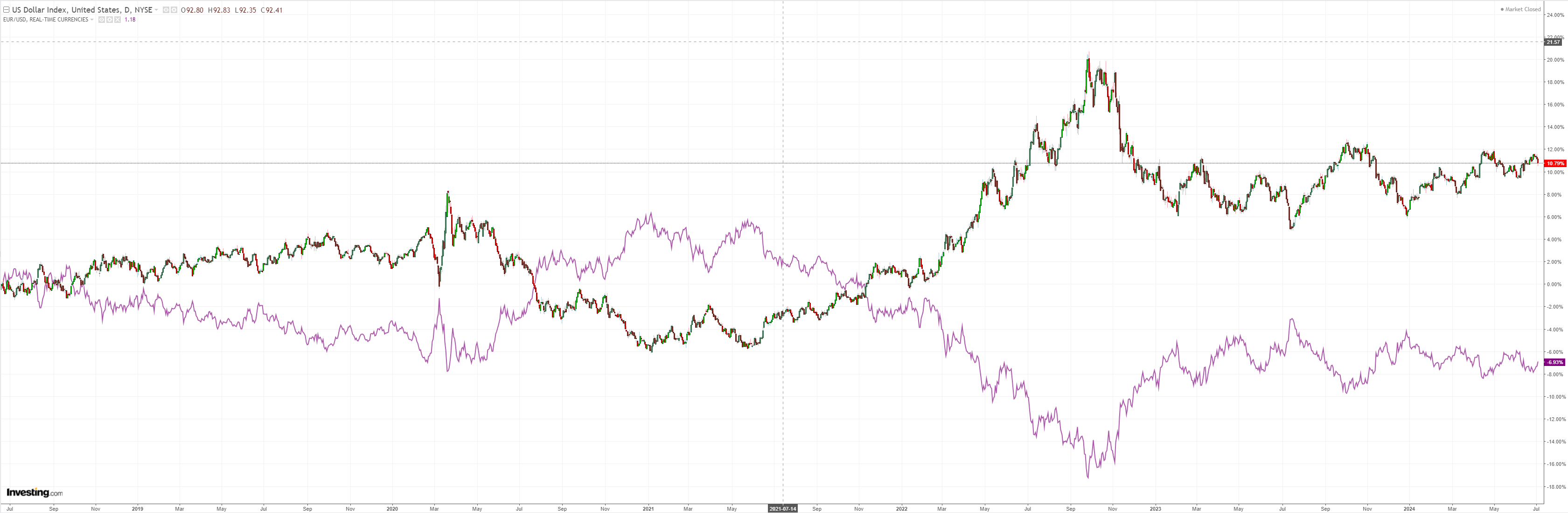

DXY was weak last night:

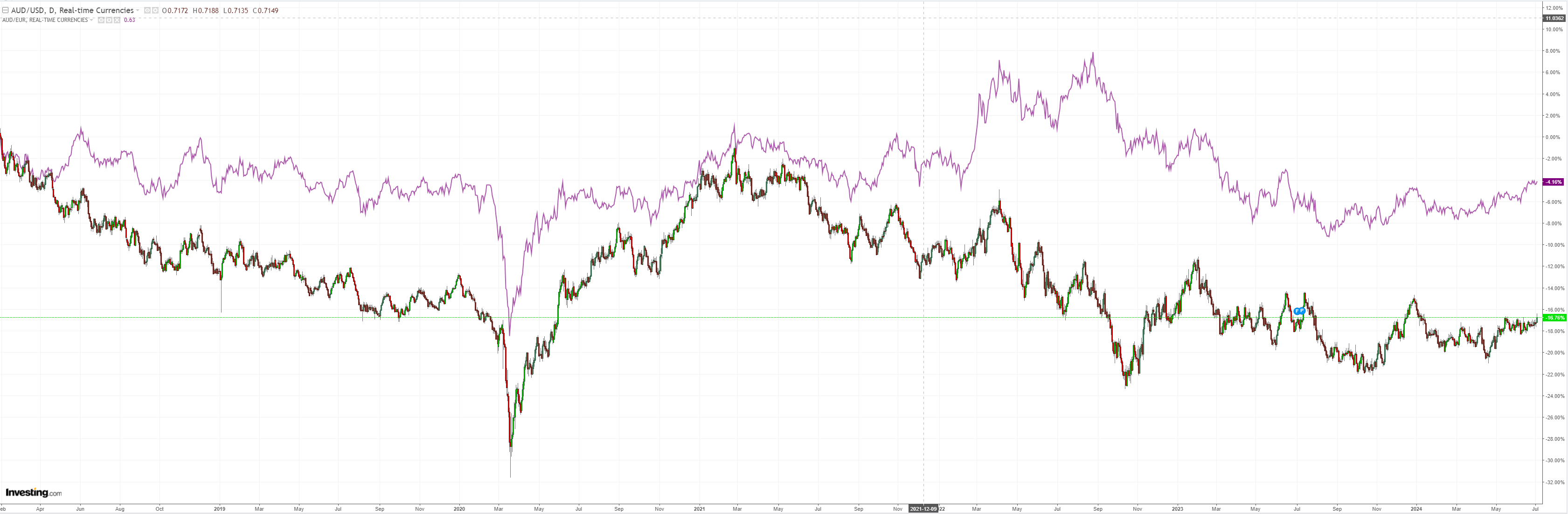

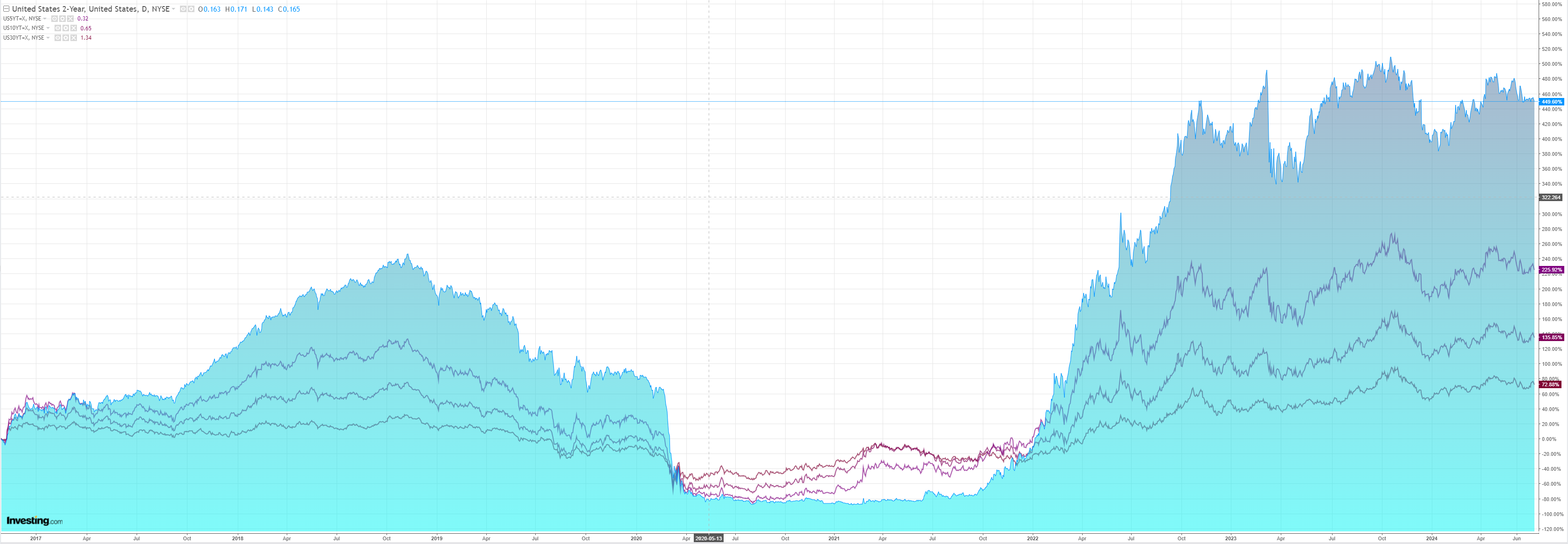

AUD is definitely threatening to breakout:

Despite Asia in free fall:

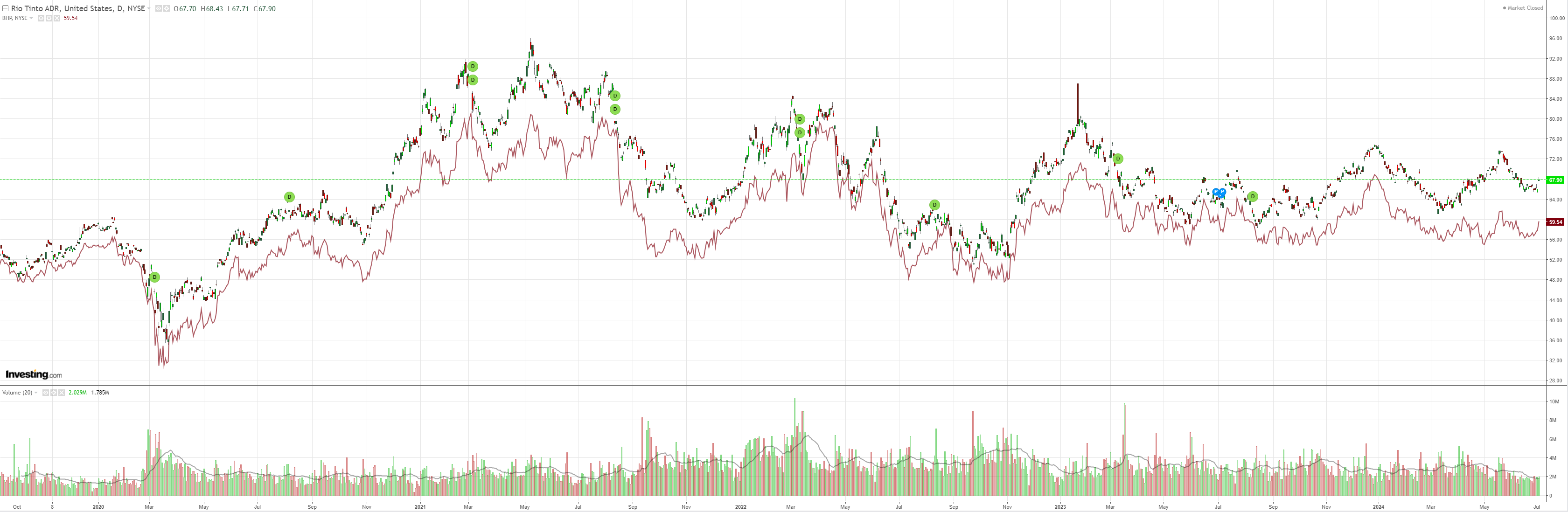

Commods all popped:

Miners too:

And EM:

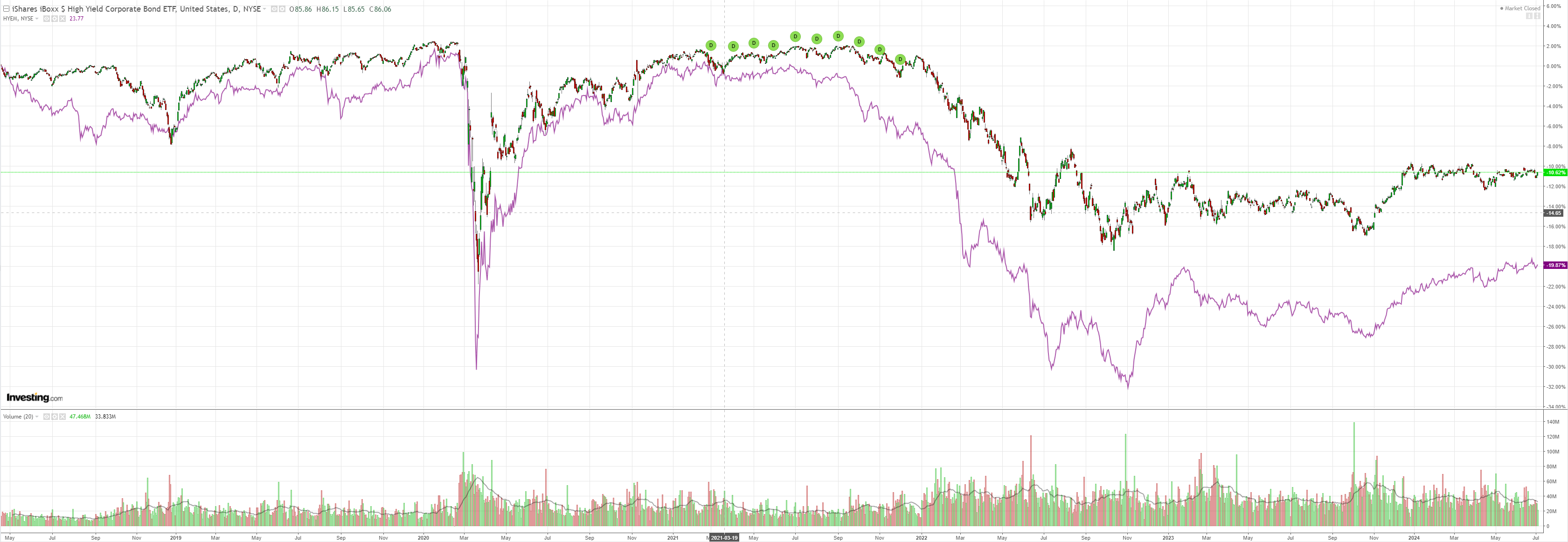

Junk meh:

Yields fell on the weak ADP:

Which stocks just loved:

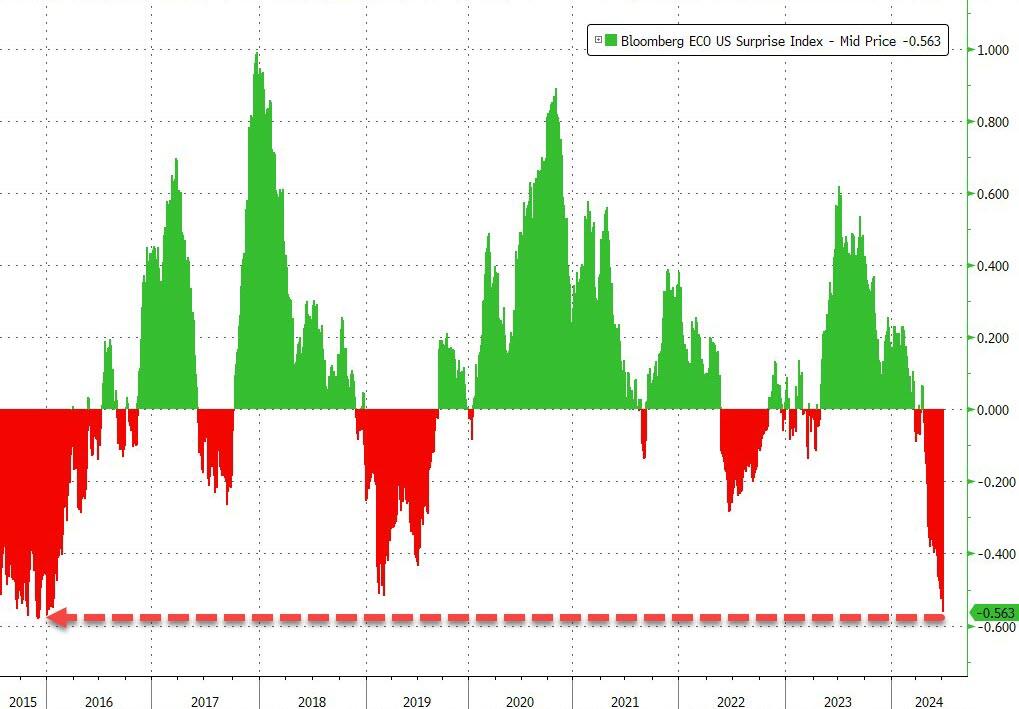

Weak US data ADP employment and jobless claims have sent the US economic surpise index to new lows:

FX is getting excited that Fed cuts are looming. There is also the growing favourtism of Donald Trump for president offering less doubt about outcomes.

Other geopolitical risks like France, Ukraine and Israel are all taking a back seat to the Fed now.

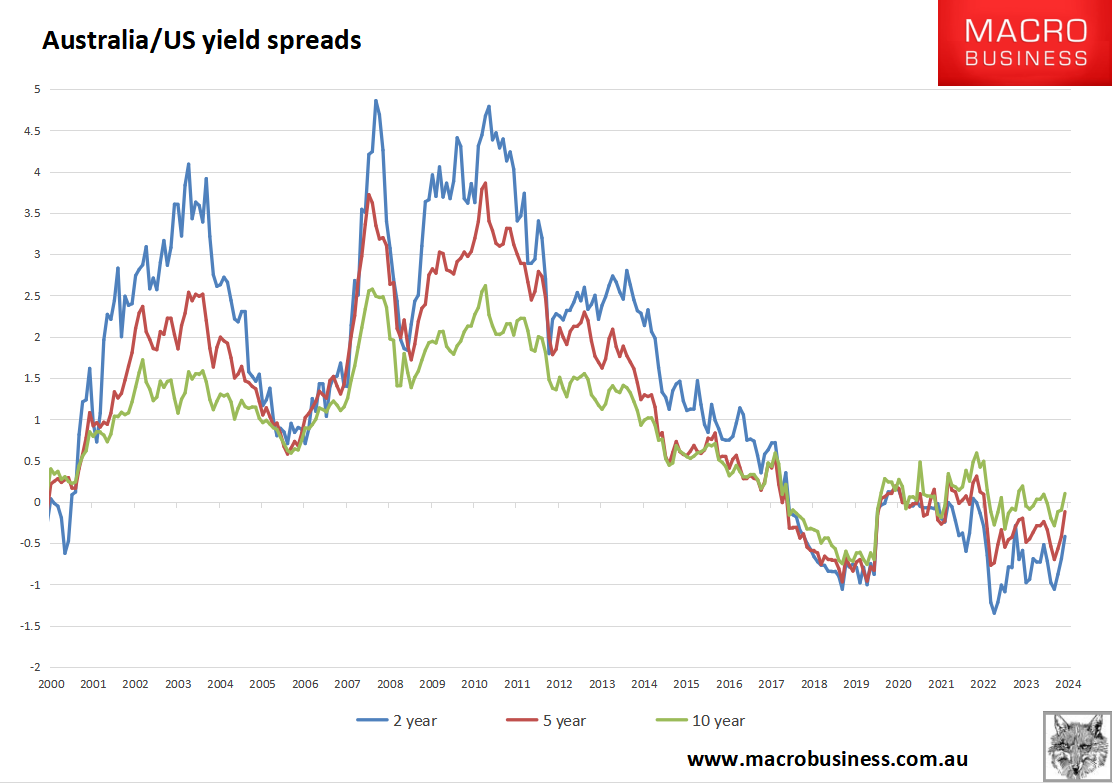

Add that the RBA is under pressure to hike and we’re getting some yield spread widening to aid the AUD:

I don’t think that the RBA is going to hike. Most of the recent inflation brouhaha is base effects and with energy relief landing now, CPI will be at 3% or below in H2.

But I do think that the Fed is going to cut soon so there maybe enough fuel in this for a short-term AUD pop.

Still, with all the geopolitical risks and Trump smash to China looming, I still can’t see it getting far.