Economist Warren Hogan believes that “FOMO on steroids”, brought about by the growing undersupply of Australian dwellings, is behind the surge in Australian home values.

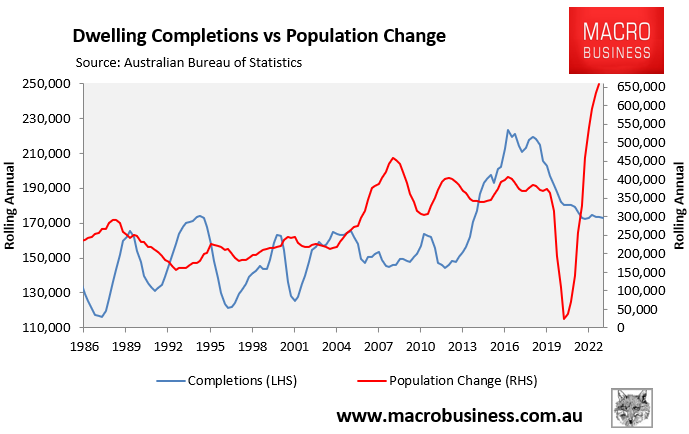

Hogan told The AFR that the ‘fear of missing out’ [FOMO] has hit fever pitch in Australia, driven by a housing shortage that is expected to hit some 300,000 over the next 18 months amid ongoing strong overseas migration and falling housing construction.

Hogan says that buyers are so fearful that the housing shortage will deteriorate and that prices will rise that their parents and grand parents are helping them get into the market.

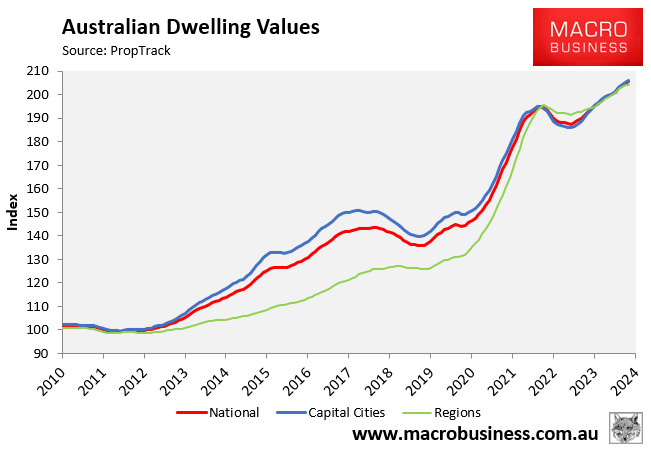

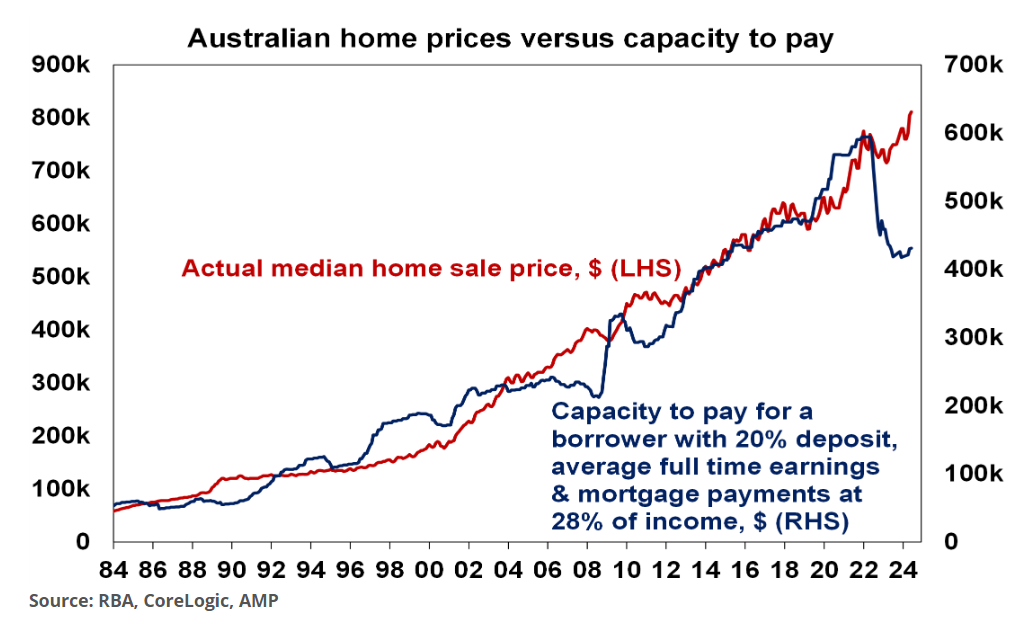

As a result, home values have risen well beyond what normal affordability metrics would dictate:

“Fear of missing out used to be a multi-month phenomenon that peaks around the spring selling season, but now it’s a multi-year event, that’s why I called it FOMO on steroids”, Hogan told The AFR.

“The perception that there is a massive shortage of homes motivates people to do whatever they can to get in [to the housing market], no matter how ridiculously expensive houses are”.

“People have the view that the shortage is going to last for a long time and that will mean prices will just continue to rise. And it’s not just fear of prices going up by 3% in the next three weeks, it’s the expectation that prices will go up by 20% in the next two to three years”.

“Even assuming there’s a pick-up in building activity, we’ll still be more than a year’s supply short, which means the undersupply is not a passing fad, it’s here to stay for some time”, Hogan added.

“Australia has never had a severe shortage like this in recent history, so this is a major market failure”.

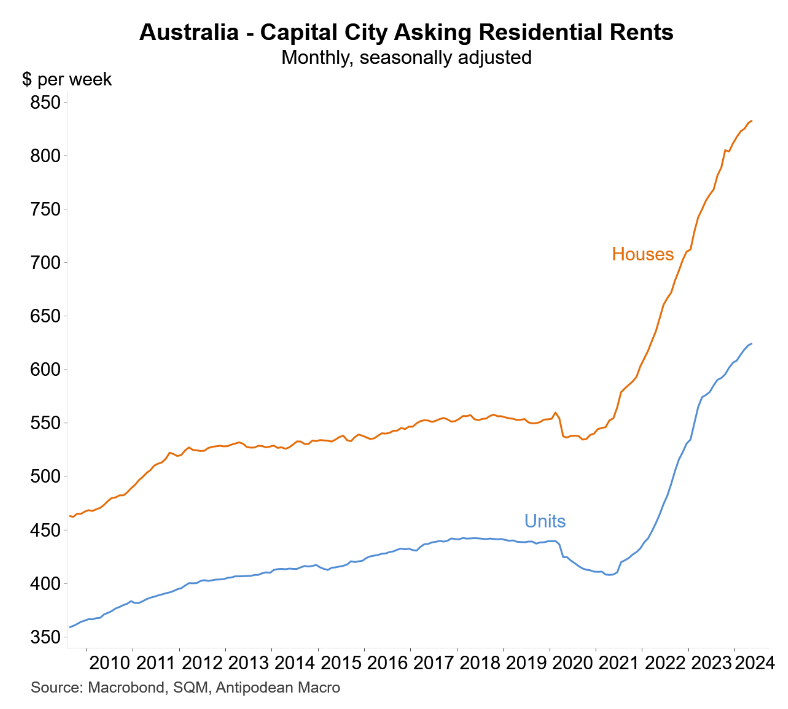

“The reality is that there is price tension in the housing market because rents are going up, because of the shortage of rental property, which is underpinning demand from first-home buyers and investors”.

“It’s not just the bank of mum and dad, it’s also the bank of grandparents, or the bank of aunties and uncles. This is playing a much bigger role than it ever has before”, Hogan explained.

The above is an excellent explanation of the current housing situation in Australia.

In a ‘normal’ Australian market, 13 interest rate rises from the RBA would have sent prices plummeting.

However, the unprecedented surge in population combined with the collapse in dwelling construction has driven a record undersupply of housing across Australia, which is expected to persist.

This undersupply of homes has driven rental vacancies through the floor and rental inflation the roof, driving first home buyers and investors into the market.

This frenzy has also become an intergenerational affair, with the ‘Bank of Mum & Dad’ and the ‘Bank of Grandma and Grandpa’ joining the fold and helping to push values higher.

The massive dislocation between home prices and serviceability will eventually come undone. Although your guess is as good as mine as to when that happens.