Prominent Sydney real estate agent and auctioneer, Tom Panos, believes that “the boom of the first four months is gone”.

In his weekly auction market wrap, Panos noted that after “a sprint for a few months”, “buyer energy is getting a little bit fatigued”.

Panos also noted that “it’s very clear that the media and the Reserve Bank have actually got buyers on notice and that they are worried that they are not getting carried away like they were during the mini-boom that we had for the first four or five months of this year”.

“Prices are holding up reasonably well for only one reason. And that is supply”, Panos said.

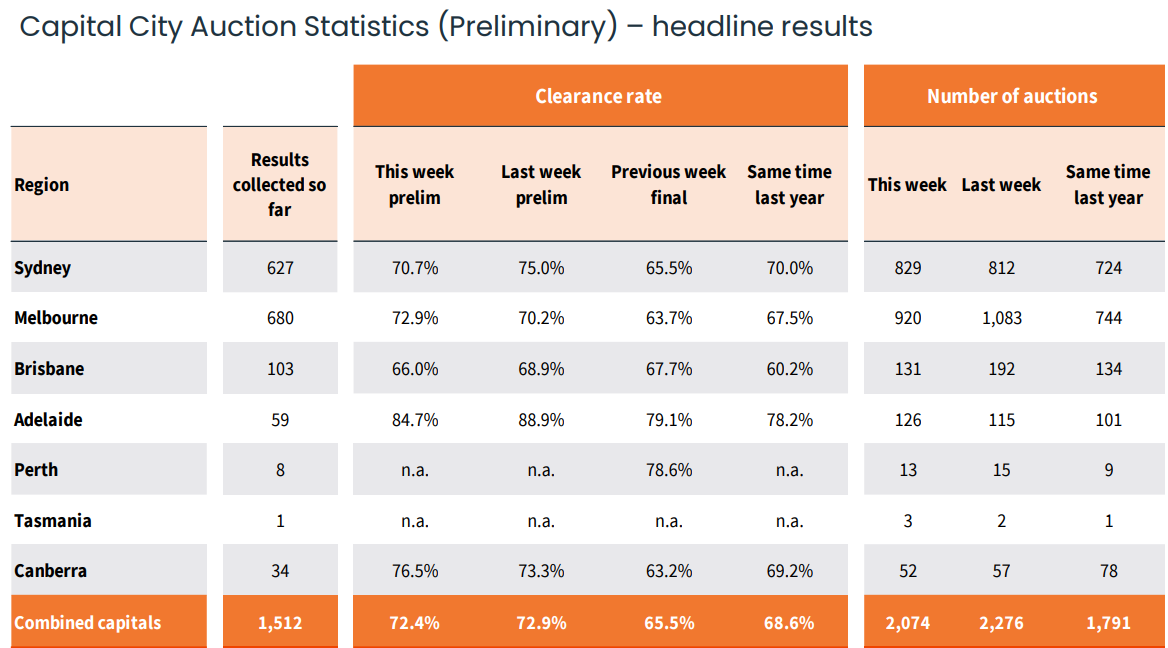

Panos’ comments come amid the latest preliminary auction results from CoreLogic, which show that auction clearance rates have actually firmed in recent weeks across the major markets:

Source: CoreLogic

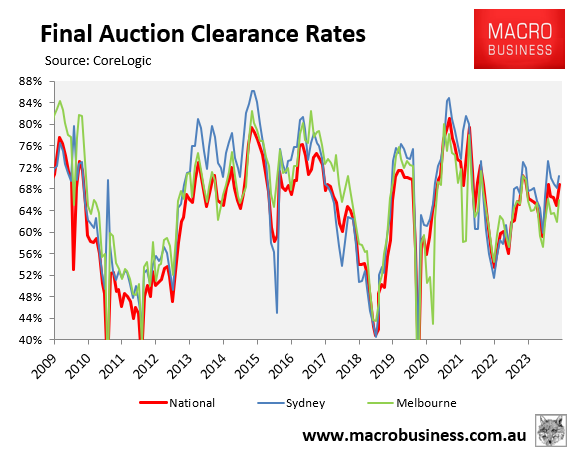

As illustrated in the next chart, final auction clearance rates to 16 June (i.e., not including this weekend) have bounced across Sydney, Melbourne, and the combined capital cities:

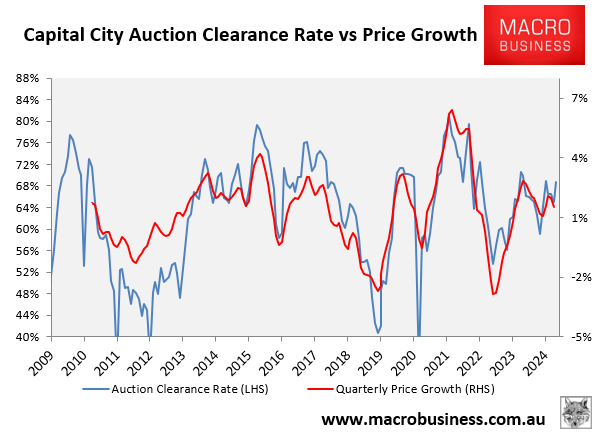

The rise in auction clearances would typically be associated with an increase in price growth, as illustrated clearly below:

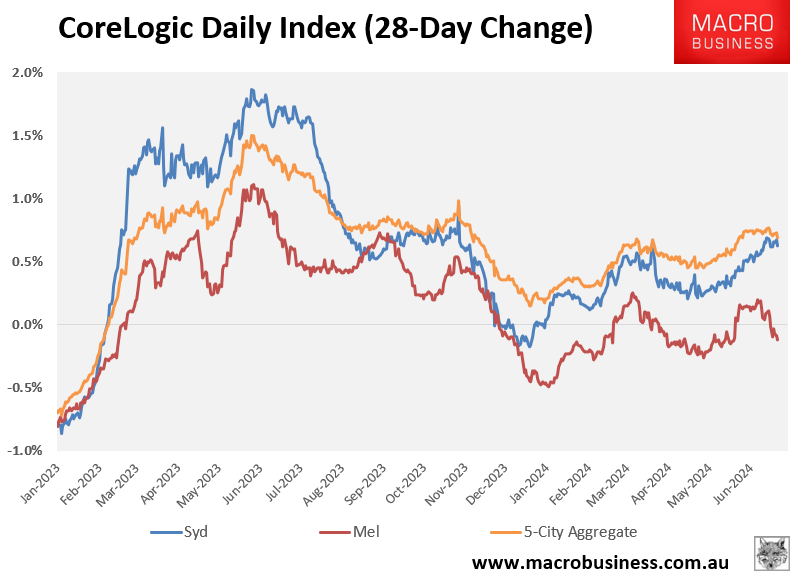

CoreLogic’s daily dwelling values index shows that price growth has accelerated in Sydney and the 5-city aggregate level, but have weakened materially in Melbourne:

Therefore, there isn’t any statistical evidence of the mini price boom in Sydney ending. It will be interesting to see whether the situation changes over the coming months.