Amazingly, Australia has discovered an even worse way to grow its economy than the immigration/housing ponzi economy.

The National Disability Insurance Scheme (NDIS), a bottomless public spending pit, fuels the bedpan economy.

The giant economic suckhole costs a literal mint:

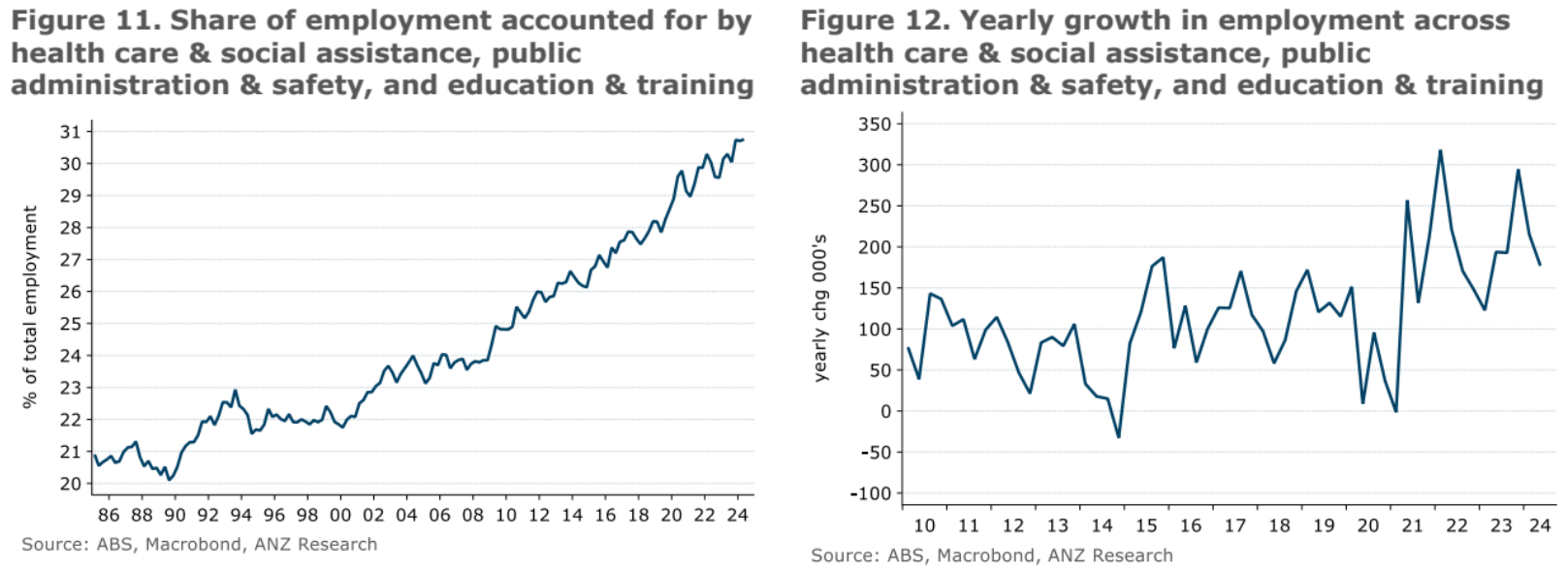

It has helped drive public-funded jobs towards one-third of employment:

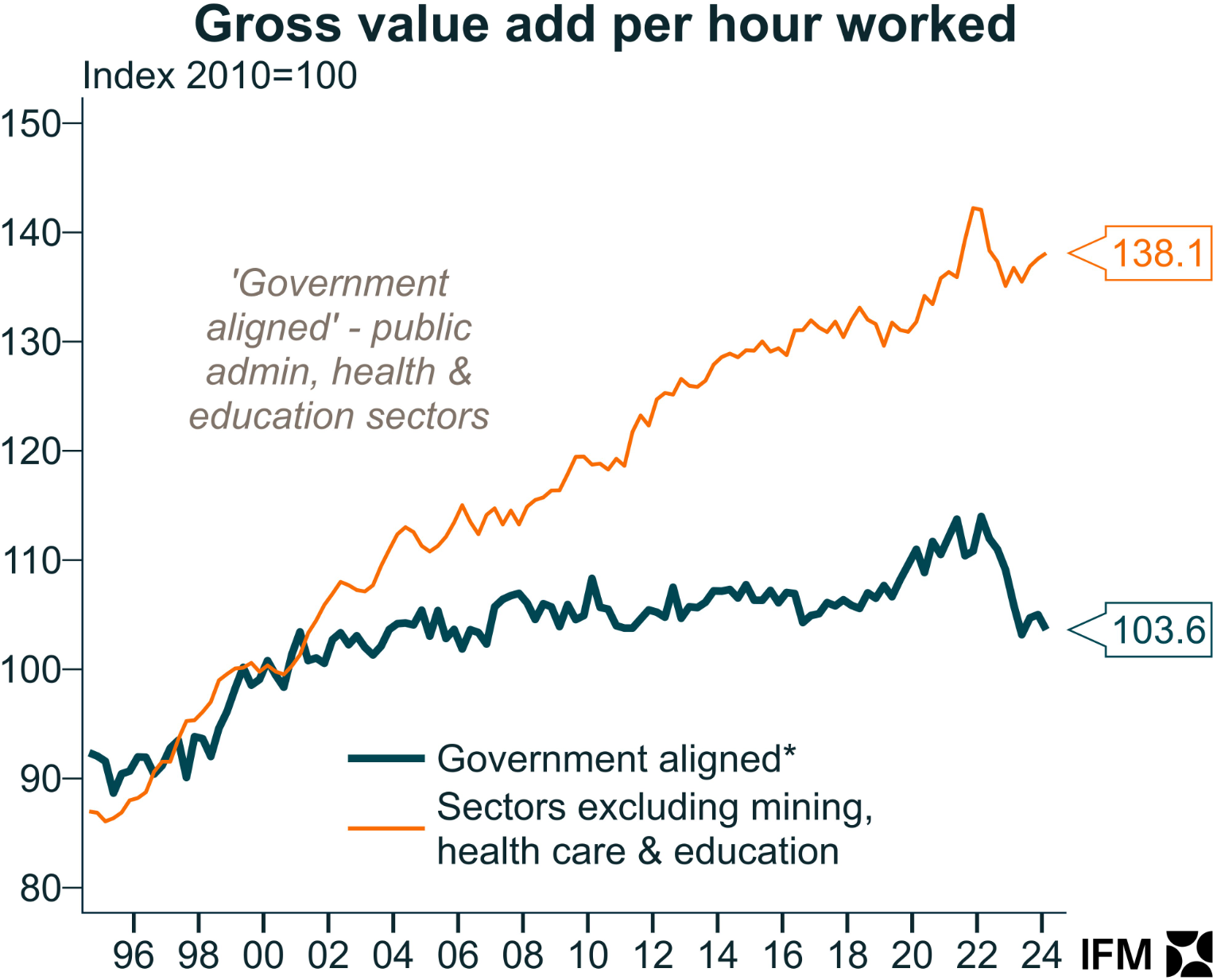

Systematically devouring productivity:

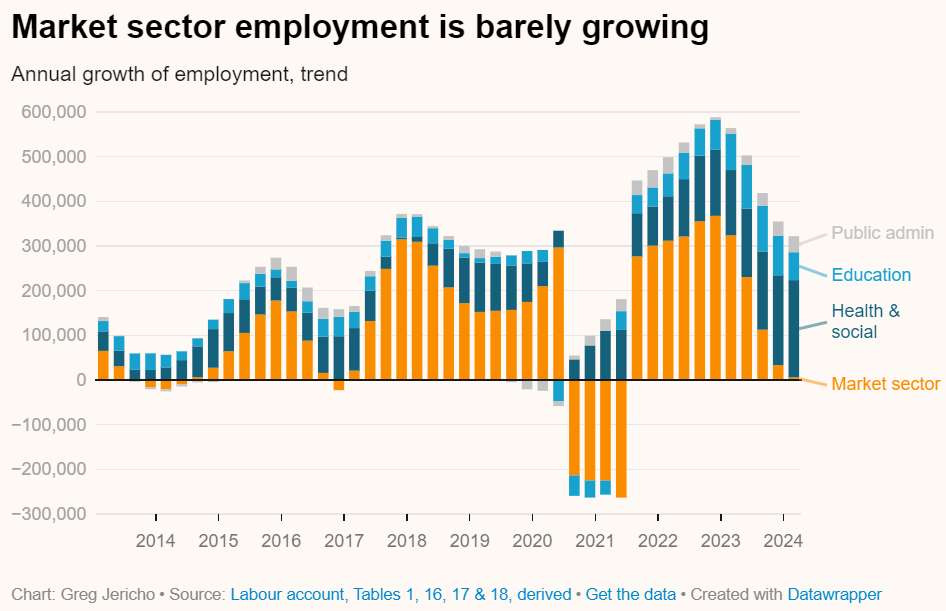

As the private sector is crowded out:

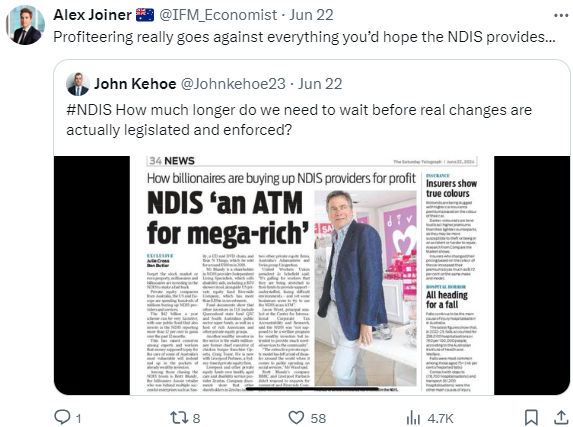

And feeds the Game of Mates:

Let’s not beat around the bush. Millions of Australians haven’t suddenly discovered that they are disabled.

Rather, a fiscal incentive of immense proportions has motivated an entire population to disable itself while the rich exploit it.

This can be seen everywhere in the emergence of new and exciting disabling terminologies such as “neurodivergence,” “ADHD,” “spectrum,” etc, etc.

To be clear, I am not saying that these conditions do not exist. Of course, they do.

But many of today’s disabilities used to be called “anxiety,” which was treated with a Bex and a good lie down rather than a public sinecure.

On the supply side, we have private equity, billionaires, and even organised crime defrauding the entire system. To wit:

Domacom, the ASX-listed platform that allows investors to buy fractional stakes in property, says the trustee of its flagship fund has suspended it from raising new money and from facilitating any secondary market transactions.

MSC Trustees has temporarily suspended the product disclosure statement relied on to raise about $200 million, Domacom said in a statement to the exchange on Monday.

That detailed how investment schemes marketed by investment advisory firm ASR Wealth Advisers pitched double-digit, government-backed returns to prospective landlords of tenants with disabilities.

“In the light of The Australian Financial Review article and its ongoing compliance and risk monitoring, the trustee and responsible entity of the fund has requested that the product disclosure statement be temporarily withdrawn for new business,” Domacom said.

“The trustee has also required that the secondary market for the fund be temporarily suspended.”

Domacom has been chaired by former Liberal leader John Hewson since April 2022 and allows investors to buy into managed investment schemes. The company manages about $200 million in more than 100 funds, which are largely tied to NDIS-linked properties.

The decision followed revelations in The Australian Financial Review that investors in properties tied to the National Disability Insurance Scheme were facing capital losses due to a failure to secure tenants.

The plague of disability alongside the fattening NDIS is just too wild a coincidence to ignore!

This is a major issue of equity. The rise in fraud is depriving the genuinely disabled of their support and is now fleecing investors as well.

Nor is it fair to the taxpayer or future generations that must pay the enormous bill.

As for the economy, the more resources sucked into the bedpan economy, the less dynamic and income-generating it will become.

This means that the entire NDIS sector is based on other sectors carrying the deadweight loss, or it is based on public borrowing.

How is the NDIS going to be funded to the tune of $60-70bn in the next few years when national income is in freefall with commodity prices?