DXY is firm:

AUD is not convincing:

JPY is signalling more trouble ahead:

As is oil or does OPEC prefer Kamala?

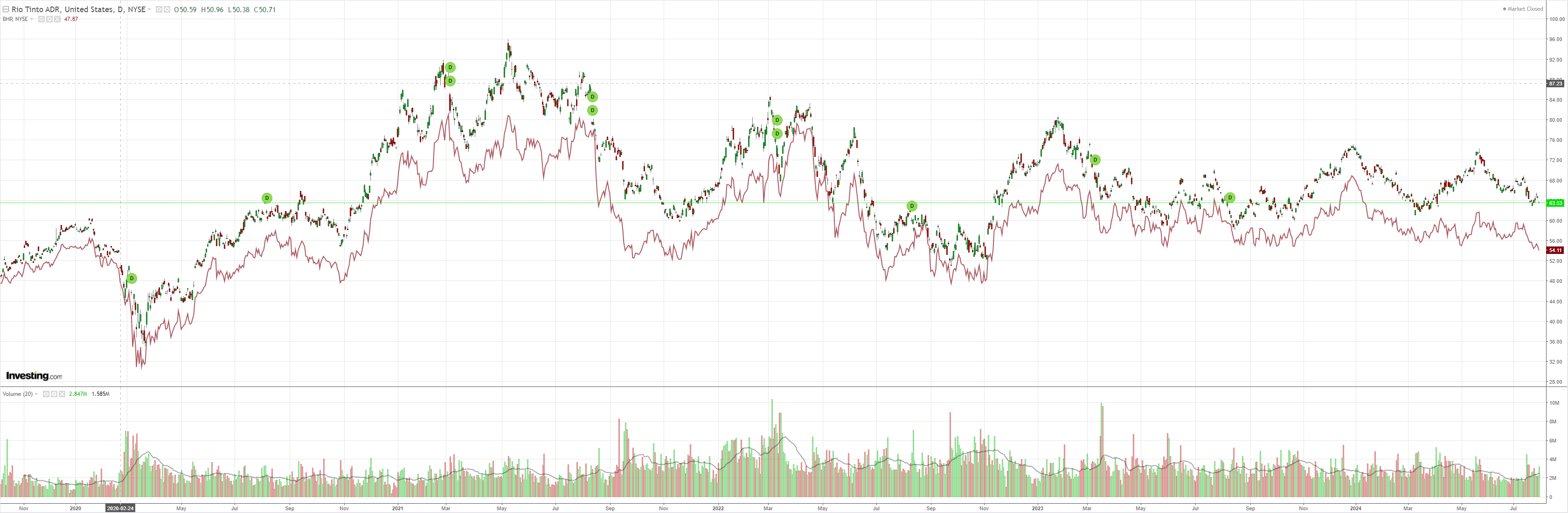

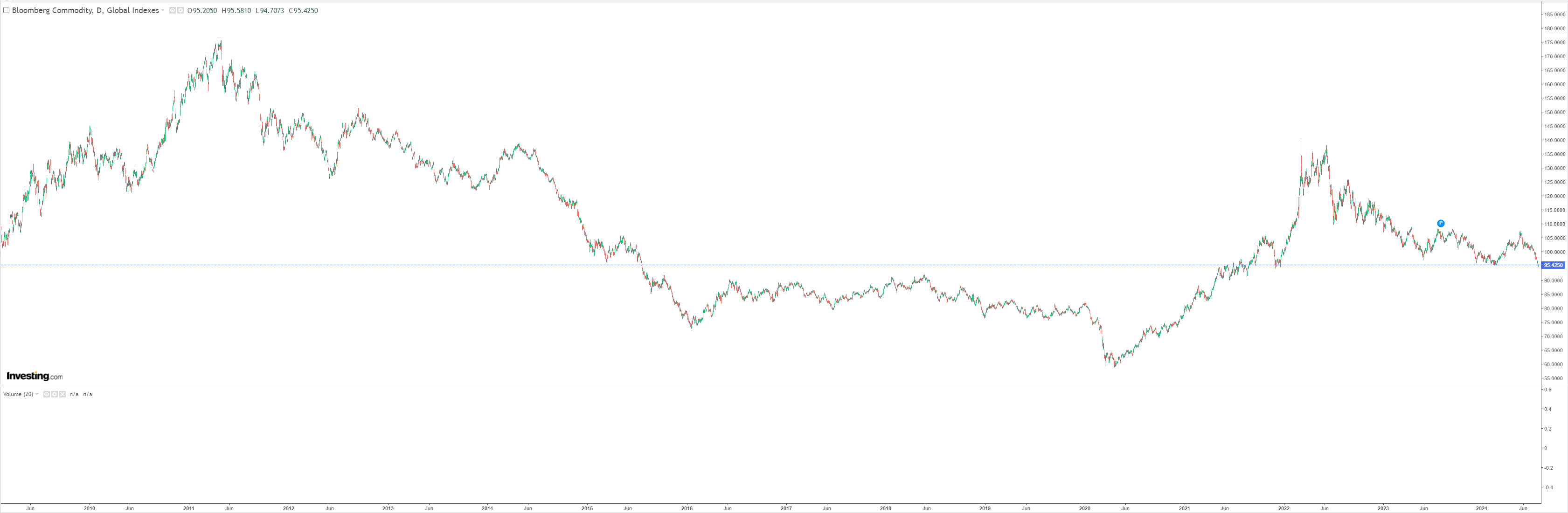

Commods also unconvincing:

BHP broke:

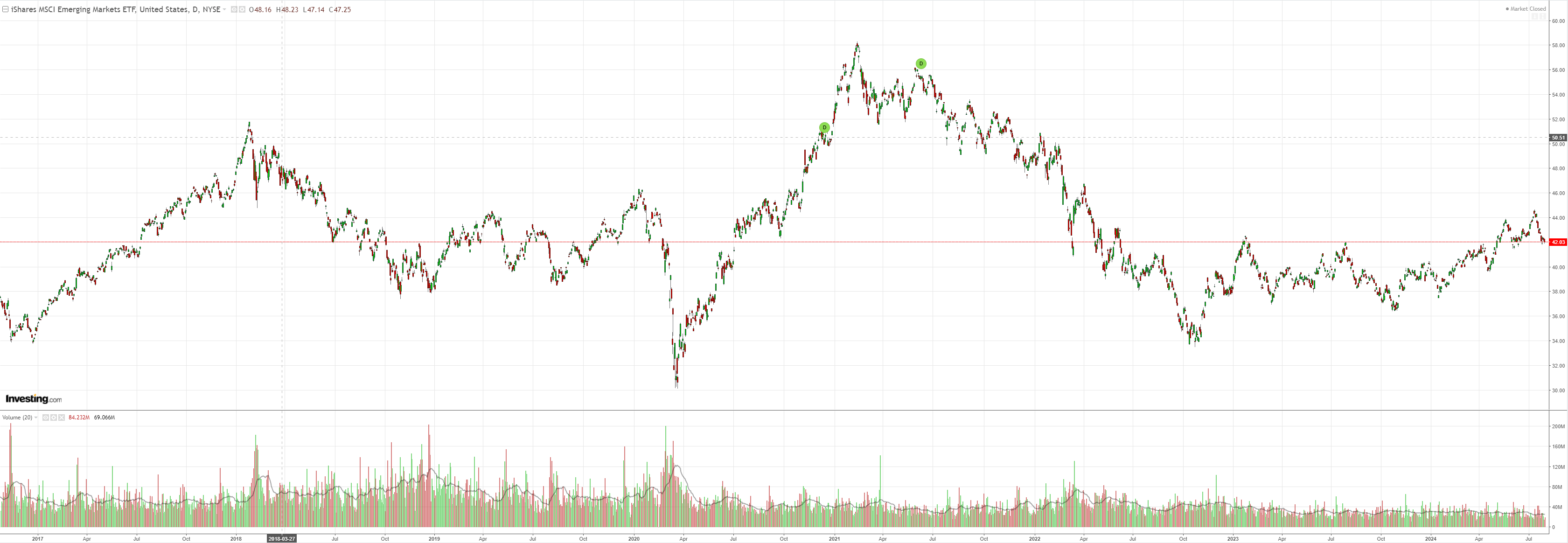

EM struggling to hold support:

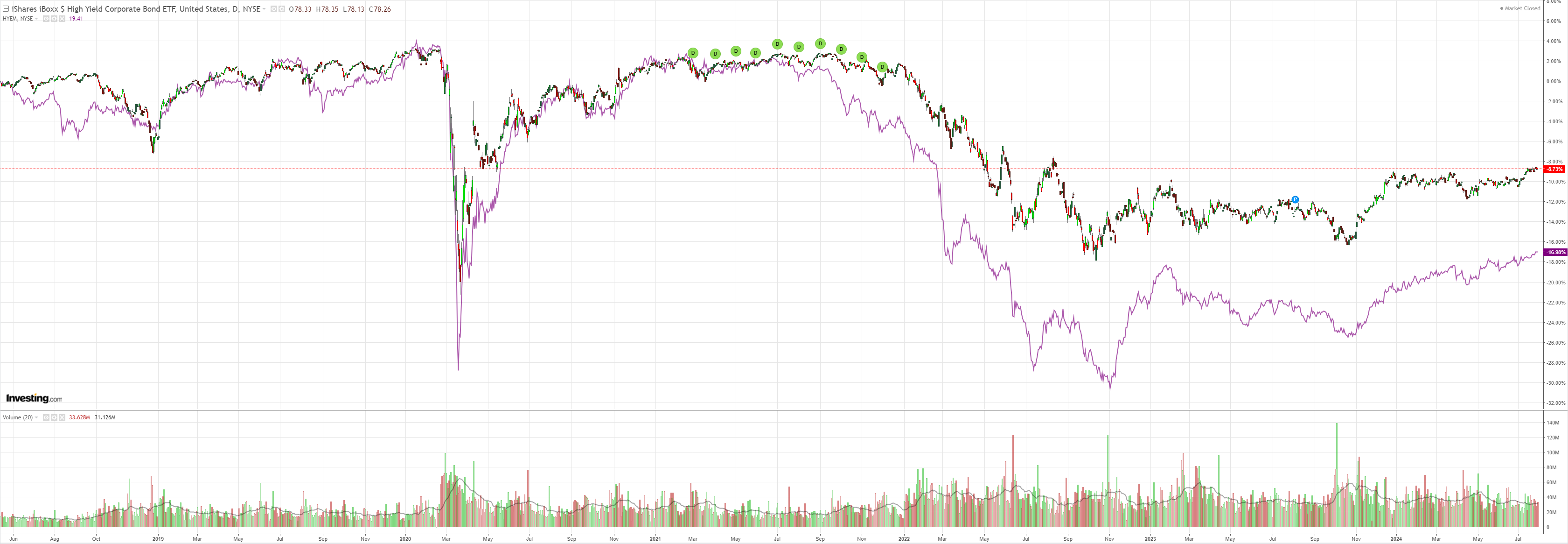

Junk is all about the soft landing:

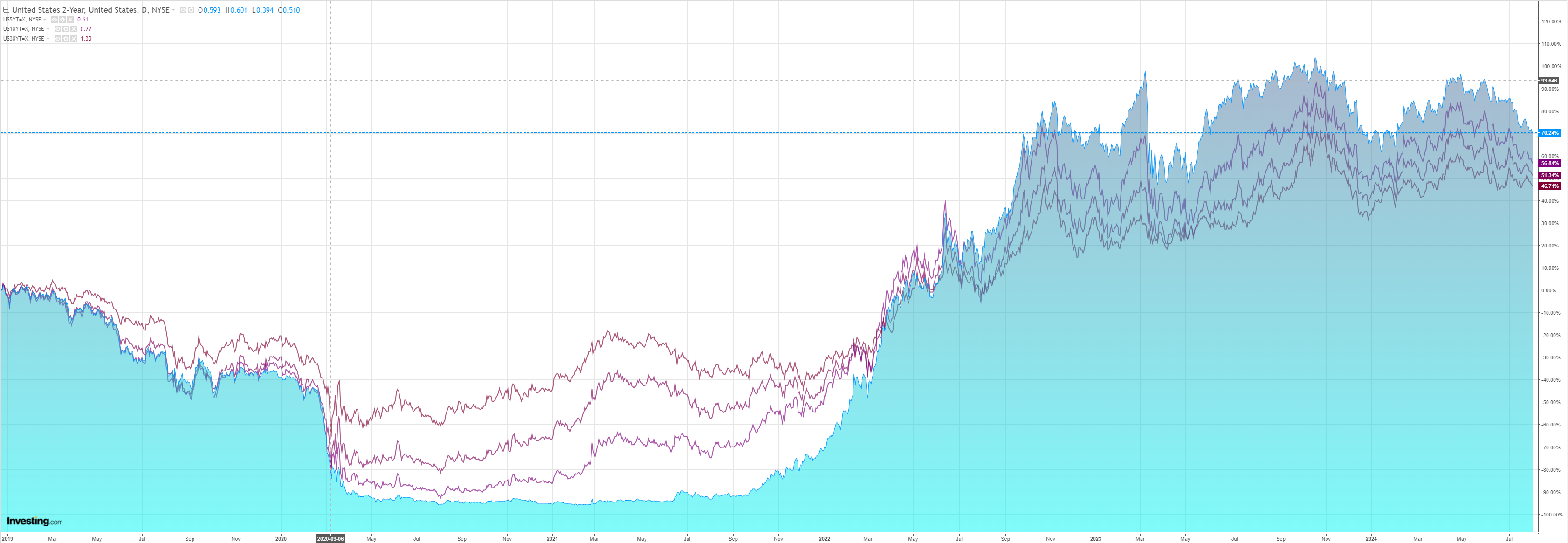

As US yields prepare to break the uptrend:

And stocks keeps falling:

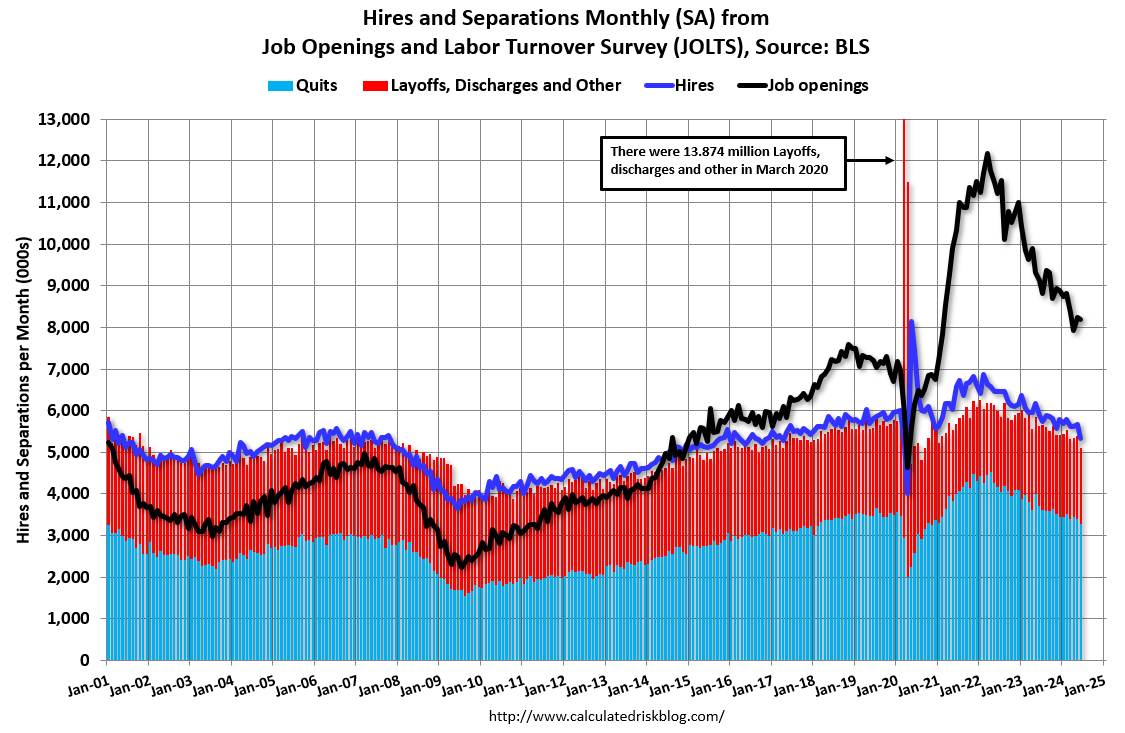

JOLTS was the release dejour, continuing to weaken and confirming Fed easing is on deck:

The first cut is proving to be quite problematic for markets, not least AUD.

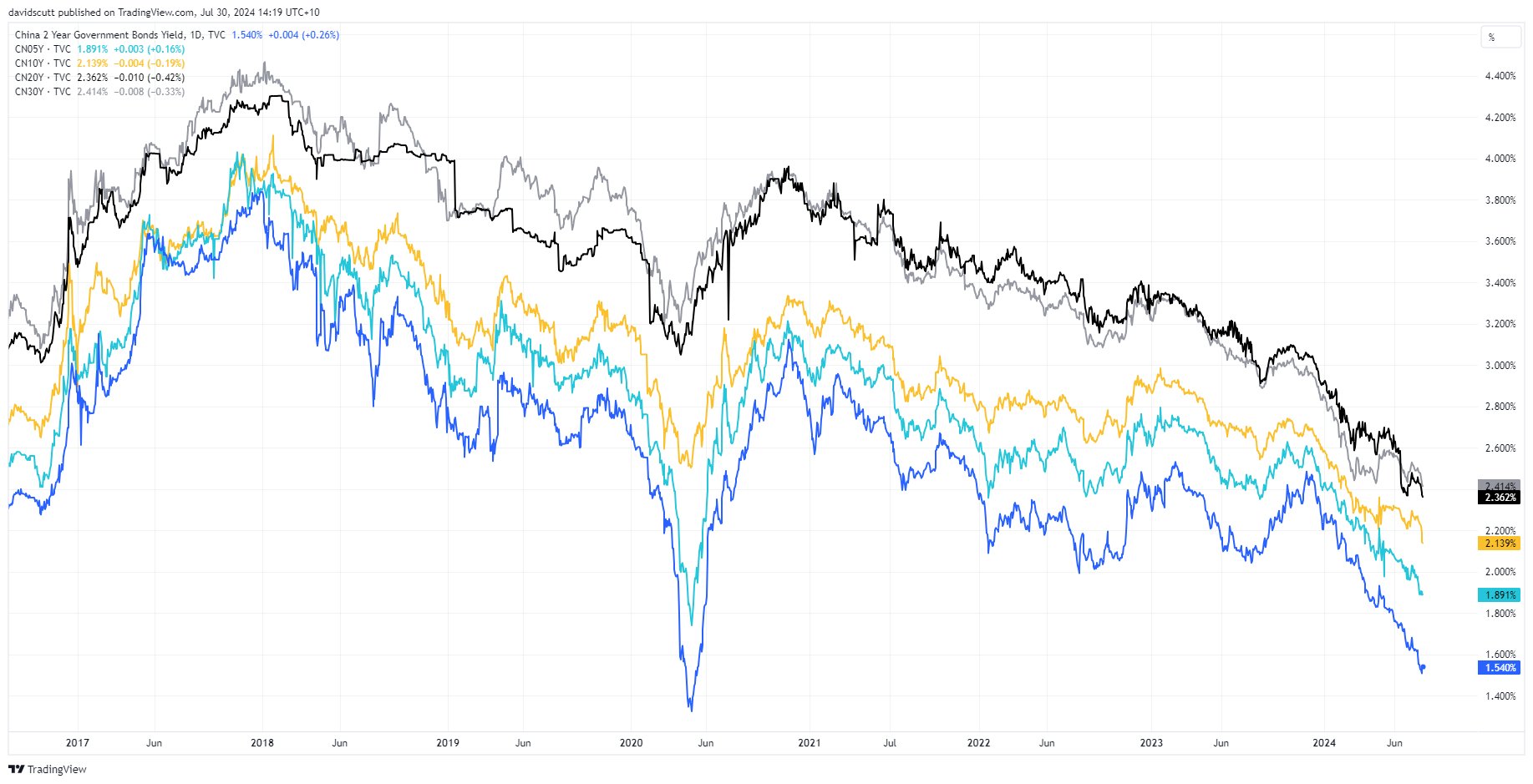

Stocks are wobbling as growth worries build, Chinese yawnulus is not helping and yields are collapsing:

A prospective Trump presidency makes both worse, triggering commodity free falls as the BCOM index breaks terminal support:

Soft landing is still the play but, without China, the growth plane is more likely to taxi along the tarmac instead of taking off again.

An AUD hard landing is still a risk, though let’s see what CPI throws up today.