Yarra Capital chief economist Tim Toohey warned that Australia is not creating enough jobs to soak up the large numbers of migrant workers arriving, which risks pushing the unemployment rate sharply higher.

“Since mid-2023 a new phase commenced, whereby the strength in net migration was more than sufficient to supplant non-migrant workers in the workplace, generating a trend rise in the unemployment rate”.

“In other words, net migration is currently supplying 1.4 people for every new job created”…

“Unless policymakers achieve a better balance between total employment and non-migrant employment growth, hard won gains in the labour market could quickly reverse”.

“Unless non-migrant employment growth and total employment growth move back into balance, we believe there is a far greater risk of a larger rise in the stock of unemployed and the prior gains in lifting workforce participation will reverse”.

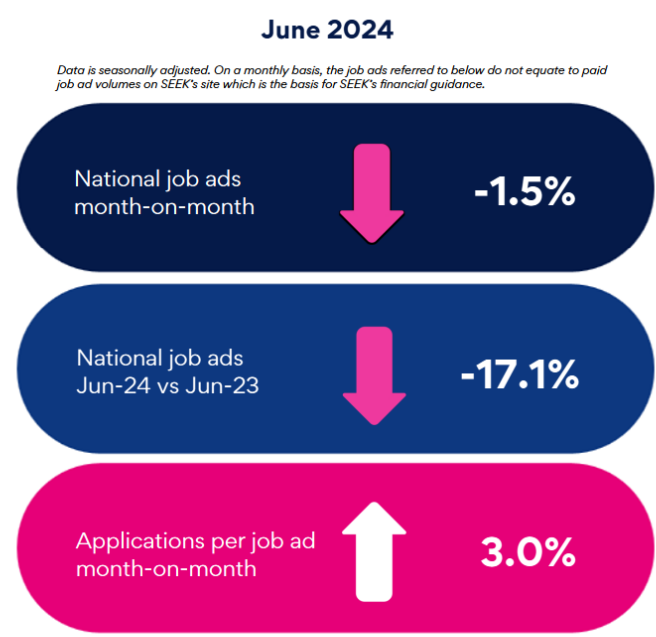

The latest SEEK employment data, which further deteriorated in June, supports Toohey’s warnings:

The number of jobs advertised by SEEK fell by 1.5% in June to be down 17.1% year-on-year, whereas the number of applicants per job ad rose by 3.0% over the month.

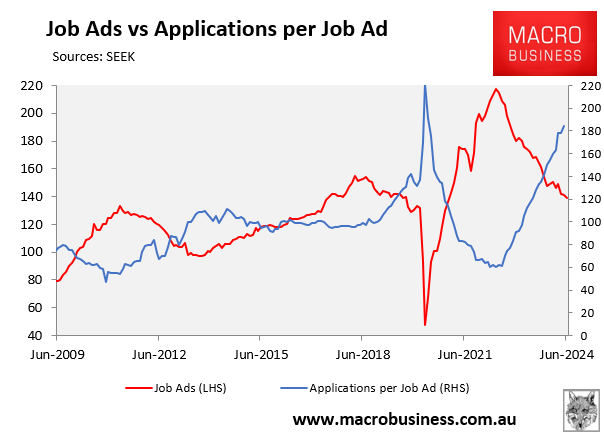

The following chart plots both series together and shows that the number of jobs advertised by SEEK has fallen back to pre-pandemic levels, whereas the number of applications per job ad is running way ahead of pre-pandemic levels:

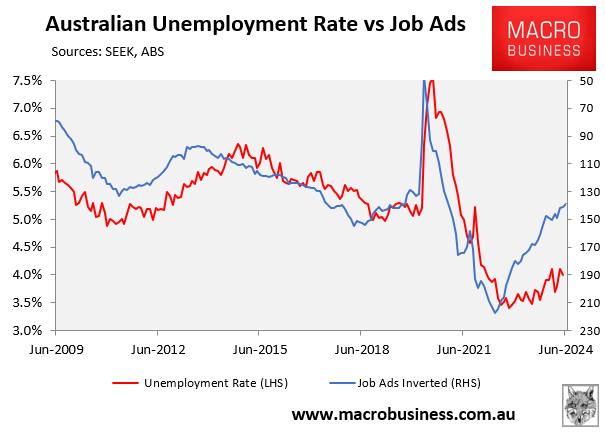

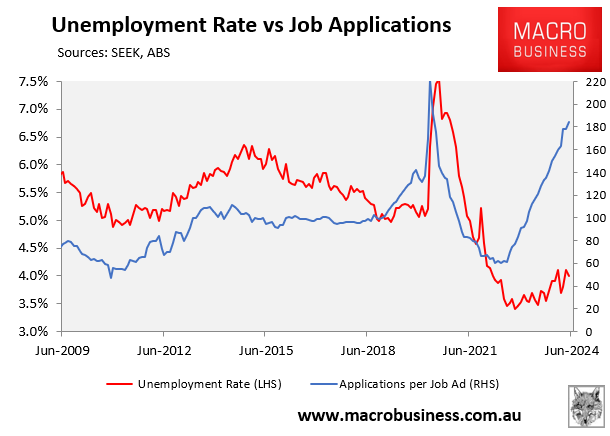

Both series point to a sharp rise in Australia’s unemployment rate:

Given the precariousness of Australia’s labour market, Tim Toohey warned that further interest rate hikes from the Reserve Bank of Australia (RBA) risk a hard landing.

“If the RBA does choose to restart the hiking process with these dynamics already in chain, then a hard landing for the Australian economy would become increasingly likely”, he said

Toohey is not wrong. With unemployment certain to rise, wage growth already slowing, and the economy experiencing a deep per capita recession, additional rate hikes appear foolhardy.