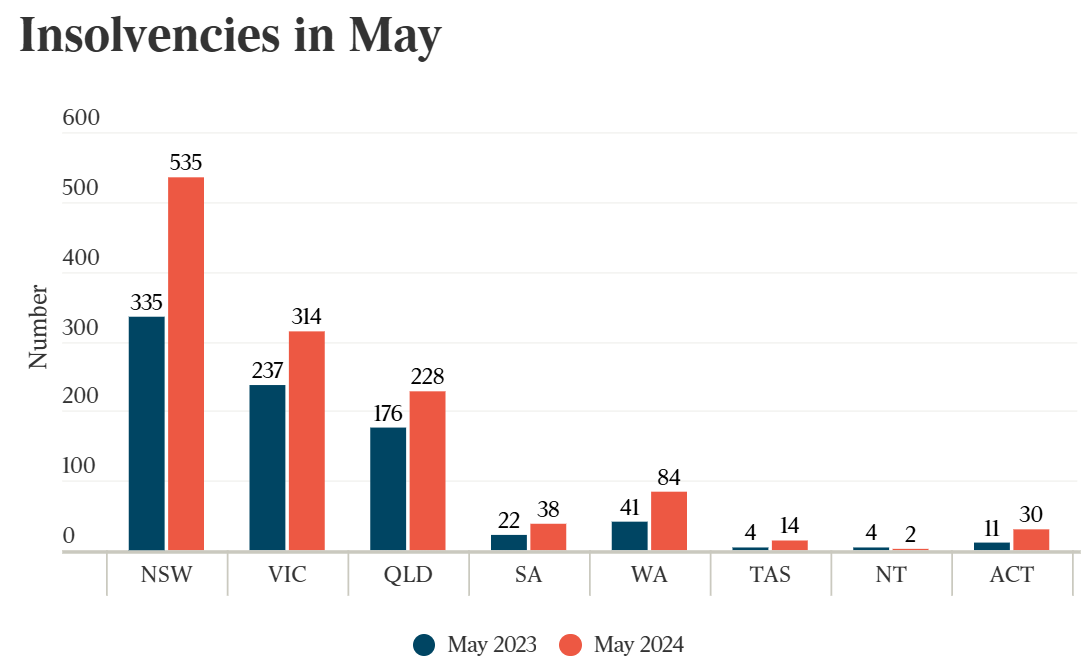

Data from the Australian Securities & Investments Commission (ASIC) shows that a total of 1,245 companies were declared insolvent in May.

This is 44% higher than the same period in 2023 and 122% higher than in May 2022. It is also the highest number of insolvencies in a single month since ASIC started reporting this data in 1999.

Chart from The Australian

Gayle Dickerson from KPMG warns that insolvencies probably have not peaked.

“We haven’t hit the peak yet and how long until we do remains a question, which will be driven by broad economic circumstances”, she said.

“At the moment, it is very evident at the small to medium enterprise level where we are seeing the impact of cost of living, discretionary spending and inflationary pressures”.

“There is no doubt, we’re in a tough economic cycle, and some of those pressures will start to shift up to larger companies towards the back end of the year”, she said.

Likewise, CreditorWatch chief executive Patrick Coghlan warned that insolvency records were likely to continue to be set each month for the rest of 2024.

“It’s hard to find an industry that hasn’t been significantly affected. You’ve got reduced discretionary spend, you’ve got inflation, which has pushed up all of their input costs. A lot of industries will struggle to increase their pricing to levels that make them profitable”, he said.

The surge in insolvencies was driven by the construction sector, which recorded 313 insolvencies in May – a record for this cycle.

Accommodation and food services insolvency appointments grew to 177 in May, whereas retail trade appointments jumped by 61% in May to 92.

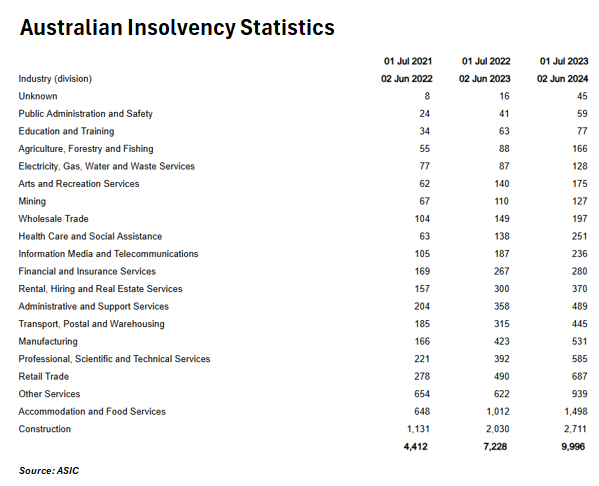

The following table from ASIC shows that there were 9,996 companies that entered external administration in the eleven months to 2 June 2024, up 127% from the same period in 2022:

The construction sector led the way, with 2,711 companies entering external administration so far in 2023-24, up 140% from the same period in 2022.

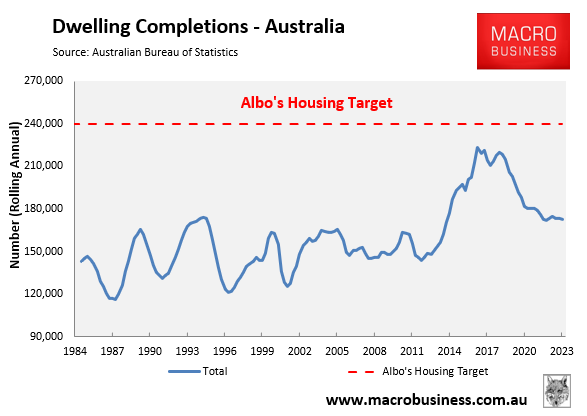

The high number of construction insolvencies presents another barrier to the Albanese government’s target of building 1.2 million homes in five years—a level of construction that Australia has never achieved before:

Obviously, having so many construction firms enter administration will greatly hamper the achievement of this target.