This week is pivotal for the Australian economy.

On Wednesday, the Australian Bureau of Statistics (ABS) will release the Q2 CPI inflation figures, which will determine whether the Reserve Bank of Australia (RBA) will raise the official cash rate at its 6 August meeting.

The recent monthly CPI indicator exceeded expectations, and the RBA has sharpened its language regarding the inflation outlook.

The CBA forecasts that underlying (trimmed mean) inflation will print at 0.9% for the quarter and 3.9% annually. Such an outcome would give the RBA enough breathing room to leave rates on hold despite being marginally higher than their implied forecast of 0.8% for the quarter.

According to the CBA, a print of 1.0% over the quarter would be in the “grey zone”, making a rate hike a line-ball decision dependent on the component details.

A print of 1.1% or above for the quarter would test the RBA Board’s resolve and likely be answered with an interest rate hike.

Several media commentators and economists claim that the RBA has erred by not raising rates, thereby locking Australians into higher inflation.

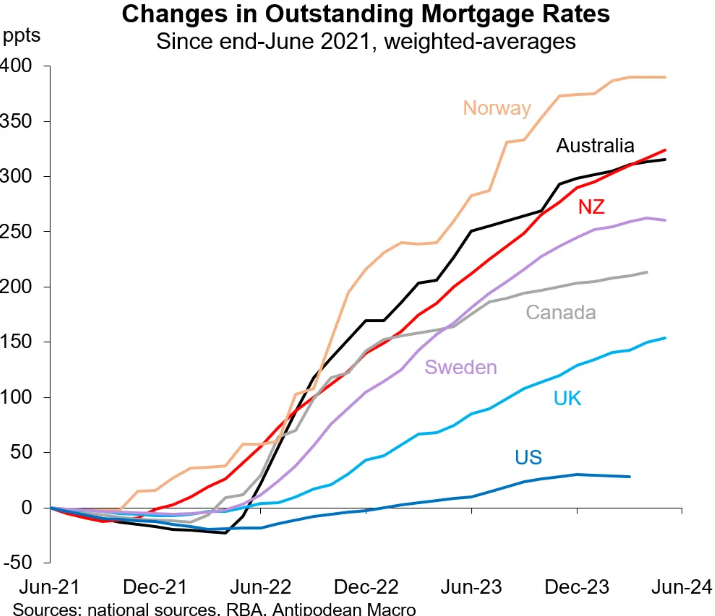

However, monetary transmission in Australia is far more sensitive than in comparable nations, owing to its globally high share of variable-rate mortgages.

This faster transmission of monetary policy has driven Australia’s mortgage rates up faster than most other developed nations despite the RBA lifting official interest rates by less.

The blame for Australia’s stubborn inflation should also be concentrated on our governments rather than the RBA.

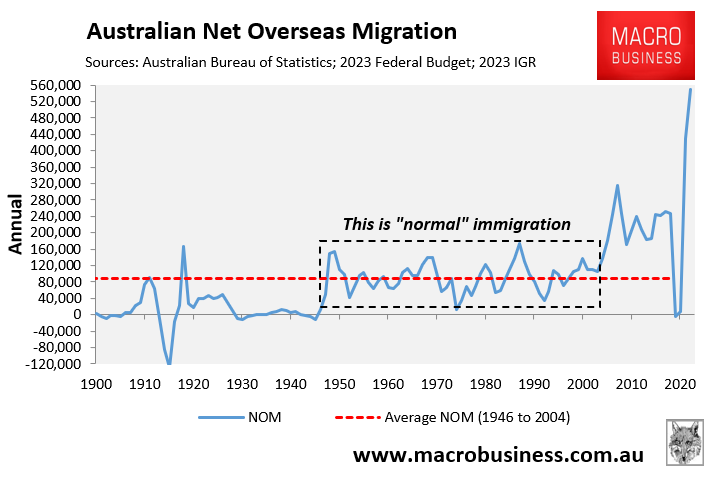

The federal government has chosen to run the biggest immigration program in Australia’s history into a supply-constrained economy.

An unprecedented one million net overseas migrants arrived in Australia in 2022 and 2023, massively pumping aggregate demand as individual households cut back.

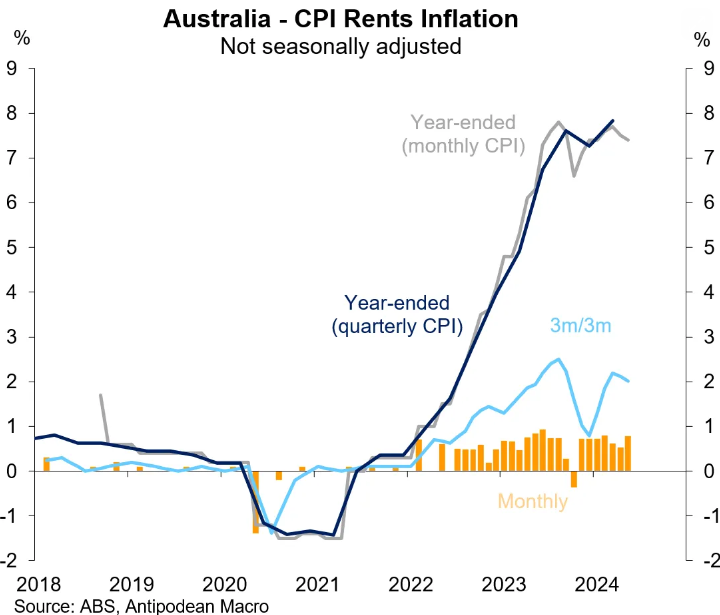

This extreme immigration has increased inflation in several areas, most notably the housing market.

The federal government’s failures in energy policy, most notably the gas market, have also driven up energy prices, driving CPI inflation directly and indirectly via cost-push inflation.

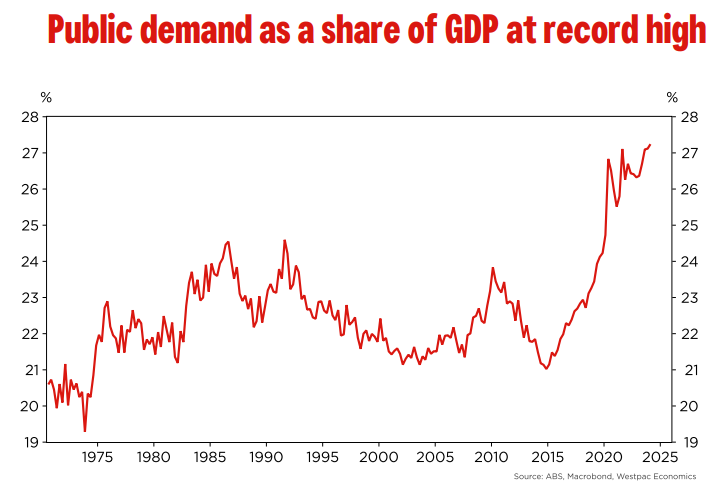

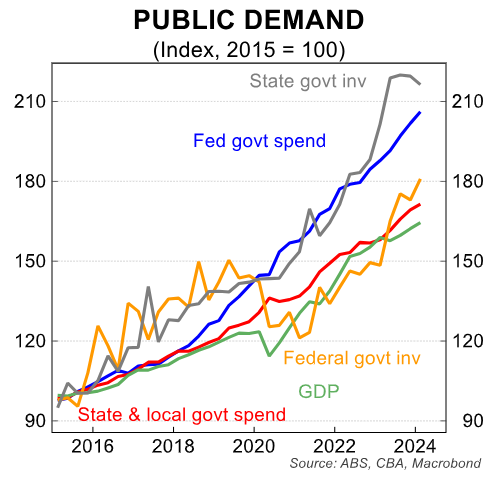

Then there are the state and federal governments, which are driving massive spending via the NDIS and infrastructure projects.

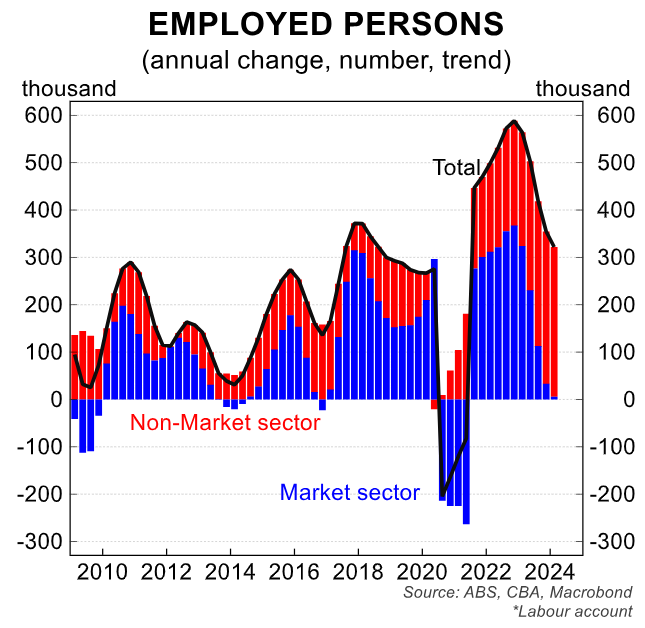

Government-aligned spending, most notably from the NDIS, has driven virtually all of Australia’s job growth over the past year, with the private sector stuck firmly in recession.

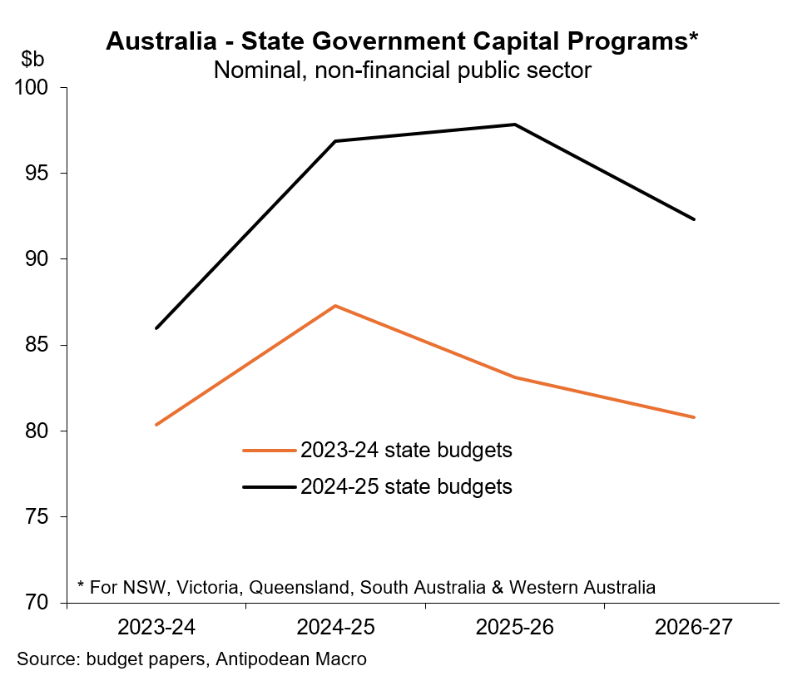

Whereas state governments are spending like drunken sailors on capital works:

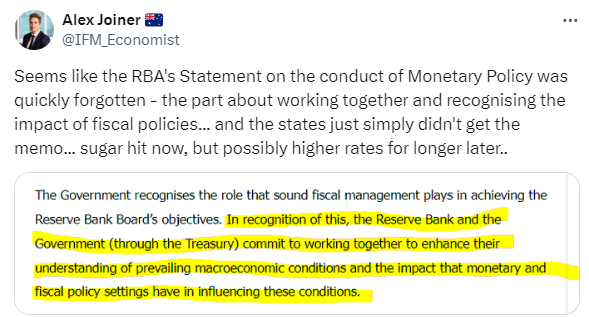

Alex Joiner, chief economist at IFM Investors, captured the situation nicely in the following Tweet:

In short, Australia’s governments are working at cross-purposes to the RBA by pumping aggregate demand.

It is always worth remembering that the RBA has only one blunt tool to manage inflation—the official cash rate—which directly impacts only one-third of the population with owner-occupier mortgages.

By contrast, our governments have many policy tools to influence inflation.

The number one and two solutions should be for the federal government to:

- Cut immigration hard to ease the growth in aggregate demand, relieve housing inflation, and reduce the need for state government capital works programs.

- Implement a domestic gas reservation scheme and/or gas export levies alongside traditional cost-plus regulation of domestic gas prices.

The RBA should also become more vocal and demand policy assistance from the government to lower inflation.

Otherwise, it will continue to push uphill with blunt interest rates.