There has been some market repricing over the last few days as the reality of sinking US inflation and rising Fed dovishness sinks in.

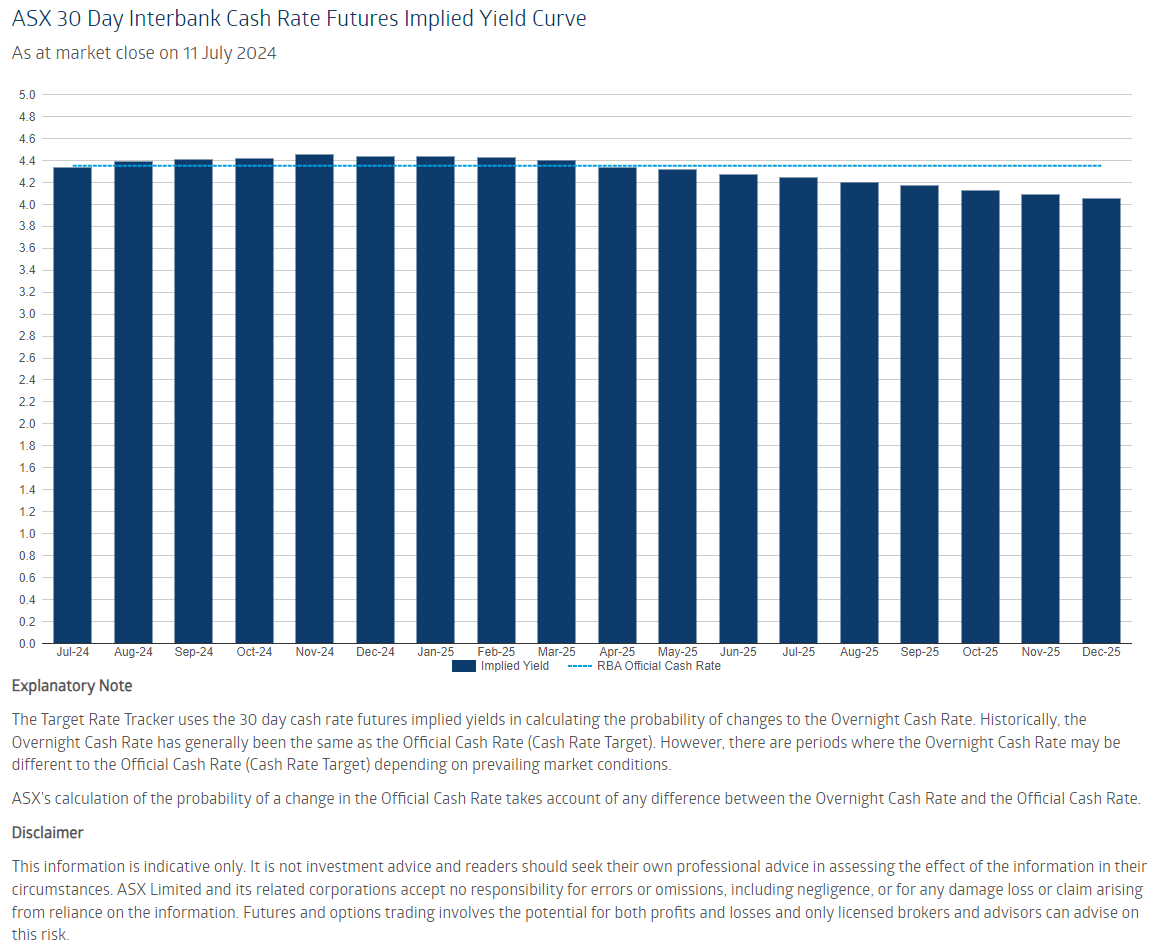

RBA fund futures are now pricing no more than 10bps above the current cash rate and will likely come in further today:

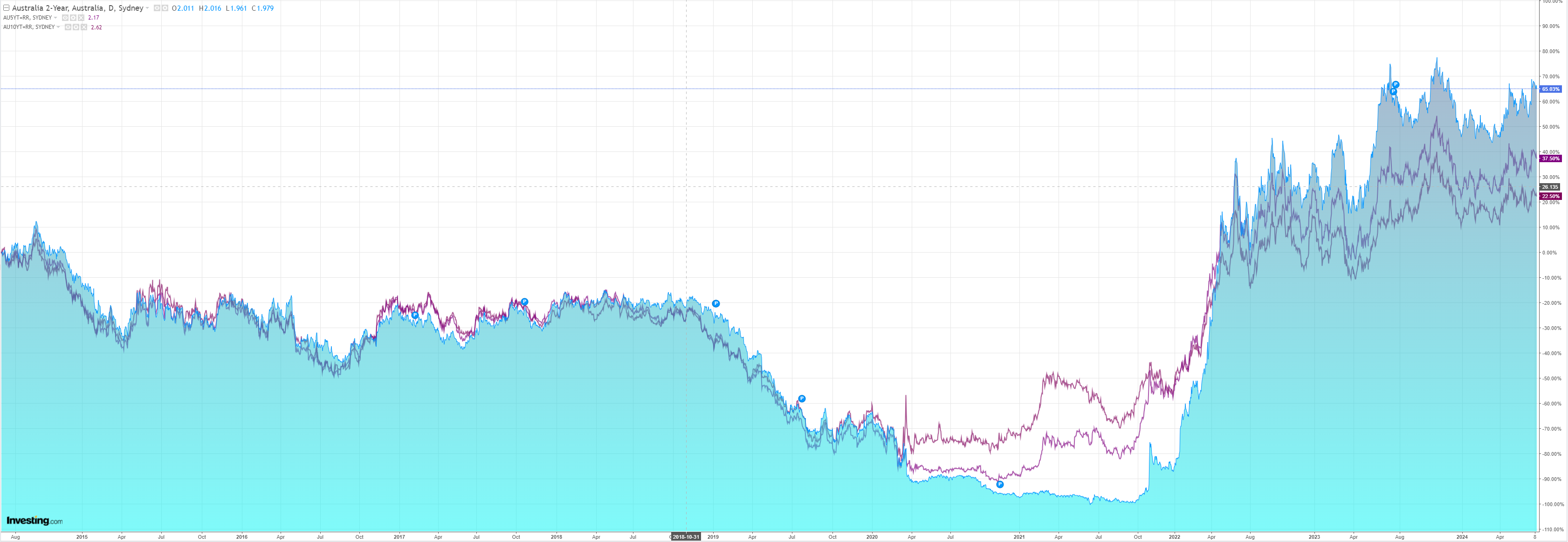

Local bond yields are fighting the US downdraft but they are still easing and any upside move has been cut off:

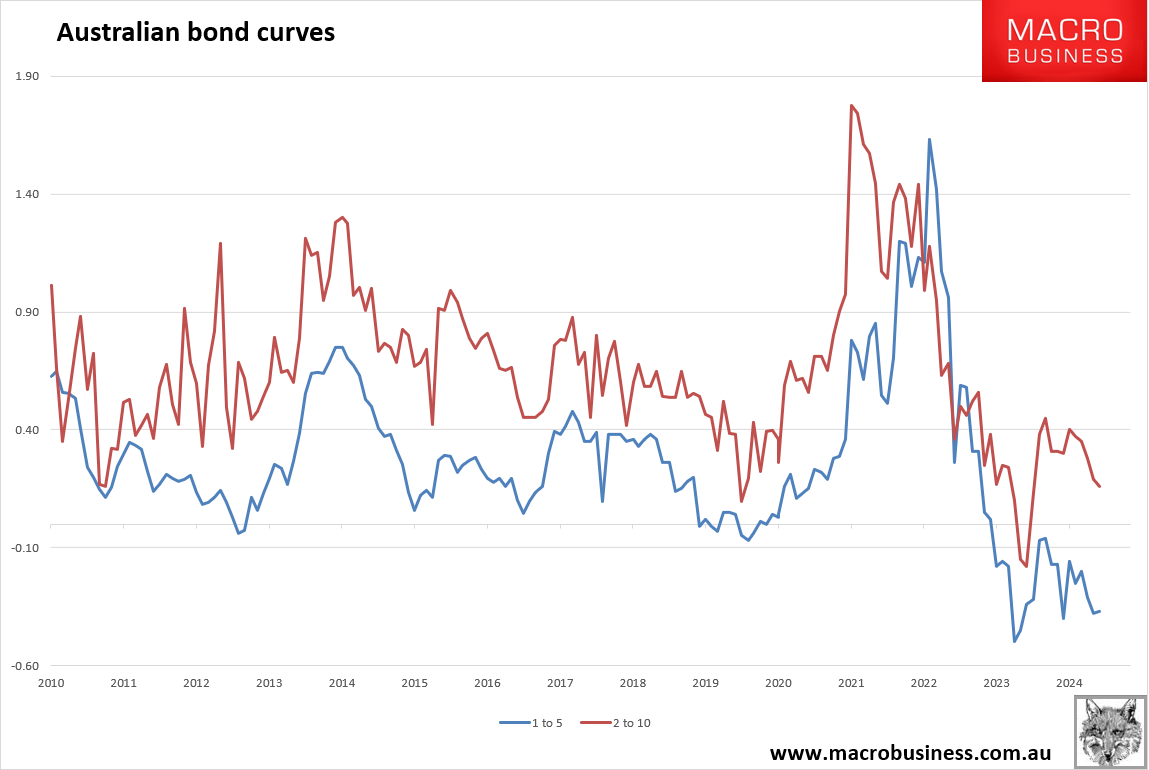

Local bond curves are also pricing ongoing and intensifying Australian economic stress.

The 1-5 curve is sharply inverted and indicative of ongoing and severe per capita recession.

The 2-10 curve has been flattening again and indicates a rising risk of headline recession:

Indeed, some prefer the 3-month-10-year curve as an indicator of recession and it is also inverted 12bps.

There is little else but economic weakness and broad disinflation in this outlook.