New Zealand’s economy may have emerged from recession in Q1, courtesy of headline GDP growth of 0.2%.

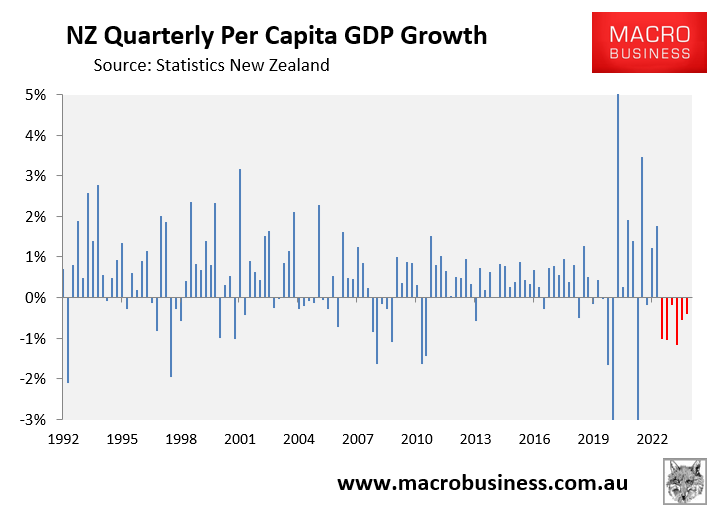

However, this does not mean that the economy is healthy, with real per capita GDP falling for six consecutive quarters to be down 4.3% from the late 2022 peak.

That represents a larger decline than the 4.2% per capita fall New Zealand recorded in the wake of the Global Financial Crisis.

David Hargreaves at Interest.co.nz noted over the weekend that economic data has weakened in Q2, suggesting that New Zealand’s per capita recession has deepened.

First, Hargreaves notes that New Zealand’s population surged by about 130,000, or 2.5%, in the year to March 2024 on the back of a massive net overseas migration.

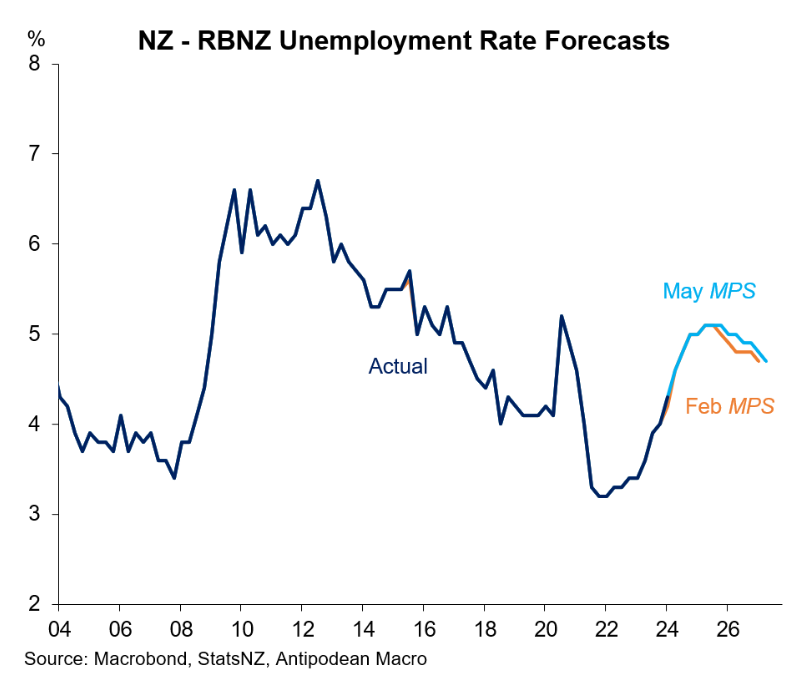

“This immigration surge soaked up the previous slack in the labour market”, Hargreaves wrote.

As a result, New Zealand’s unemployment rate rose to 4.3% in March, ahead of the Reserve Bank’s forecast of 4.2%.

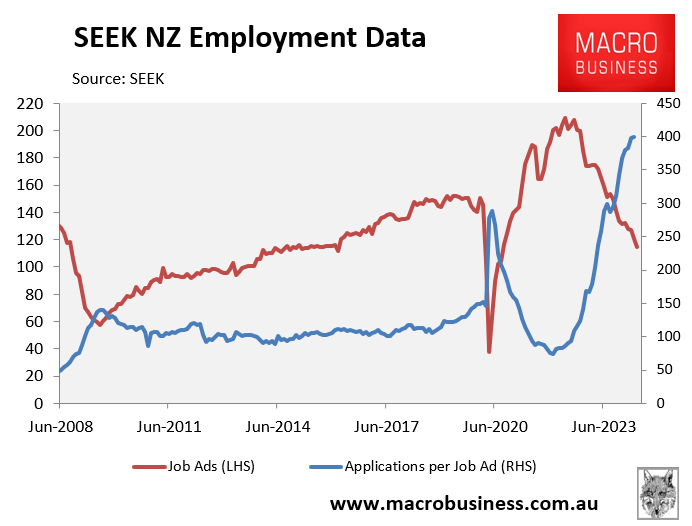

Worse, according to the latest BNZ-SEEK job ads report, job ads plunged by 4.8% in May to be 30.5% lower year-on-year and at their lowest level since since February 2016.

“This is a clear sign of continued contraction in the labour market”, says Hargreaves.

Indeed, with fewer ads and labour supply increasing, the number of applications per job ad continued to trend aggressively higher in April, up 69% year-on-year:

“Fewer job ads and more applications per ad are consistent with employment struggling to grow and an increase in the unemployment rate”, noted BNZ-SEEK.

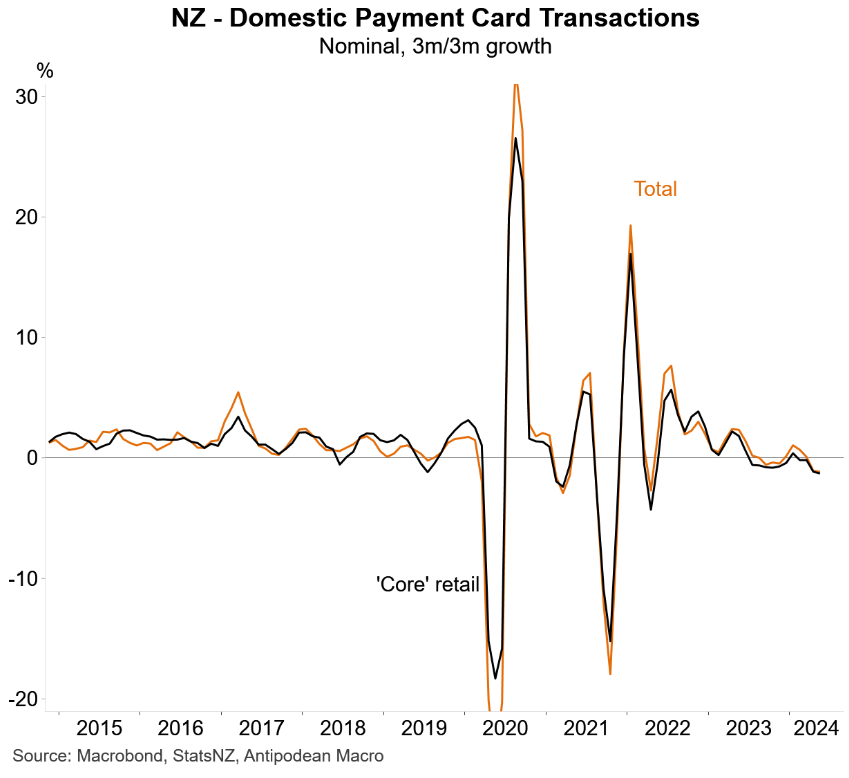

Next, Hargreaves pointed to electronic card transaction data for May, which reported the fourth consecutive monthly fall in retail sales, with May’s being the largest drop of the four.

“The wallets have been put away. Businesses that have been doing it tough are finding it’s suddenly getting even tougher”, wrote Hargreaves.

Next, Hargreaves noted that the BNZ – Business NZ Performance of Services Index (PSI) recorded the lowest level of activity for a non-COVID lockdown month since the survey began in 2007.

The services sector accounts for about two-thirds of New Zealand’s GDP. Therefore, “if it is sagging the economy is sagging”, says Hargreaves.

The Performance of Manufacturing Index was also “soft”, which BNZ economists says “points to GDP falling by more than many might care to believe” in Q2.

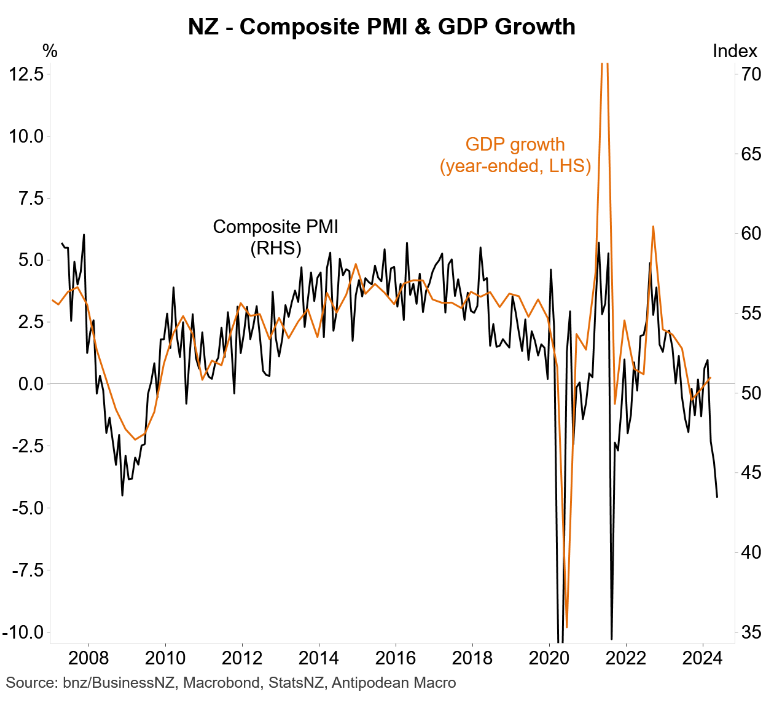

The next chart from Justin Fabo at Antipodean Macro tells the story, with New Zealand’s composite PMI collapsing, pointing to a sharp decline in Q2 GDP:

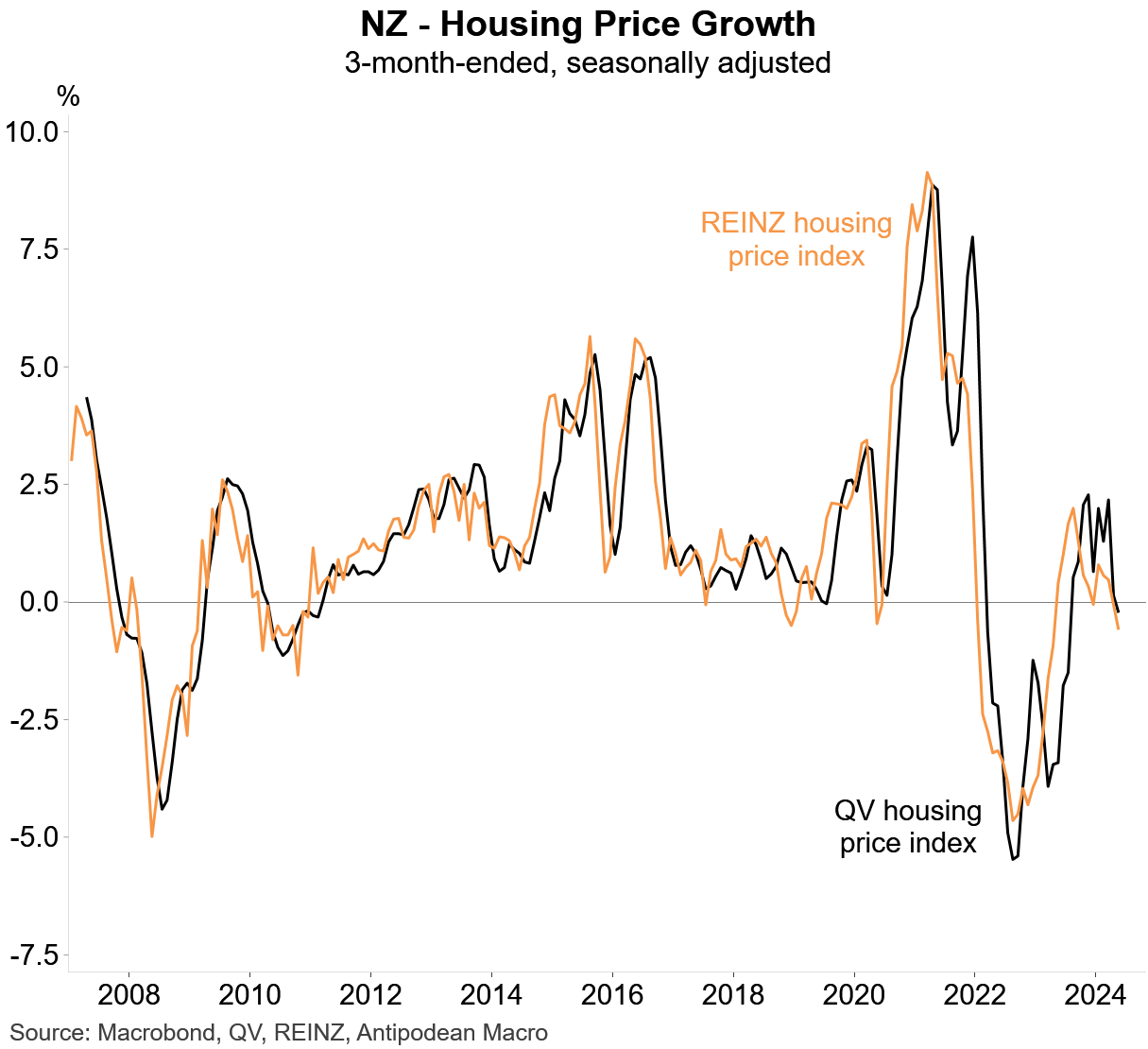

Finally, New Zealand’s housing market is once again in decline – both in terms of home values and construction.

The median price fell 2.5% in May, according to the Real Estate Institute of New Zealand, and declined by 1.2% after seasonal adjustment. “And there’s a glut of available houses”, says Hargreaves.

The overall picture is that New Zealand’s monetary policy is too restrictive, which has driven Kiwis deep into recession.

This is why I firmly believe that the Reserve Bank will soon follow Canada and commence an easing cycle. It cannot afford to let the economy slide deeper into the abyss.