DXY rebounded last night:

AUD fell:

North Asia too:

Oil and gold eased:

Advertisement

The copper bubble burst:

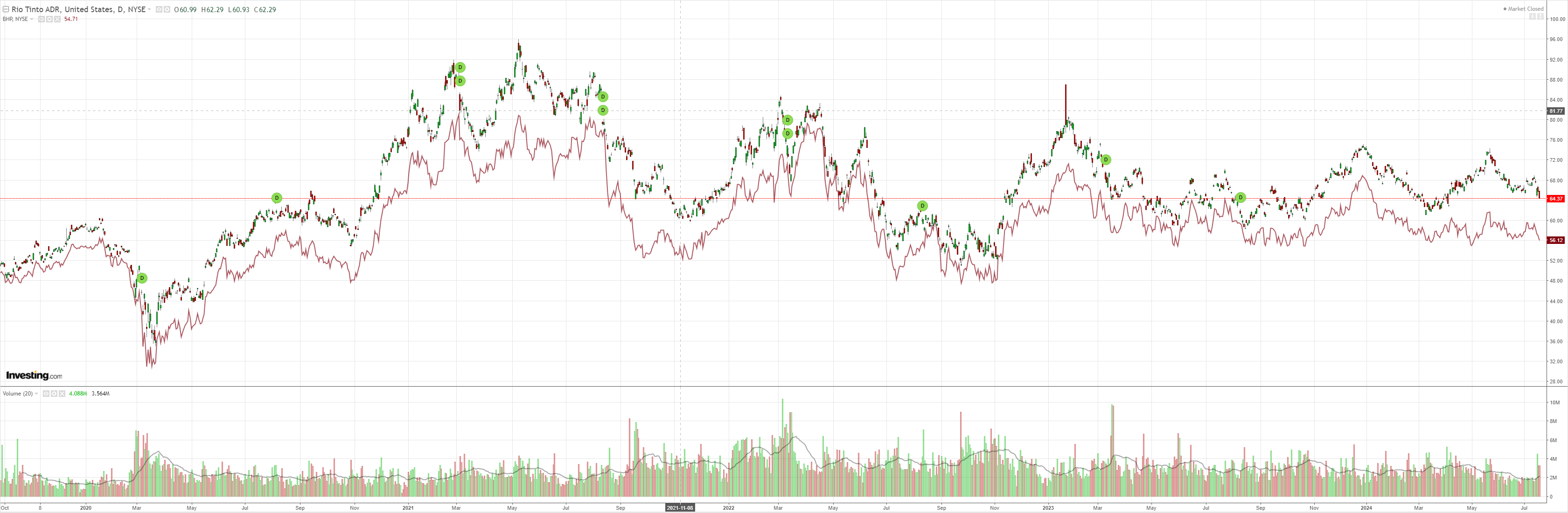

Miners retest on deck:

EM too:

Advertisement

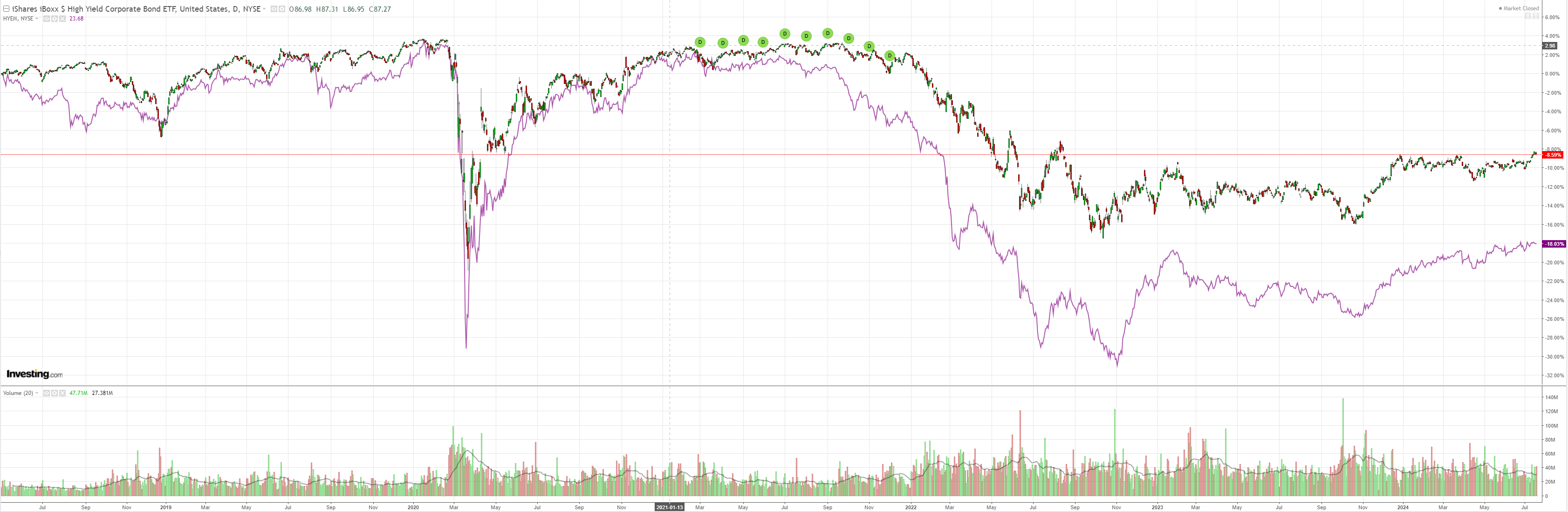

Junk is fine, suggesting a run of the mill correction for overheated risk:

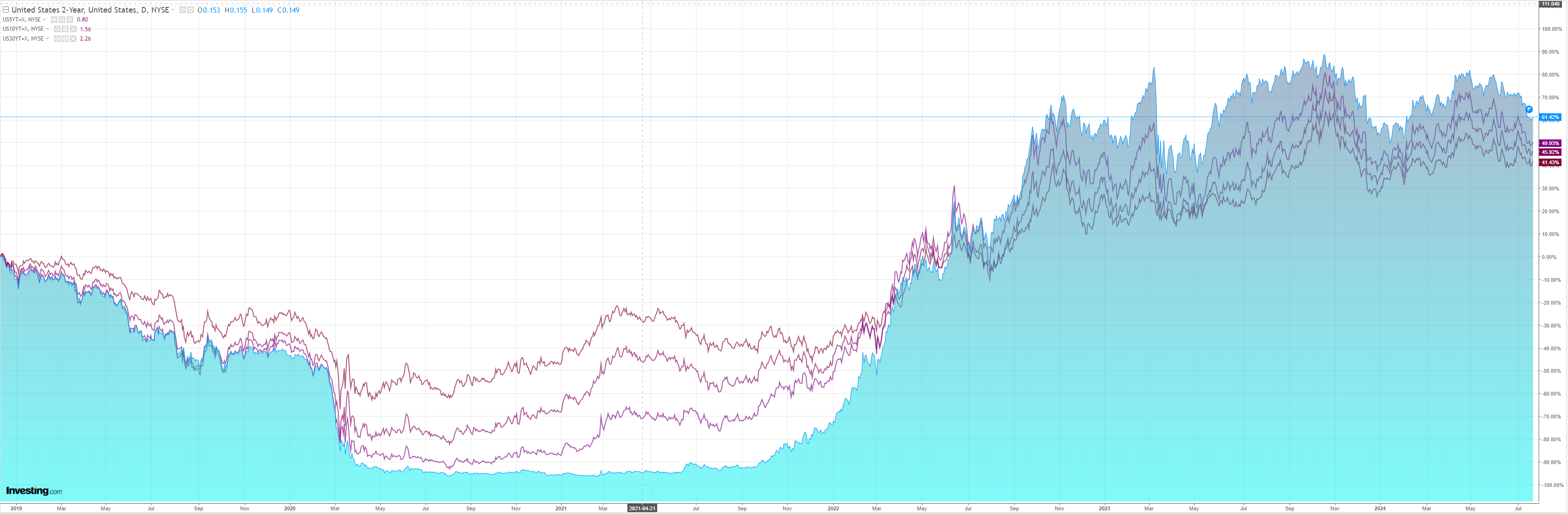

Yields popped:

Advertisement

Stocks dropped:

Commodities were puked, and why not?

- China’s Third Plenum was all quality and no quantity for growth.

- A Trump presidency will smash China and boost DXY.

- A Trump presidency will go after lower oil prices via geopolitics and drilling.

- Global growth and inflation are easing.

That’s a toxic combination for dirt, which was enough to take down AUD.

Advertisement

There is a sequencing issue for the developing commodity bear market insofar as we have Fed cuts coming too.

But, outside of gold, there’s no upside for dirt at this juncture.

AUD will be caught between the two.

Advertisement