CoreLogic’s June housing report revealed that Australian rental growth is easing, but continues to grow at an historically high pace.

CoreLogic’s national rental index recorded a monthly increase of 0.4% (lowest since September last year) and an annual rise of 8.2% (lowest since November last year).

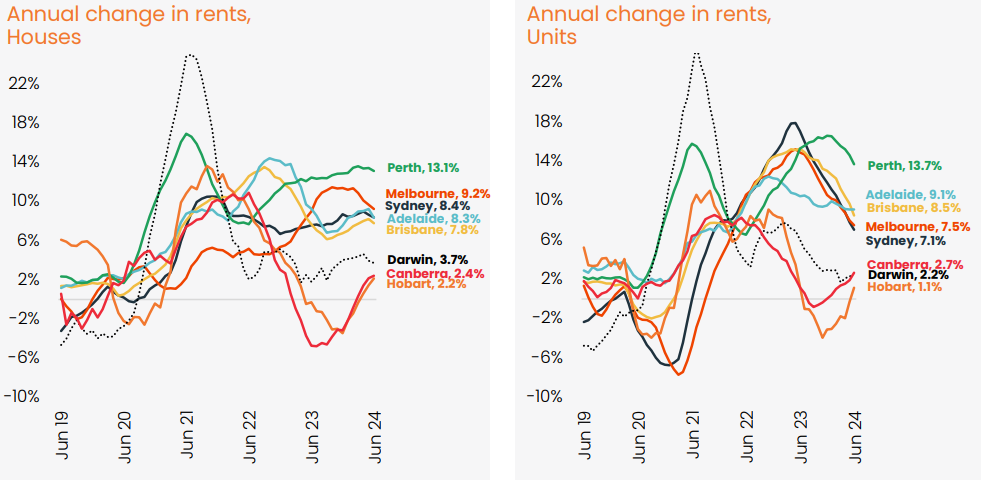

Source: CoreLogic

As illustrated above, rental growth is slowing most in Australia’s three main capitals, particularly in the unit sector.

Sydney’s unit market has experienced the greatest decline in annual rental rates. Over the last financial year, growth has moderated by 10% to 7.1%.

During the same period, Melbourne unit rents decreased from 14.9% to 7.5%, while Brisbane unit rents fell by 6.8% to 8.5%.

CoreLogic attributes the moderation in rental growth to three primary factors.

First, there is a seasonal component, given that rental demand from students tends to peak in the first quarter of the year.

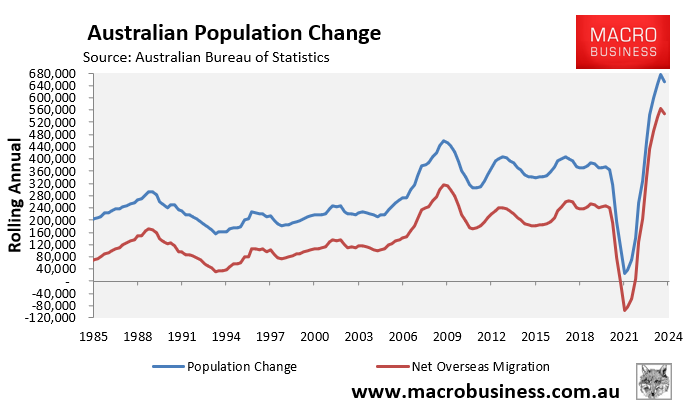

Second, net overseas migration is finally moderating after peaking in the September quarter of 2023.

This slowing in net overseas migration is having the greatest impact on the unit markets of the three largest capital cities.

Finally, rents appear to be hitting an affordability ceiling.

“National unit rents are up 22% over the past two years compared with a 16% rise in house rents over the same period”, notes CoreLogic.

“CoreLogic affordability metrics to March showed the median income household would need to dedicate 32.2% of their gross annual income to rental payments, the highest portion on record”.

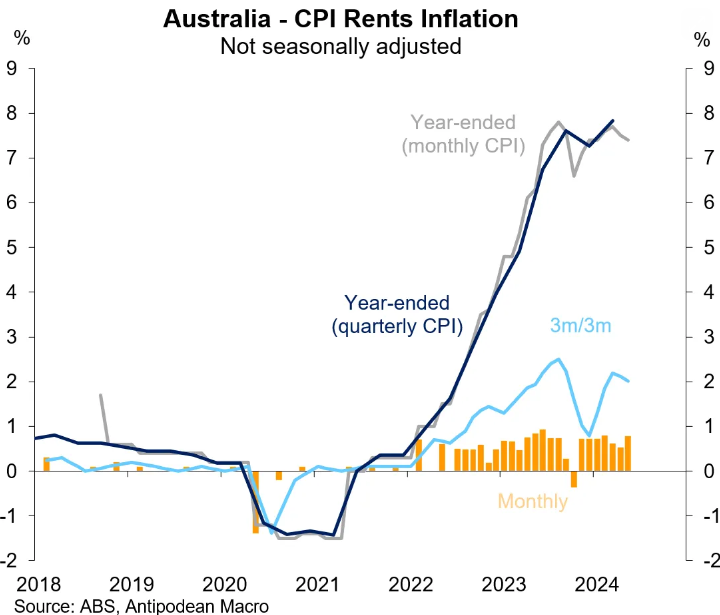

Despite the moderation of rental growth, rents are still rising at a strong pace, which points to worsening rental affordability.

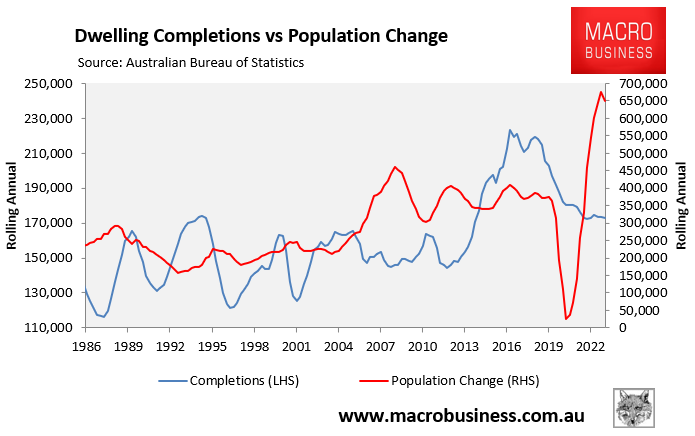

This above-average growth in rents will continue so long as population demand via net overseas migration continues to swamp new dwelling construction.

It also points to ongoing strong CPI rental inflation, which makes up around 6% of the overall CPI inflation basket.

The Albanese government manufactured the rental crisis by deliberately choosing to ramp-up net overseas migration to record levels.

It must slash immigration to a level below the nation’s capacity to build housing and infrastructure.

Otherwise, the rental crisis will drag on, plunging Australians into group housing and homelessness, as well as placing upward pressure on CPI inflation and interest rates.