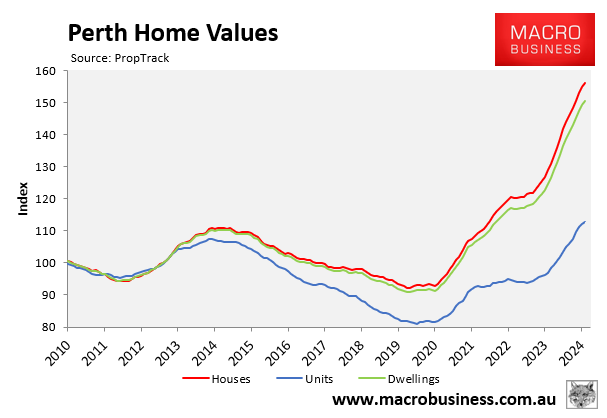

According to PropTrack, Perth dwelling values have soared by 64% since the beginning of the pandemic in March 2020.

The latest price forecasts from Domain and NAB project that Perth will lead the nation’s price growth this year and next amid feverish demand.

Perth’s house price boom is being driven by a combination of factors.

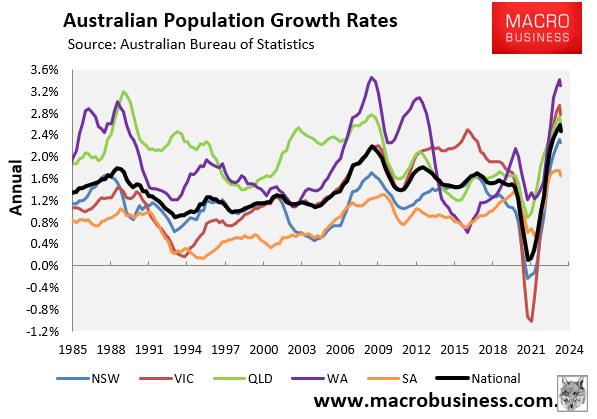

First, Western Australia (led by Perth) is experiencing the nation’s fastest population growth:

Western Australia’s population grew by 3.3% in 2023, much faster than the national rise of 2.5%.

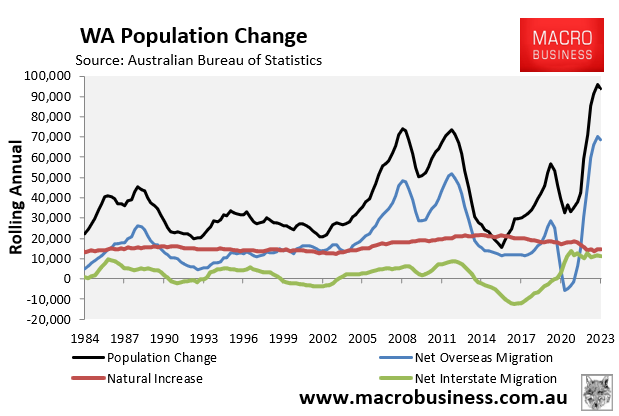

Strong net migration from overseas and from other Australian states has driven this extreme population increase.

Second, East Coast investors are helping to drive up home prices, with many paying above asking prices and buying homes site unseen.

Hotspotting director Terry Ryder described Perth’s housing market as a “frenzy” that may ultimately lead to pain for some buyers.

“Many will regret decisions made in haste amid the frenzy”, he said.

“The latest sales volumes data suggests that the Perth market has passed its peak in terms of buyer activity”…

“Our new analysis shows a significant drop-off in sales across Greater Perth in the past six months”.

“There are a number of other signals that the peak has been reached, or passed, in this market – including longer “days on market” in some areas and price decline at the top end of the market”, he said.

What Ryder has described above sound a lot like the formation of a price bubble.

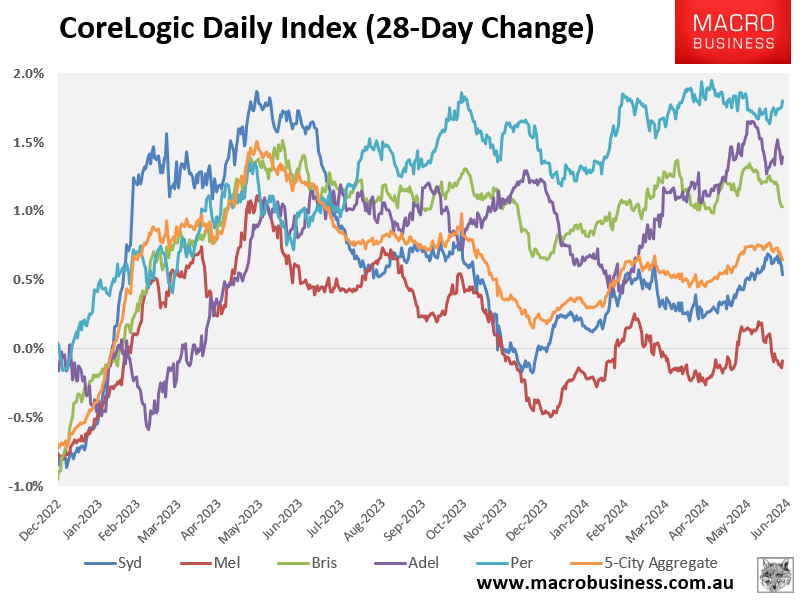

Certainly, CoreLogic’s daily dwelling values index shows no signs of slowing, with Perth values growing by 1.8% over the past 28-days:

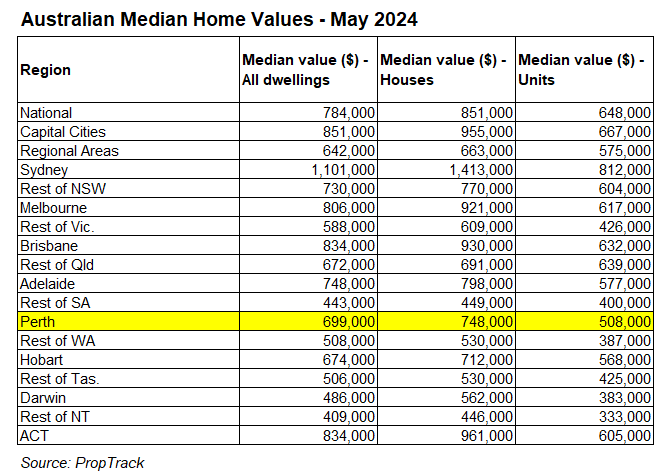

There is also more upside risk, given that Perth housing is still relatively affordable compared to the East Coast capitals:

That being said, Perth’s housing market has been notoriously boom and bust, with values tanking by 18% in nominal terms and significantly more in real terms between 2014 and 2019.

At some point, Perth’s housing market will bust again. And I wouldn’t want to be an East Coast raider paying significantly above asking prices near the top of the market.