Equifax’s Executive General Manager, Moses Samaha, warned that Australia’s SME sector is facing a spike in insolvencies alongside the rise in mortgage arrears.

Equifax data has found that sole traders in construction are 60% more likely to be in early mortgage arrears versus the average consumer, whereas this figure is 75% for sole traders in the hospitality sector.

With insolvencies at their highest point since 2015, Equifax warns that a rise in interest rates may impact the survival of many businesses, especially SMEs in construction and hospitality.

“Across the board, many Australian consumers are struggling, with Equifax data showing that early stage mortgage arrears were up 30% in Q1 compared to the same period 2 years ago. But we’re seeing patches of even greater stress among SMEs and sole traders within certain industries”, Moses Samaha said.

“According to Equifax data, sole traders in construction are 60% more likely to be in early mortgage arrears versus the average consumer, and SMEs in this sector are 30% more likely to be in arrears”.

“Similarly, sole traders in the hospitality sector are 75% more likely to be in early mortgage arrears than the average consumer”.

“With insolvencies at their highest point since 2015, a rise in interest rates may impact the survivability of many businesses – particularly those, like the SMEs and sole traders in construction and hospitality, that are facing financial stress in both their professional and personal lives”.

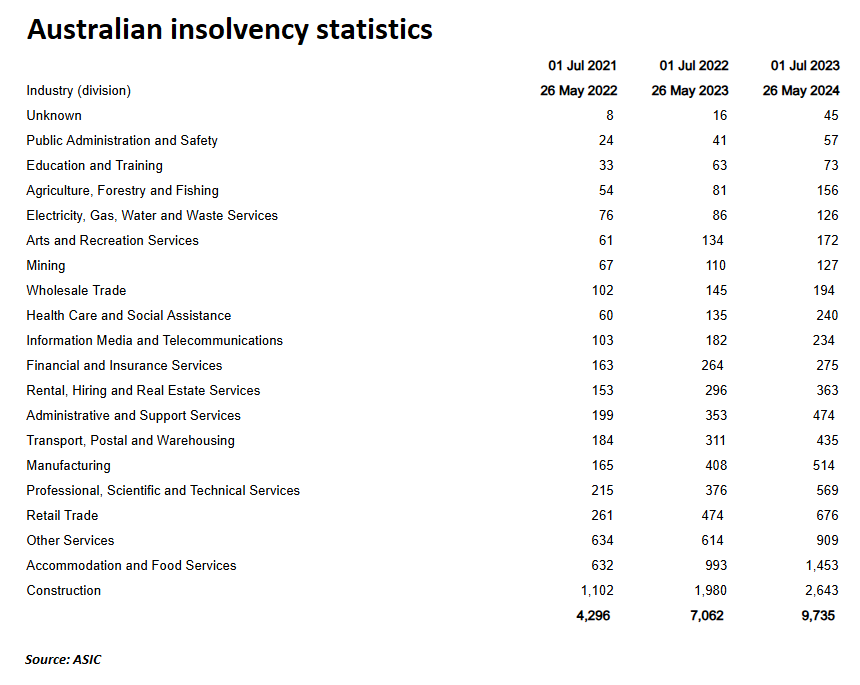

Equifax’s data aligns with ASIC’s insolvency statistics, which show that the number of firms entering external administration was 127% higher in the 11 months to 26 May 2024, than the same period in 2022:

As shown above, the surge in insolvencies has been driven by the construction sector (up 140%) and the accommodation and food services sector (up 130%).

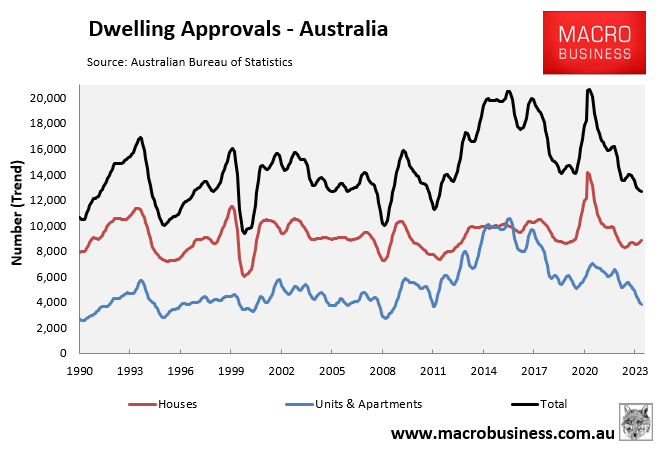

The surge in construction sector insolvencies is especially concerning, as it is further evidence that the Albanese government’s target of building 1.2 million homes in five years has no chance of being achieved.

In fact, construction rates are falling alongside the collapse in the building sector:

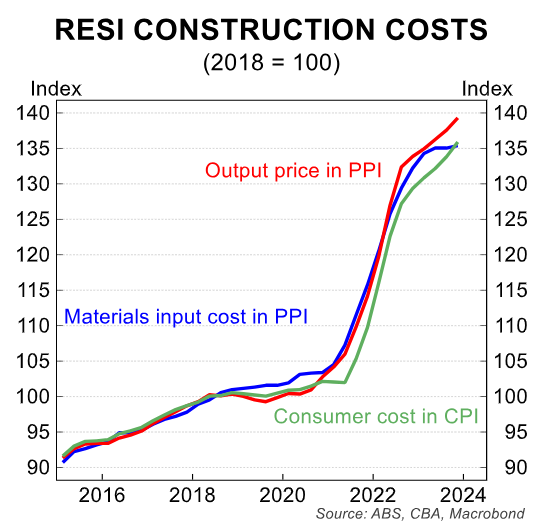

The cold, hard truth is that residential construction costs have surged by between 30% and 40% since the beginning of the pandemic, which has made it unprofitable to build homes.