Another mixed session on Asian markets with the pullback on Wall Street overnight upsetting most equity markets while the sharp appreciation in Yen and local unemployment figures helped muddy the currency waters. European and US stock futures are quite flat as we head into the London session while the USD is being pushed around again as expectations are high for tonight’s ECB meeting. The Australian dollar despite the headline jobs number looking good as it tries to steady around the 67 cent level.

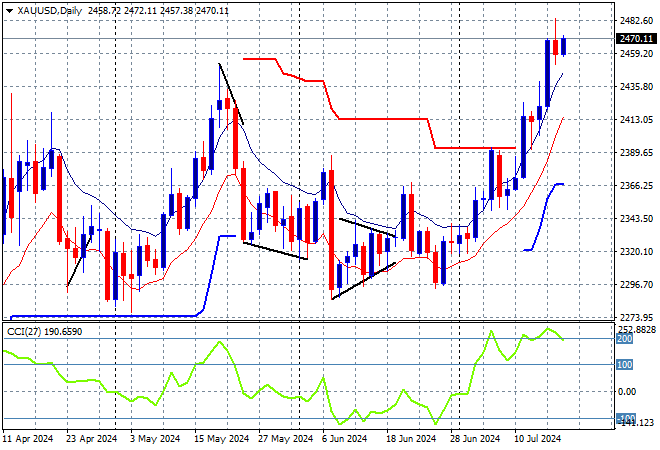

Oil prices have lifted again with Brent crude pushing above the $85USD per barrel level while gold remains above its previous high, currently floating above the $2470USD per ounce level:

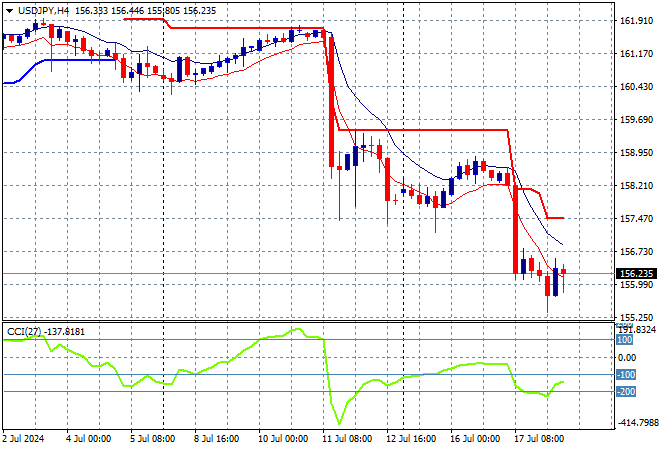

Mainland Chinese share markets are doing better with the Shanghai Composite up more than 0.3% while the Hang Seng Index is gaining some lost momentum, about to close 0.6% higher at 17849 points. Meanwhile Japanese stock markets have slumped as Yen appreciated overnight with the Nikkei 225 closing some 2.4% lower at 40126 points while the USDJPY pair has tried to steady at its overnight low just above the 156 level in afternoon trade:

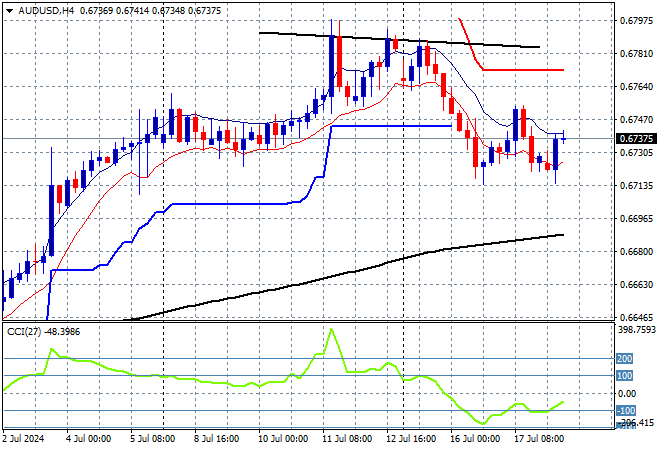

Australian stocks were unable to advance the most with the ASX200 slipping 0.3% or so to remain above the 8000 point level, closing at 8036 points while the Australian dollar has stayed below its Friday night finishing position but did bounce a little higher on the unemployment print, remaining just above the 67 cent level next as momentum flat lines:

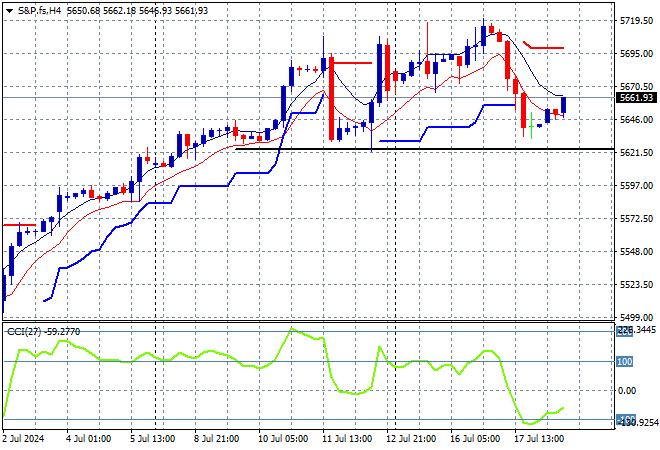

S&P and Eurostoxx futures are flat as we head into the London session with the S&P500 four hourly chart showing price action hesitating around the point of control at the 5700 point level with volatility and hope rising that it can get out of this pickle fast:

The economic calendar includes the latest UK unemployment figures and then the ECB interest rate meeting and post meeting press conference.