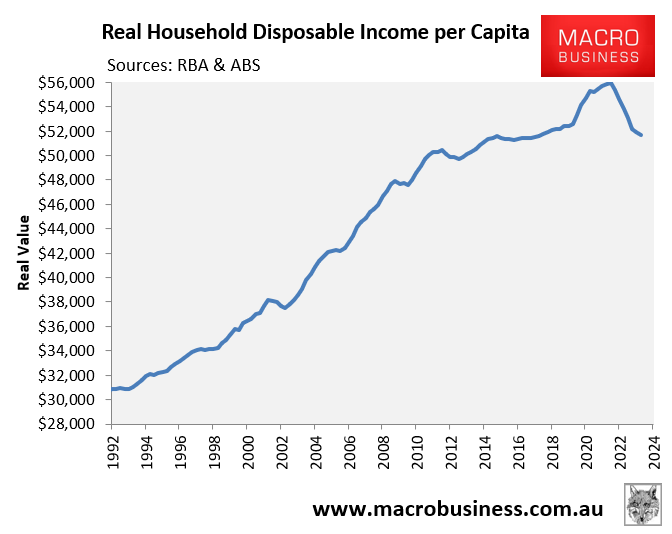

Therefore, overall real per capita household spending remains in negative territory, alongside real per capita household disposable incomes:

Based on the data flow to date, Q2 is shaping up to be another shocker for Australian households, with per capita consumption and GDP firmly stuck in recession.