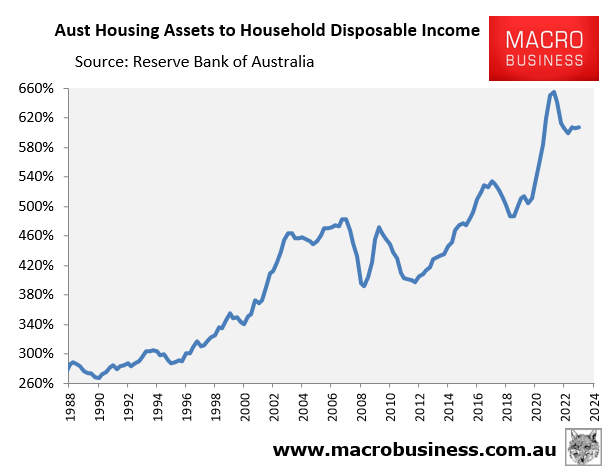

Reserve Bank of Australia (RBA) statistics show that Australian housing values have doubled relative to household incomes over the past 30 years:

This doubling in valuations has arisen despite the growing prevalence of double-income households.

Last week, satirical Twitter (X) user The Reserve Bank of Property posted the below video from the 1960s showing Australians purchasing large blocks of residential land for only $3,100 in Sydney:

The difference between today on who has rich parents or are parents of inferior renters. They should have bought for $3100 back in the day. Always be the highest bidder at auction. pic.twitter.com/1pbsd7xe4r

— Reserve Bank of Property (@RBASHAGGER) June 18, 2024

One of the would-be buyers stated that it is “ridiculous to pay such a lot of money for a block of land”.

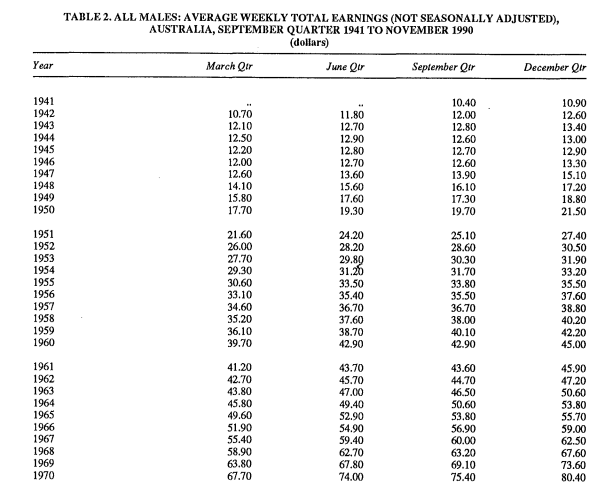

I know what some of you think: Australians earned far lower incomes in the 1960s than today. And you are correct.

According to the Australian Bureau of Statistics (ABS), the Average Weekly Male Earnings in the December quarter of 1965 were $55.70 a week, or $2,896 a year:

Therefore, the $3,100 for the block of land cited above equates to just over one year’s gross average male earnings.

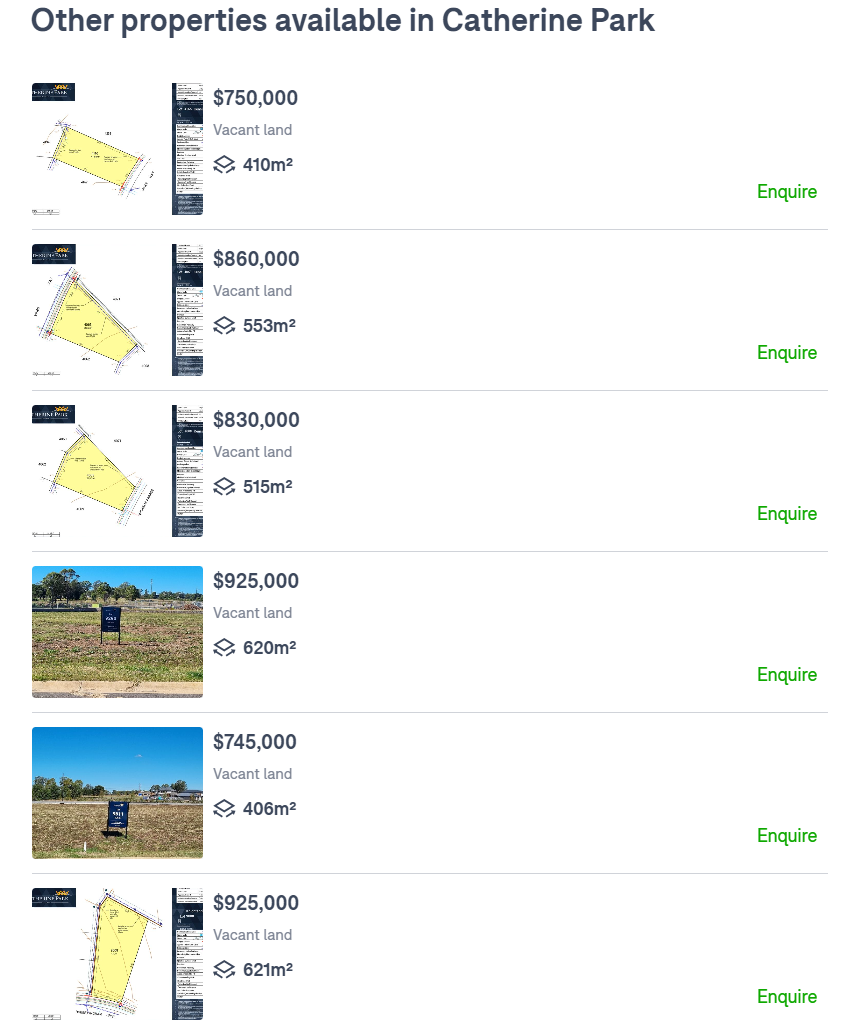

Now fast forward to today, where small Sydney housing lots in far-flung satellite suburbs are selling for $750,000 plus:

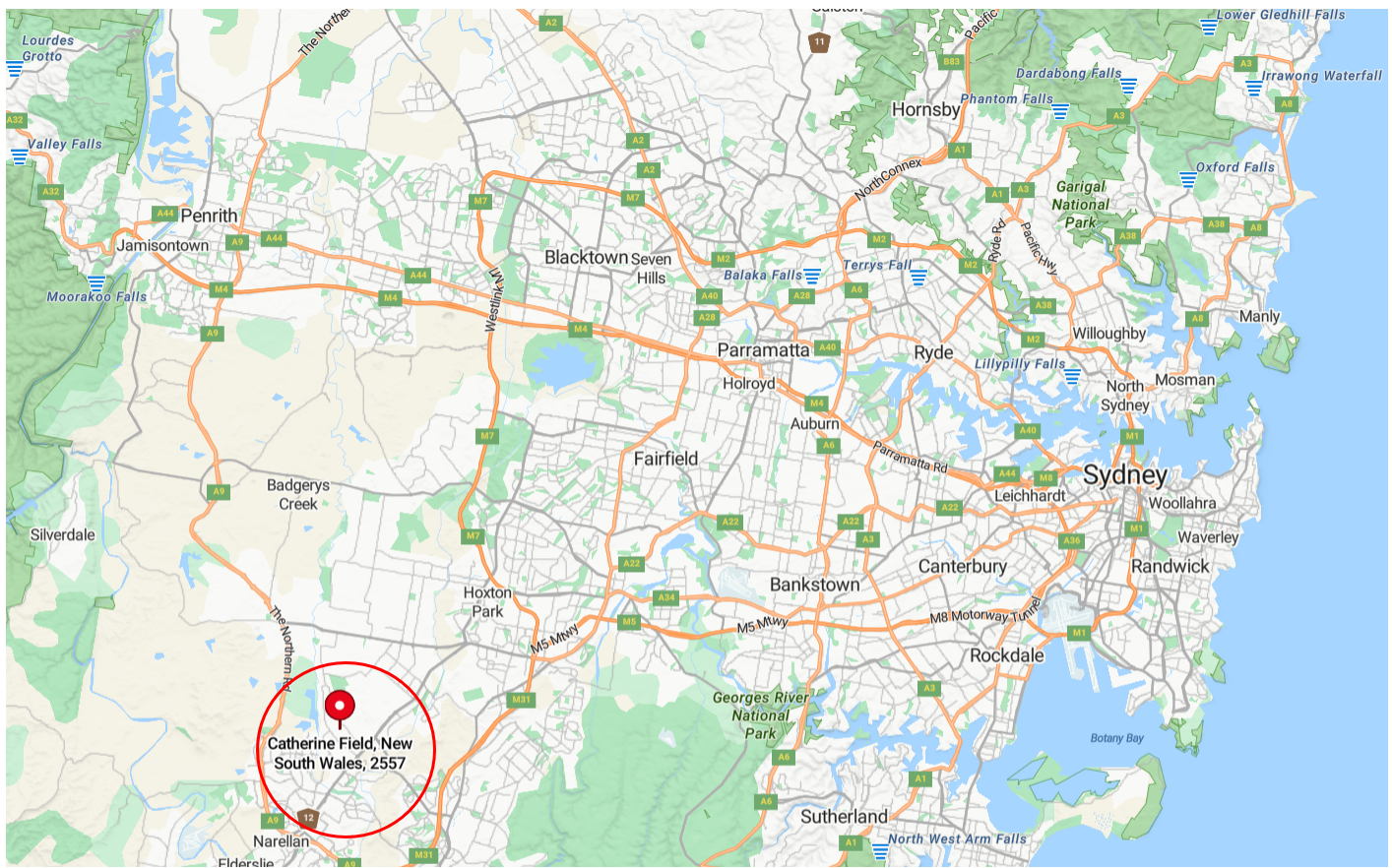

Check out the location of the above Catherine Park Estate development. It is more than 40 kilometres south-west of the Sydney central business district:

Remember this post the next time an older Australian tries to lecture you about home ownership, the importance of self-sacrifice, financial responsibility, and how buying a home was “tougher in my day”.

The reality is that for today’s young home buyers, even buying a small starter home in the middle of nowhere is near impossible in Sydney without family help.

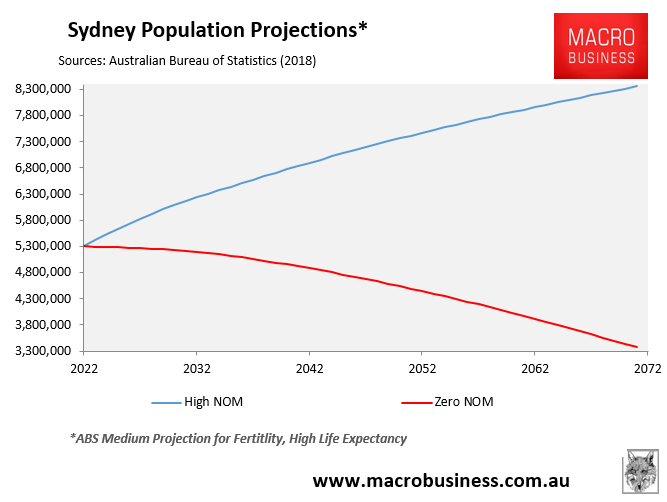

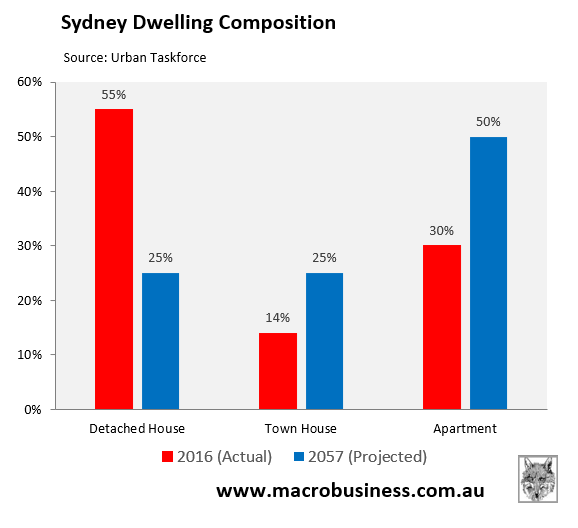

Moreover, it will only become harder as Sydney’s population swells via mass immigration and the city’s housing composition morphs into high-rises:

By the middle of this century, high-rise apartments are projected to make up half of Sydney homes, whereas detached houses with backyards will constitute only one quarter of homes.

Is this the future that we want for our children and grandchildren?