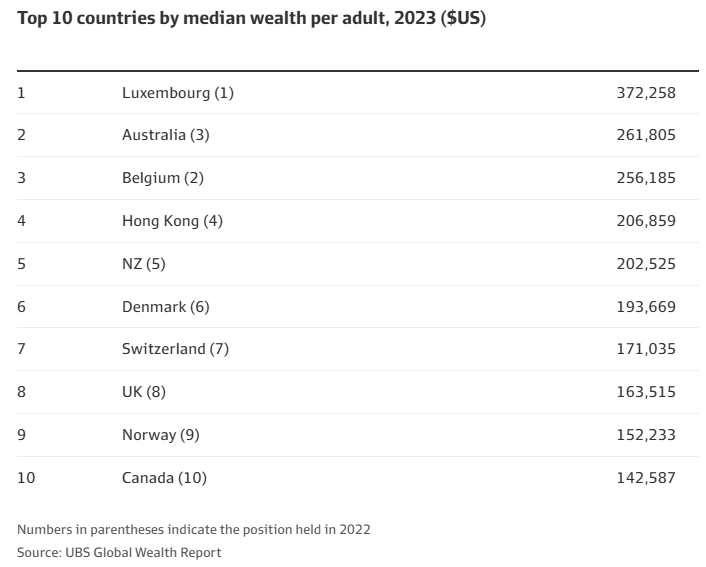

The latest edition of the UBS Global Wealth Report shows that Australia now boasts 1.9 million US-dollar millionaires, whose combined wealth is now $US5.4 trillion ($8 trillion).

UBS has forecast that the number of US-dollar millionaires will rise by 21% to more than 2.3 million by 2028, due to factors such as rising house prices and intergenerational wealth transfer.

The report also shows that the average Australian’s wealth increased by nearly 10% in 2023, while median wealth increased by around 5%.

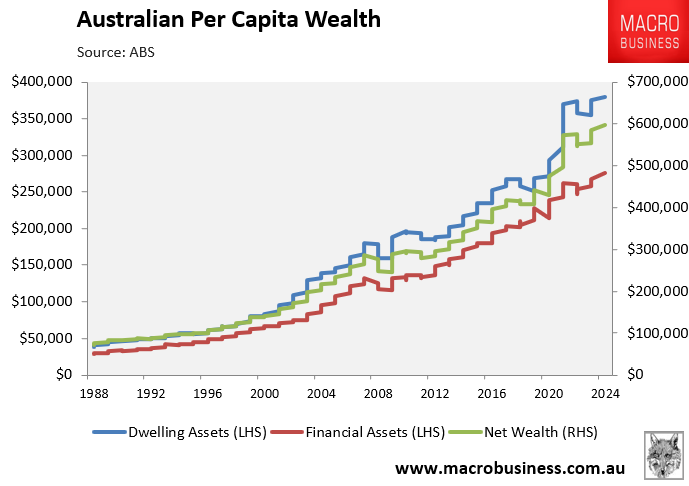

Australia’s median home value has reached $749,000, with homeowners gaining an average $59,000 wealth boost from their properties in 2024.

More than half of Australia’s wealth is held in non-financial assets, such as real estate. By contrast, in the rest of Asia-Pacific, the majority (60%) of wealth is held in financial assets such as shares, bonds, and cash. In North America, financial assets account for 70% of total wealth.

“The inheritocracy, the bank of mum and dad, it’s real. To be able to afford a house, young people are going to need help”, Managing director at UBS Wealth Management Australia Andrew McAuley said.

Is a nation where its younger citizens cannot afford to house themselves without parental report really “wealthy”?

Australians would be “wealthier” if the strong house price appreciation had never occurred, our median home price was $370,000 instead of $750,000, and Australia’s household debt was 70% of income instead of 140% of income.

Australia would be a much more egalitarian society and we would be better off financially if our housing cost half as much as it does and we were not carrying so much debt.

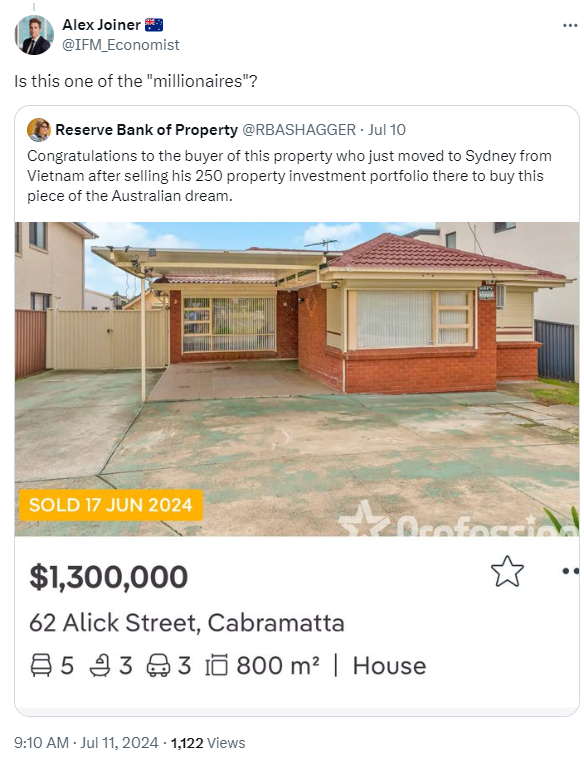

Australia’s house price appreciation has come at the expense of our children and grandchildren, who, when it is their turn to enter the market, will be required to pay far more for housing than they should, making them poorer.

A home has the same function, whether it is valued at $500,000, $1 million or $5 million. For the vast majority of people who just live in their homes and don’t own investment properties, higher housing “wealth” is useless.

Most of Australia’s household wealth, therefore, is not real. It is locked up in overpriced housing.

As a result, future Australian homebuyers will be saddled with large debts or will be locked into the rental market for the rest of their lives.

Australians would be far better off if we had never experienced this house price boom and were not ranked at the top of the global wealth table.