With friends like Innes Willox at the Australian Industry Group, industry doesn’t need enemies:

“It is welcome that the coalition has put some of their nuclear cards on the table. It is a debate that Australia needs to have. Australia has real energy problems that demand well-considered responses from all sides of politics,” Innes Willox, Chief Executive of national employer association Ai Group said today.

“The coalition’s vision needs over time to be fleshed out with more detail such as around cost, viability and timelines, especially given the long delays and cost blow-outs in delivering nuclear in other Western economies.

“With no delivery projected until the middle of the next decade, the proposal does not immediately help with short-term emissions reduction or the cost and reliability of energy in the short term.

“The proposition too that the Federal Government own and operate the bulk of electricity generation in Australia raises some red flags. If it effectively renationalises electricity in Australia, there is a risk that private sector investment gets killed off.

“Using public funds for assets that may be uncommercial means more debt, more taxes or more cuts to other spending priorities.

“The Government’s vision for a heavily renewable grid backed by gas peakers is right now at face value perhaps a better approach but the problem is delivery. Despite all the effort so far on system planning and finance mechanisms, planning approvals for new energy assets are slow and actual delivery is seriously lagging. The cost of new builds is higher than it should be. Social licence for new development is needed and it is not being sought or earned fast enough.

Talk about burying the lede.

Where’s the fire and brimstone about gas?

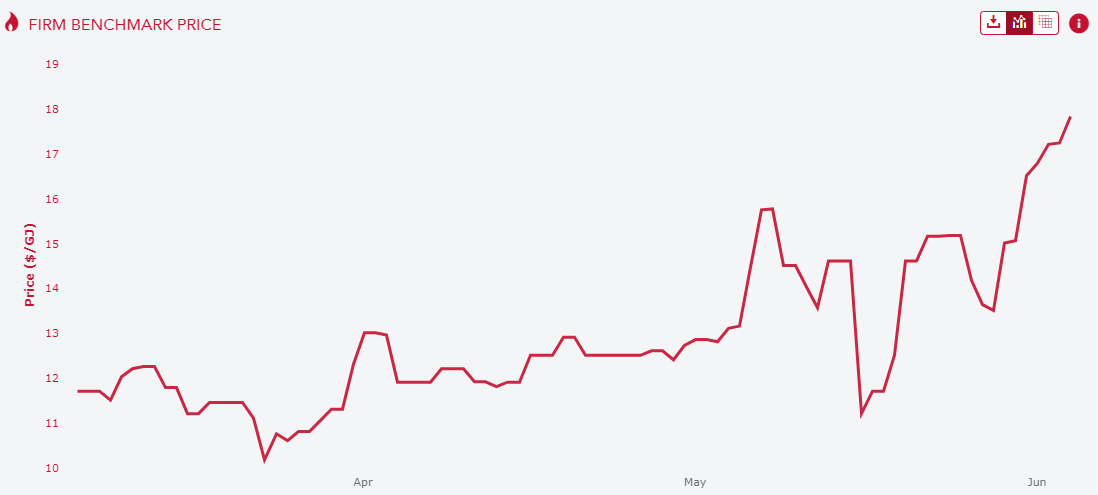

“Planning approvals”? Christ. What about the gas export cartel that has spot prices at $18Gj? 600% above historic averages.

Where is Resources Minster Mad King and the Australian Domestic Gas Security Mechanism?

That Albo didn’t apply it to the spot gas market is a disaster playing out in real-time as manufacturers go bust wholesale owing to the world’s highest gas and electricity prices.

Why would anybody, including the government, which isn’t and won’t, build a gas peaker when there is NO SECURITY OF SUPPLY for gas?

We need either domestic reservation or export levies for gas NOW. It is the way to stabilise manufacturing and meet Paris Agreement targets.

The AIG should sack Willox and put an overpriced Aussie-manufactured brick in charge.

It would be more threatening to policymakers.