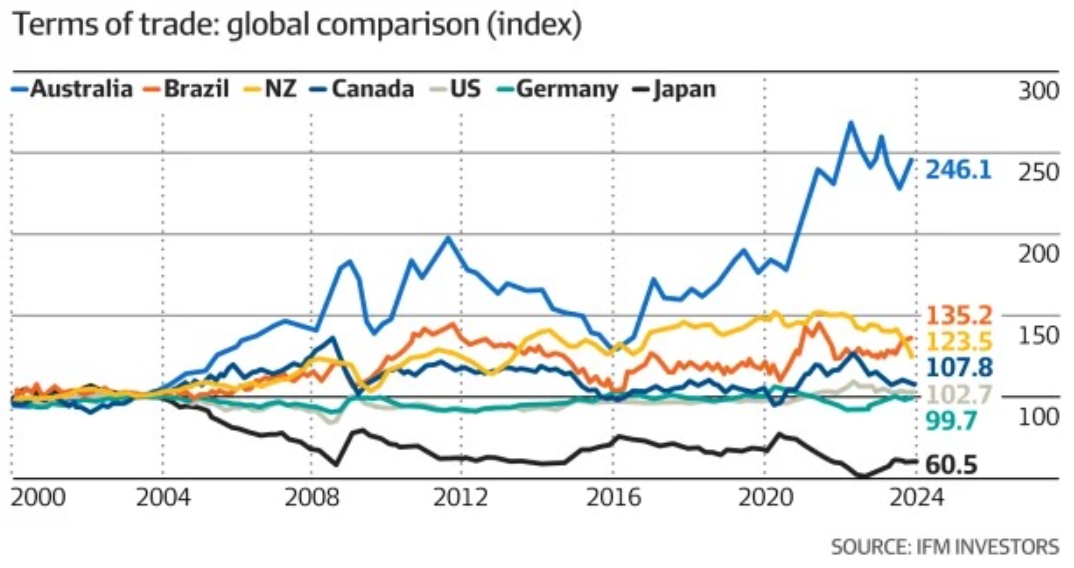

In May, The AFR published the following chart showing how Australia has benefited the most from global commodity prices over the last 20 years:

“The price received for exports has surged ahead of other countries, including big iron ore producer Brazil and oil and gas exporters Canada and the United States”, wrote John Kehoe.

“Compared to other countries, it has increased by almost two and a half times, or 146 per cent since the turn of the century”.

Economist Chris Richardson projected that since 2000, the terms of trade boost had increased tax receipts by $100 billion per year by 2024, primarily through company taxes.

While this “dumb luck” has undoubtedly benefited the federal budget, it would have been far better for Australians if we had a genuine resource tax mechanism in place, as Norway has.

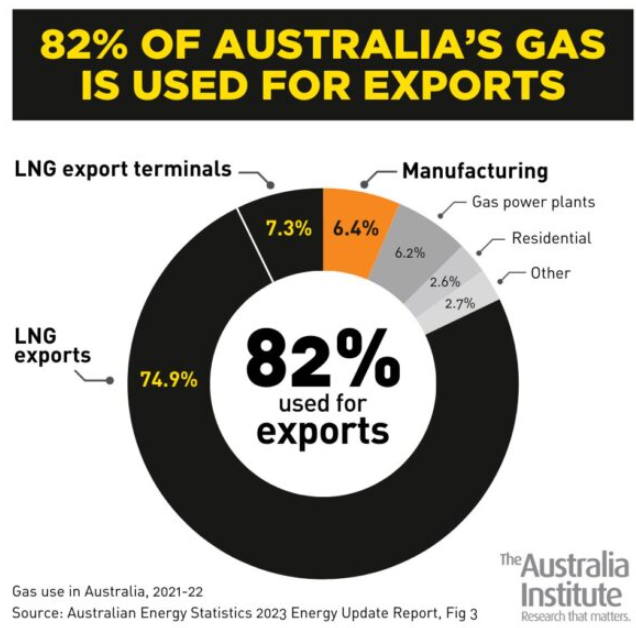

Consider Australian natural gas. Until recently, Australia was the world’s largest LNG exporter (now ranked third behind the United States and Qatar).

Almost all of Australia’s natural gas is exported, resulting in an artificial domestic gas shortage and internationally high gas and electricity costs on the East Coast, where no domestic reservation policy exists.

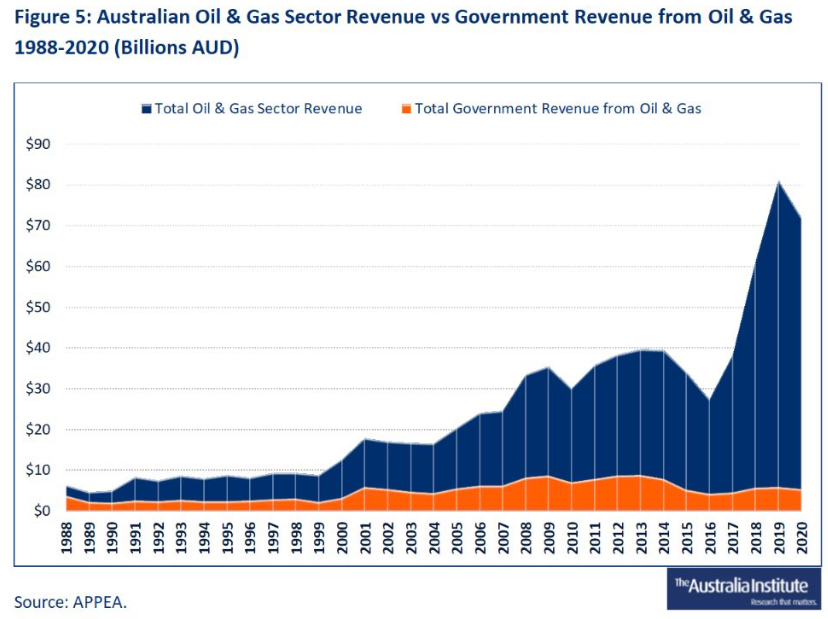

The surge in LNG exports, which reflects the rise in Australia’s terms of trade, has resulted in massive profits for foreign-owned oil and gas companies. However, Australia’s tax revenues from this boom have stagnated:

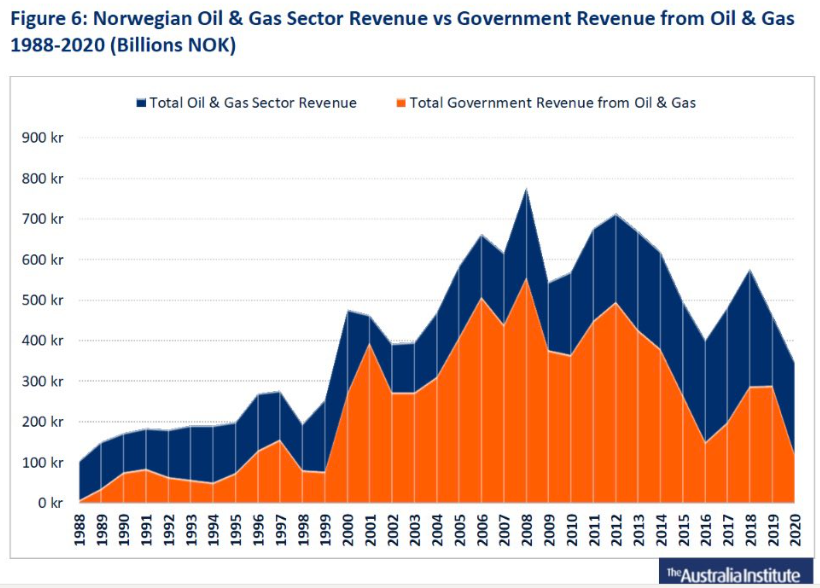

Now compare us to Norway, which taxes its oil and gas sector at around 80%. As a result, Norway’s tax earnings from its oil and gas sector have increased in tandem with its export revenues:

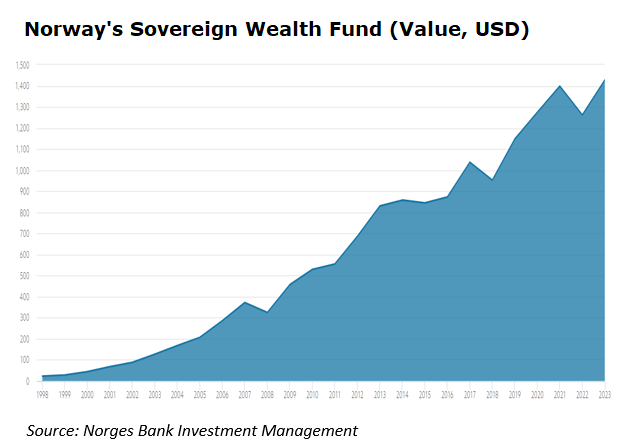

Norway has invested its oil and gas windfall in a sovereign wealth fund that is the world’s largest and valued at approximately US$290,000 per Norwegian resident:

Norway’s oil and gas wealth has made Norwegians the richest people on the planet, a title that Australia would have claimed if we properly taxed our resources.

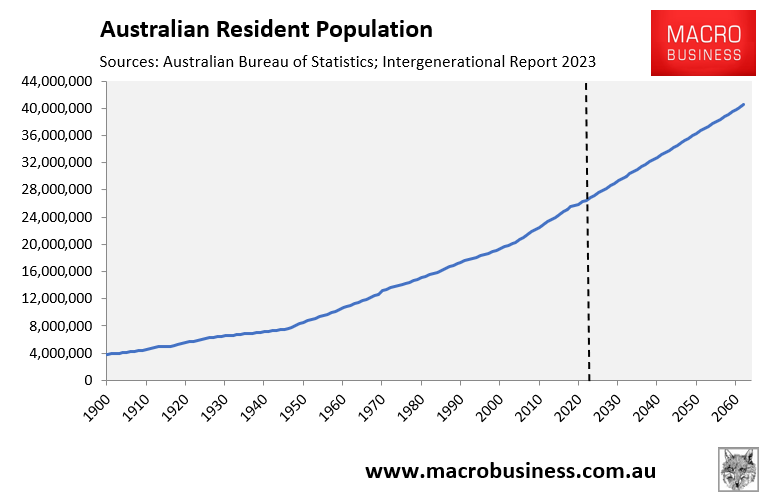

Instead, we did the opposite and taxed our resources lightly. We then grew the nation’s population aggressively via immigration, which has diluted our mineral wealth.

Qataris have also benefited financially by correctly taxing their resources.

In his latest magnum opus on Australia’s political economy, Matt Barrie explains how Qataris benefit from their nation’s LNG exports in a way that Australians could only dream of:

Qatar’s largest export by far is LNG, the same volume as Australia.

Yet Qatar generates enough wealth from this trade that residents pay zero income tax, zero property tax, zero corporate income tax, have free healthcare, free education, have subsidised housing and plentiful access to cheap electricity and petrol.

Similarly, Norway, another resource-rich nation, has leveraged its oil wealth to create a sovereign wealth fund worth over $1 trillion, ensuring long-term prosperity for its citizens. Australia’s failure to create comparable benefits from its resources highlights a critical policy shortfall.

In Australia, most of our export facilities pay no royalties at all to the state or federal government…

Australians currently pay $11.67/Gj wholesale. The Americans pay $2.34/Gj, and Qataris even less. But that’s only because the government stepped in and forced a $12 price cap as prices got to almost $50 in last year.

In June, the Australian energy market regulator, AEMO, warned that the east coast could run out of gas in winter.

Despite being a gas superpower, what Australia does is export it to China and Japan, who don’t actually need it and resell it. China resells about a third of what we need domestically. Half the gas we sell to Japan is resold.

Imagine Saudi Arabia telling their citizens they can’t have cheap petrol…

Australians should be the richest people on earth.

Instead, we have impoverished ourselves by engineering an artificial gas shortage, driving up domestic gas and electricity prices, while also diluting the nation’s mineral wealth via mass immigration.

We are not a serious country.