DXY is holding firm:

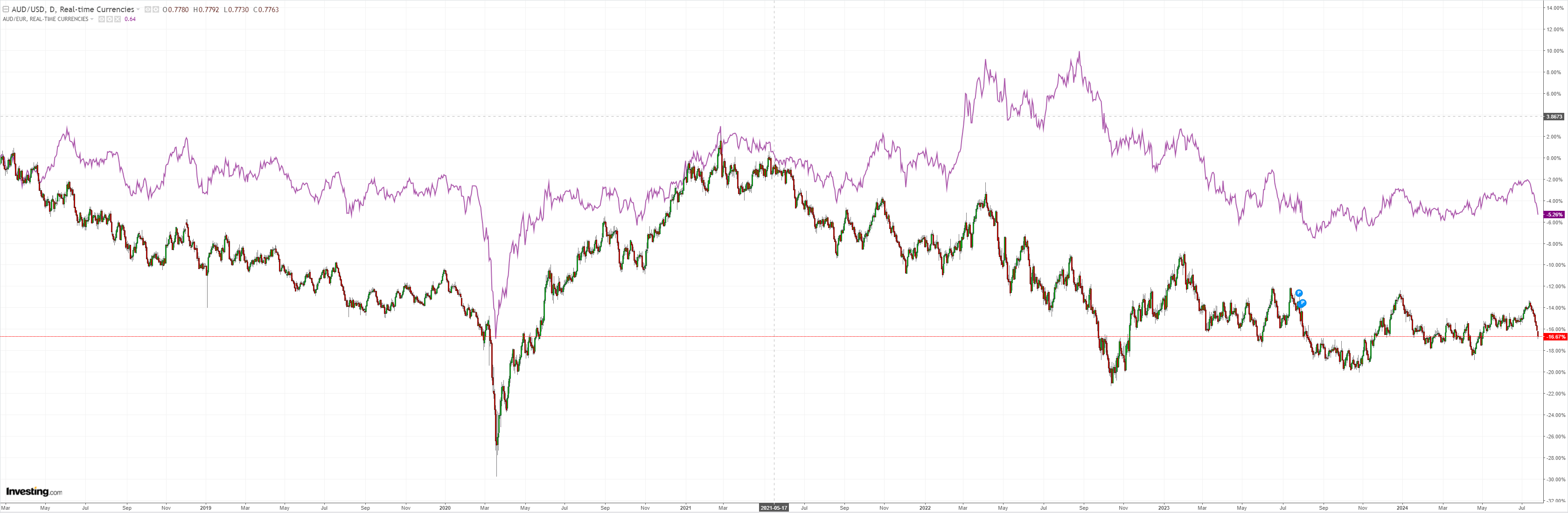

AUD is being obliterated:

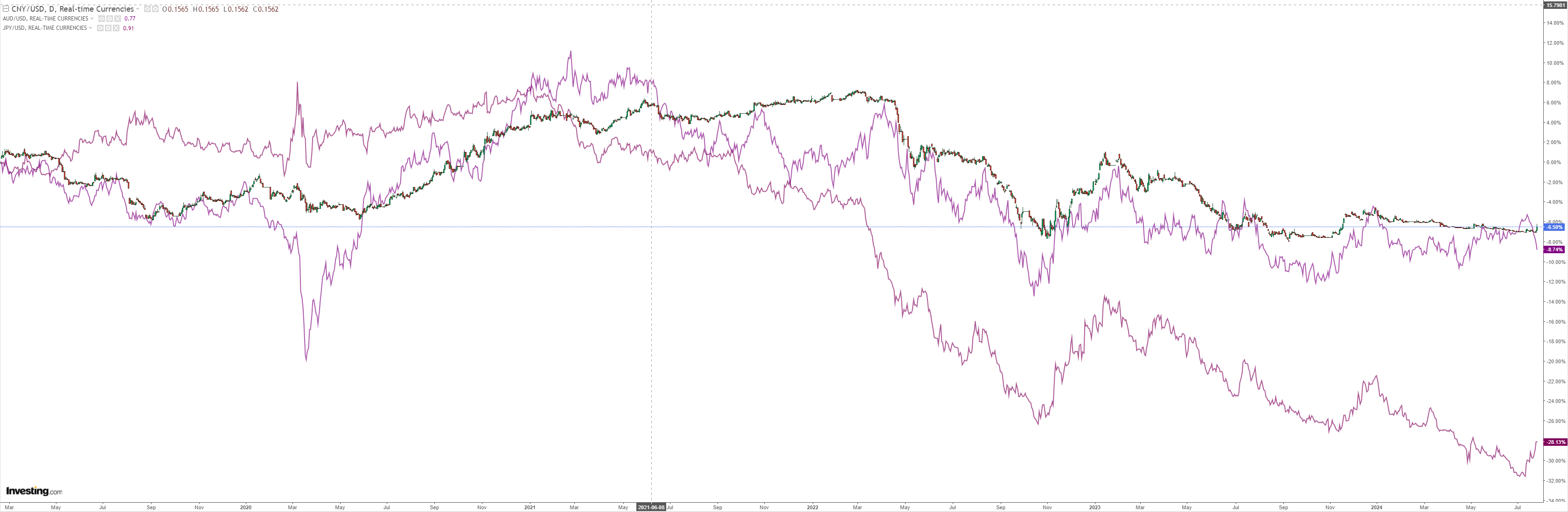

North Asia couldn’t save it:

Oil up, gold down:

Copper is like a daily comedy show:

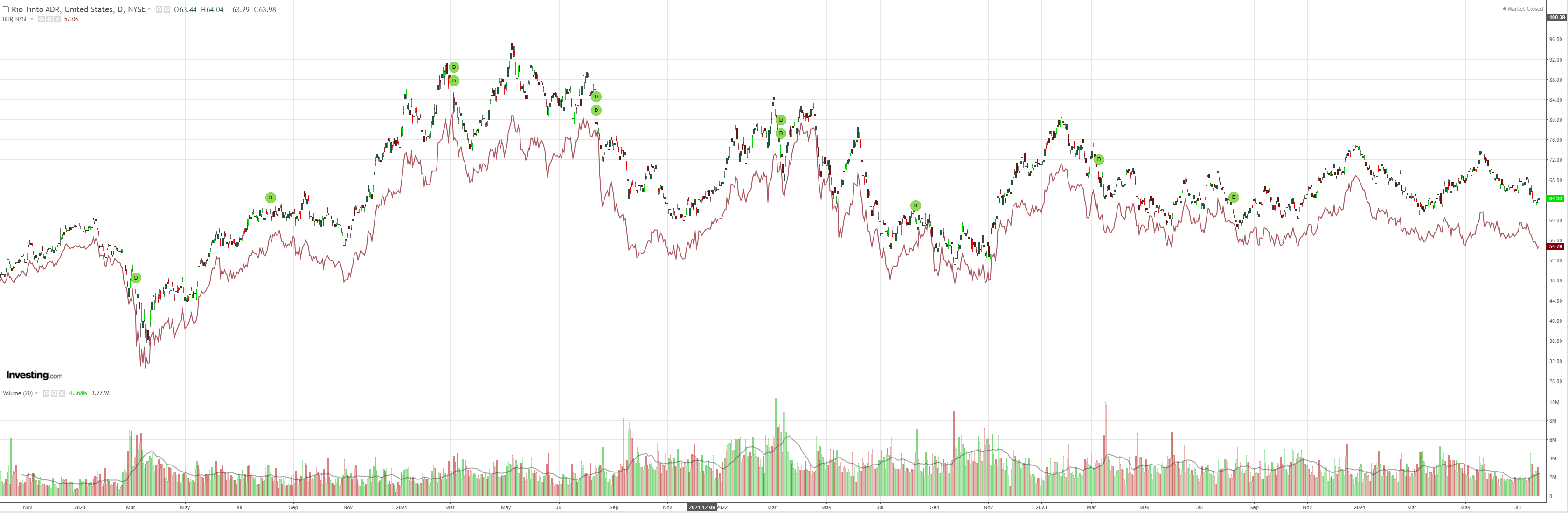

Big miners dead cat bounced:

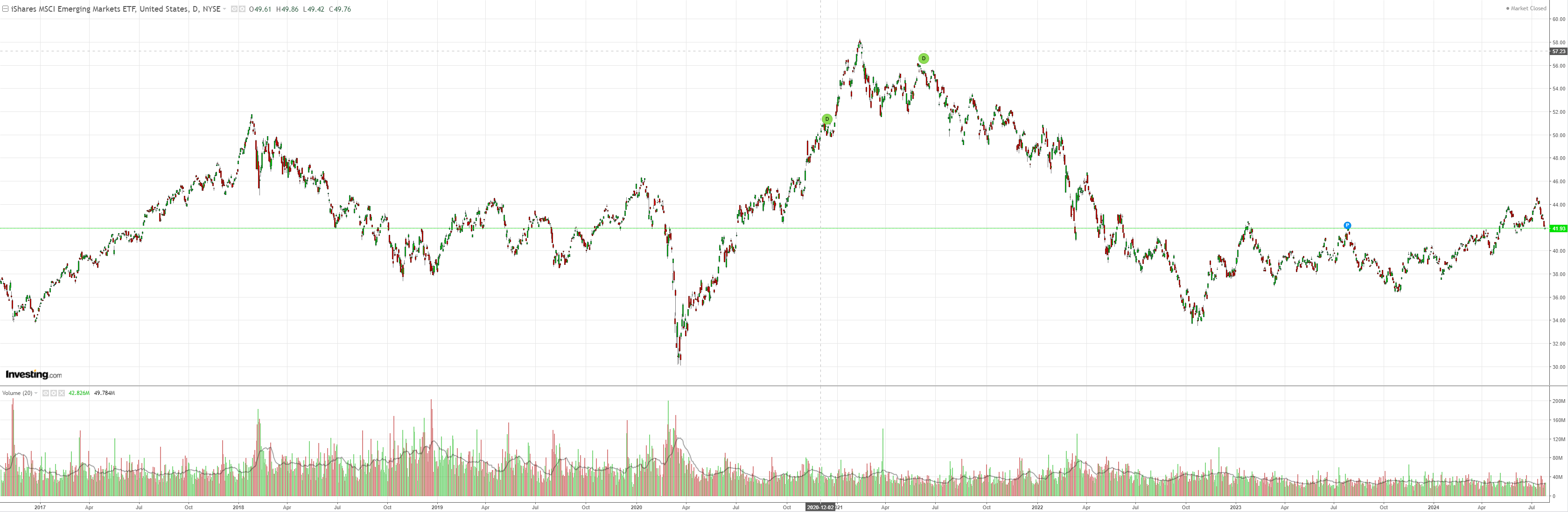

EM false break?

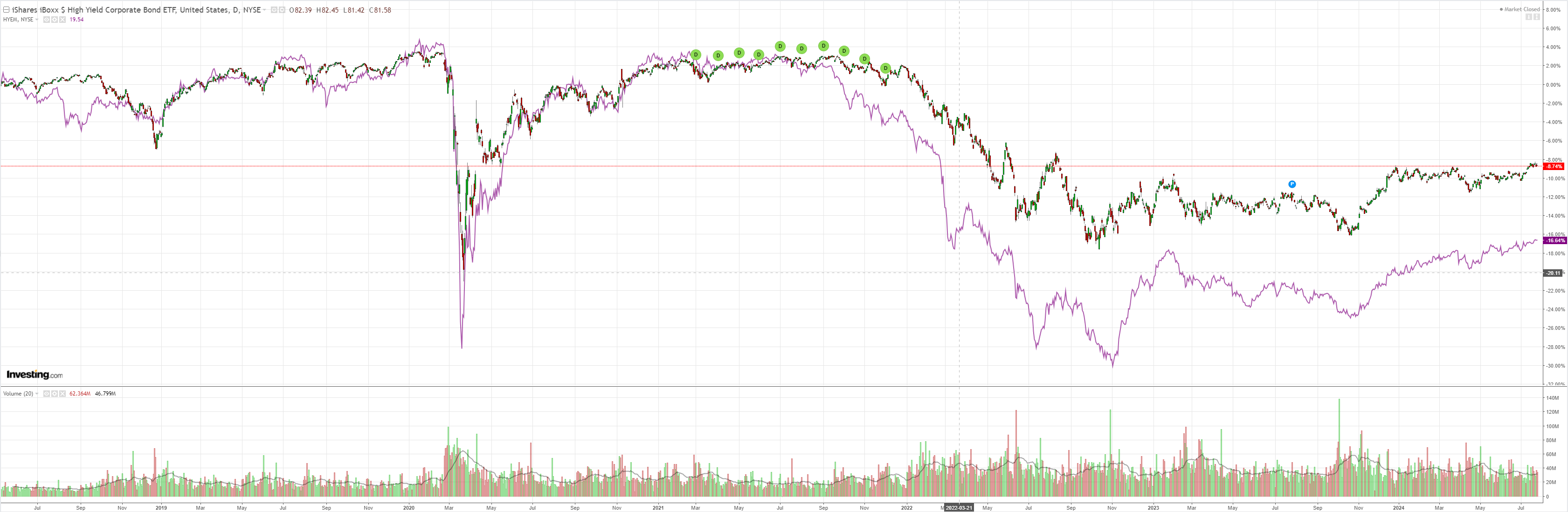

Don’t get too bearish. Junk is serene:

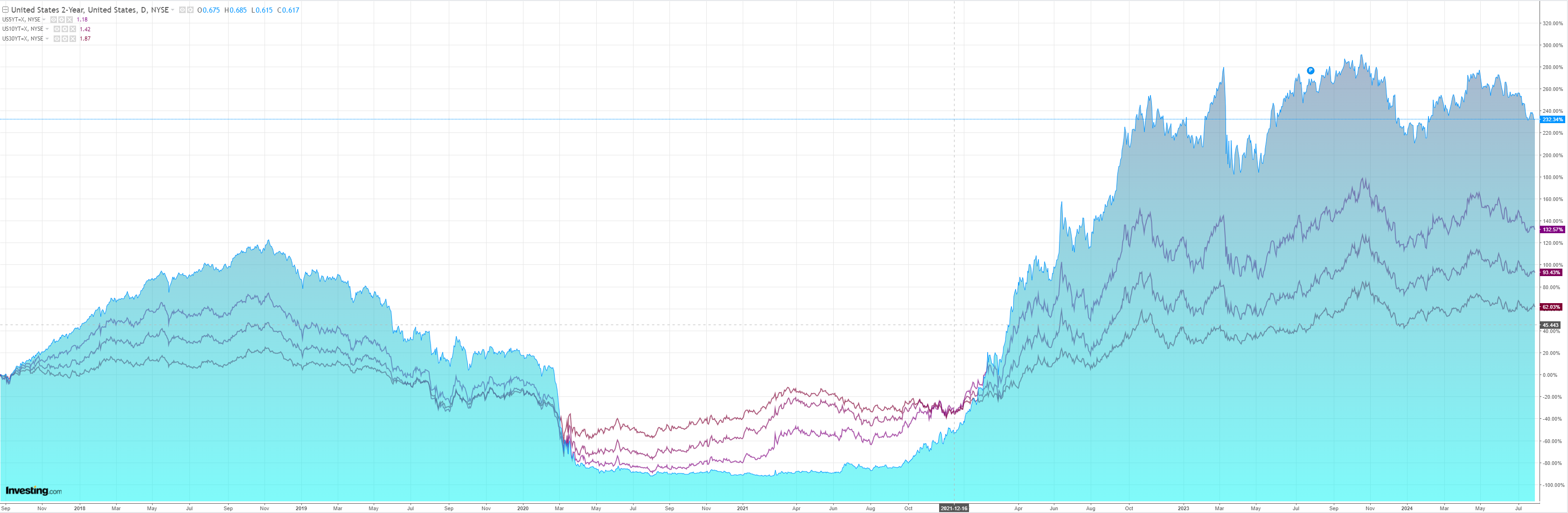

Yields fell:

Stocks down the lift:

Credit Agricole wraps us up:

According to our models, global equity market performance is a bit more than half as important a driver of AUD/USD as the Australian-US short-term rates differential.

However, the jump in global equity market volatility in the past week has elevated its importance as a driver of the exchange rate.

When trading the AUD/USD in the coming week, investors will have a close eye on the further US technology stock earnings including heavyweights such as Microsoft, Meta, Apple and Amazon, even as the Australian CPI data also released next week will determine the outcome of the RBA’s August meeting.

With the Australian rates market pricing in only about a 20% chance of a 25bp rate hike by the RBA in August an upside surprise in the Australian CPI data would be a boon for the AUD.

Most of the AUD’s gains would be against the NZD, however, and the bump in the AUD against the USD would likely been seen by investors as a chance to sell AUD/USD if risk is still selling off.

Sensible enough. However, yesterday it was the event risk of the unexpected PBoC rate cut that did the job on AUD.

As I have described exhaustively for months, AUD is caught between decoupling superpowers on every front:

- China’s property crash and commodities.

- US election, tariffs, tax cuts, and exceptionalism.

The only positive for the currency is monetary policy but that will take a backseat the more that the superpower headwinds intensify, raising the prospect of a national income shock and more RBA cuts.

Expect the Fed and, increasingly, the PBoC to push the AUD around.