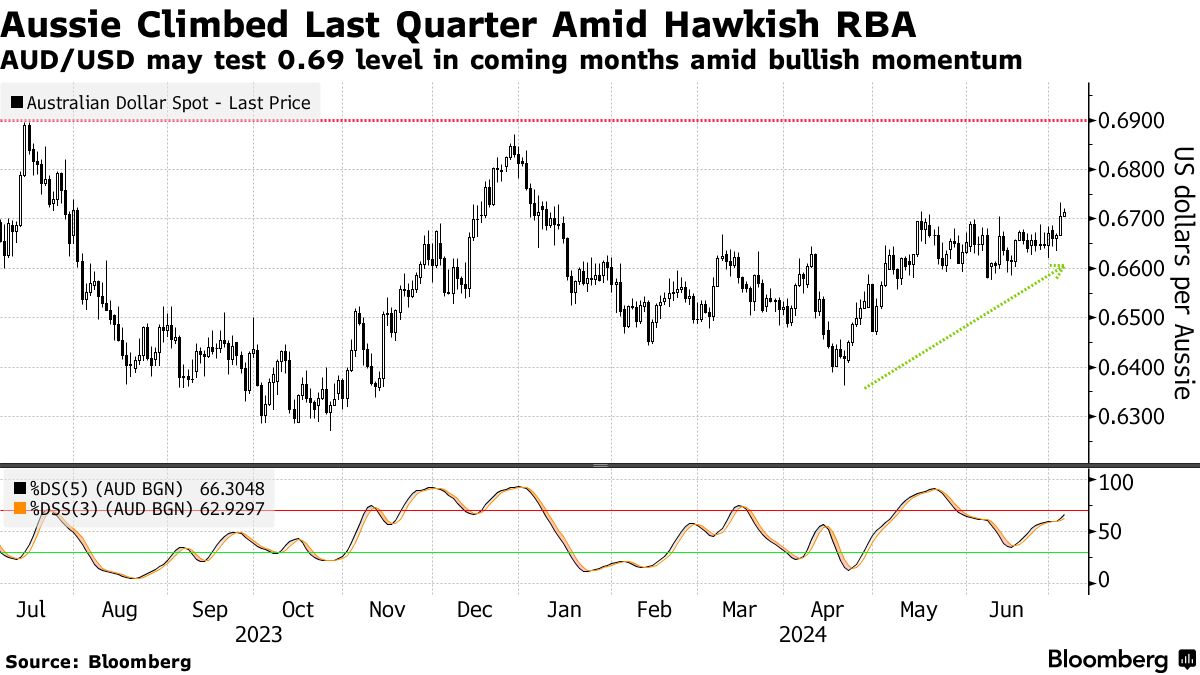

Bloombergo is getting excited:

The typically risk-sensitive currencies were the top performers among a Group-of-10 peers last quarter, both climbing around 2% against the greenback despite a surge in volatility in global markets. Australia’s dollar closed 0.3% higher at 67.49 US cents on Friday, while New Zealand’s finished 0.5% stronger at 61.45 cents.

Rate hike bias from both the Reserve Bank of Australia and the Reserve Bank of New Zealand suggests the run may continue, offering protection from a strengthening greenback. The dollar surged 2% last quarter as traders shifted bets on Federal Reserve rate cuts, surprise elections in Europe and the outcome of a recent US presidential debate.

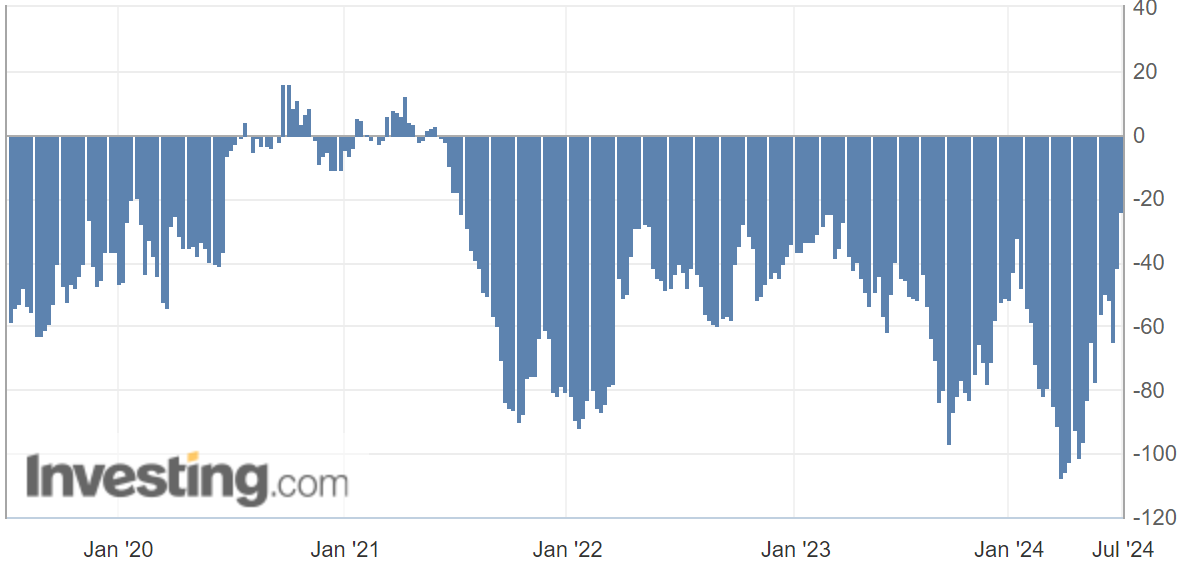

Indeed, AUD bears on CFTC are at their lowest level in three years. That said, theoretically there is still room to run into a bullish bias:

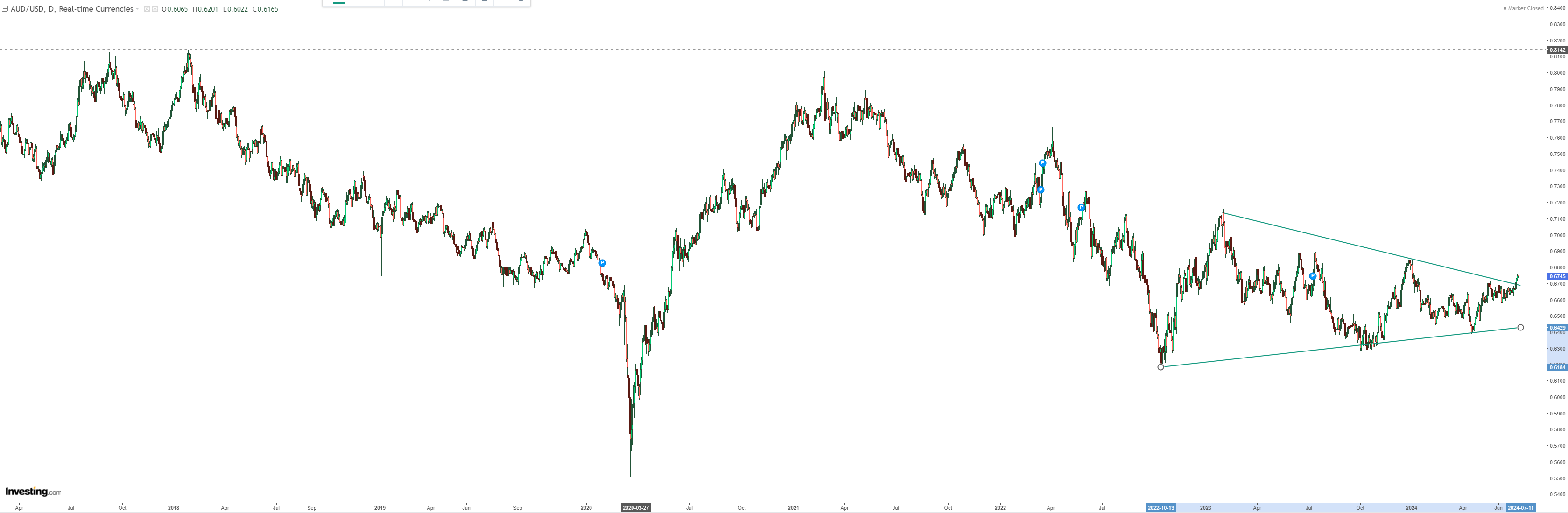

The technicals are also strong as AUD breaks north of its two-year wedge:

A run toward 0.69 is a reasonable argument. Anything beyond that is still fraught as global growth fails to rebound strongly held back by China, the RBA joins the cutting cycle and elections bump risk.