It’s about to rain rate cuts across the developed world.

In the US, the Fed will likely cut in September, Citi:

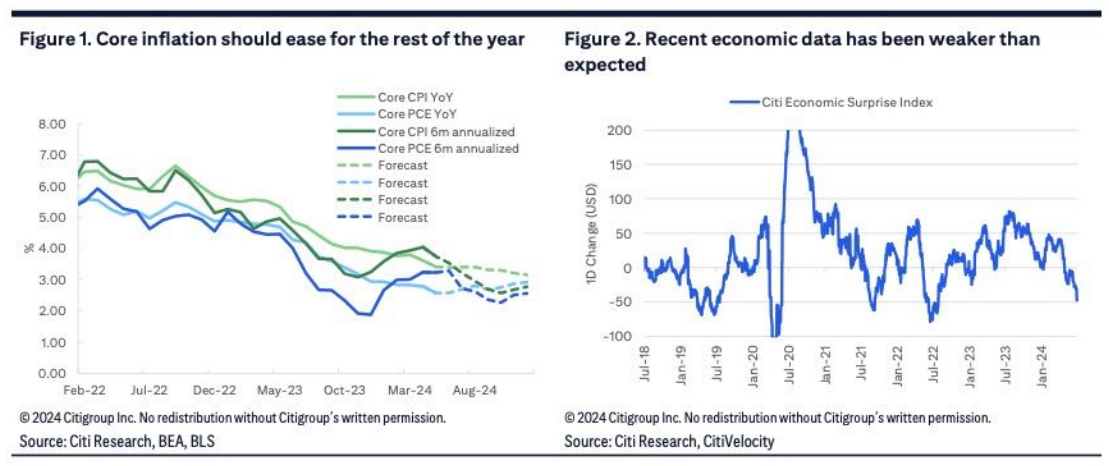

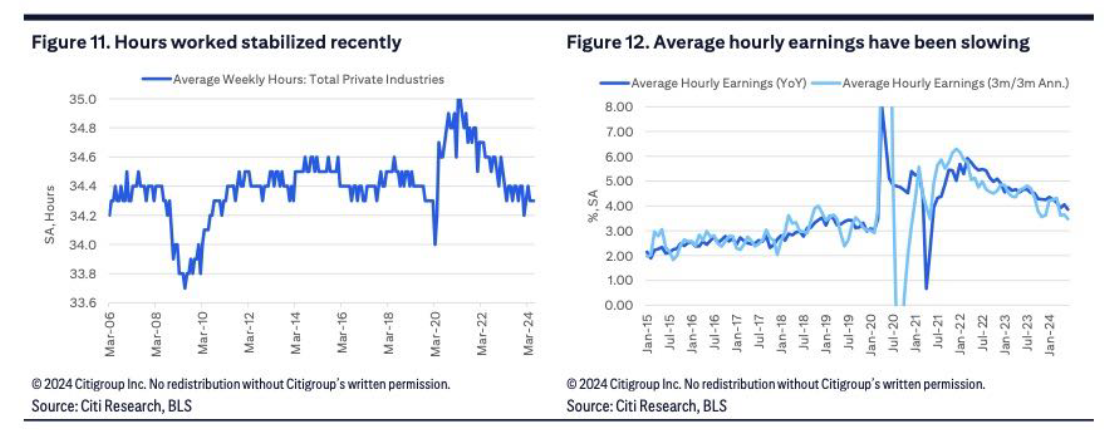

Economic growth has slowed from its heady pace in 2023 and core inflation has softened in Q2 after a series of upside surprises in Q1.

A decline in ISM services to 48.8 and the unemployment rate rising to 4.1% raise the risk of a sharper weakening of economic activity.

Chair Powell’s dovish comments in Sintra together with recent data suggest a first rate cut is very likely in September.

A continued softening of activity will provoke cuts at each of the subsequent seven Fed meetings, in our base case.

Cuts have already started in Canada and Europe and are imminent in New Zealand.

Australia has lagged this cycle by a quarter or two from the outset owing to its stricter lockdowns but it will not buck the easing cycle.

Local energy bill rebates, rising unemployment and tumbling wage growth, as well as the endless per capita recession will have their day.