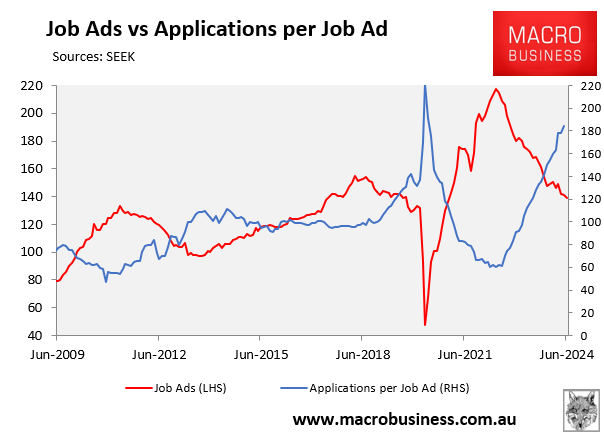

The latest employment report from Seek showed that the number of applicants per job ad surged by 3.0% in May (latest available) to be up 61.6% over the year:

The surge in applicants per job ad follows a sharp softening in the number of job ads combined with strong labour supply courtesy of historically high net overseas migration.

Director at recruiter Robert Half, Nicole Gorton, told the ABC that large volumes of international students, migrants, and returning ex-pats are entering an already well-supplied labour market. As a result, Robert Half is now receiving hundreds of applications for each individual job opening.

“We can shortlist from 200 down to three”, she said.

“Our job really is to do that short-listing on behalf of an organisation … and a lot of those are not appropriate”.

The surge in job applicants comes as the proportion of employers who were currently recruiting or who had recruited in the past month fell sharply in June and is tracking at its weakest level since 2021:

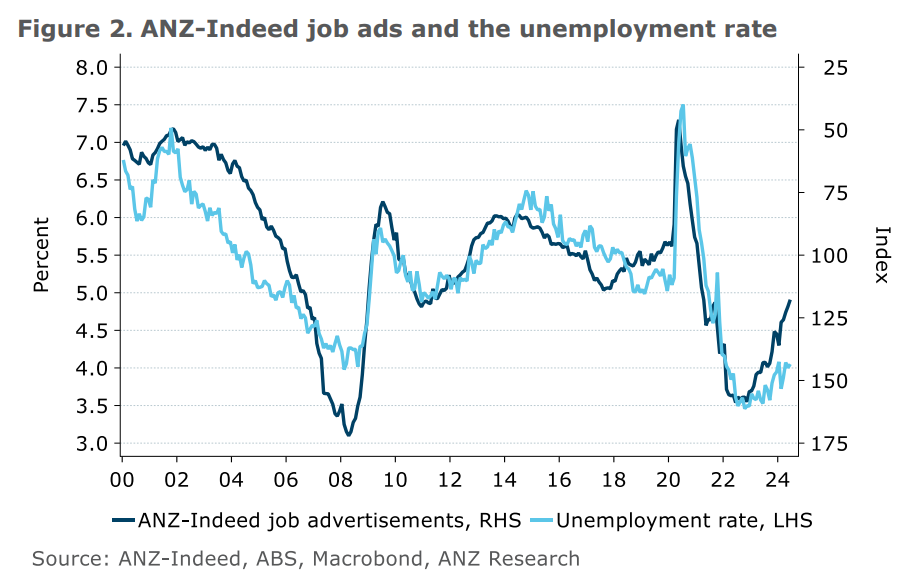

The souring job market has prompted a warning from ANZ senior economist Blair Chapman that Australia’s unemployment rate could soon shoot up to 5% as new job seekers increasingly struggle to find work.

Job ads and job vacancies have declined notably as a share of the labour force over the past two years, yet the unemployment rate has only increased by 0.6ppt so far.

The ratio of job ads to the labour force fell by a similar magnitude between 2010 and 2013, and the unemployment rate increased by around 1.5ppt, although with a lag of 6 to 12 months. A further 0.9ppt increase in the unemployment rate from its current level would put it at 5%, well above the RBA’s estimate for full employment of 4.3%.

The share of employers recruiting has fallen notably in recent months and is back to levels last seen during the east coast lockdowns in 2021. The proportion of employers expecting to increase staff is also back to a 2021 low. Both declines are a sign that labour demand has weakened considerably since 2022…

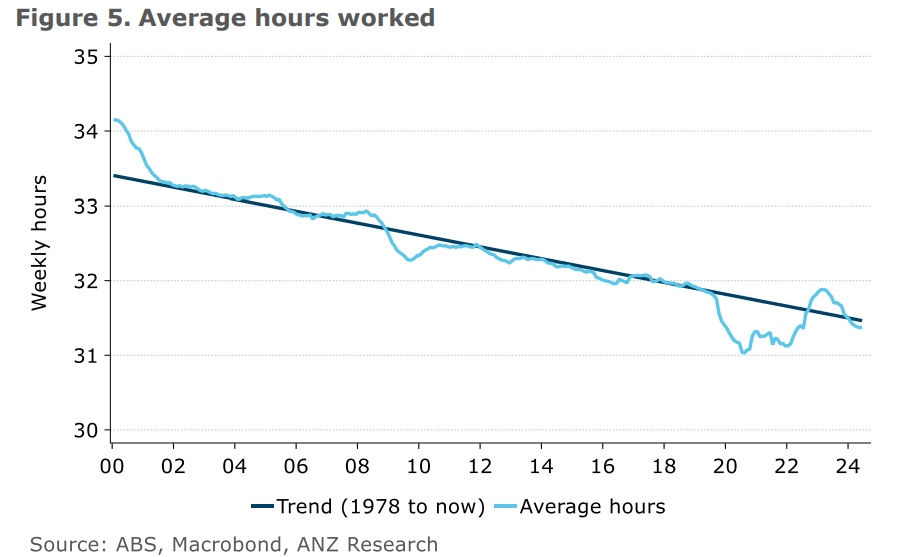

Total hours worked grew 1.4% over the year to June, below its pre-COVID average of 1.9% y/y, despite employment growth of 2.8% and population growth of 2.9% over the same period…

This has resulted in average hours worked per employed person declining 30 minutes a week since February 2023, with average hours worked now below the level implied by their long-run trend…

Over the past year, the decline in average hours has been quick and is now below trend, suggesting there is a risk of a sharper increase in the unemployment rate than we or the RBA are forecasting…

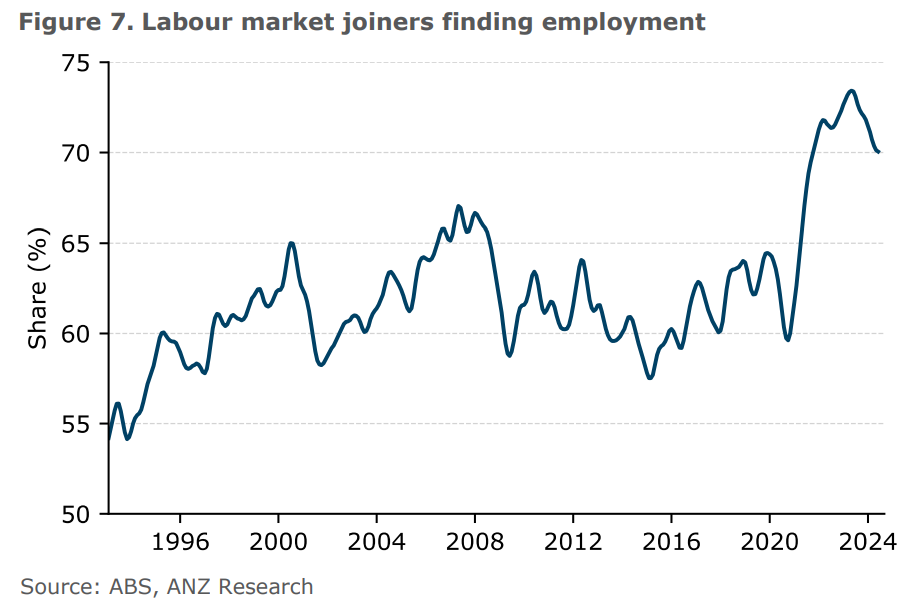

Most of the movement in the unemployment rate is driven by the job finding probability rather than job losses. Following the end of lockdowns the share of people who were able to find work increased sharply (Figure 7).

The share of those joining the labour market who are finding employment is still elevated but it can decline quickly during downturns as seen in the early 2000s and in the aftermath of the GFC in 2009…

Further declines in the share of people finding employment would see the unemployment rate increase quickly as it did in the early 2000s and 2009…

Net migration will continue to add to labour supply…

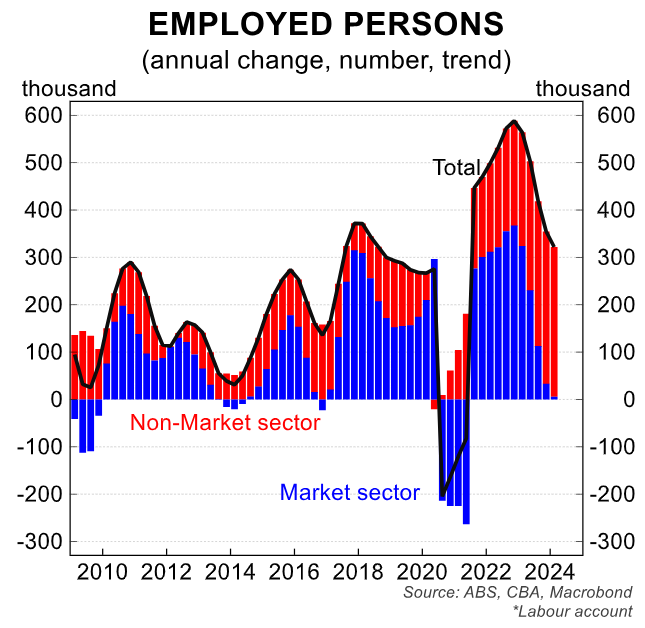

To date, the boom in NDIS jobs has papered over the collapse in market sector employment, keeping Australia’s unemployment rate low:

However, it is only a matter of time before the strong labour supply and weak economic fundamentals pushes unemployment higher.

The unemployment rate won’t defy gravity forever.