The Reserve Bank of Inflation Island is not happy:

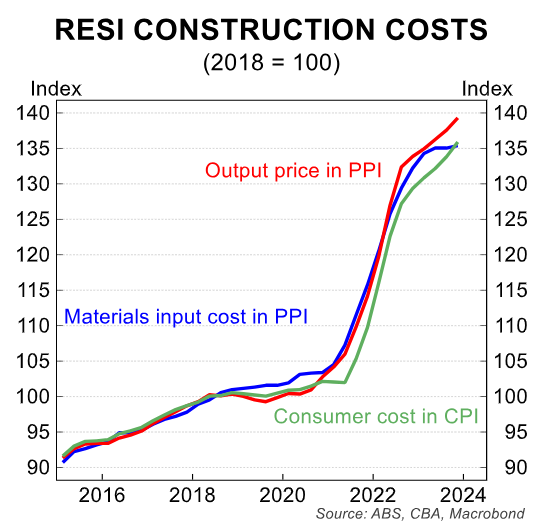

Rapidly rising building costs are keeping inflation in Australia higher than overseas, Reserve Bank of Australia governor Michele Bullock has warned, as the economy enters a “difficult” stage where demand remains too hot.

“We’re not seeing the same progress [on inflation] as overseas,” she told an annual superannuation lending roundtable hosted by The Australian Financial Review and packaging company Visy on Tuesday.

“But having said that, we know from overseas that progress is bumpy. It’s up and down, so the challenge is understanding where the risks might lie.”

…“[Building costs] are still going up,” she said. “Part of that is labour shortages, and some of it is to do with electricity costs which are causing the building material costs to continue to rise.”

Building costs are the result of four major errors by the Albanese Government.

- Over-migration has simultaneously pressured dwelling and infrastructure construction volumes higher.

- No tradies have been part of the immigration, to protect the appalling CFMEU.

- There have been no spending cut offsets at the federal level.

- Failure to address the gas cartel has injected massive input cost inflation into energy-intensive building materials.

All of these outcomes were avoidable. Indeed, MB warned of each in advance as the failing policies were rolled out.

The Reserve Bank of Inflation Island is on tenterhooks:

Ms Bullock said the RBA board was balancing the fact that demand was still too strong with the fact that monetary policy acts with a lag. Parts of the economy like the jobs market and household spending were slowing in response to action already taken by the RBA board.

The response from Anthony “Mr Rourke” Albanese: We need some more spending, Tattoo.

Jim “Tattoo” Chamlers: Yes, boss.

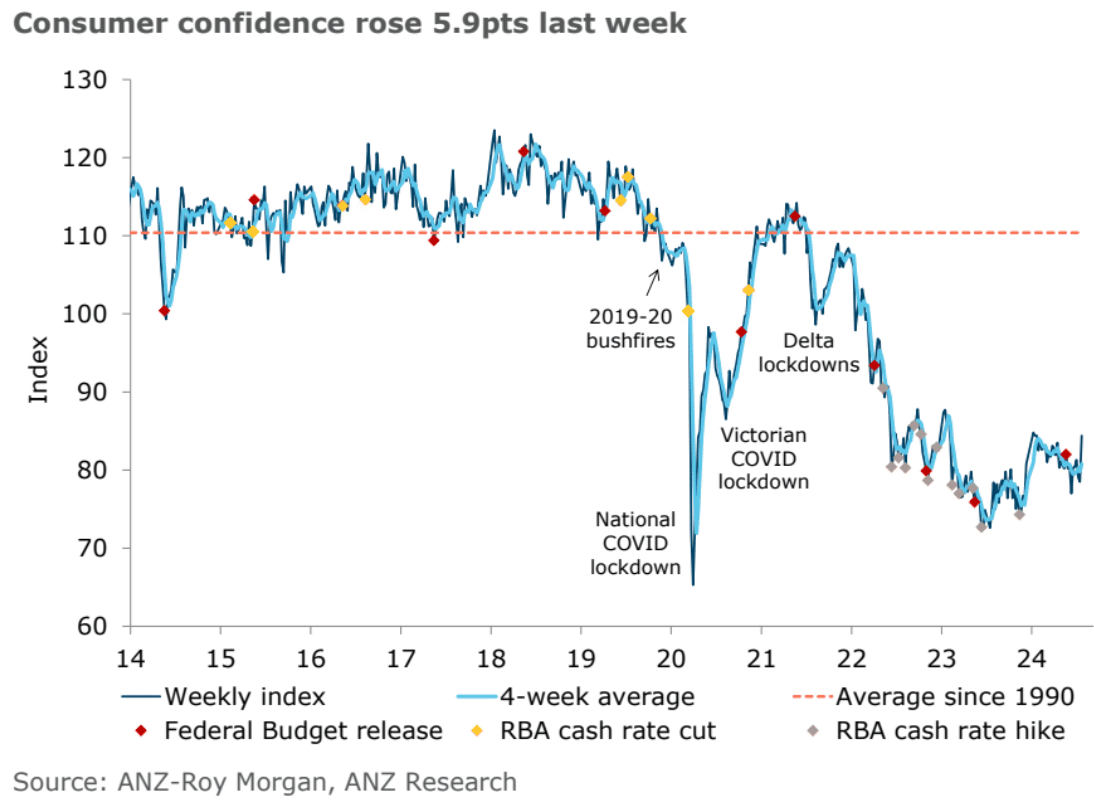

And so ANZ consumer confidence jumped this week as tax cuts landed:

ANZ-Roy Morgan Australian Consumer Confidence recorded its largest weekly rise since April 2021, jumping 5.9pts to hit a six-month high.

The improvement in confidence was broad-based, with each of the subindices increasingby at least 5pts.

Notably, households’ confidence in their current financial situation was the second highest since early-2023.

This suggests households may be starting to see a boost to their incomes from the Stage 3 tax cuts and other cost-of-living relief measures.

The next few weeks will be important in determining whether this is the start of a sustained recovery in consumer confidence.

We are a long way from a sustained recovery but the tax cuts will accumulate and any easing in the per capita recession will raise the prospects of more RBA tightening.

Welcome to Inflation Island, where all your dreams of rising living standards turn into dark nightmares under the baleful watch of Albo Rourke and his economic dwarf:

An Aussie influencer has divided social media after revealing the “wild” price she paid at a Perth cafe for a takeaway sandwich and serving of avocado toast.

In a TikTokvideo, user Mea Jasmin lamented the national cost of living as “a joke” while displaying both meals, which set her back $40.

One sandwich was sliced tomato, smashed avocado, and eggplant between two pieces of bread; while the other was two slices of toast with smashed avocado on the side.