If only:

Greens housing spokesman Max Chandler-Mather has made clear the minor party’s policies are aimed at achieving a real decline in housing values over time to ensure the next generation has a better chance of buying a home

…The Greens have proposed a major overhaul to phase out negative gearing and abolish the capital gains tax discount, as well as the establishment of a government-owned property developer to rent and sell at below-market prices.

The party has also advocated for a rent freeze and cap on rents, arguing that 20 per cent of renters across the nation vote Green.

My best guess is that the Greens mix of housing policies would not trigger sustained house price falls.

Various studies have suggested NG is worth about 10% to house prices.

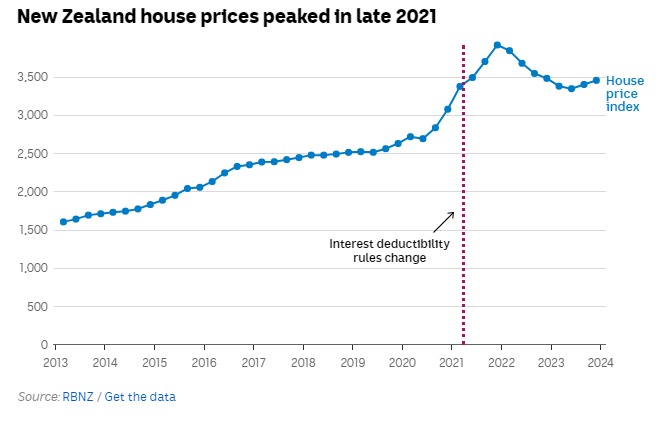

When New Zealand removed negative gearing, house prices fell roughly that but it is not easy to distinguish between the policy change and interest rates that were also rising:

The Greens government developer is very unlikely to be large enough to become the marginal price setter in the market.

What about the easy credit standards of APRA and the RBA? The Greens want the government to take control of the central bank and cut rates!

What about the great land banking scams of the big developers that drive up land prices? Until the recent cycle, this was the sole source of rising property prices. Now it is construction costs as well.

Rent freezes are bad policy. While housing shortages predominate, freezes will just drive rent increases into a black market.

And that is the rub. If your policy platform does not redress the imbalance of houses to people then you will fail to drop prices.

Australia’s and The Greens’ over-migration policies are the foundation problem for affordable housing, not to mention the environment.

They used to know it and then they didn’t as the fakes arrived:

The Greens would end Labor today if they were an environmental stable population party.