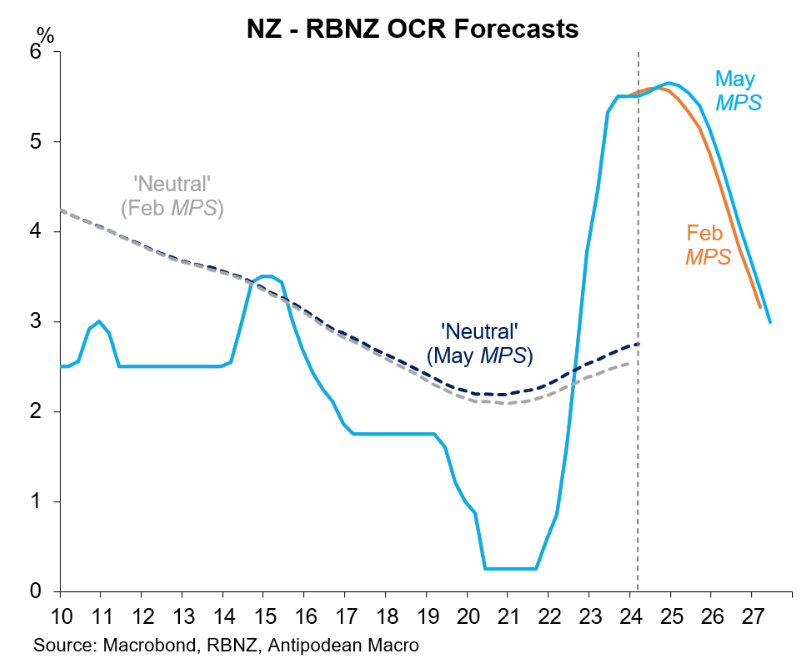

It is hard to believe that the Reserve Bank of New Zealand’s May Monetary Policy Statement lifted its forecast for interest rates.

As illustrated by the following chart from Justin Fabo at Antipodean Macro, the Reserve Bank indicated that the official cash rate could rise further before cuts begin late next year:

The Reserve Bank’s hawkishness is in contradiction to a wide range of data showing that New Zealand’s economy is deteriorating.

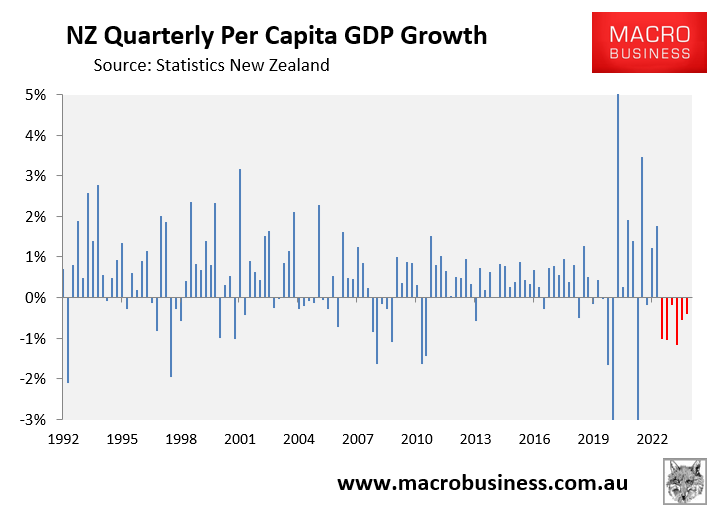

While the overall economy eked out 0.2% growth in the March quarter, per capita growth continued to plummet amid historically high net overseas migration.

Real per capita GDP has fallen for six consecutive quarters, down 4.3% from the late 2022 peak. That represents a larger decline than the 4.2% recorded in the wake of the Global Financial Crisis.

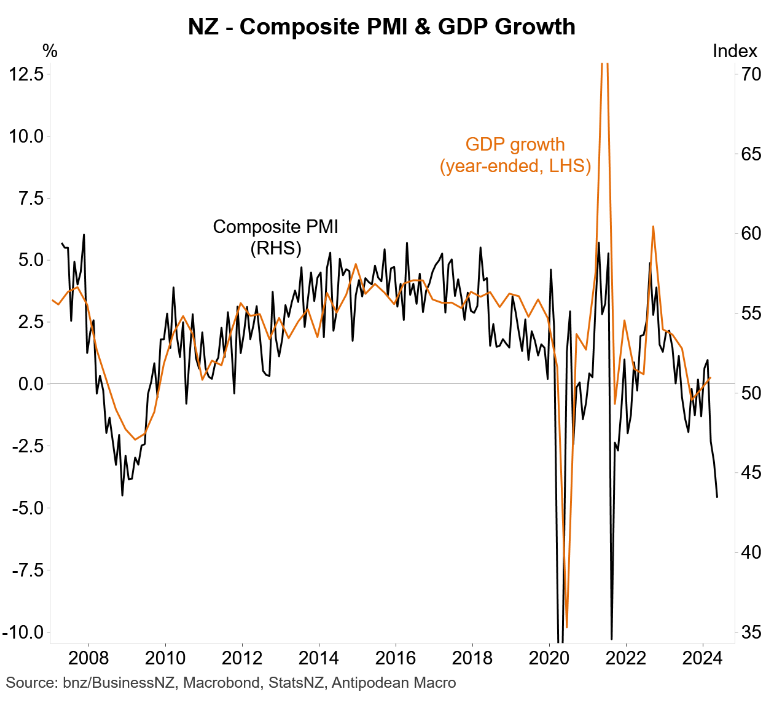

New Zealand’s composite PMI has collapsed, pointing to further GDP declines in Q2:

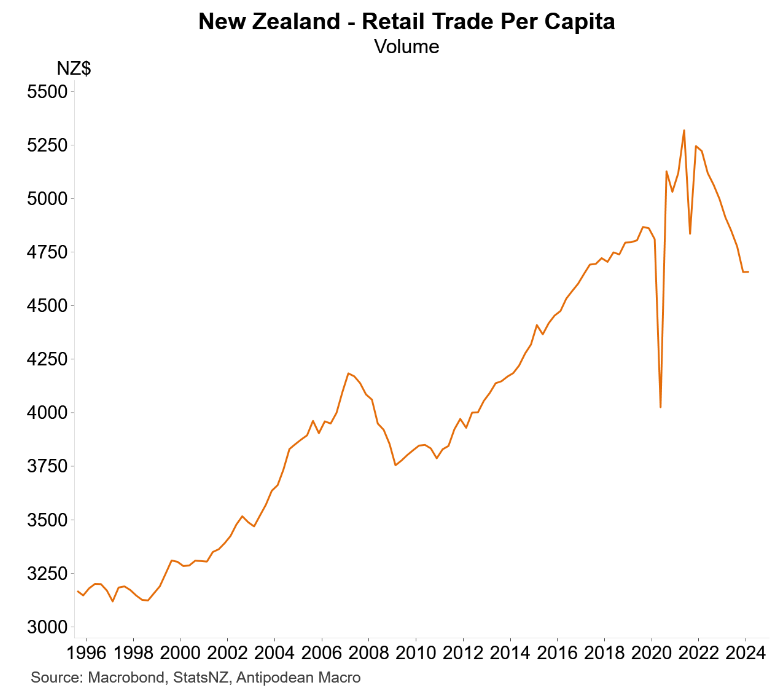

Consumer spending is also collapsing, with retail sales falling sharply in per capita terms:

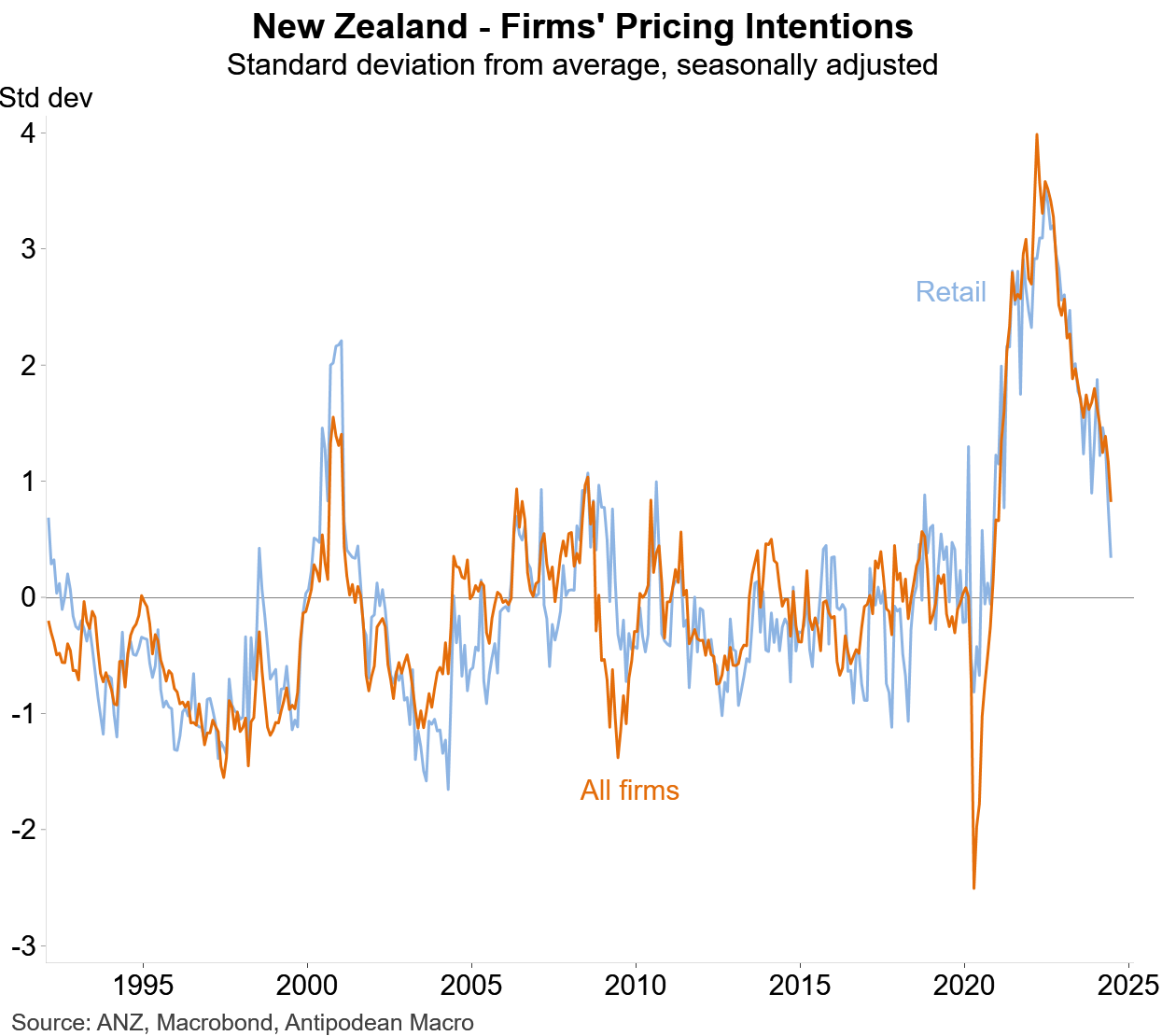

This collapse in consumer demand has dramatically lowered firms’ pricing intentions, especially among retailers:

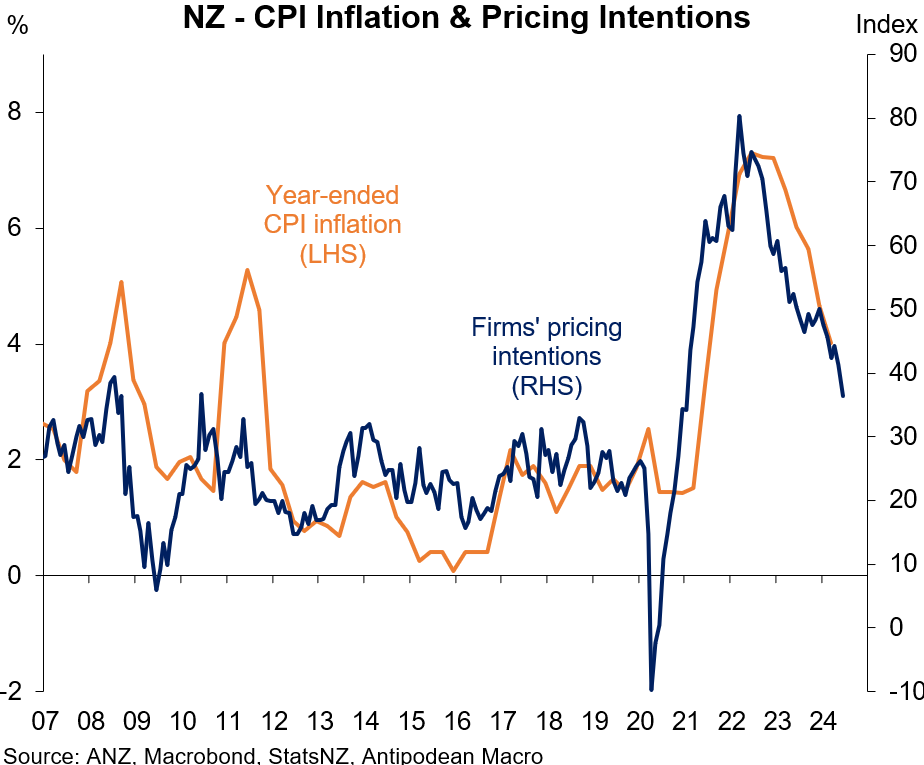

In turn, the outlook for CPI inflation has improved significantly:

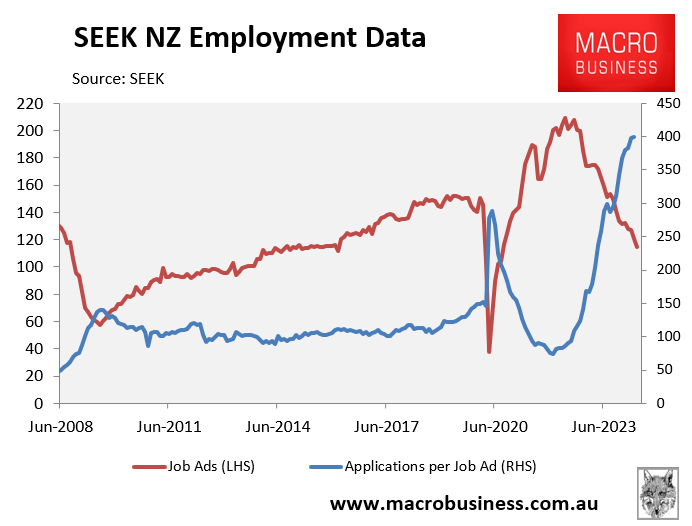

Meanwhile, New Zealand’s labour market remains in a funk, with job ads plummeting and job applications soaring:

“Fewer job ads and more applications per ad are consistent with employment struggling to grow and an increase in the unemployment rate”, noted BNZ-SEEK.

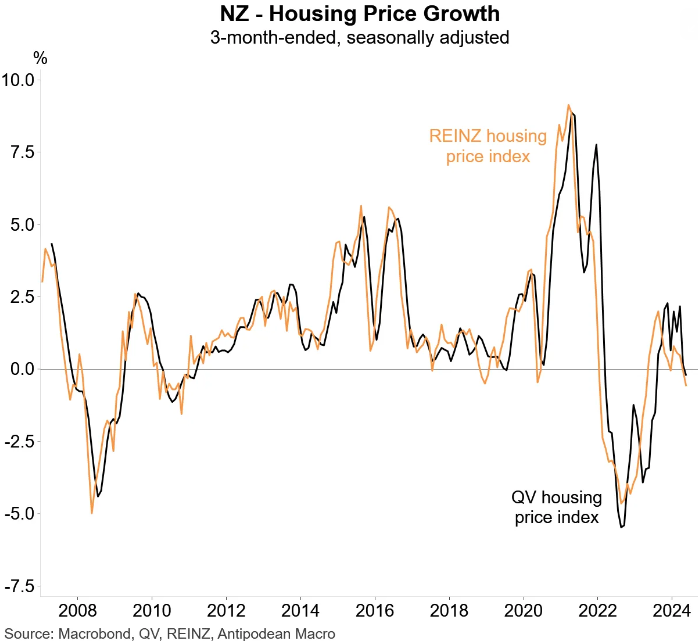

Finally, the housing market is falling, as measured by all three major data providers.

The following chart tracks the REINZ and Quotable Values price indices:

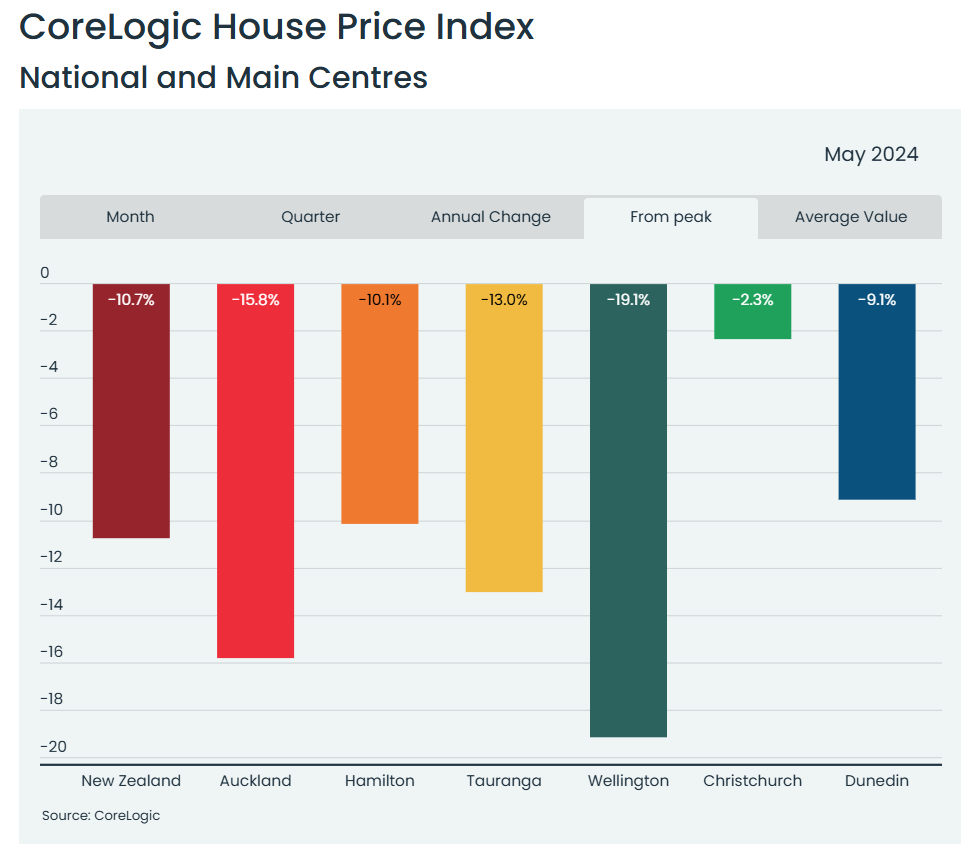

CoreLogic’s average housing price index also fell by 0.1% in April and by 0.2% in May to be down 10.7% from the peak:

The overall picture is that New Zealand’s monetary policy is too tight, which has plunged Kiwis into a deep recession.

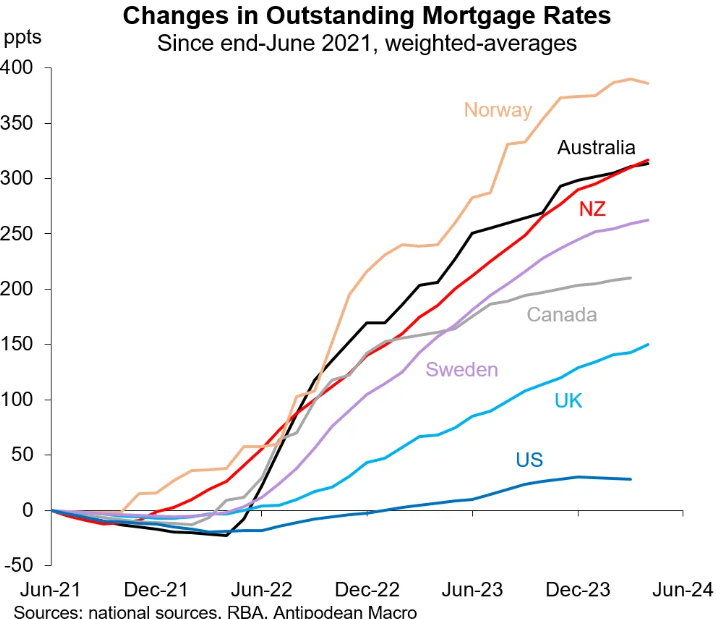

New Zealand’s average mortgage rate increase recently overtook Australia’s to be among the most restrictive in the world:

Moreover, New Zealand mortgage rates will rise further as cheap pandemic fixed-rate mortgages continue to roll over to higher rates.

With this backdrop, it is only a matter of time before the Reserve Bank makes a 180-degree turn and commences an interest rate easing cycle.