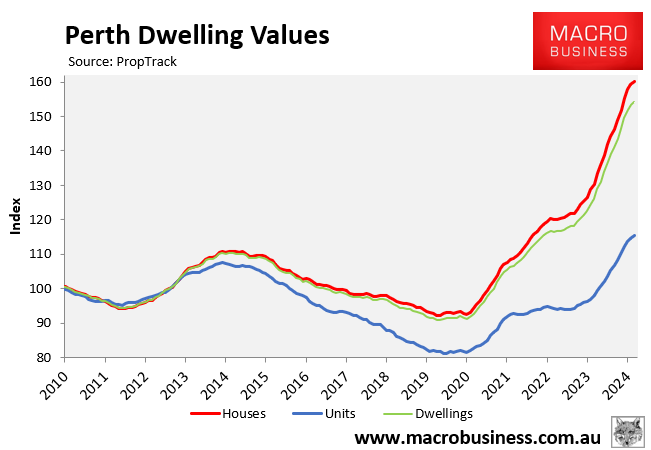

Perth dwelling values have rocketed by 69% since the beginning of the pandemic in March 2020, according to PropTrack:

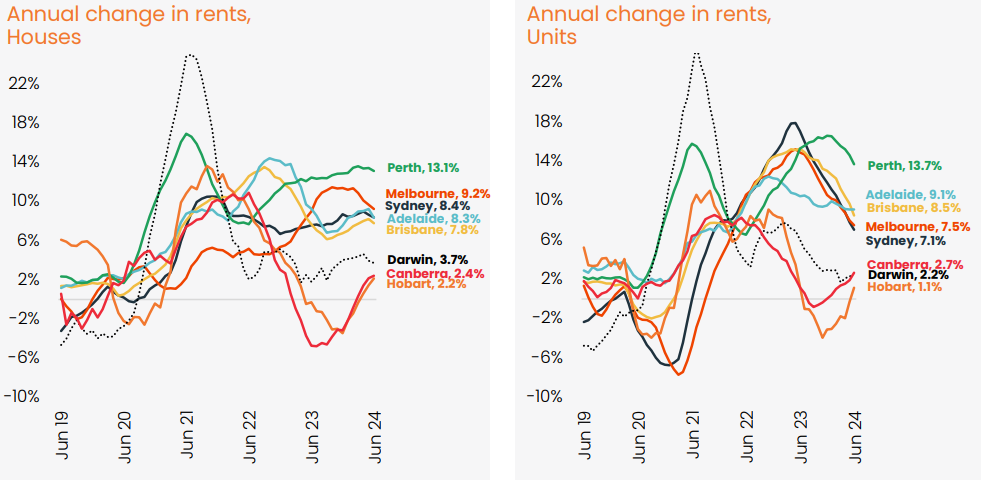

Perth is also experiencing the strongest rental growth in the nation, rising by 13.1% (houses) and 13.7% (units) according to CoreLogic:

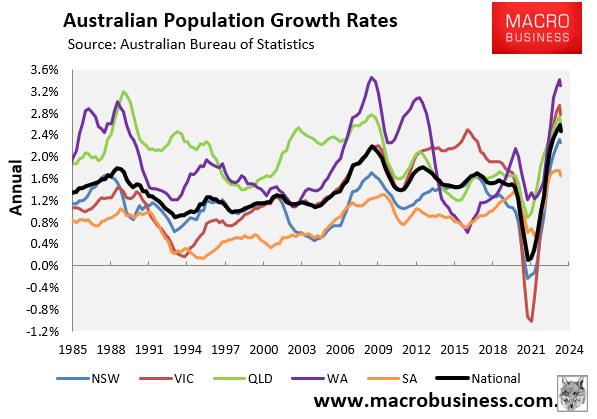

Perth’s property boom is being fuelled by extreme population growth, with Western Australia’s population soaring by 3.3% in 2023, much faster than the national increase of 2.5%:

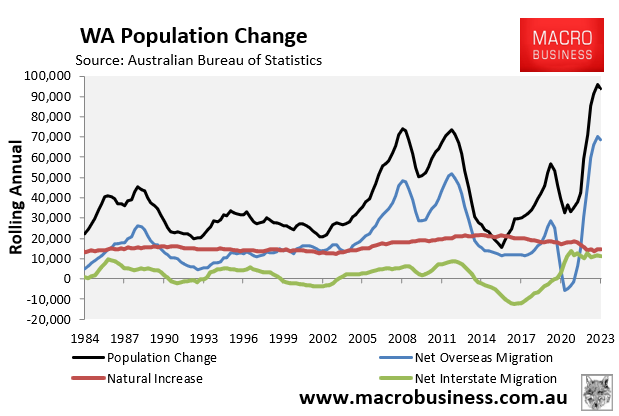

Western Australia’s strong population growth has been driven by a combination of record net overseas migration as well as strong inward migration from other states:

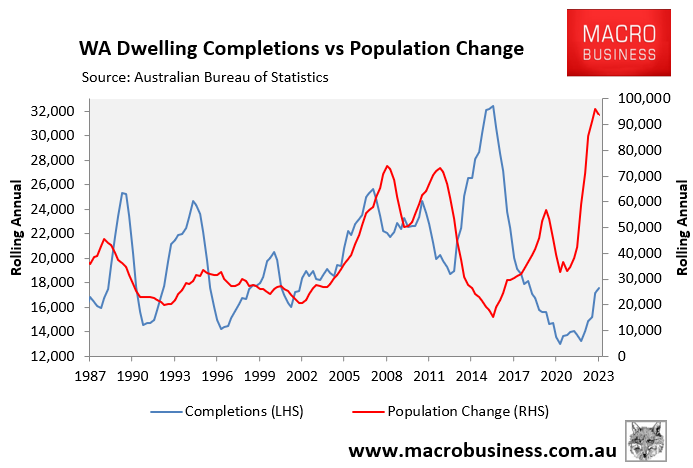

This strong growth in population has occurred at the same time as the rate of construction is soft:

In 2023, Western Australia’s population grew by 93,800 against a dwelling construction rate of only 17,500.

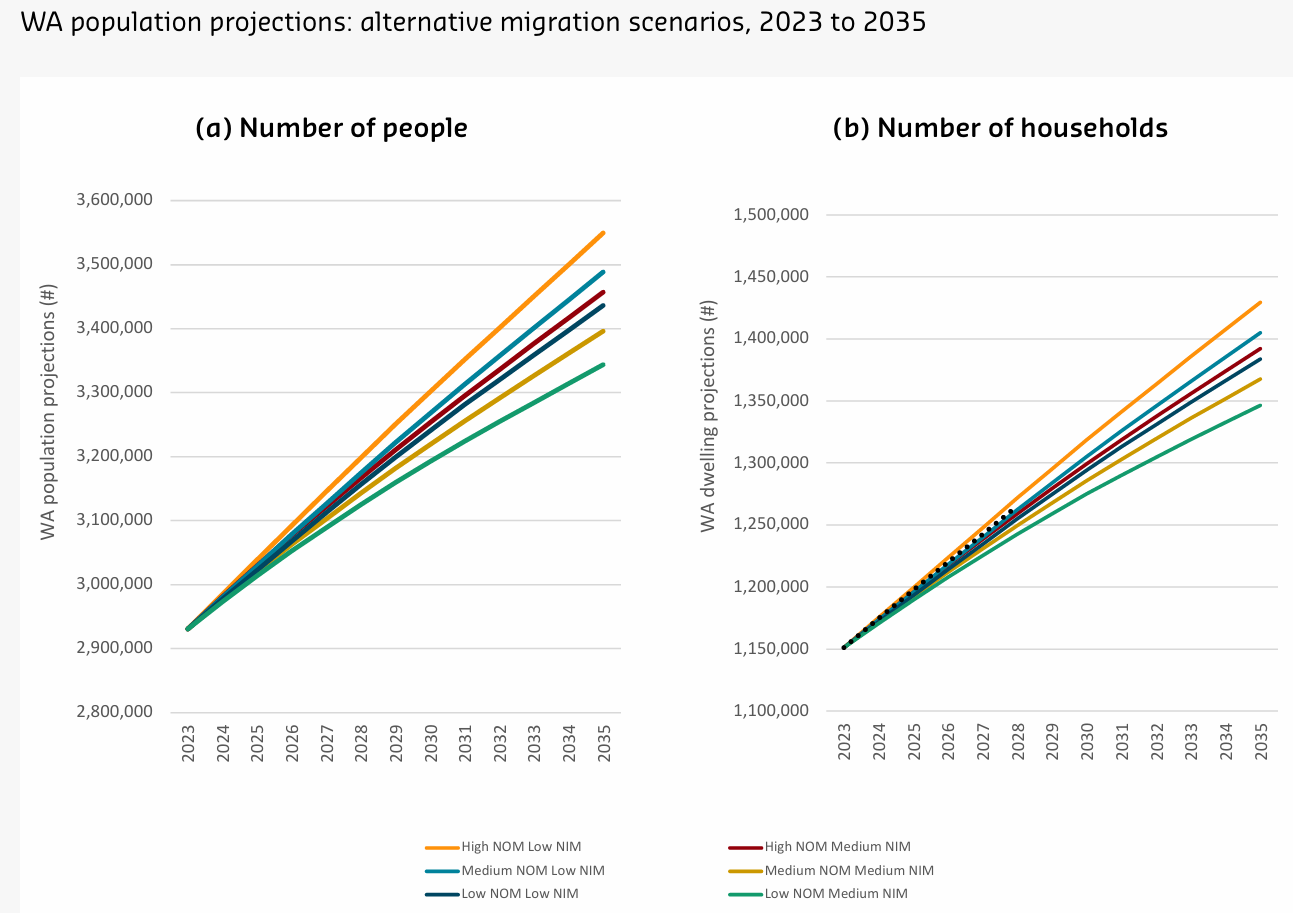

New analysis from the Bankwest Curtin Economics Centre shows that with current rates of dwelling completions, Western Australia will fall well short of the National Accord target of 25,000 new dwelling units per year – a figure which will only just keep pace with the state’s projected population growth.

“WA needs a minimum of 20,000 more dwelling units each year just to keep pace with population growth, and up to 24,000 more depending on the state’s changing demographic profile and demand for skilled workers”, the report says.

Clearly, the Albanese government’s mass immigration policy has helped to created the “hunger games” in Perth, which has driven up both prices and rents.

Upward pressure on prices and rents will remain so long as demand via population growth continues to overwhelm the supply-side of the housing market.