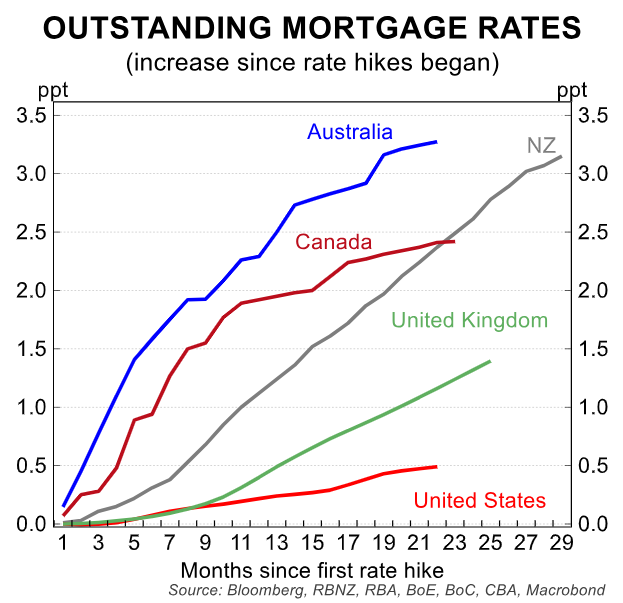

Australians have experienced one of the sharpest rises in mortgage rates in the developed world:

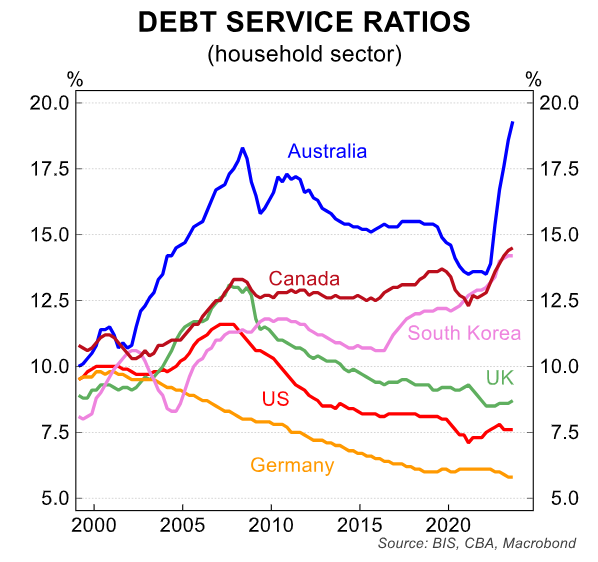

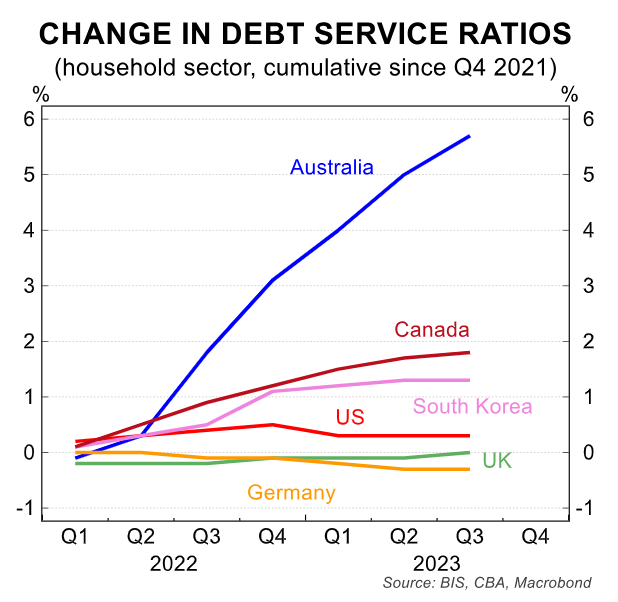

Australians have also experienced the largest rise in debt servicing costs in the developed world:

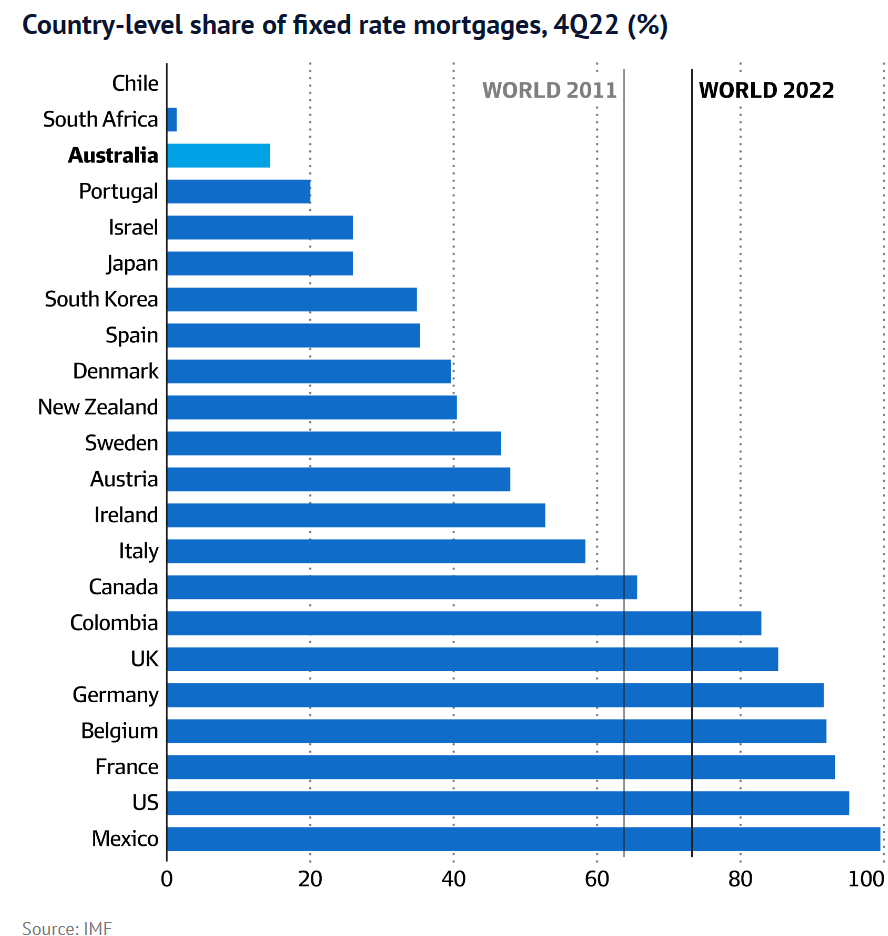

The reason for Australia’s sharper rise in mortgage costs is that we have one of the highest concentrations of variable rate mortgages in the world.

Therefore, increases in official interest rates are passed on more quickly to borrowers in Australia than elsewhere.

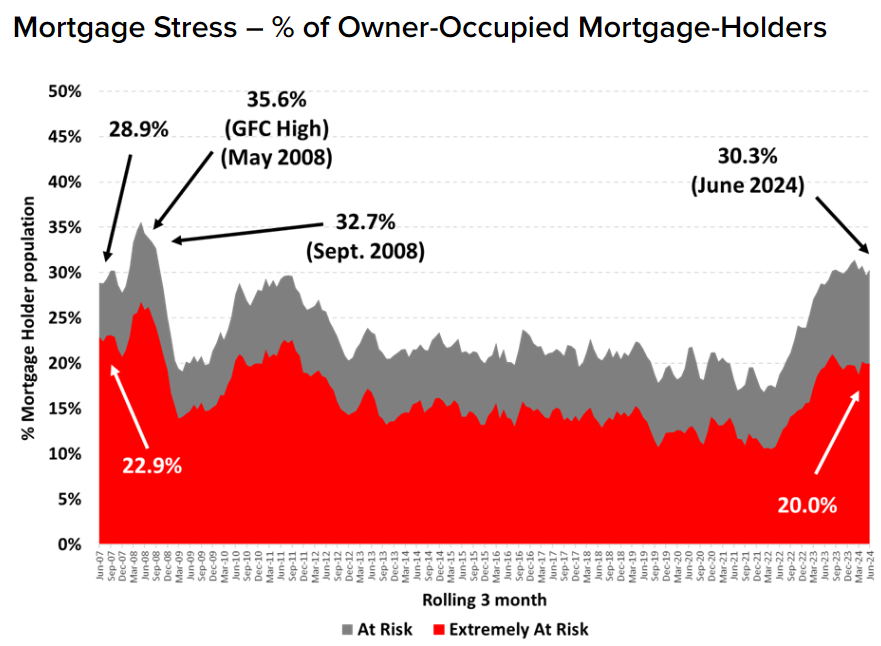

The impact on Australian household budgets is illustrated in the below chart from Roy Morgan Research.

According to Roy Morgan, the number of mortgage holders ‘At Risk’ of mortgage stress has increased by nearly 800,000 in the two years since the RBA commenced its interest rate tightening cycle:

Compared to May 2022, when the RBA began a cycle of interest rate increases, the number of Australians ‘At Risk’ of mortgage stress has increased by 795,000. Official interest rates are now at 4.35%, the highest interest rates have been since December 2011, over a decade ago.

Over a million mortgage holders are now considered ‘Extremely At Risk’ (1,016,000 or 20.0% of mortgage holders) which is significantly above the long-term average over the last 10 years of 14.5%.

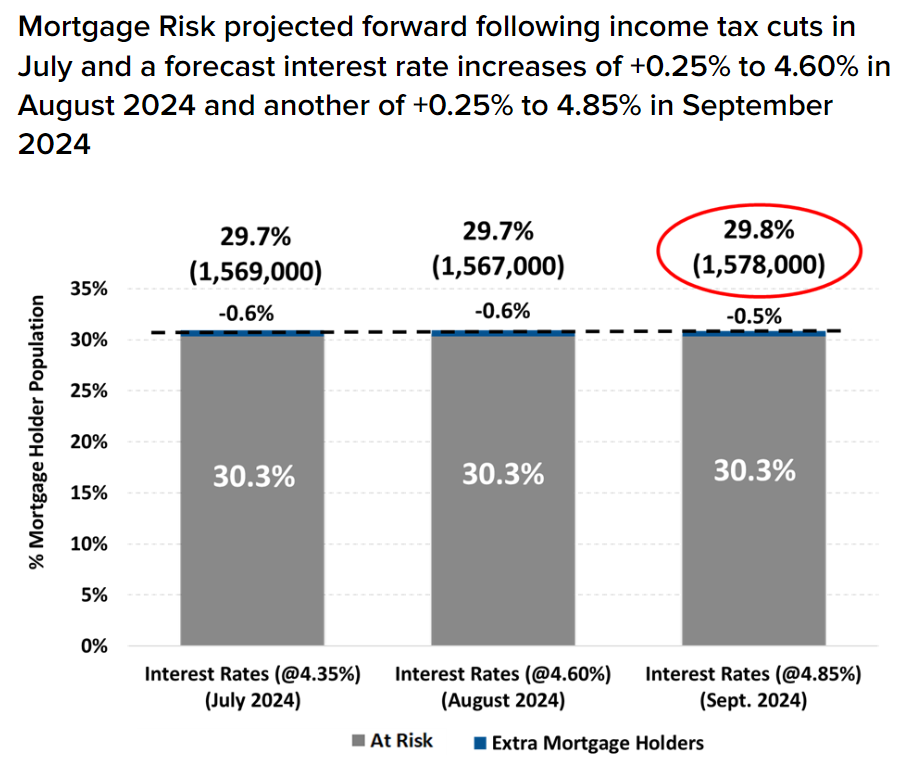

The outlook is brighter, however. Roy Morgan notes that mortgage stress should decline after the Stage 3 tax cuts begin flowing into bank accounts, even if the RBA hikes interest rates again.

In June, 30.3% of mortgage holders, 1,602,000, were considered ‘At Risk’ and this figure is forecast to fall in both July and August, even if the RBA decides to increase interest rates in August by +0.25% to 4.60%.

In August, the number of mortgage holders considered ‘At Risk’ is forecast to fall by 35,000 from currently to 1,567,000 (29.7%, down 0.6% points) of mortgage holders after the impact of the Stage 3 tax cuts.

Looking forward into September, if the RBA decides to increase interest rates by +0.25% to 4.85% in September, that will increase the number of mortgage holders considered ‘At Risk’ in August (1,567,000), up 11,000 to 1,578,000 (29.8% of mortgage holders) in September; but still down 24,000 from current figures.

That said, the biggest risk to mortgage holders is no longer interest rates but unemployment. Because if a household loses their job, they will struggle to make repayments.

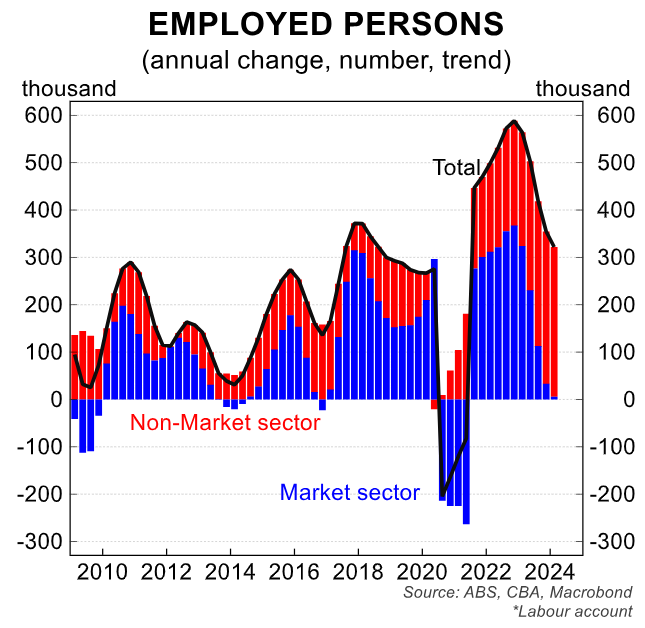

Australia’s unemployment rate remains low at 4.1%, bolstered by NDIS jobs in the non-market sector:

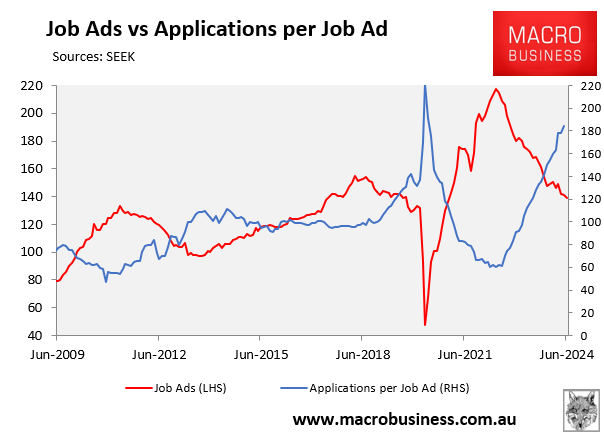

However, broader labour market indicators are much weaker, suggesting that unemployment could still rise aggressively:

If you wish to save thousands of dollars in mortgage payments, try the MB Compare n Save mortgage comparison tool. It takes less than a minute.

And if you choose to refinance, Compare n Save will handle the process.