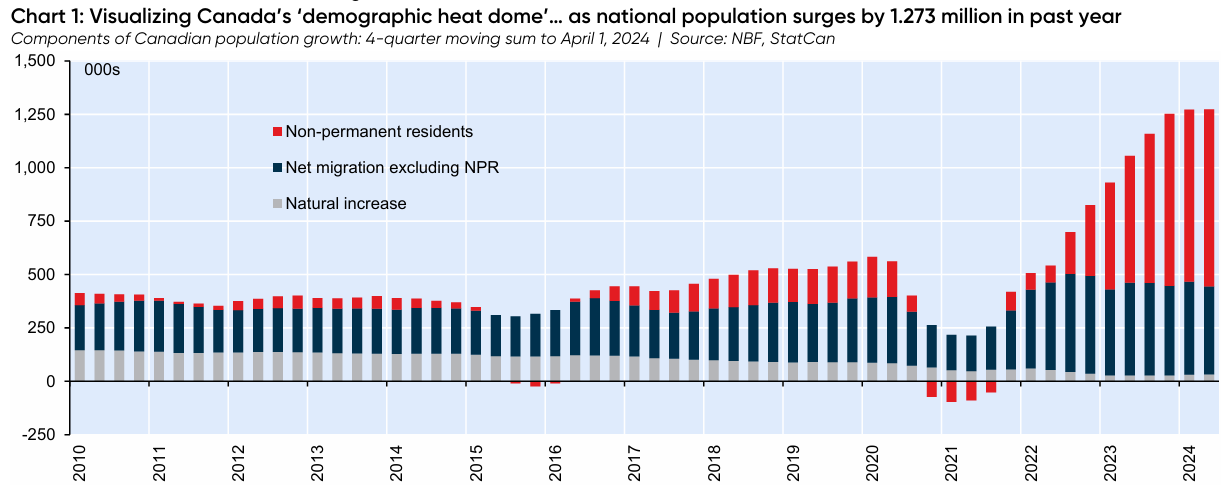

The latest population data from Statistics Canada was startling, with the country’s population surging by 1,273,000 people in the year to March 2024, representing a growth rate of 3.2%:

The National Bank of Canada described the population numbers as a “demographic heat dome”, with “atmospheric temperatures dialed up to downright dangerous levels”.

“You won’t find a larger four quarter increase in Canada’s population”, the Bank’s economists wrote.

Moreover, Canada’s population growth is overwhelmingly an immigration story, with 97% of the annual population increase coming from net overseas migration.

“That’s an unprecedented rate of increase, adding much strain to an under supplied housing stock to say nothing of other ‘system’ pressures, including on assorted public infrastructure”, the National Bank of Canada wrote.

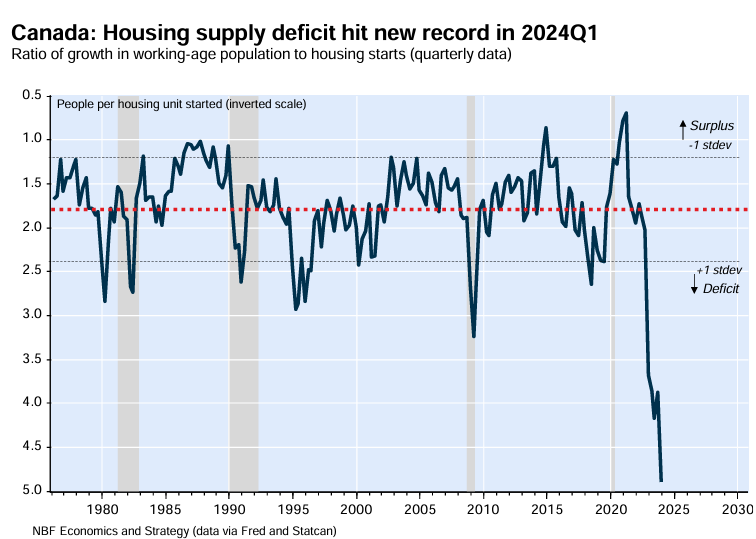

The impact on Canada’s rental market has been brutal.

The surge in immigration has created a record shortfall of housing supply relative to demand:

As a result, Canadian rental inflation has surged to unprecedented levels, hitting 8.9% in the year to May 2024:

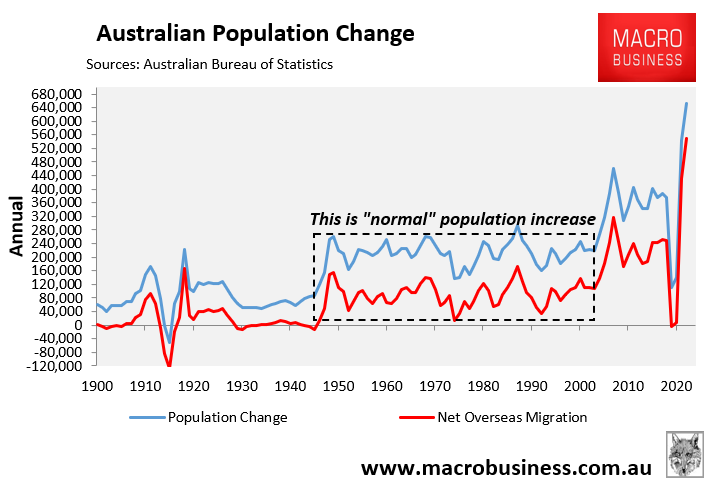

The situation is similar, albeit less extreme, in Australia.

Australia’s population ballooned by 651,200 in 2023, driven by record net overseas migration of 547,200:

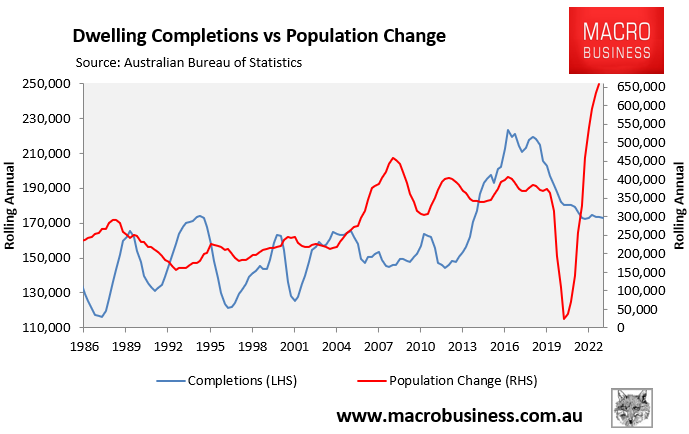

This unprecedented surge in net overseas migration has driven a record shortfall between housing supply and population demand:

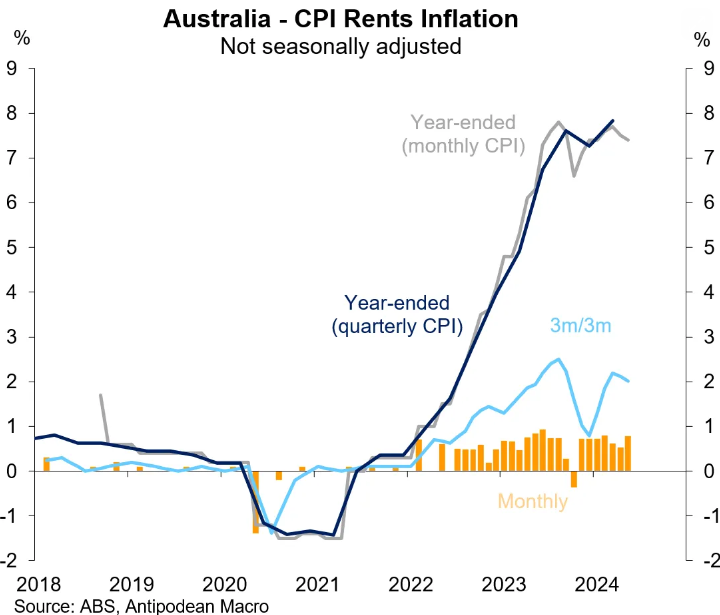

As a result, Australia’s rental inflation surged by 7.4% in the 12 months to May:

However, Australia’s rental inflation would have risen by 9.3% without the federal government’s increase in Commonwealth Rent Assistance.

Clearly, the decision by Albanese and Trudeau governments to run a record immigration policy has been an unmitigated disaster for tenants of both countries.

Millions of residents are now facing extreme financial stress, are being forced to live in group housing, or have been forced into insecure living arrangements and homelessness.