Melbourne is becoming an economic wasteland.

According to data from the Australian Bureau of Statistics (ABS), Victoria experienced a net reduction of 7,606 businesses during the financial year 2022-23.

The rising cost of doing business in Victoria drove numerous companies to migrate interstate or internationally, with increased state taxes being one of the primary factors cited.

By contrast, Queensland saw the greatest net increase in businesses, expanding by 11,031 in 2022-23.

There are two main reasons why Victoria was the only jurisdiction to record a drop in business counts.

First, the Victorian government’s draconian Covid lockdowns likely closed many businesses, particularly those that are small and focused on people (think cafes, personal trainers, boutiques, etc.).

Second, the Victorian government included a payroll tax surcharge in the 2021-22 State Budget as part of a mental health and wellbeing levy, but only for businesses with a payroll of $10 million or more.

The State Budget for 2022–23 then raised payroll taxes on the same businesses as part of a 10-year Covid debt levy to help repay the government’s record borrowing during the pandemic.

I recently spoke with someone who works for a business valued at more than $10 million. They indicated that their company was prepared to relocate its headquarters from Melbourne to Brisbane, which has cheaper payroll taxes.

The Victorian government’s proposed increases to WorkCover premiums, which businesses pay for, run the risk of driving more businesses out of the state.

WorkCover is necessary if the actual or planned employee compensation exceeds $7,500, or if apprentices and trainees are hired.

Changes announced in May 2023 lifted premiums by 42%, from 1.27% to 1.8% of an employee’s compensation.

The Victorian Parliamentary Budget Office expects the amendments to cost businesses $17.8 billion over the next decade.

ANZ CEO Shayne Elliot recently referred to Victoria as “one of the toughest” places to conduct business.

The ABS data on business counts appears to back up these statements, with the state government successfully pushing business north, particularly to Queensland.

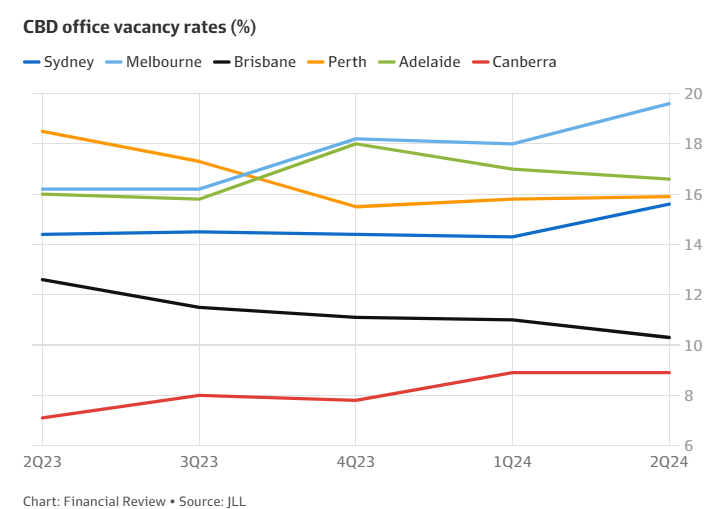

With this background in mind, it was unsurprising to read that Melbourne’s office vacancy rate has climbed to 19.6%, the highest since 1995.

Melbourne’s office market recorded a “negative net absorption” of 26,600 square metres—the size of medium-sized office building—meaning more space was left empty than freshly leased in the June quarter.

Steve Urwin, who runs tenant advocacy firm Kernel Property, offered a dire prognosis for Melbourne’s office market.

“Melbourne is a one-way slope and hasn’t hit bottom. There is worse to come”, he said.

Investor Shane Quinn, who chairs commercial property syndicator Quintessential, described Melbourne’s CBD office market as “a proper basket case, and it’s going to be a basket case for the next five years”.