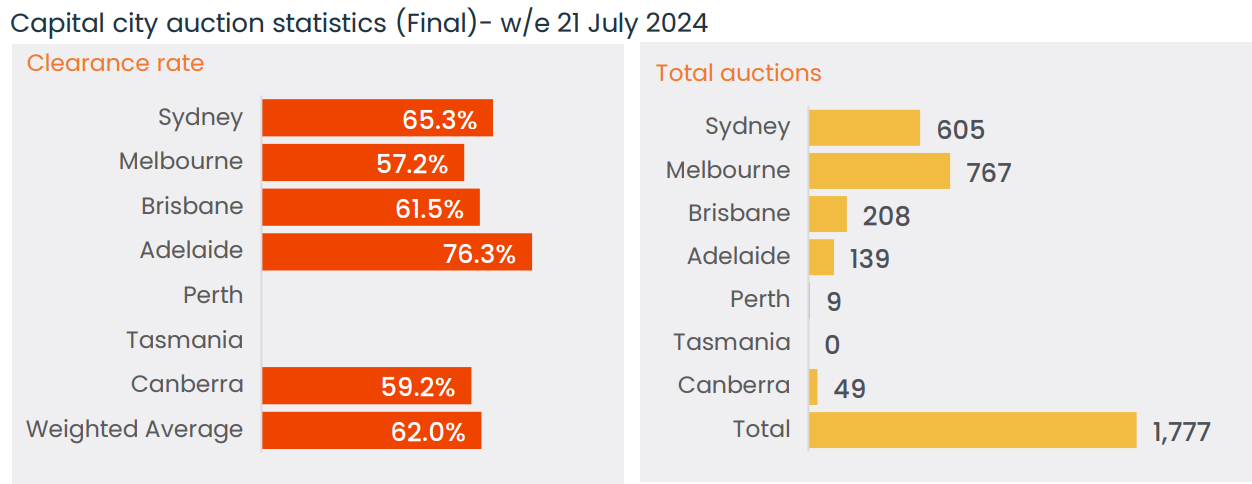

CoreLogic released its final auction results for last weekend, the most notable aspect of which was the collapse in Melbourne’s clearance rate to only

Source: CoreLogic

Melbourne’s final auction clearance rate slumped to 57.2%, the second lowest so far this year, behind the week ending 9th June (55.6%). This is just the second time all year that the clearance rate has fallen below 60.0%.

One year ago, 681 homes were taken to auction across Melbourne and the city recorded a clearance rate of 64.6%.

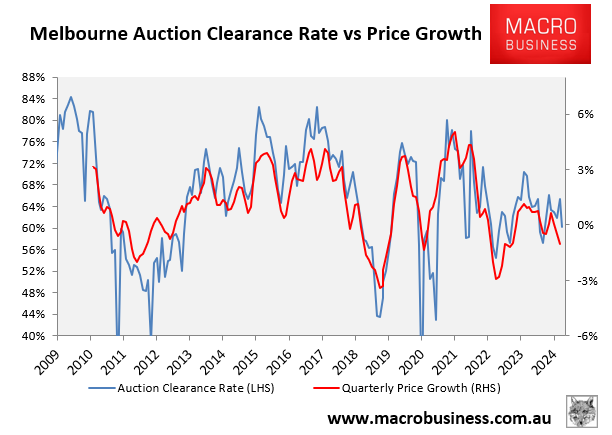

The slump in Melbourne’s auction clearance rate has been matched by prices.

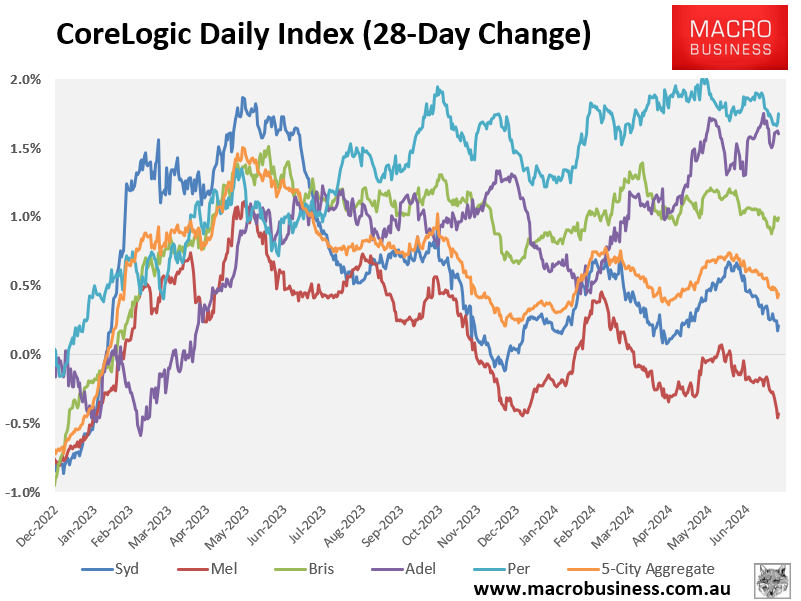

CoreLogic’s daily dwelling values index shows that value declines have steepened with Melbourne values down o.4% over the past 28 days:

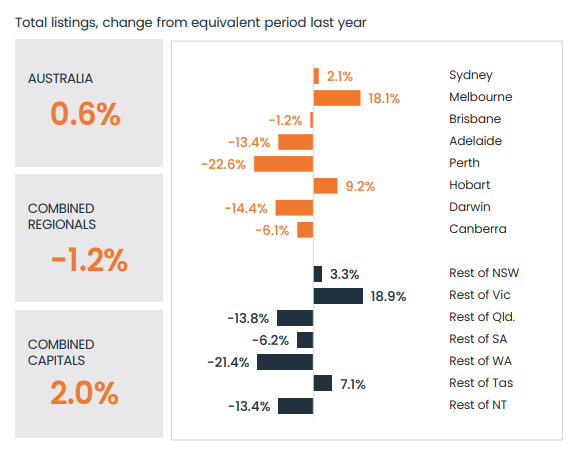

CoreLogic’s head of research, Tim Lawless, reported over the weekend that Melbourne “buyers have more choice” with “listings [that] are close to 14% above the previous five-year average and 17% higher than at the same time last year”.

Source: CoreLogic

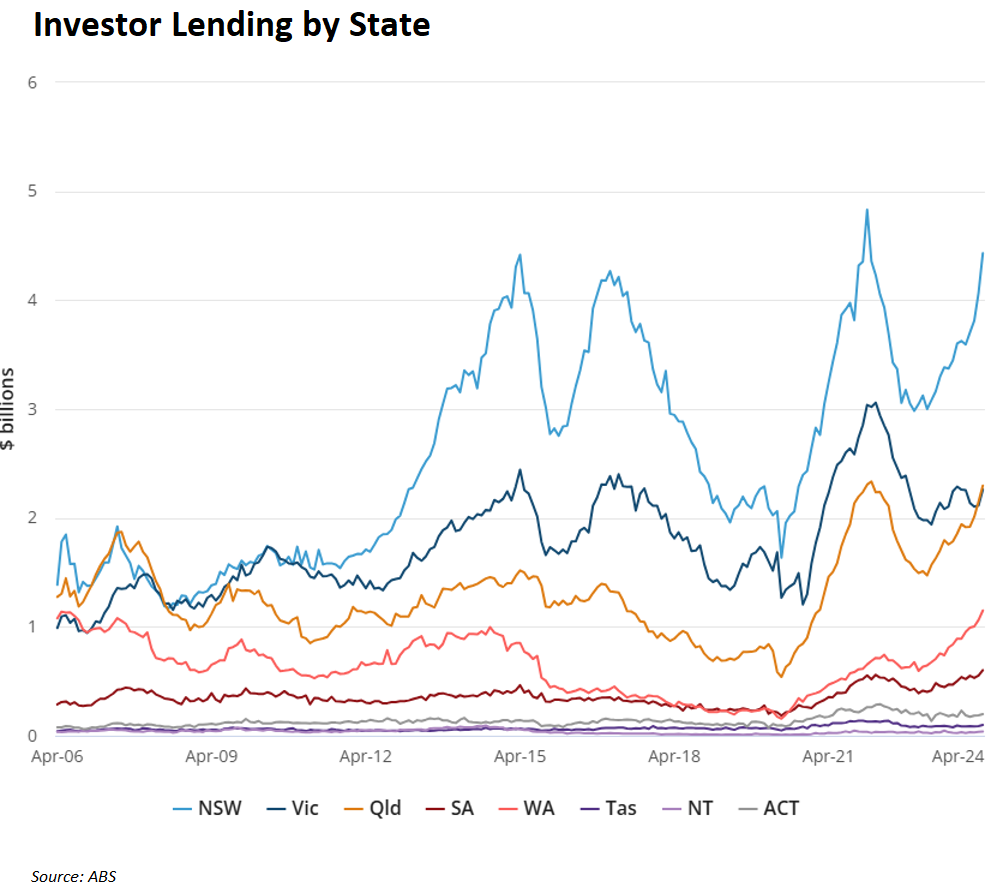

A key reason why Melbourne home values are falling vis-à-vis the other major capitals is that investors have abandoned the city in favour of other jurisdictions:

A recent survey by Property Investment Professionals of Australia (PIPA) claimed that “talk of Victorian investors selling up is rife, with investor groups blaming interest rates, increased land taxes, and the scrapping of no-fault evictions”.

The upside is that Melbourne housing has become relatively more affordable for first home buyers.