DXY was flat night:

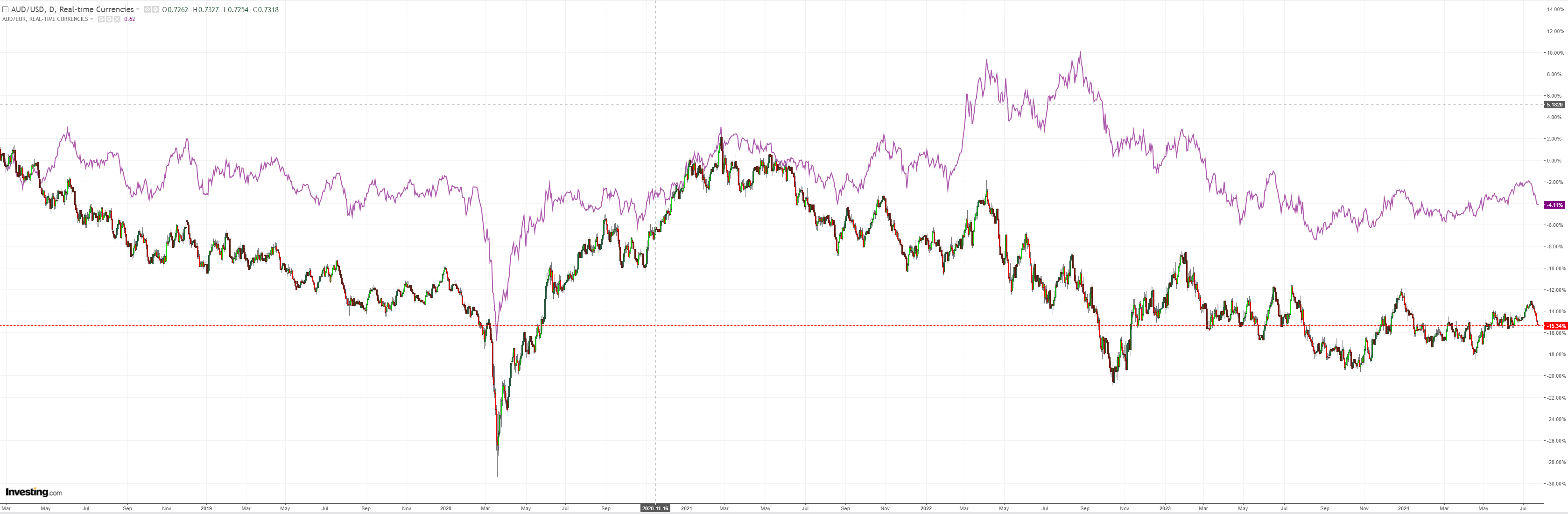

AUD was flogged again:

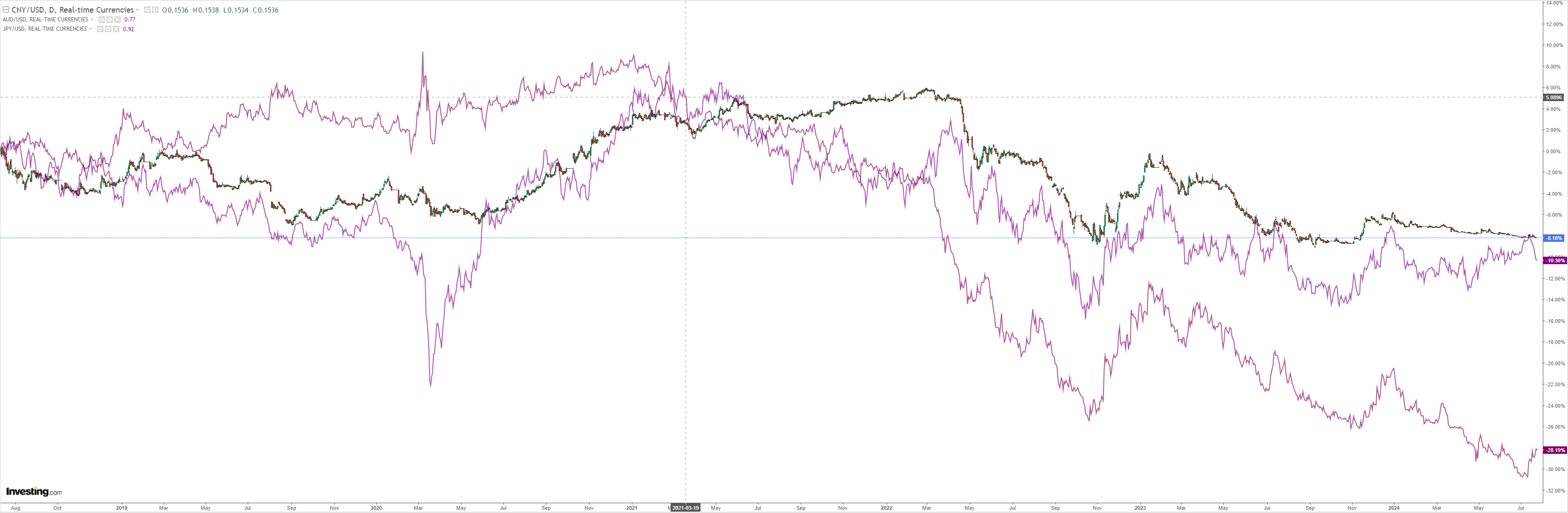

North Asia is bifurcating with JPY up and CNY down:

Advertisement

Oil down:

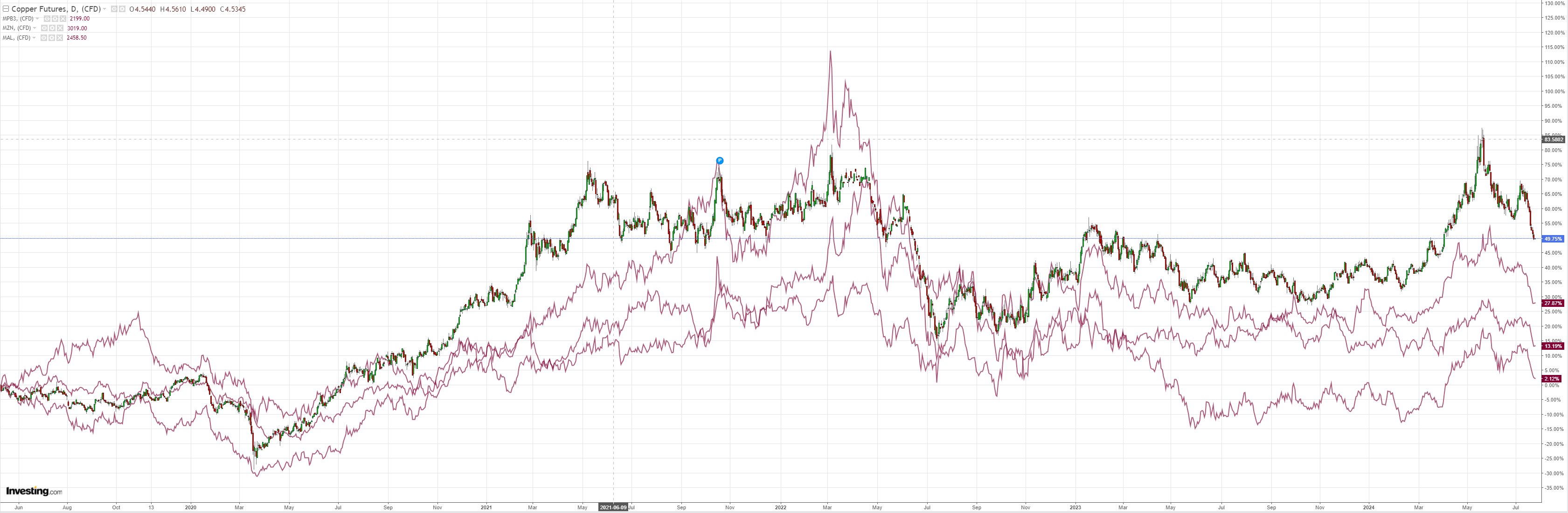

Commodities down:

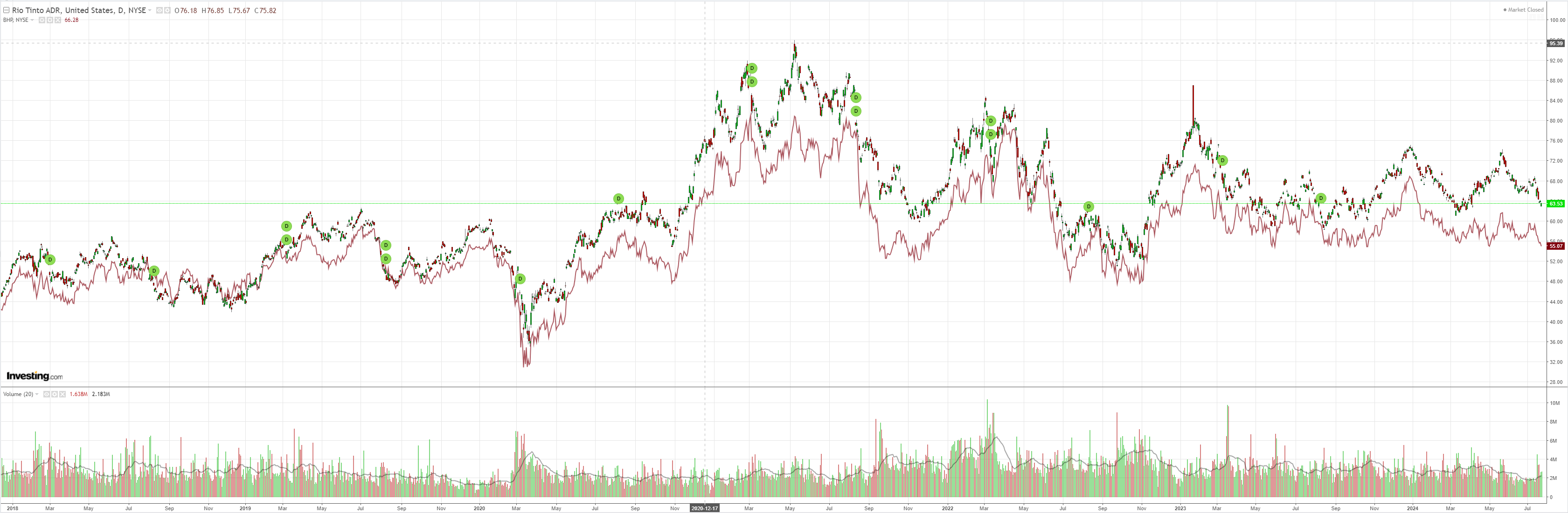

Miners at the cliff’s edge:

Advertisement

EM is fine:

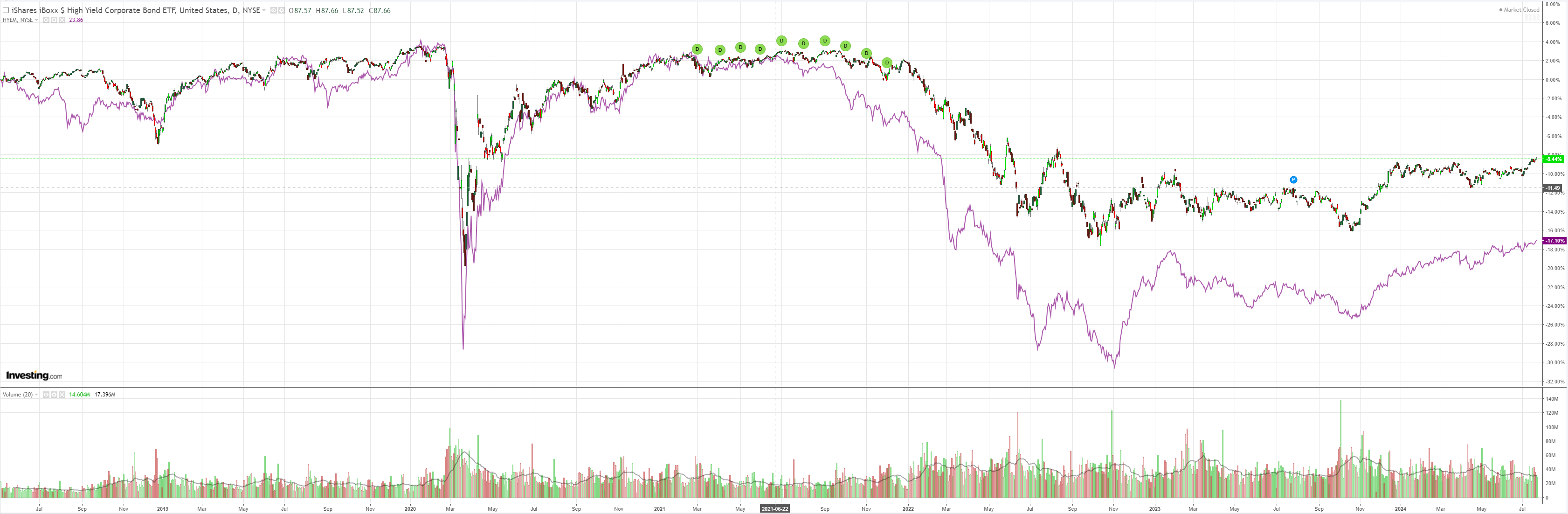

Junk is fine:

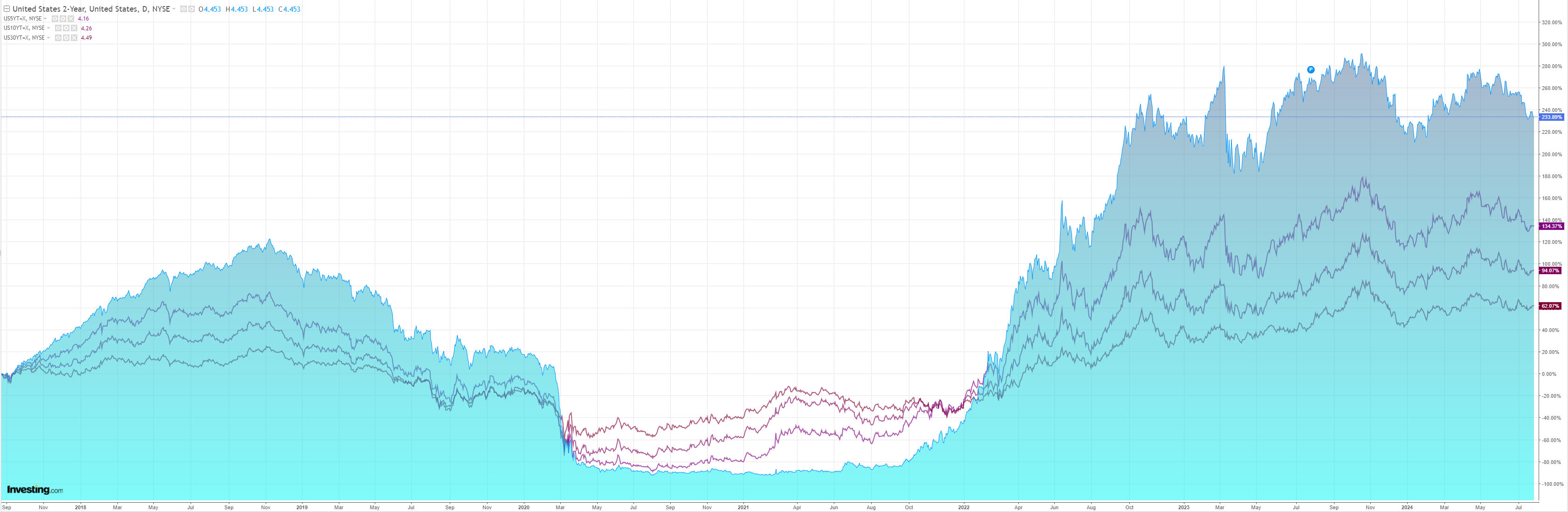

The curve bull steepened:

Advertisement

Stocks faded:

The tactical future of the AUD lies in the US with the election and Fed cuts.

The longer-term future is still tied to China and commodity prices.

Advertisement

Fed cuts could give us a pop in AUD at any moment.

However, rallies will push against the fast deteriorating strategic outlook of failing Chinese growth, exacerbated by a likely Trump presidency.

It adds up to a sell-the-rallies view of the AUD.

Advertisement