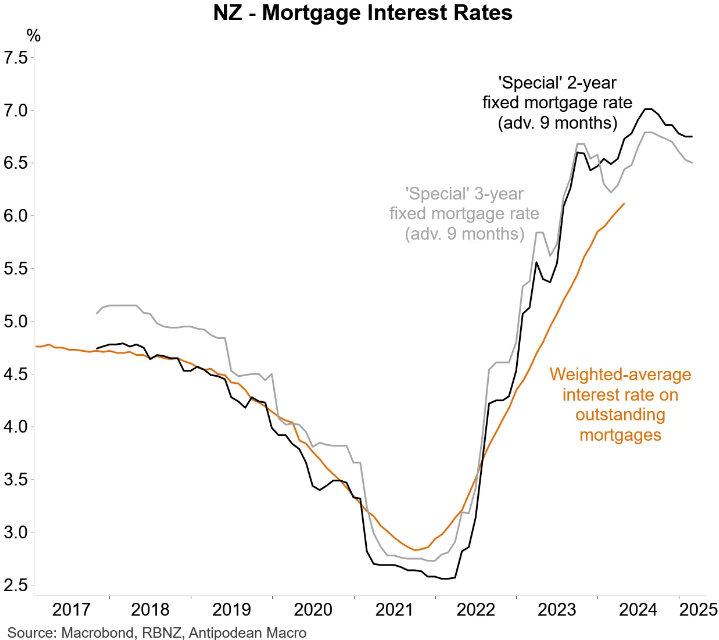

Justin Fabo at Antipodean Macro posted the following chart showing that the weighted average interest rate on outstanding mortgages in New Zealand continued to rise in April amid the ongoing expiry of fixed-rate mortgages, which are being rolled over at higher interest rates:

This increase in average mortgage rates represents de facto monetary tightening.

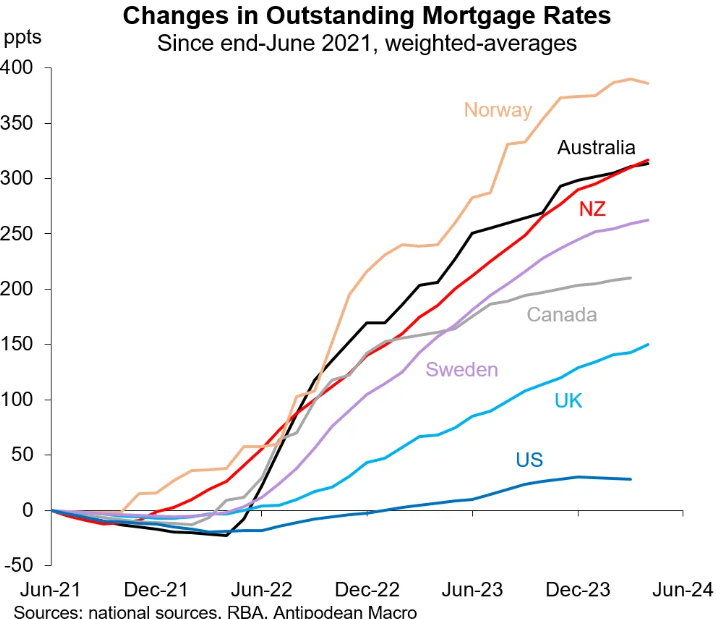

According to Fabo’s calculations, the increase in New Zealand’s outstanding average mortgage rate has now leapfrogged Australia’s and has risen by around 310 basis points since June 2021:

The Reserve Bank of New Zealand should take heed of the above data and move into a monetary easing cycle.

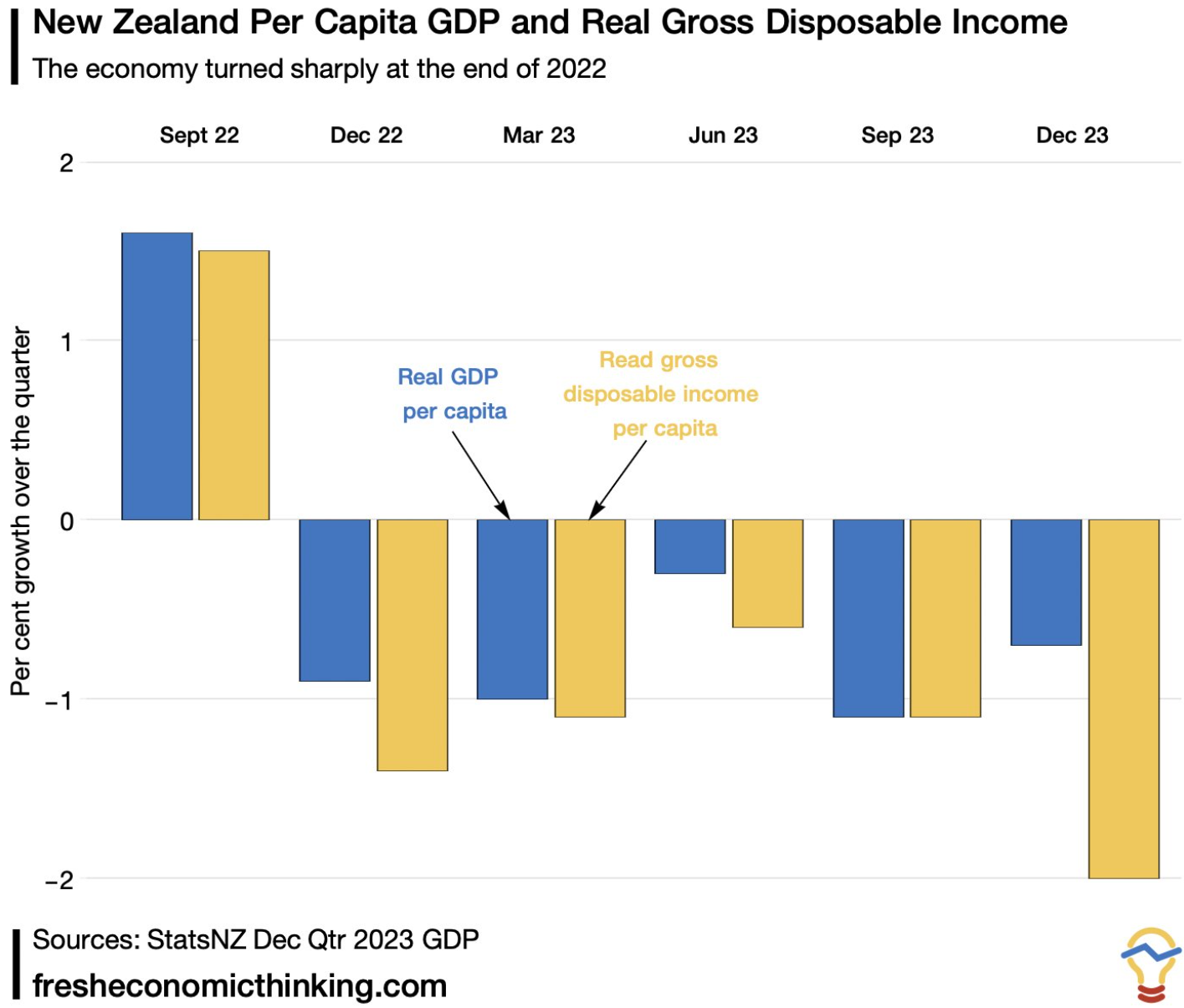

At the end of last year, New Zealand’s economy was already in a technical recession and a very deep per capita recession:

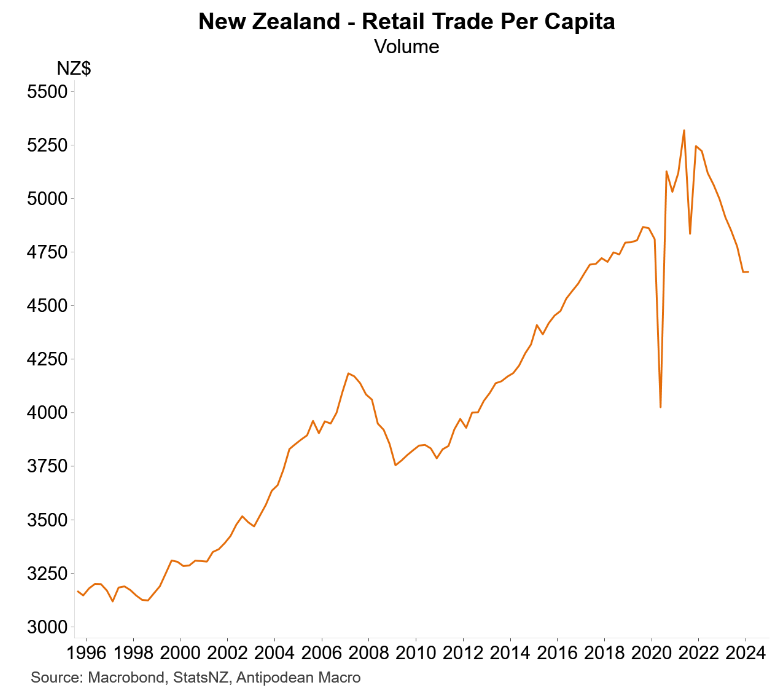

Retail sales per capita also plunged 12.4% from their high:

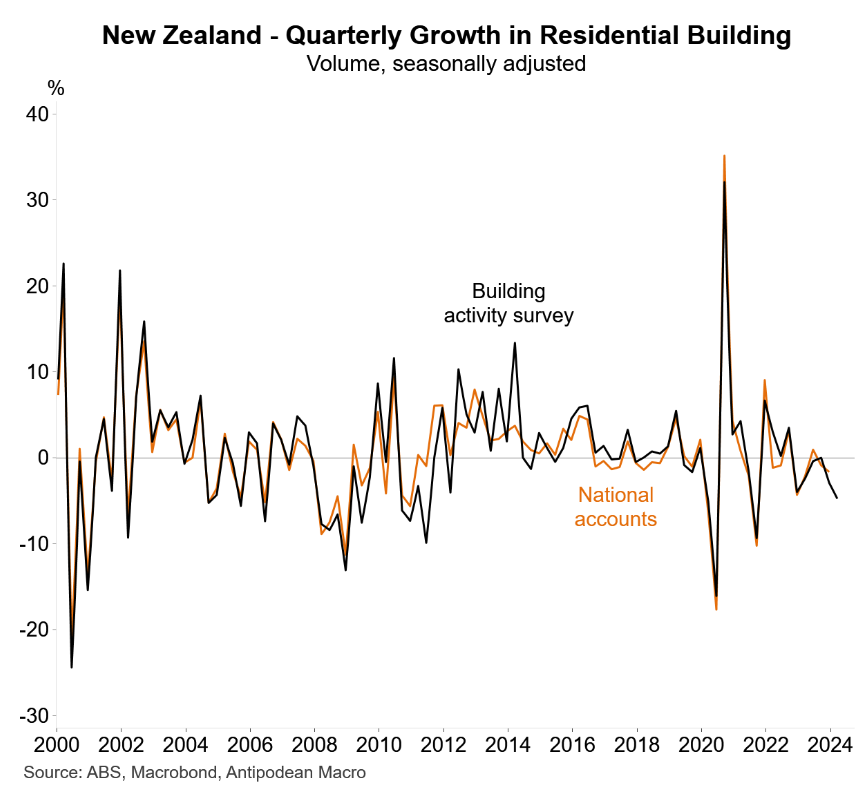

New Zealand’s residential building activity is likewise declining:

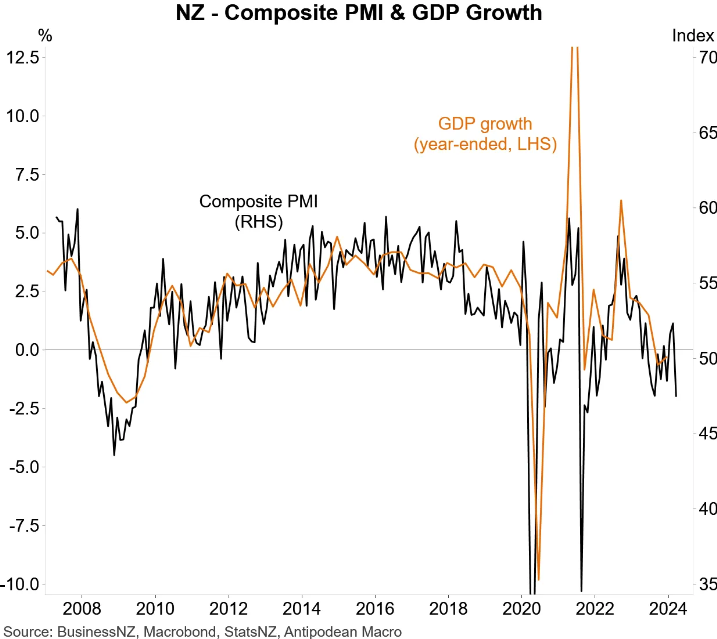

The composite PMI has also plummeted, pointing to a deeper recession when official GDP numbers for Q1 are revealed on 20 June:

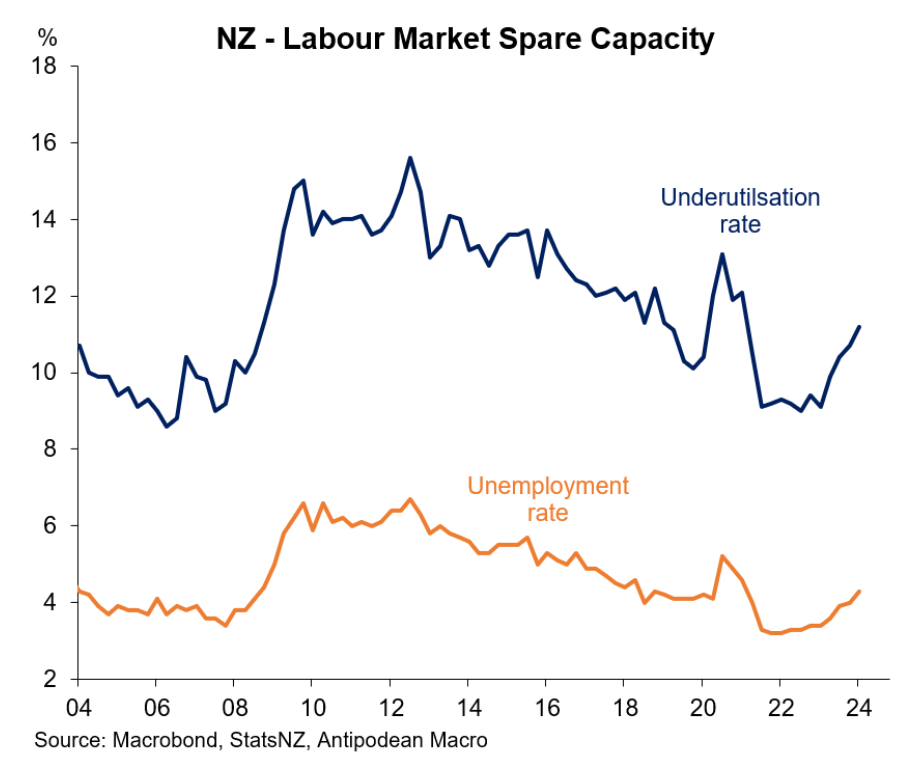

New Zealand’s official labour force data has also deteriorated significantly.

Unemployment and underemployment rates in New Zealand are rising, and this trend is expected to continue.

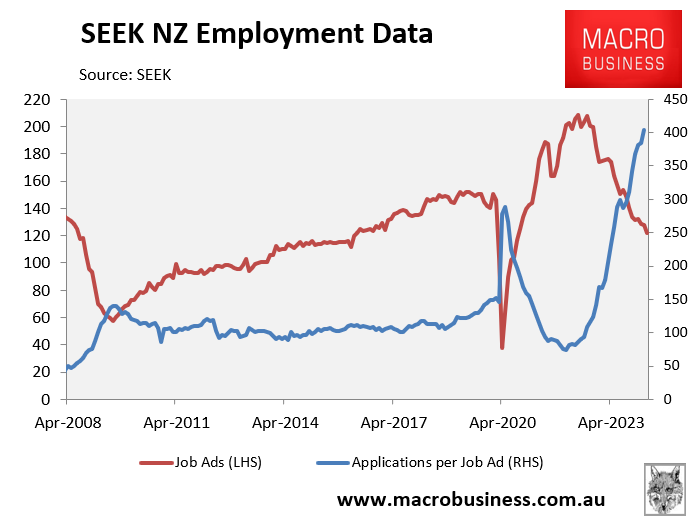

Worse is to come, given the record increase in the number of applications per job advertisement:

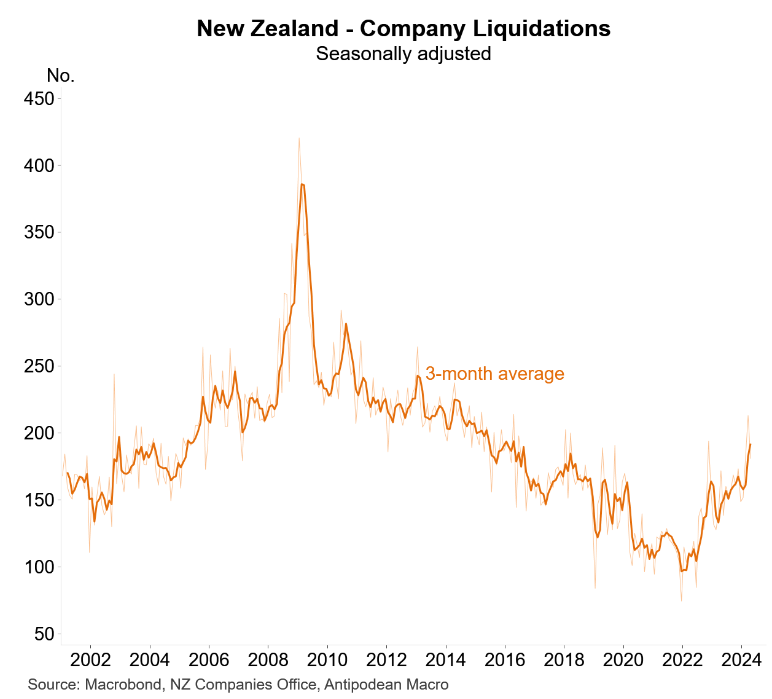

Company liquidations have also risen sharply in New Zealand:

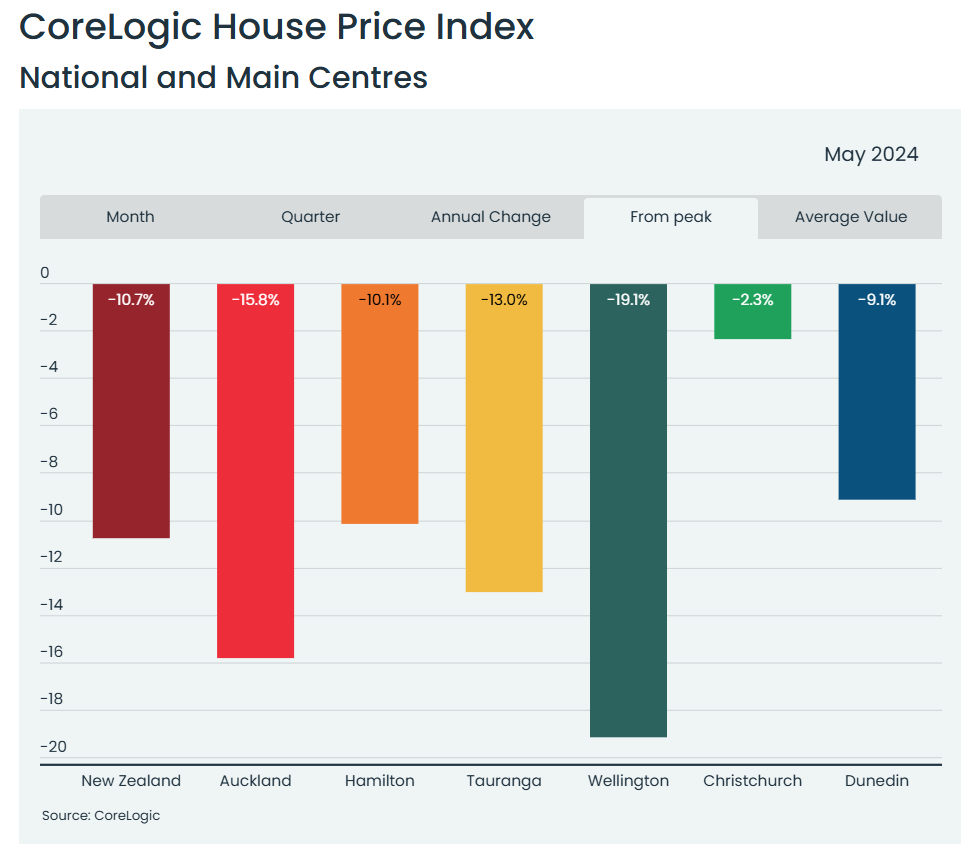

Finally, unlike in Australia, New Zealand home prices are falling, remaining 10.7% down from their peak, according to CoreLogic:

New Zealand’s economy is clearly sliding deeper into recession and monetary conditions are too tight.

The Reserve Bank should follow the Bank of Canada and commence an easing cycle.