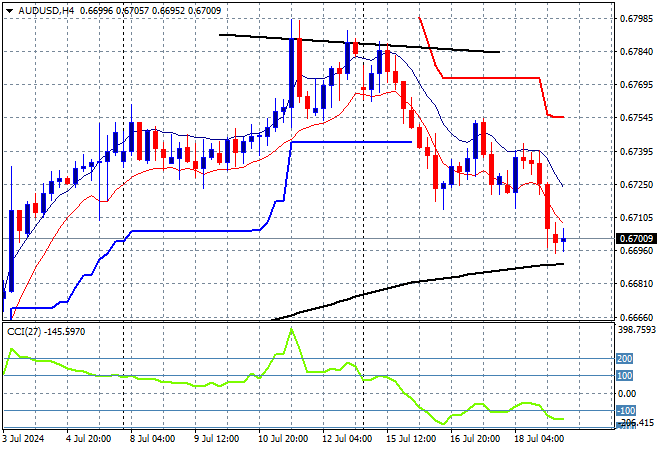

A sea of red across most Asian markets as they end the trading week on a downer as the two negative sessions in a row on Wall Street continues to upset confidence. The latest Japanese inflation figures were not as upsetting although core inflation above 2% is still worrying the BOJ. The USD continues to lift higher against almost everything following last night’s ECB meeting with the Australian dollar about to break below the 67 cent level.

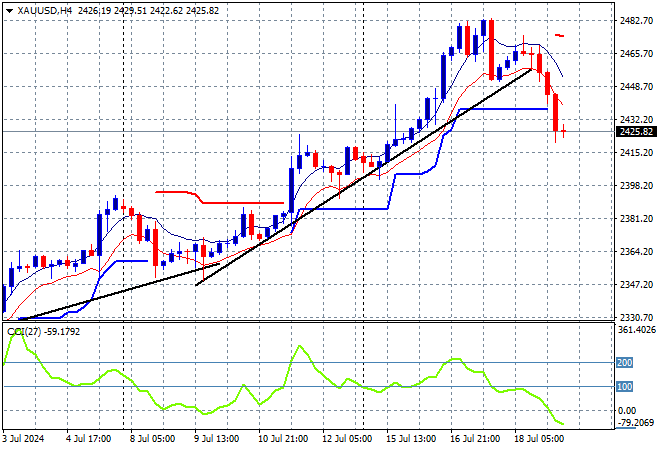

Oil prices are flat with Brent crude unable to push above the $85USD per barrel level while gold has fallen sharply in afternoon trade, down to the $2425USD per ounce level:

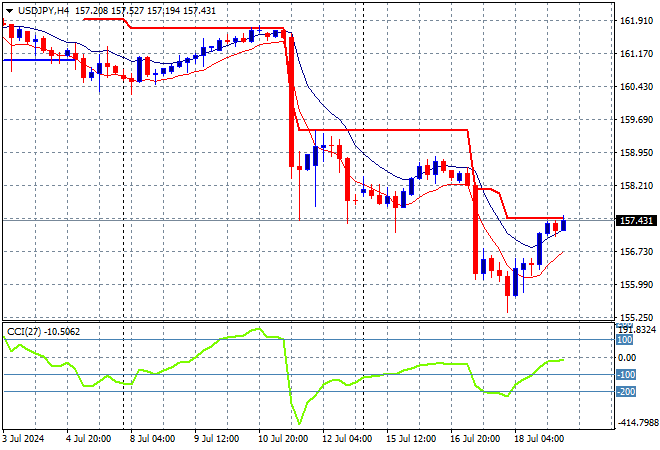

Mainland Chinese share markets are flat with the Shanghai Composite down 0.1% while the Hang Seng Index is losing ground very fast, currently off by more than 2% at 17401 points. Meanwhile Japanese stock markets are trying to stabilise but failing amid politic-economic machinations around the Yen with the Nikkei 225 0.4% lower at 39991 points while the USDJPY pair has lifted almost to the mid 157 level in afternoon trade following the inflation print:

Australian stocks were the worst performers with the ASX200 down 1% to flop below the 8000 point level, currently at 7956 points while the Australian dollar continues its retreat below its Friday night finishing position after yesterday’s unemployment print, barely remaining above the 67 cent level next as momentum goes negative:

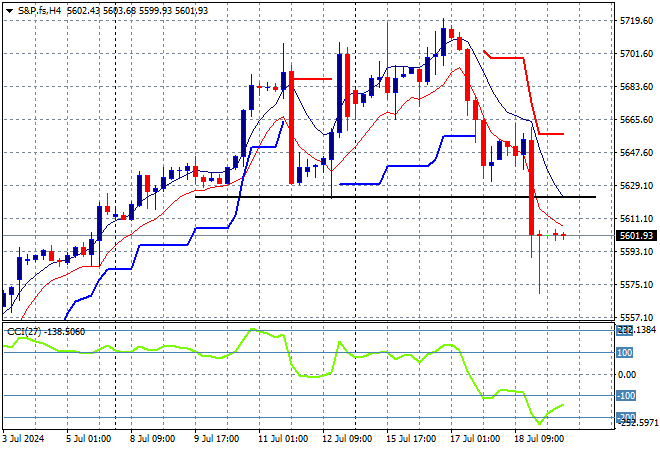

S&P and Eurostoxx futures are flat as we head into the London session with the S&P500 four hourly chart showing price action looking weak below the previous point of control at the 5700 point level with volatility rising – watch out below:

The economic calendar finishes the week with a whimper with a just a few Fed speeches and tertiary releases.