DXY firmed last night:

AUD was thrashed lower:

Much of the damage was done earlier in the day by the PBoC rate cut, an ominous signal for Trump tariffs:

Oil fell, gold firmed:

The copper bubble is a laugh a minute:

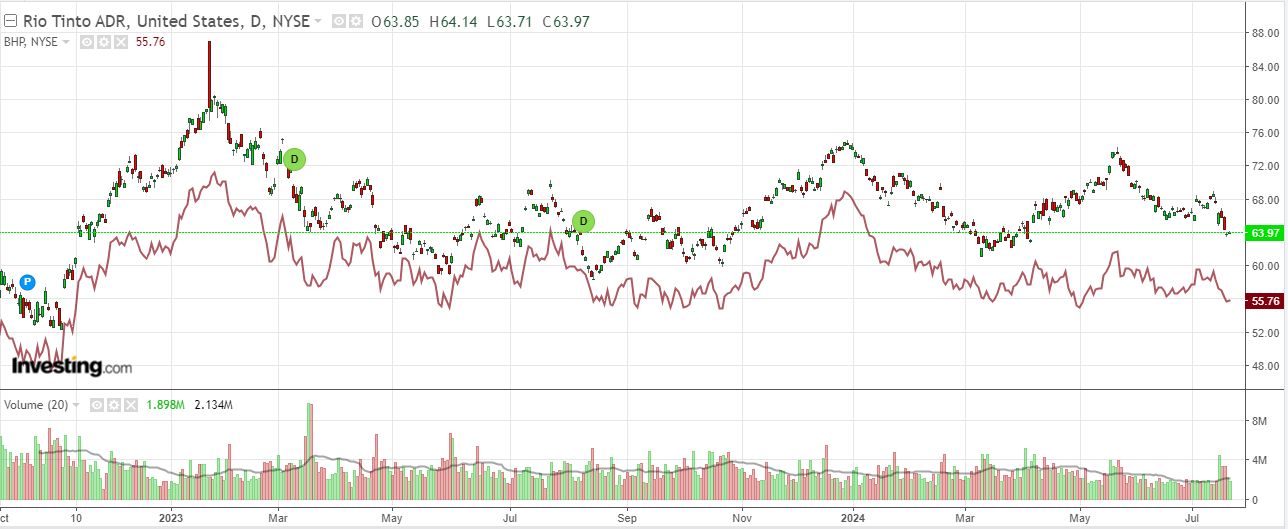

Big miners are in big trouble:

EM stocks popped:

Junk is bullish:

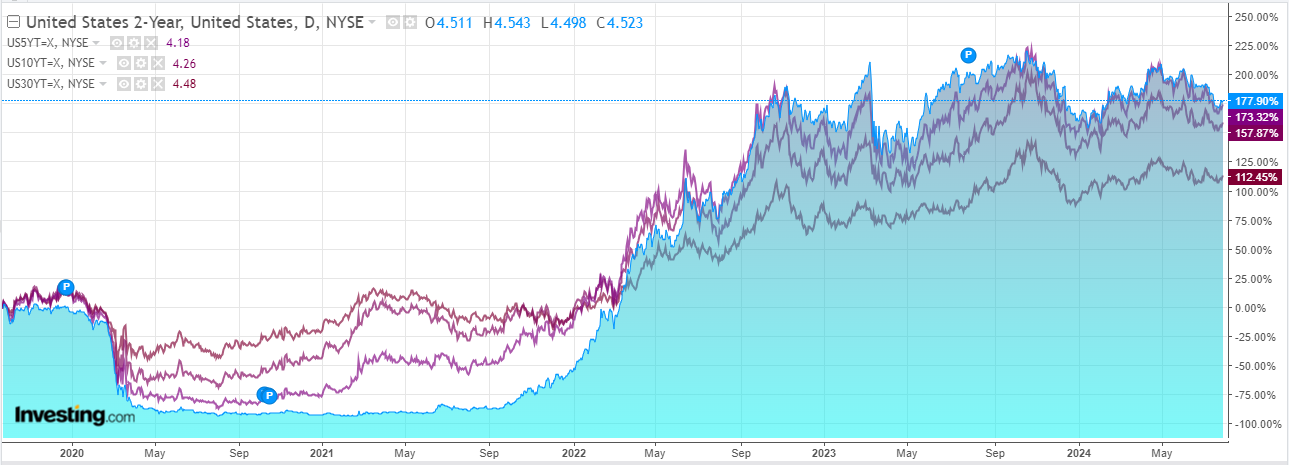

Yields firmed:

Stocks took off:

Westpac wraps the action:

There has been no change in market thinking around the Fed policy outlook. If anything .

Meanwhile over the next several months. Altogether interest rate differentials between Australia and the US continue to lean in favour of AUD/USD holding onto the higher terrain near 0.6800 that it claimed in mid-July.

The main catalyst for AUD/USD’s latest setback back into May-June ranges is a combination of renewed weakness in commodities and a volatile US presidential election news cycle that has put the November race into uncharted territory.

Some of that, sure. But AUD is still caught in the Chinese downdraft as well.

The forthcoming Fed cuts will act as tailwind in the short term but any move higher is unsustainable as China keeps slowing, not least if it is execerbated by a Trump presidency.

I’d be looking to sell into all bounces for AUD.