DXY is firm and its uptrend is intact:

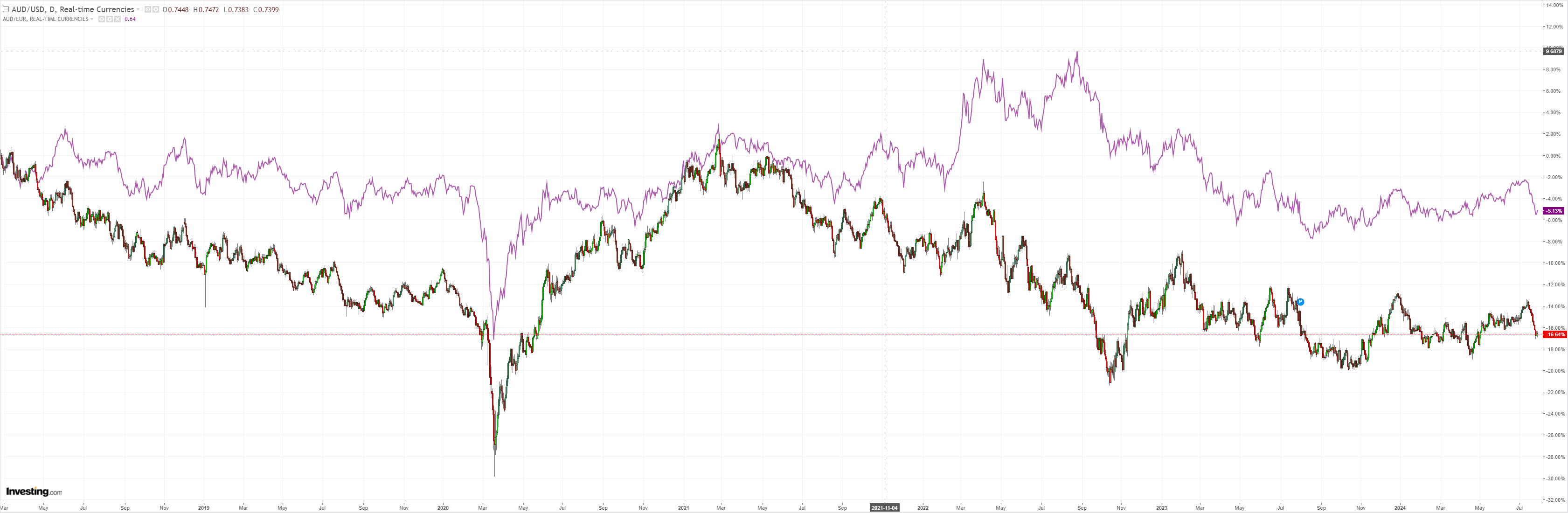

AUD is not well:

North Asia is volatile:

Oil puked:

Commods puked:

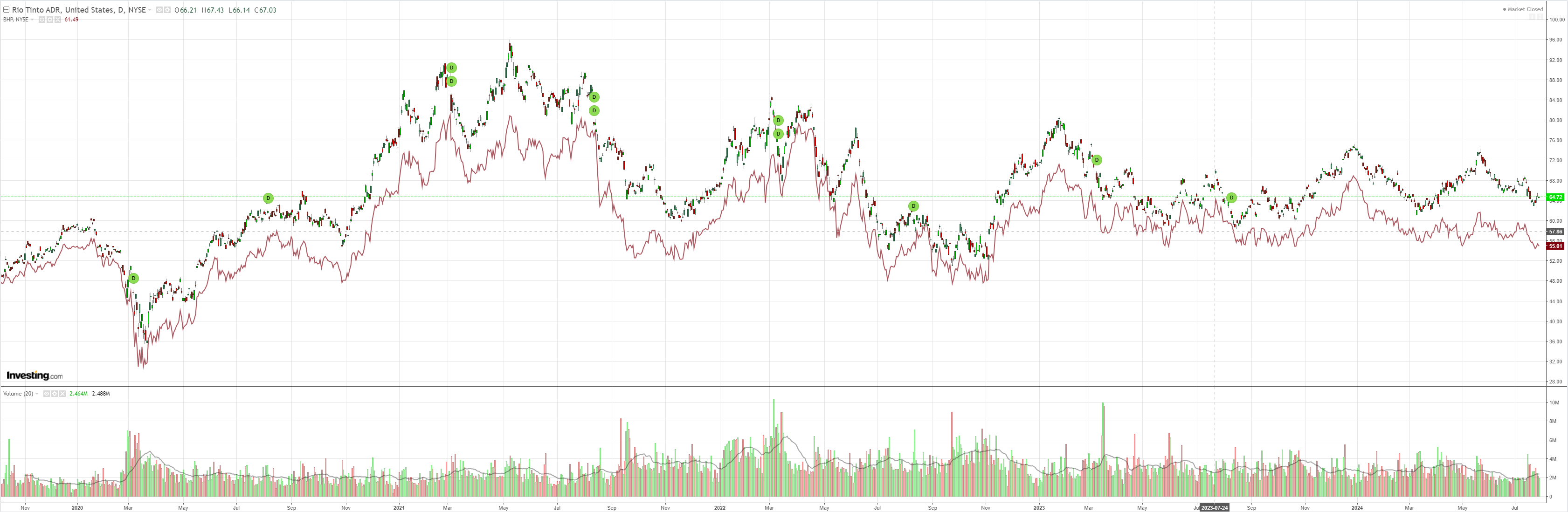

Miners puked:

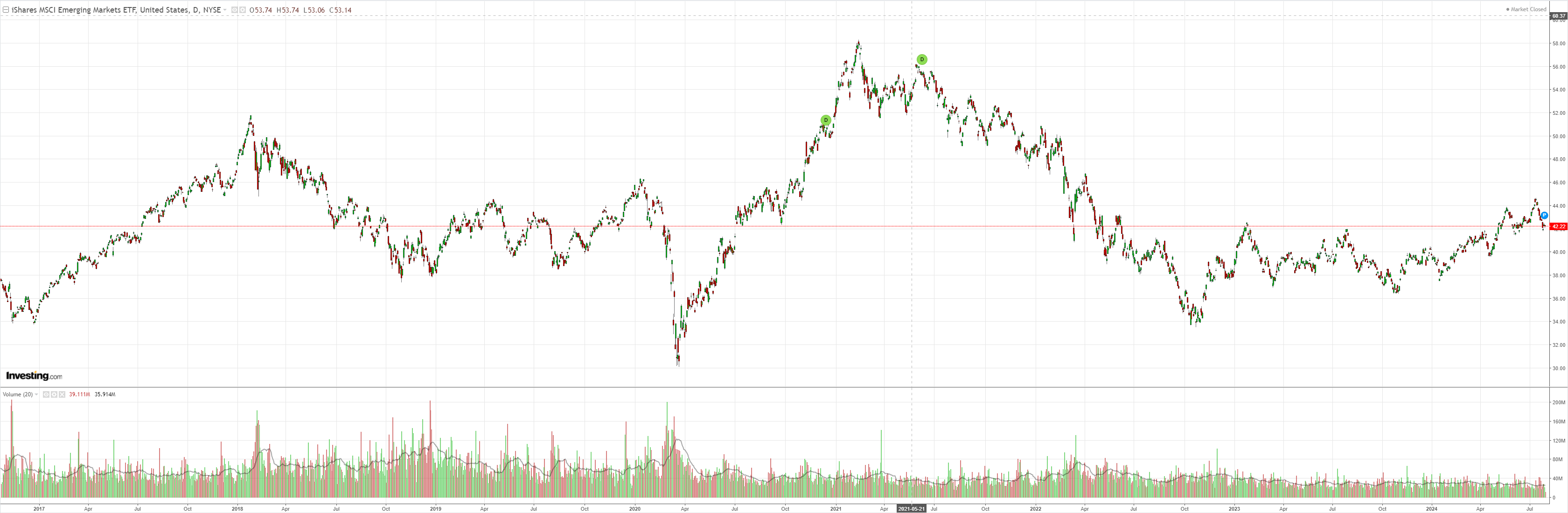

EM is holding support:

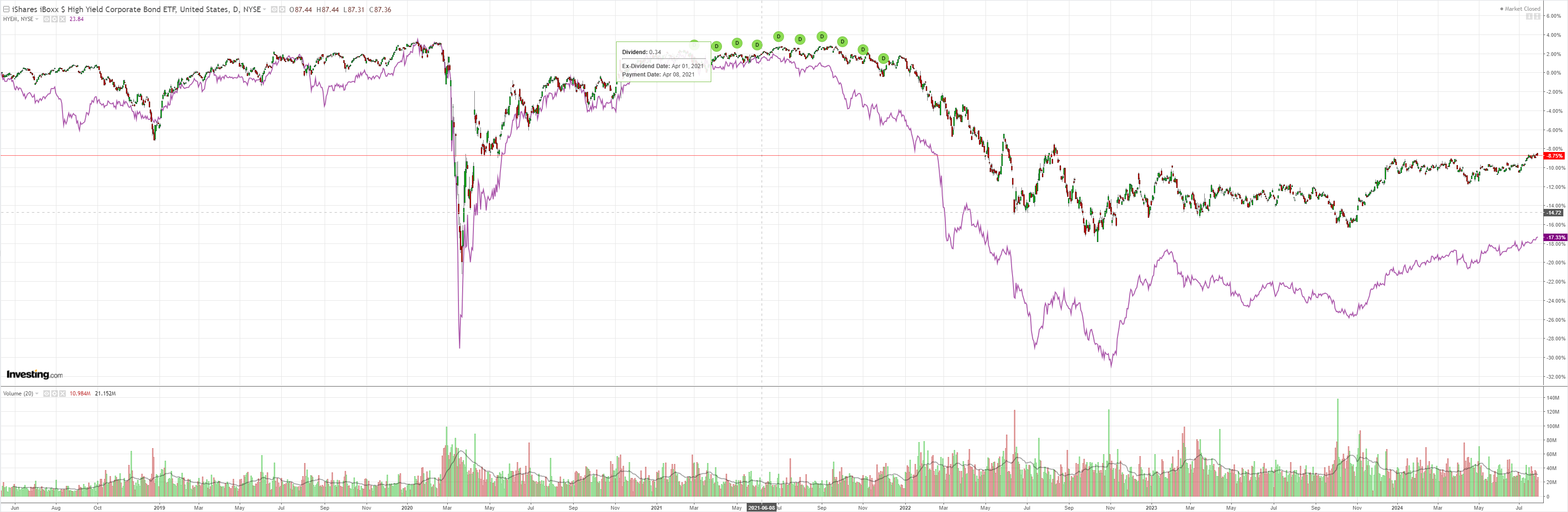

Junk is da man:

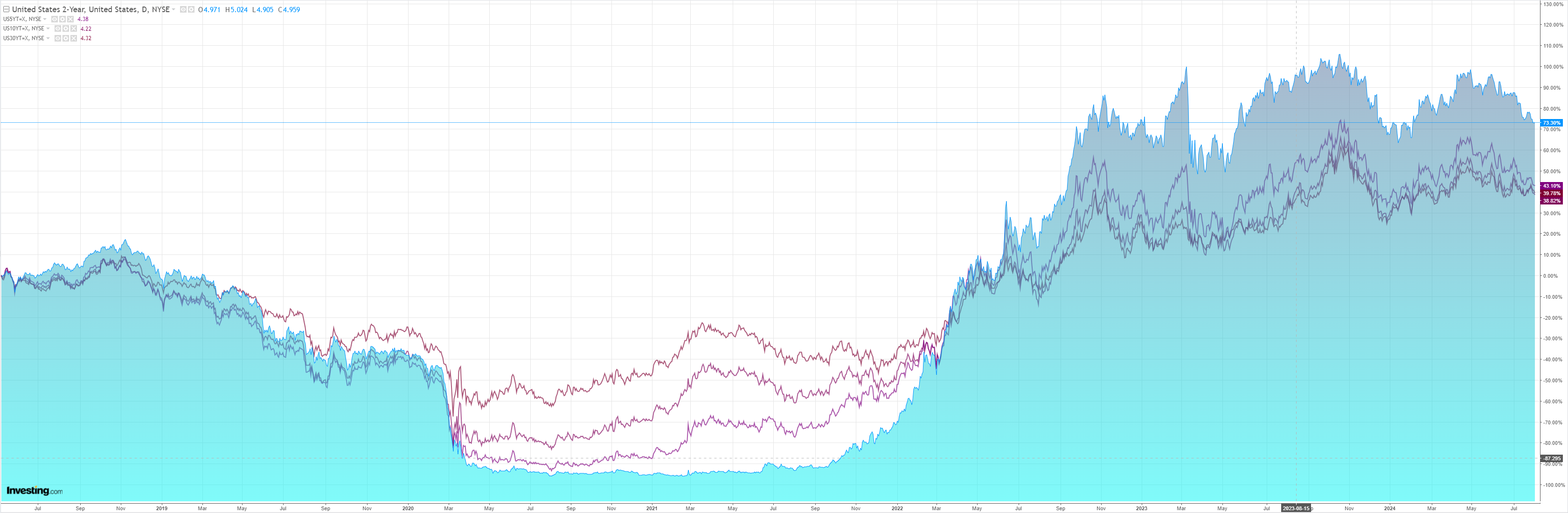

As yields roll over:

But stocks can’t get a bid:

As the Fed moves to cut, the market is wondering whether it is inflation that is cooked or it is growth.

Hence, yields are falling but so are stocks:

Junk spreads are telling us loud and clear that it is a soft landing. But there is softish and less soft. If it is the latter then high stock valuations do not make sense.

Add that Trump is still the favourite to win the White House, bringing maximum pain to China, and the outlook for global growth becomes worrying, and alarming for commodities.

AUD positioning is neutral after the recent rally so there is plenty of downside room if the “less soft” narrative gathers ballast.

That is the base case for now.