AMP chief economist Shane Oliver posted a series of charts on Twitter (X) suggesting that Australia’s labour market is not as rock-solid as Thursday’s official June labour force survey from the ABS suggested.

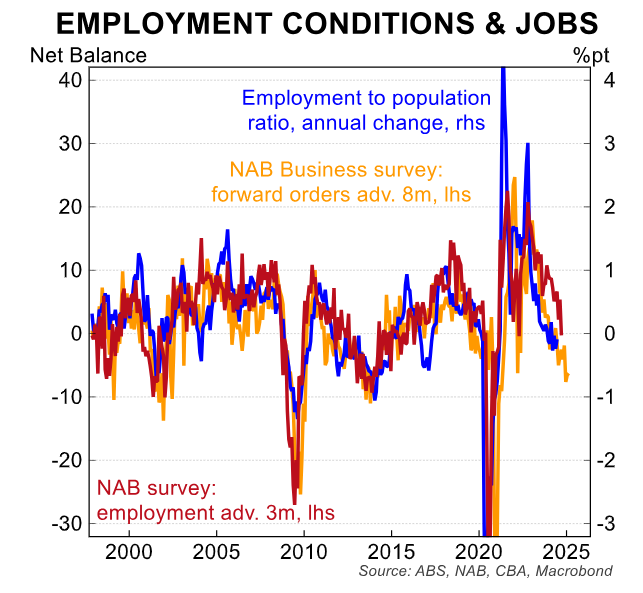

Oliver noted that the June quarter NAB business survey showed a further fall in hiring plans:

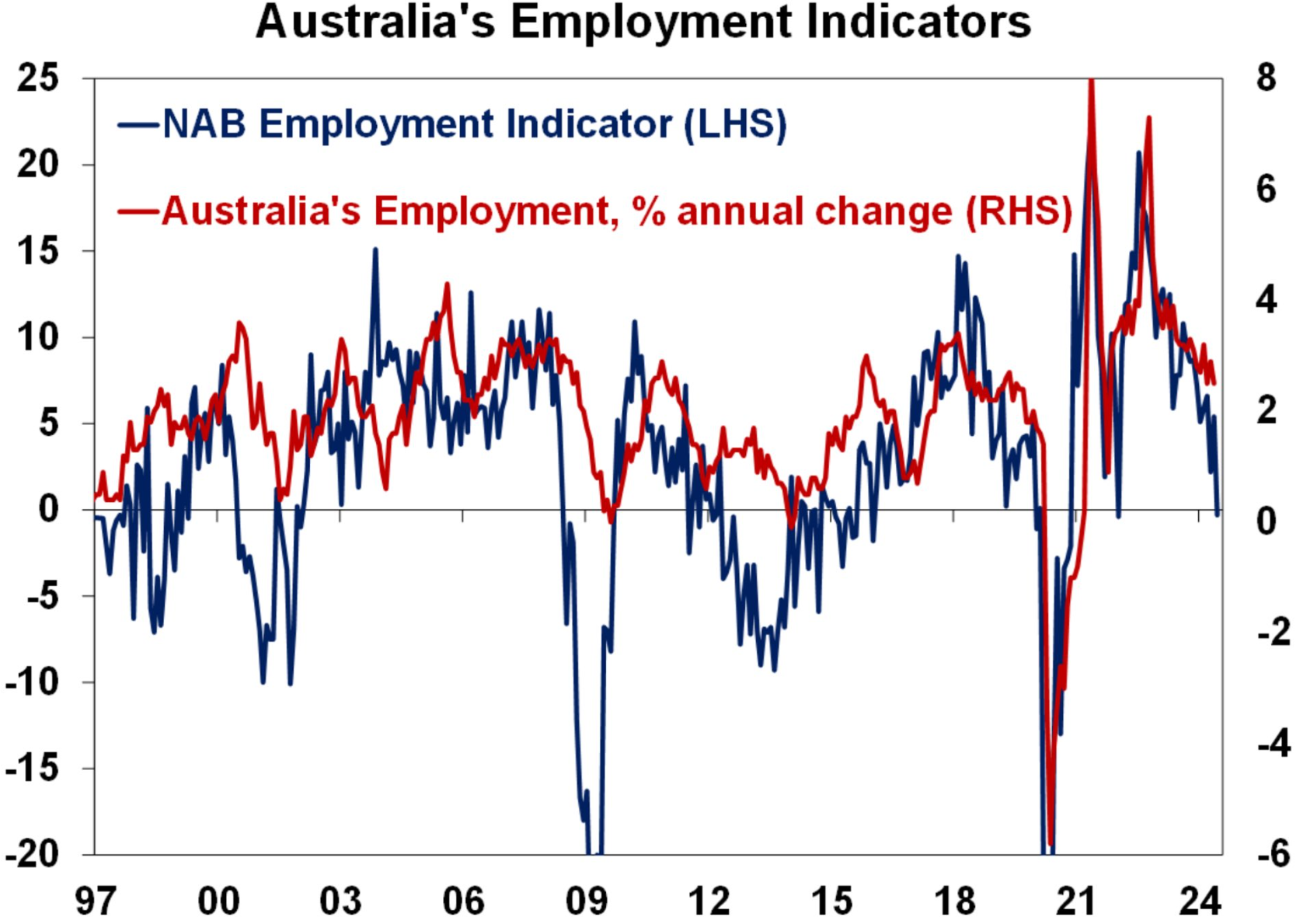

This followed the monthly NAB business survey released last week, which registered a sharp decline in NAB’s employment indicator:

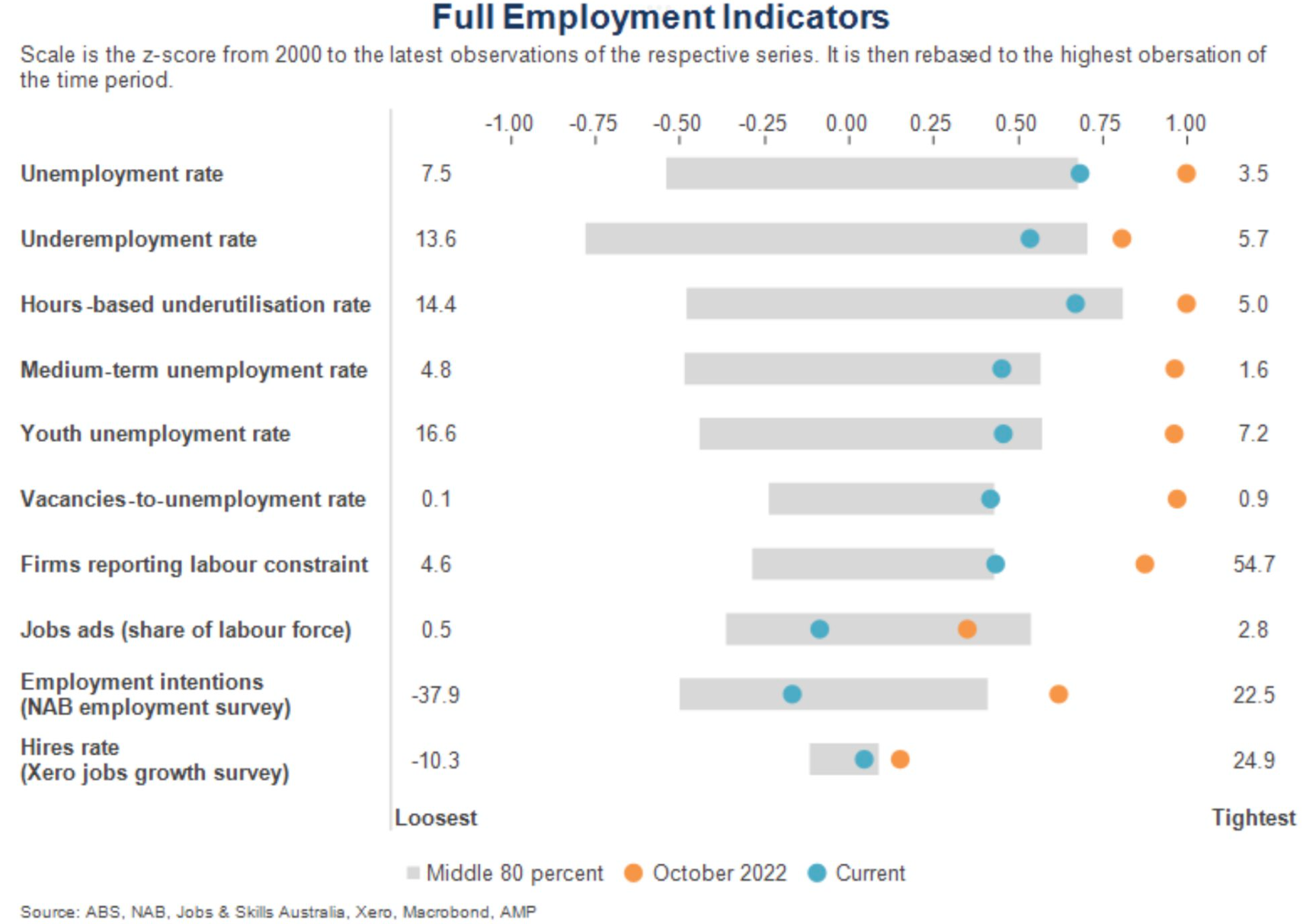

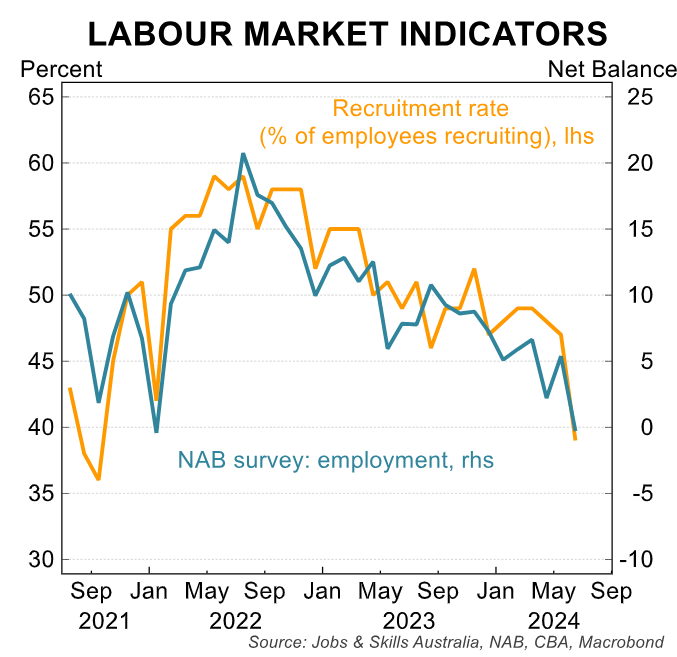

Oliver also posted the below chart tracking the various labour market indicators, which “show that the labour market is still tight, but it’s become less so – particularly for leading jobs indicators like job ads and NAB survey hiring plans”:

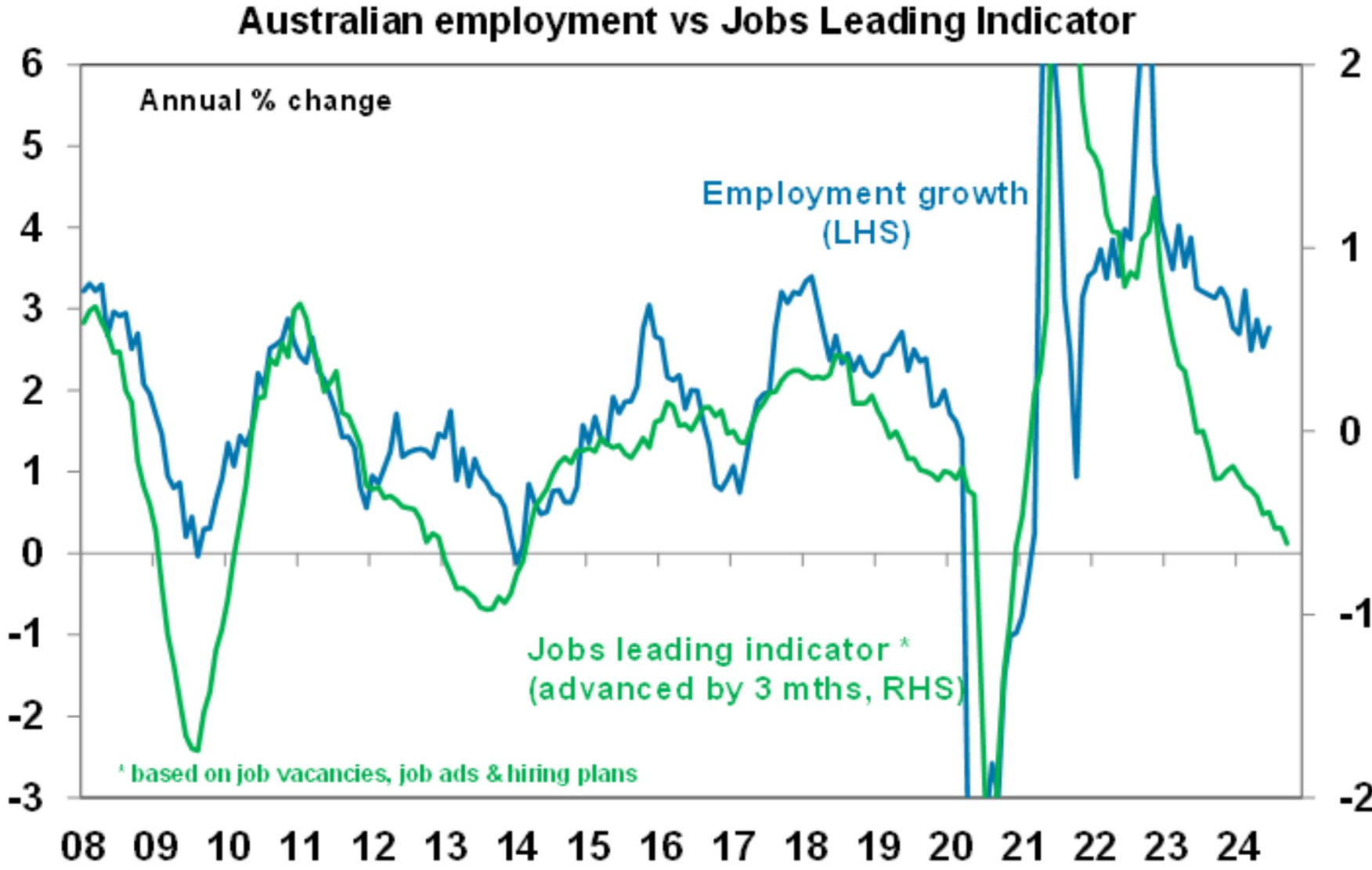

As a result, AMP’s jobs leading indicator, which is based on job ads and hiring plans, “continues to point to slower jobs growth ahead”:

Oliver contends that “labour hoarding” by firms “may have delayed the slowdown in employment so far”. This is being reflected in the “faster slowdown in growth in hours worked (after smoothing monthly volatility) relative to growth in employment”:

Separate analysis by Gareth Aird at CBA noted that “the pace of loosening in the official figures is quite modest when compared against economic growth, which is well below trend”.

“The various measures of job ads continue to decline at a decent clip. And according to Seek, the number of applicants per job ad continues to march higher. This is a sign that the labour market has become increasingly competitive”.

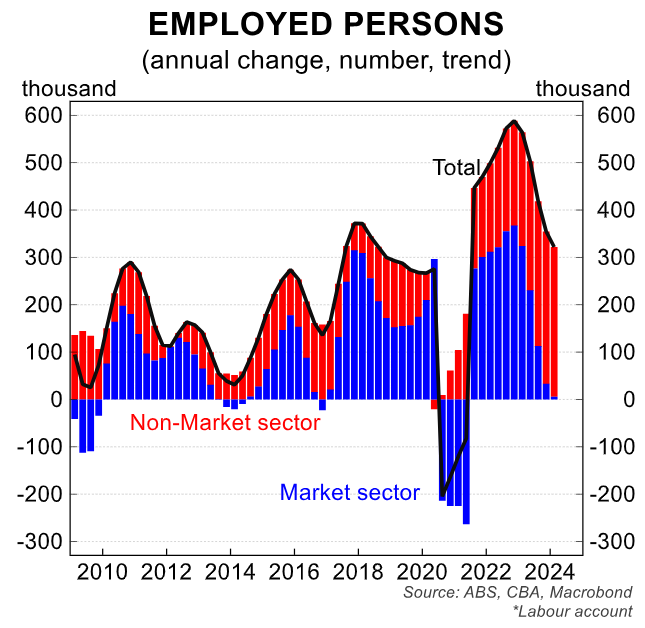

Aird noted that the strong growth in non-market sector jobs, driven by the NDIS, “go along way to explaining why the labour market has held up better than we had anticipated at this stage of the cycle”.

“Almost all of the growth in employment over the past year has been in the non-market sector (largely health and social assistance, public administration and education). The big increase of spending on the NDIS in particular has supported non-market sector employment”.

“In contrast, market employment, where outcomes are strongly linked to the business cycle, has seen essentially no growth over the past year”.

“Our expectation is that non-market sector employment growth will slow from here. And that will pull the overall rate of employment growth lower and push the unemployment rate higher”.

In short, the Australian labour market has become detached from economic conditions.