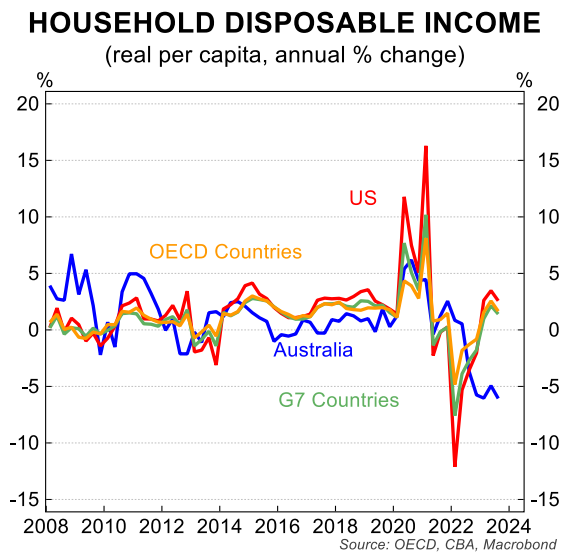

Last year, Australian households experienced one of the world’s biggest decreases in real per capita household disposable income.

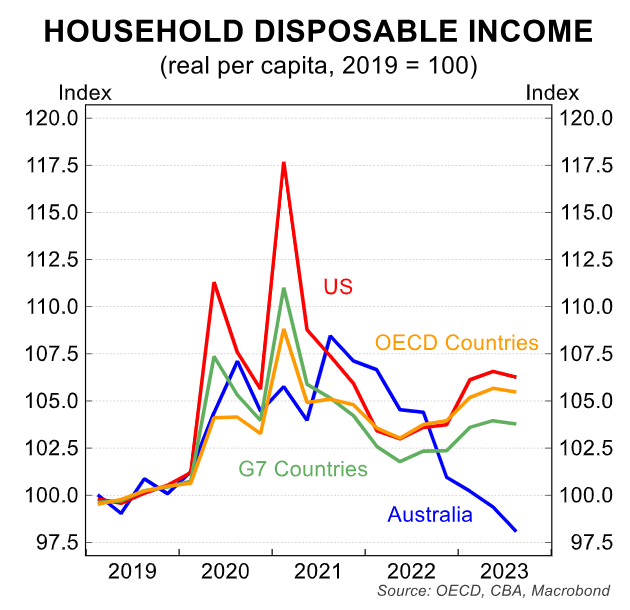

Australians have also had one of the steepest reductions in real per capita since the beginning of the pandemic:

According to the Australian Bureau of Statistics’ (ABS) March quarter national accounts, annual real per capita household disposable incomes in Australia have fallen by 7.6% from their June 2022 peak to levels last seen in early 2018.

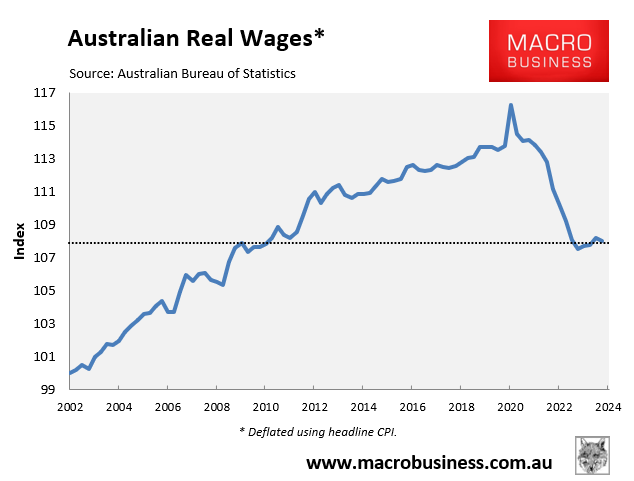

Earlier this month, the Organisation for Economic Co-operation and Development (OECD) showed that Australia also recorded one of the world’s sharpest declines in real wages:

On his weekly Save the Nation program last week, David Flint interviewed me, and I discussed how Australia’s living standards will remain under attack.

The interview covers a wide range of areas, including the upcoming commodity price rout, the energy crisis, and cost blowouts in the NDIS.

Below are highlights from the interview, broken down by theme.

Iron ore shake-out:

China is building out the Simandou iron ore project in Africa, which is due to come online next year and has been dubbed the “Pilbara Killer” because it is going to dump about 120 million tonnes of ore on the market a year.

It will effectively make Africa the third largest iron ore exporter in the world after Australia and Brazil, and all of this extra supply is likely to collapse the global iron ore price.

This is obviously not going to be good for Australia, and it’s also coming at the same time as China is winding down it’s building of apartments, empty cities, infrastructure, and all those sorts of things.

China has obviously been the key driver of global iron ore demand. So, we have effectively got a situation where global iron ore supply is going to increase because of all this African ore at the same time as China’s demand for iron ore is shrinking.

China is also building up its steel capacity by using scrap to make steel, which is also going to lessen its dependence on Australian ore.

So, the outlook for Australian iron ore is pretty dire over the next several years and the longer-term. And when prices do tank, it means that the federal government is going to get less corporate tax, which is going to harm the federal budget.

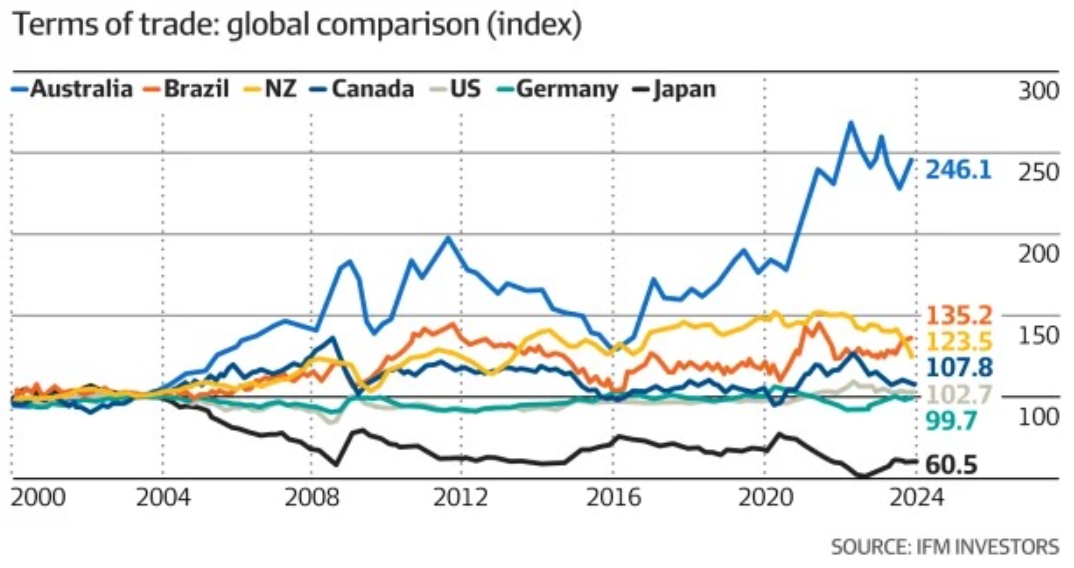

Australia has been the biggest beneficiary in the world from these surging commodity prices over the past decade or so. A lot of that is going to reverse if we see iron ore collapse, because it is still our biggest export.

Australia has benefited most from rising commodity prices.

NDIS cost blow-out:

The National Disability Insurance Scheme (NDIS) is currently costing taxpayers over $40 billion a year. And the Parliamentary Budget Office (PBO) projects that it could cost up to $100 billion within a decade. That would put it on par with the age pension for cost.

So, we’ve got these growing costs on the federal budget—both through population aging and having fewer taxpayers to go around—but also these expenditure items like the NDIS, which are massive.

This is going to place a heavier burden on the taxpayer at the same time as corporate tax revenue from commodities is likely to fall. It is a dire situation.

It also gets back to the fact that Australia doesn’t tax our energy exports properly, especially gas. We don’t have a huge stockpile of accumulated savings like Norway does from its Sovereign Wealth Fund to cushion the impact when these sorts of things happen.

So, Australia has set itself up for a pretty nasty period ahead.

Energy policy failure:

Our politicians have created a ridiculous situation whereby we are exporting over 70% of the gas on the East Coast.

We don’t have a reservation policy and the overwhelming majority of our gas is going to China and Japan, which are receiving more of our gas than they actually need.

China and Japan are actually re-exporting our excess gas for profit at the same time as we have a shortage on the East Coast.

This artificial shortage is driving up our gas prices and, thereby, our electricity prices, because gas is one of the key generators of electricity, and it sets the marginal cost of electricity.

How can one of the world’s biggest energy exporters, which is endowed with unbelievable mineral wealth, not tax its minerals properly for its own residents and not reserve enough of those energy resources for its own citizens?

The United States has now become the world’s biggest exporter of liquified natural gas. Yet, Americans pay $US2.50 a gigajoule for their gas, which is about $A4.00.

Australians, by comparison, pay between $A12 and $A25 per gigajoule on the East Coast, depending on the day. So, we are paying three to five times as much as Americans pay for gas, despite the fact that we export over 70% of our East Coast gas.

We also sell our gas cheaper to China and Japan than we pay for it ourselves. The whole situation is ludicrous.

As a result, we have a cost-of-living crisis and stubbornly high inflation. We also have manufacturers closing down left, right, and centre because their energy costs are way too high for them to be competitive.