By Gareth Aird, head of Australian economics at CBA.

Summary:

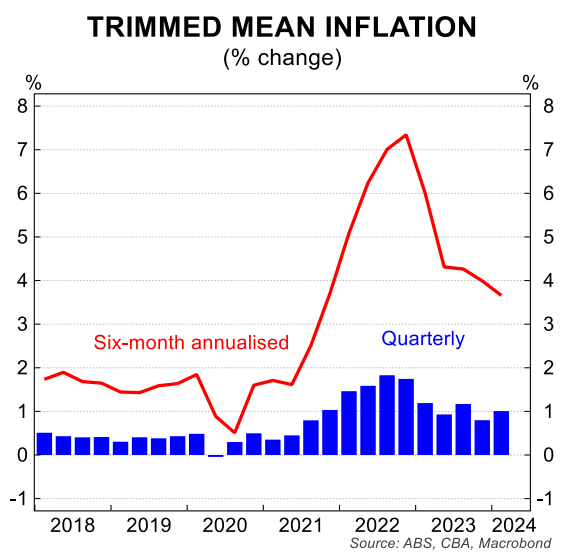

The RBA’s preferred measure of inflation is trimmed mean CPI.

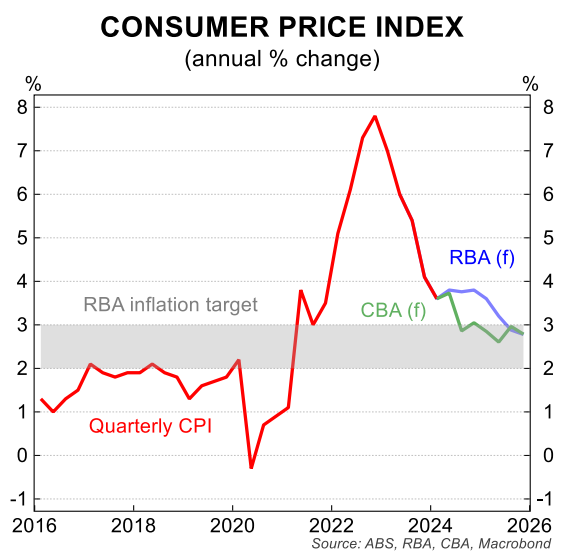

But the Statement on the Conduct on Monetary Policy makes no reference to trimmed mean inflation and simply states that the flexible inflation target is “consumer price inflation between 2 and 3 per cent”.

Consumer price inflation in the Conduct of Monetary Policy refers to headline CPI. And from Q3 24 we forecast headline CPI to be within the RBA’s target band. It will be materially lower than trimmed mean CPI in 2024/25 due to the impact of energy rebates.

We believe that market participants should put equal weight on both the headline and trimmed mean outcomes in 2024/25, in part because actual inflation influences future inflation.

The expected materially lower headline CPI outcomes from Q3 24 will help to both anchor inflation expectations as well as limit price rises for administered charges in 2025 that are linked to actual CPI outcomes.

Lower headline CPI will also put downward pressure on wages growth in 2025 given the rate of headline inflation is often used as a starting point in a lot of wages negotiations.

That said, in the very near-term market participants will be firmly focused on the Q2 24 trimmed mean CPI (due 31/7).

We expect a Q2 24 trimmed mean CPI of 0.9%/qtr or less would see the RBA leave the cash rate on hold in August (our forecast is 0.9%/qtr). An outcome of 1.1%/qtr or above would mean an August rate hike is more likely than not.

We believe a Q2 24 trimmed mean CPI result of 1.0%/qtr is in the ‘grey zone’ and other important data to be released over coming weeks would feed into the decision as to whether to raise the cash rate or not in August.

We see the RBA on hold in August, but acknowledge the margins are finely balanced. The June labour force survey (due 18/7) is also a critical piece of economic data that will feed into the policy debate.

The RBA prefers the trimmed mean CPI:

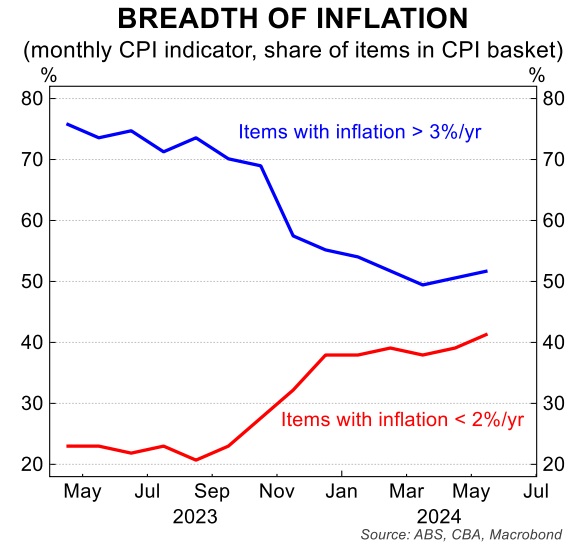

The inflation basket can be carved up in a number of different ways. Economists and market participants have generally focused more on underlying inflation (or core inflation) rather than headline inflation when assessing the outlook for monetary policy in Australia.

That is because the RBA have tended to put more weight on underlying inflation which attempts to abstract from the short-term volatility in some prices.

Quarterly movements in the headline CPI can be volatile because there are often big seasonal swings in the data, commodity prices and agricultural conditions can shift quickly, policy changes can impact quarterly outcomes and there may be infrequent price resetting.

The RBA’s preferred measure of underlying inflation is the trimmed mean CPI. But it is worth noting that the Statement on the Conduct on Monetary Policy makes no reference to trimmed mean inflation and simply states that the flexible inflation target is, “consumer price inflation between 2 and 3 per cent”.

Consumer price inflation in the Conduct of Monetary Policy refers to headline CPI.

Indeed, RBA enthusiasts will be aware that the rate of inflation quoted on the RBA’s homepage is the annual rate of headline inflation and not the trimmed mean.

However, the RBA prefers to focus on trimmed mean CPI rather than headline CPI from a monetary policy perspective as it more accurately captures the pulse of inflation.

Indeed, Governor Michele Bullock recently confirmed this in a parliamentary testimony.

When asked about how the energy rebates will impact the interest rate outlook that Governor replied, “Yes, the government’s rebates will affect headline inflation at the margin. To the extent that inflation might have a two on it in a headline sense, they might affect people’s expectations and they also might affect prices that are indexed. But, in terms of the underlying pulse of inflation, we’re looking through that to the trimmed mean, if you like, and we don’t think it’s going to have an impact”.

The RBA’s emphasis on the trimmed mean CPI over the headline CPI requires that as a general rule financial markets participants should do the same when assessing the future path of monetary policy. This is important for the upcoming CPI.

Looking further ahead, an unusual dynamic will occur from Q3 24 where a material gap will open up between headline CPI and trimmed mean CPI because of energy rebates. That disparity will broadly remain in terms of the annual rate of inflation for four quarters.

The impact of the energy rebates on headline CPI will play out over several quarters. We believe this slightly complicates the monetary policy outlook in 2024/25 and means more weight than usual should be placed on headline CPI.

On our calculations headline inflation will dip to sit within the RBA’s target band from Q3 24. The RBA will continue to emphasise the trimmed mean rate of inflation. But the Board will also need to acknowledge that headline inflation is within the target band.

From a communication perspective, we believe it makes it harder to tighten policy further if headline inflation is sitting within the target band and policy is already declared by the RBA to be restrictive.

It does not mean that the RBA would be unwilling to raise the cash rate again. But we believe it raises the hurdle a little to tighten.

We also suspect that the Federal Government will find it hard to resist the temptation to opine frequently on the rate of inflation if it has fallen within the RBA’s target band after the Q3 24 CPI prints (30/10).

The Government will likely play down the rate of trimmed mean inflation, particularly as it is not the rate of inflation referenced in the Statement on the Conduct of Monetary policy.

Here we note that the Commonwealth Treasury does not forecast the trimmed mean CPI in the Budget – an inflation forecast is only provided for headline CPI.

Headline inflation matters a lot:

The headline rate of inflation from the September quarter takes on added importance because on our forecasts it will sit within the RBA’s target band.

My colleague Stephen Wu calculated that the combined impact of the Commonwealth and State Government electricity rebates will shave two-thirds of a percentage point off Q3 24 CPI.

On our forecasts, this will drop the annual rate of headline inflation to a little under 3% where it should broadly sit over 2024/25.

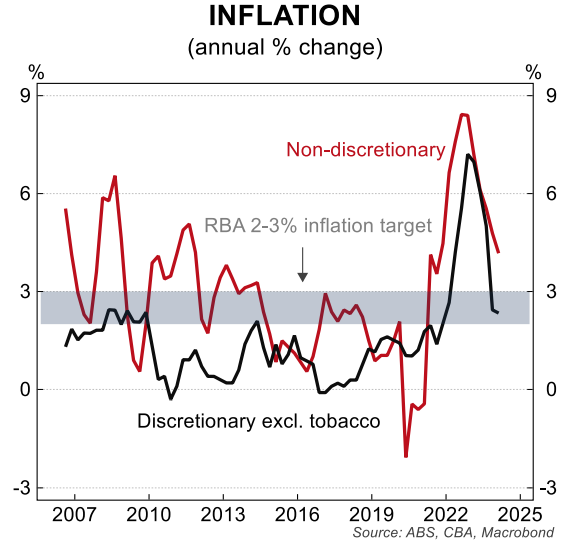

It is true that headline inflation is ‘artificially’ lowered by the electricity rebates. But we do not expect a $A75 rebate per quarter to stimulate demand more broadly in the economy. And actual inflation outcomes play a very important role in influencing the future path of inflation.

First, actual inflation influences inflation expectations. The inflation expectations amongst households and businesses often shift upwards and downwards in line with changes in the actual rate of inflation.

As such, the mechanical lowering in actual inflation from Q3 24 should help to lower inflation expectations amongst households and businesses, all else equal. This in turn will help to generate lower inflation outcomes than otherwise.

Second, there are a host of indexation arrangements linked to headline CPI in both the private and public sectors. These include indexing pension and superannuation payments, taxes and charges, some direct prices in the CPI basket (eg tertiary education course fees), some government bonds, and business contracts.

As the rate of actual inflation comes down there will be a positive knock-on effect whereby indexation arrangements linked to CPI see a smaller uplift than otherwise.

This in turn will help to cap price increases across the economy over time for some goods and services.

Third, lower headline CPI will also put downward pressure on wages growth in 2025 given the rate of headline inflation is often used as a starting point in a lot of wages negotiations.

Many wages outcomes are essentially negotiated as a spread to actual CPI. It is therefore far more likely that for many workers wages outcomes will be lower than otherwise as a result of lower actual inflation.

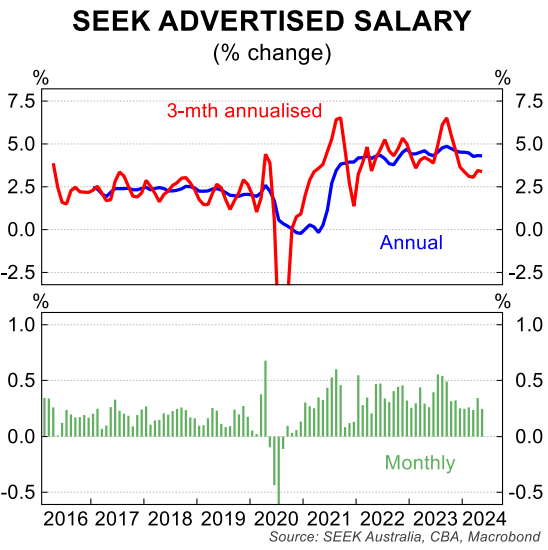

It is worth noting here that wages growth has already peaked. And the 0.8%/qtr increase in the Q1 24 wage price index was a little below where most analysts (and the RBA) expected the data to print.

Higher frequency indicators of wages, like the Seek advertised salary index, confirm that wages growth is past its peak and will moderate from here.

All eyes on the Q2 24 CPI:

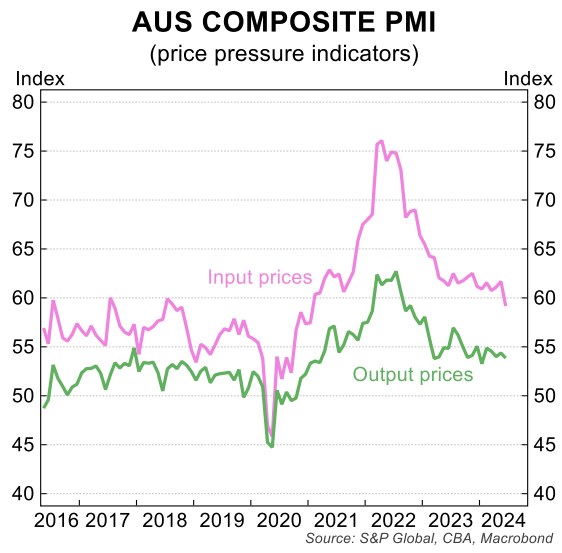

In the very near-term financial market participants are firmly focused on the upcoming Q2 24 CPI (due for release on 31 July). The outcome could see the RBA pull the rate hike trigger again if it is sufficiently strong.

The June Board Minutes noted that, “the information received since the previous meeting had reinforced the need to be vigilant to upside risks to inflation, and that the extent of uncertainty at present meant it was difficult either to rule in or rule out future changes in the cash rate target”.

The Board is genuinely concerned about an upside surprise on the Q2 24 CPI. And the May monthly CPI indicator means that there is a genuine risk that the Q2 24 CPI prints at a sufficiently strong level that would see the RBA raise the cash rate at the August Board meeting.

We readily admit that we feel a little anxious heading into the June quarter CPI given the margins look incredibly fine at the moment.

Our forecast for Q2 24 trimmed mean CPI is 0.9%/qtr. We believe such an outcome (or a weaker result) would see the RBA on hold in August. An outcome of 1.1%/qtr or above for trimmed mean CPI would mean an August rate hike is more likely than not.

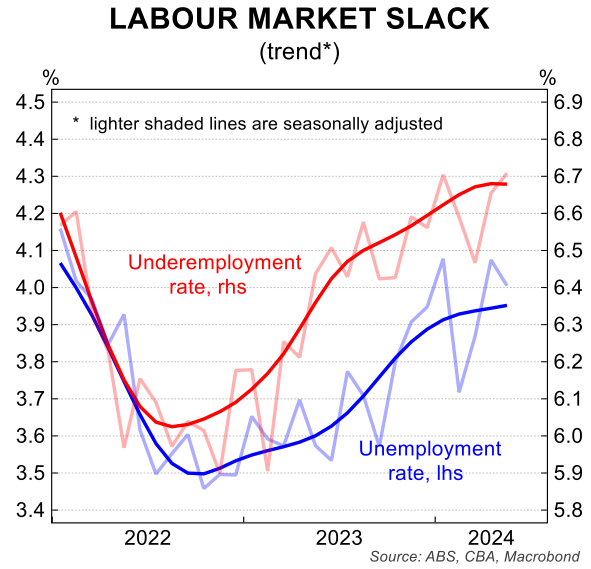

We put a result of 1.0%/qtr trimmed mean Q2 24 CPI at this stage in the ‘grey area’. If such an outcome was to materialise we think the June labour force survey would take on added importance (due for release on 18 July).

If the labour market were to further loosen in the June labour force survey the RBA may leave rates on hold in August with a 1.0%/qtr Q2 24 trimmed mean outcome.

But if the labour market showed no signs of additional loosening in June the RBA may feel compelled to pull the rate hike trigger in August.

Our base case for the RBA to sit on hold in August and to deliver a first rate cut in November is premised on both Q2 24 trimmed mean of 0.9%/qtr followed by 0.7%/qtr in Q3 24 and an ongoing upward trend in the unemployment rate.

As mentioned above, we also forecast headline inflation to dip to sit in the RBA’s target band from Q3 24. But the wriggle room on the data configuration that would see the cash rate cut in November is minimal at the moment. And the risk clearly sits with rate relief not arriving until H1 25.