AMP chief economist Shane Oliver has published research on the Australian housing market, which suggests that Australia’s housing shortage “will get worse before it gets better”.

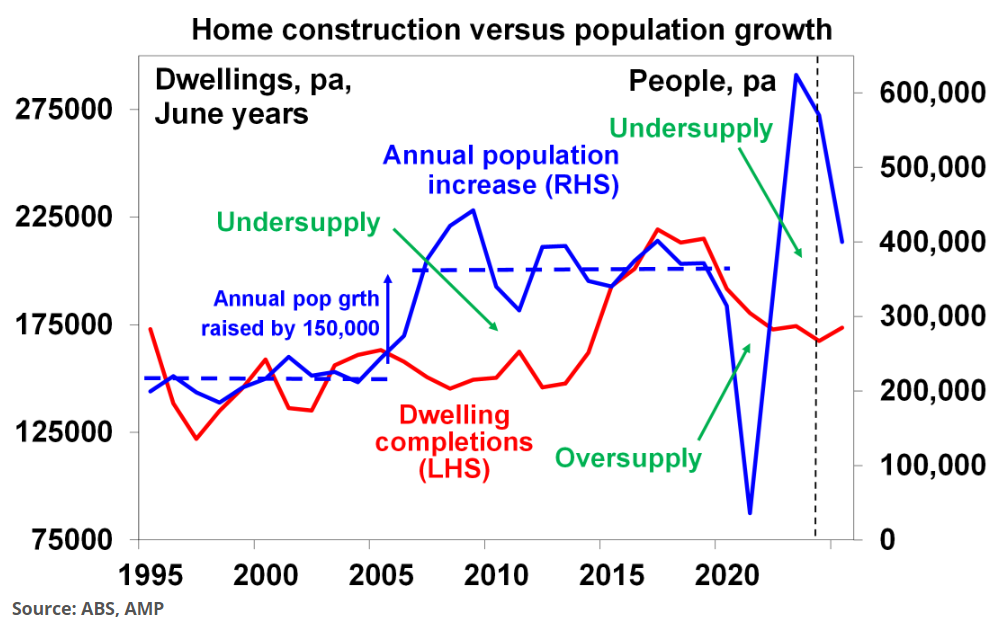

Oliver notes that “the surge in population growth to a record 660,000 over the year to the September quarter last year driven by record immigration levels meant that around an extra 250,000 new homes needed to be built”.

“But instead, completions have been running around 170,000 as the home building industry struggles to keep up with rising costs and material and labour shortages and as approvals to build new homes fell”.

As shown above by Oliver, Australia’s population growth surged in the mid-2000s after the federal government more than doubled net overseas migration.

Accordingly, Australia has experienced a persistent housing shortage for nearly 20 years.

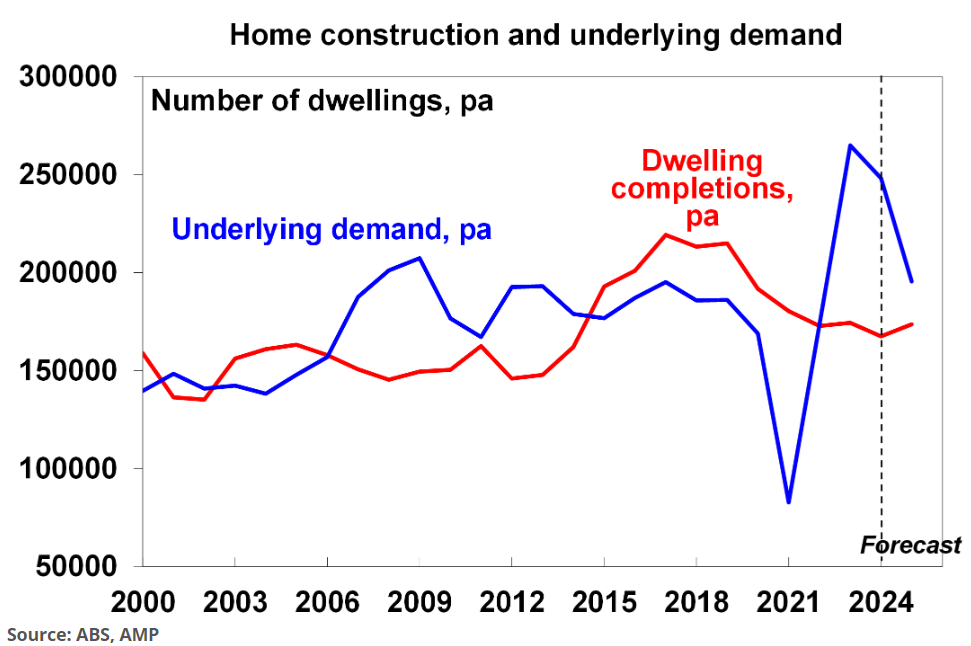

Oliver estimates that there was “an annual shortfall of around 90,000 dwellings in 2022-23 and another 80,000 dwellings this financial year (ie, the gap between the blue and red lines)”:

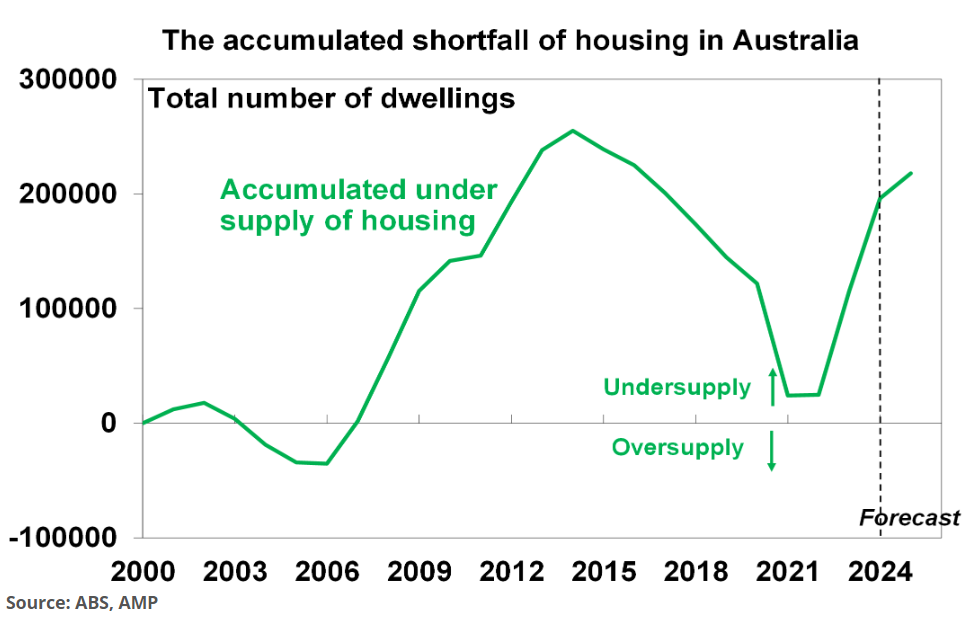

As a result, Oliver estimates an accumulated housing shortage of around 200,000 dwelling currently, which he says is a “conservative estimate”.

“If the decline in the average number of people per household seen in the last few years is sustained then the accumulated shortfall could be around 300,000 dwellings. Which would be well above where we were before the unit building boom got underway around 2015”, Oliver says.

Unfortunately for Australia’s army of suffering renters, Oliver believes “the housing shortfall looks like it will get worse before it gets better”.

While net overseas migration will likely retrace from current historically high levels, “housing construction is likely to remain depressed in the face of cost pressures and capacity constraints”, with “approvals are now running around 160,000 new dwellings a year”.

The upshot is that rental vacancy rates will continue to track near current lows and rental inflation will remain elevated.

It is an inequality disaster in the making for Australian renters that can only be fixed by slashing net overseas migration to a level that is below the nation’s capacity to build homes and infrastructure.