PropTrack has released its rental market report for the June quarter, which showed persistently strong demand for rentals amid limited supply.

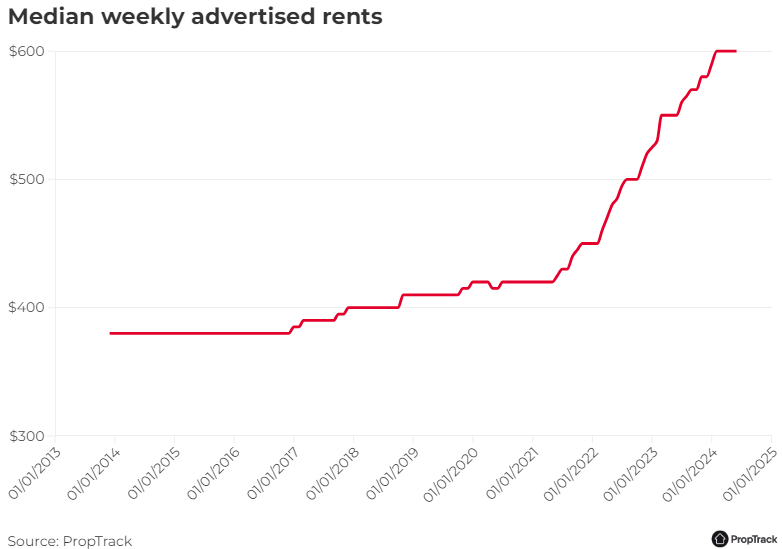

National advertised rents were unchanged over the June 2024 quarter, remaining at $600 per week:

Over the 12 months to June 2024, national advertised rents increased by 9.1%, or an additional $50 per week. This price growth is steady from the previous quarter but well down from the 13.4% increase over the 12 months to June 2023.

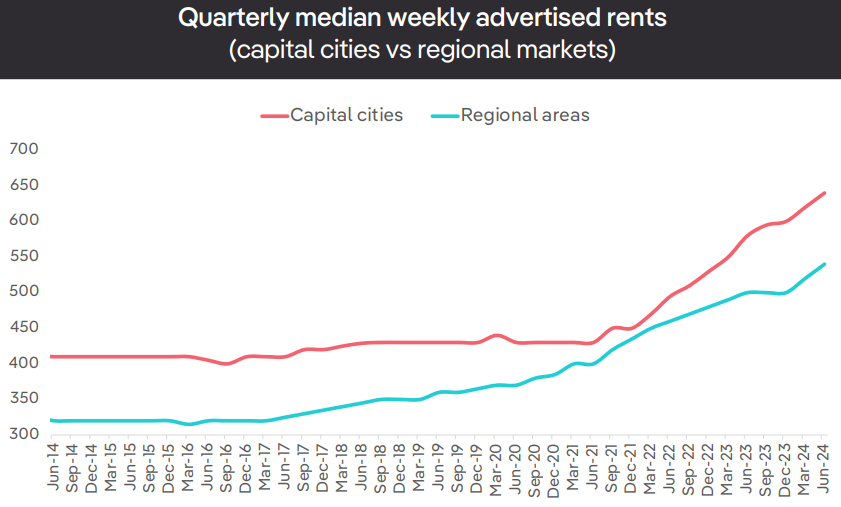

The typical capital city advertised rent ($640 per week) is $100 more expensive than the typical regional rent ($540 per week), and rents in the capital cities have grown at a faster pace over the past year compared to regional markets with increases of 10.3% and 8% respectively.

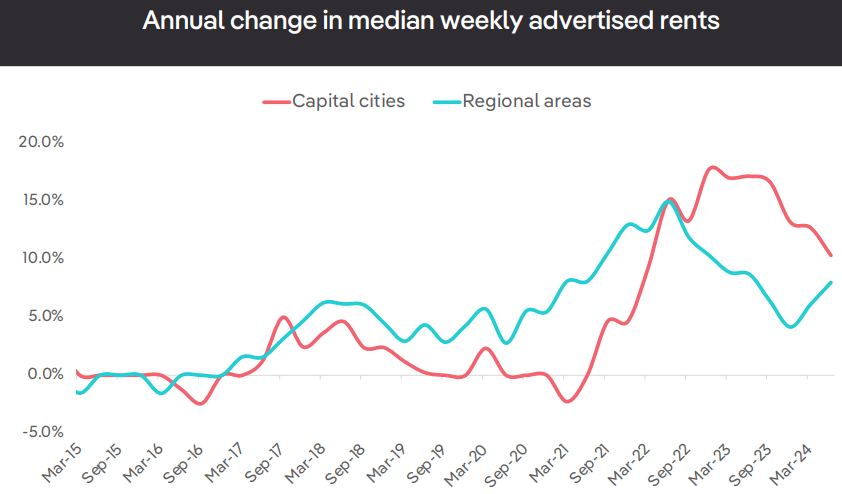

Both capital cities and regional markets have seen annual rental growth slow compared to a year ago with the slowing more pronounced in the capital cities.

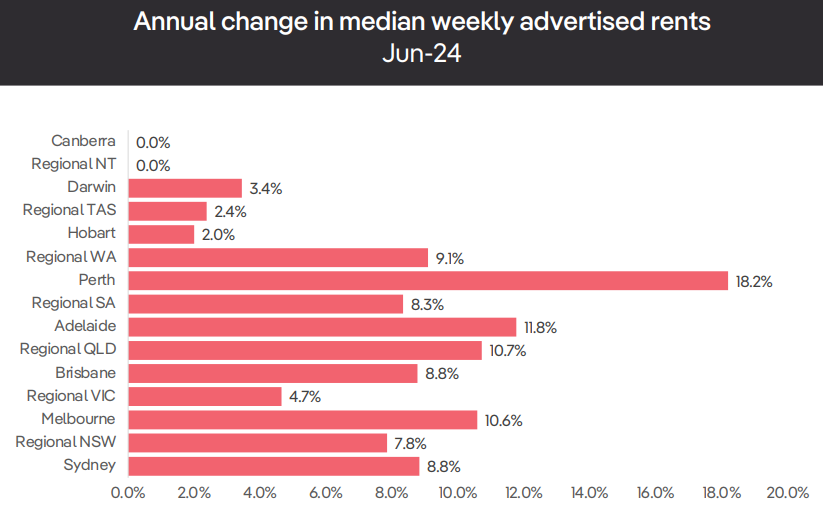

The next chart shows the annual change in rents by sub-market:

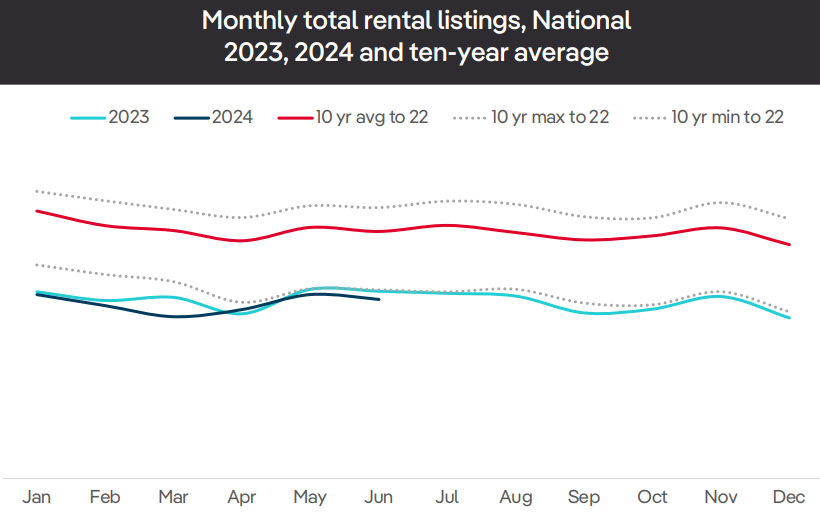

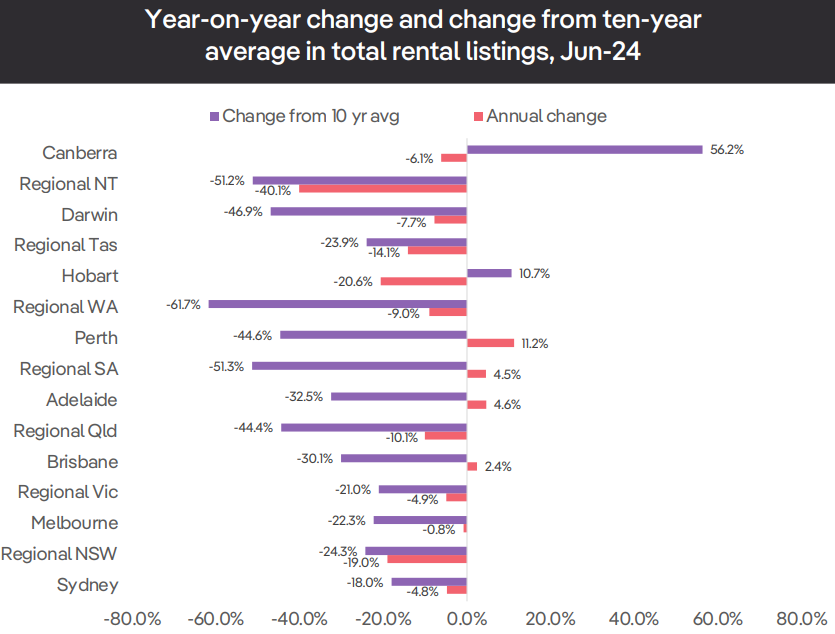

Tenants remain starved of choice, with total rental listings in June down 4.4% from June 2023, with the fewest total rental listings for the month of June since 2010:

The combined capital cities have seen a 1.7% reduction in total rental listings over the year to June 2024, sitting 24.2% lower than the June average over the decade to 2022.

Regional markets have seen a larger annual decline in total rental listings of 12.5% and relative to the decade average, total listings are 35.8% lower.

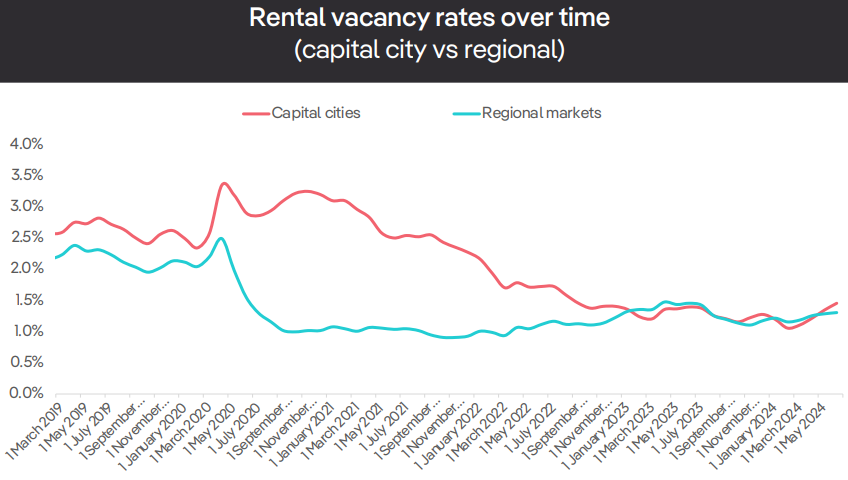

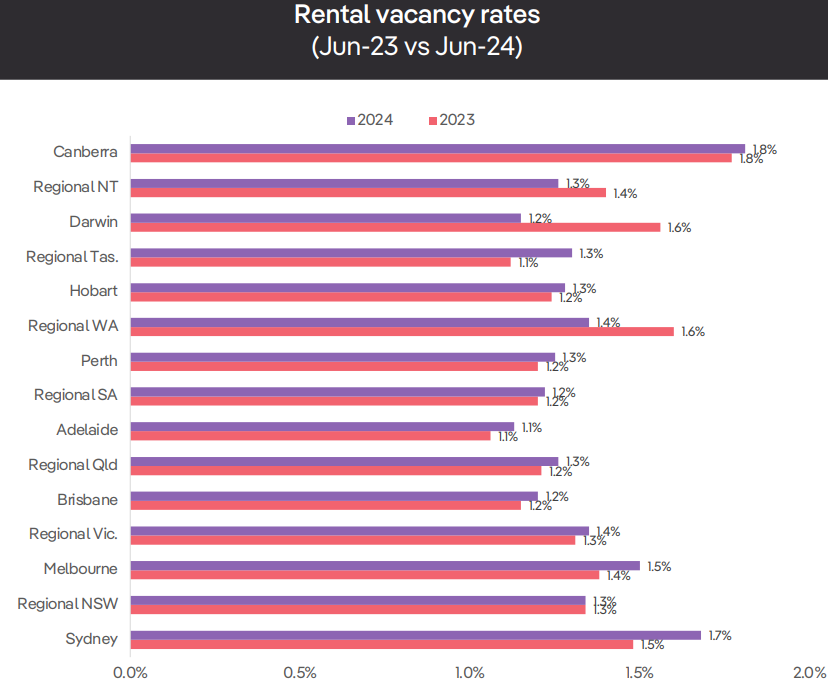

The national rental vacancy rate was recorded at 1.4% in June 2024, up from 1.1% in the previous quarter and unchanged compared to June 2023.

This compares to a national rental vacancy rate of around 2.5% prior to the pandemic.

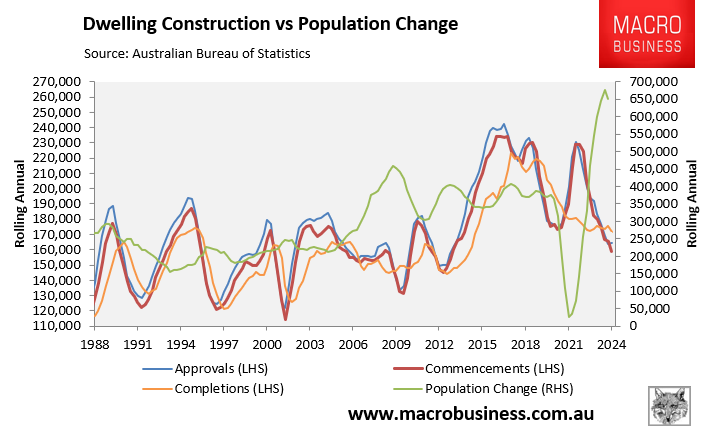

Despite the modest improvement across a range of measures, PropTrack warns that renters will remain under chronic pressure amid “rapid population growth” and a shortage of supply.

“Fundamentally, supply remains far too low and demand far too high, but with the cost of living surging the capacity to pay rents is reducing”.

“In response to higher rents, people will look to reduce the size of their rental properties, move to a less desirable location in which rents are cheaper or share their rental properties with others to reduce the cost”…

“With limited new rental supply and persistent strong demand for rentals, the vacancy rate is anticipated to remain low. This highlights again how a significant lift in rental stock or reduction in rental demand is required to see more stable rental conditions similar to pre-pandemic”…

“Although rental growth is expected to slow, it is anticipated to continue to outpace the rate of inflation. The imbalance between demand and supply persists, exacerbated by limited new housing construction, many investors selling, and a low volume of investors purchasing”.

“Consequently, it is difficult to imagine rental prices stabilising. The primary driver of slower rental growth is likely to be the capacity for renters to afford rising rent prices”.

“From here, we expect rents will continue to climb, particularly in the major capital cities. This is due to persistent low supply and strong demand being exacerbated by rapid population growth. While population growth is forecast to slow, it will remain elevated this financial year and next”.

“As was the case in 2023, we expect that the rate of rental growth will slow in 2024 as the higher cost of rent and the overall rise in cost of living will limit rental increases. Renters will be increasingly looking for smaller and cheaper properties or forced into share house living to save on rental costs”.

In short, with population growth likely to exceed construction for the foreseeable future, the outlook remains grim for Australian tenants.

That said, unlike mortgages, rents cannot be leveraged. This means that rental growth is more closely tied to household incomes, limiting its potential increase.