Traditional Australian retailers are in a world of pain.

Sales volumes have collapsed in the face of high interest rates and the cost-of-living crisis, with discretionary retailers hit hardest.

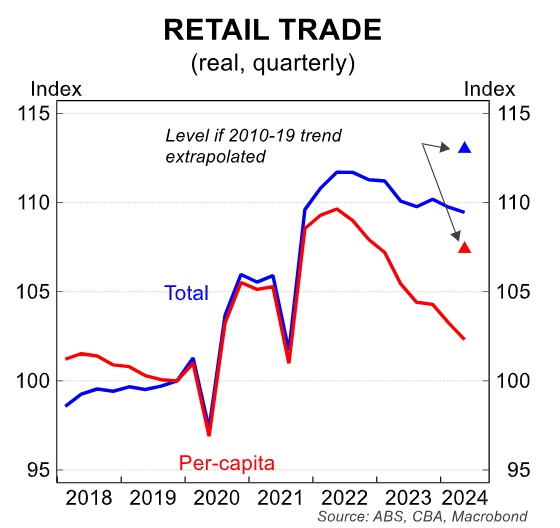

The annual change in retail sales has been negative for the past five quarters. Outside of the pandemic, only four other quarters have seen negative yearly growth since the 1980s.

Even worse, retail volumes per capita (-0.9%) fell for the ninth consecutive quarter, down 3.0% from the same period last year.

Traditional brick-and-mortar retailers are seeing increased competition from online sellers, which offer greater convenience and lower prices.

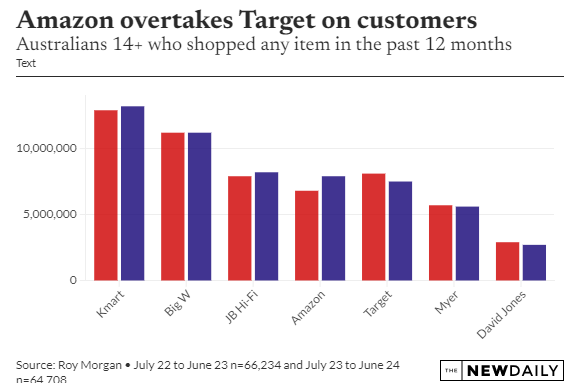

Amazon joined the Australian market in December 2017 and has subsequently increased its presence. It offers comparable prices and unsurpassed convenience, with most things delivered free to your door within 48 hours if you have an Amazon Prime account.

Earlier this year, Amazon revealed plans to expand its operations and delivery network in Australia.

Roy Morgan data showed that Amazon’s customer base rose 16% in the year to June 2024, with 1.1 million more people using the platform than the prior year.

Retail Doctor Group CEO Brian Walker believes Amazon is on track to become Australia’s extensive retailer, alongside Kmart and Big W.

“Amazon could be [among] Australia’s largest general merchandise retailers within the next five years”, Walker said.

“You’re in the gun barrel of them if you haven’t got a competitive offer that doesn’t rely on speed, range, price or convenience”.

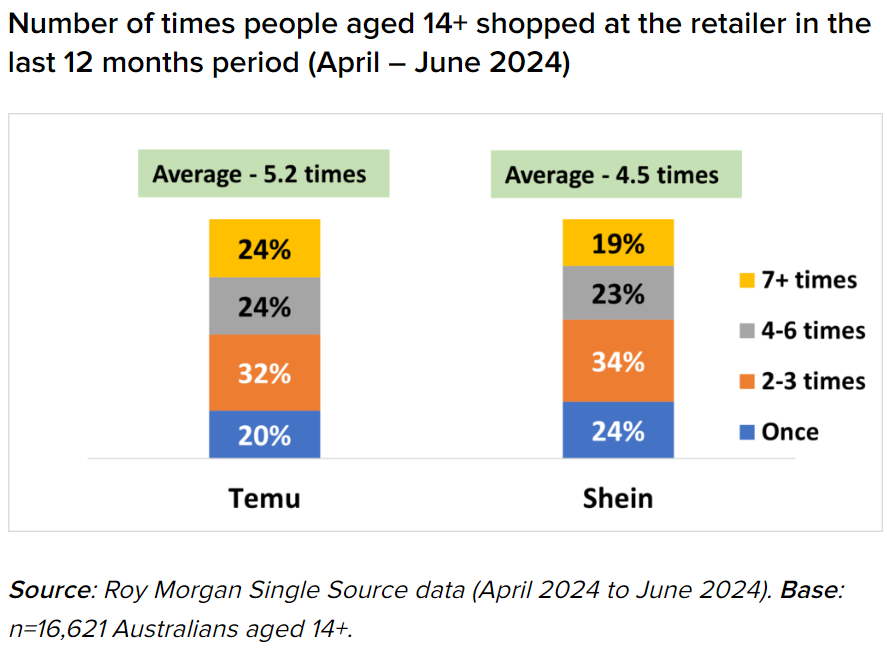

New data from Roy Morgan also shows that 3.8 million Australians aged 14 and above have shopped at Temu at least once in the last year, while 2 million have purchased from Shein at least once.

According to the data, 80% of Temu shoppers and 76% of Shein shoppers are repeat consumers; many are also high frequency purchasers, with 48% of Temu shoppers purchasing four or more times in the last year, compared to 42% of Shein shoppers.

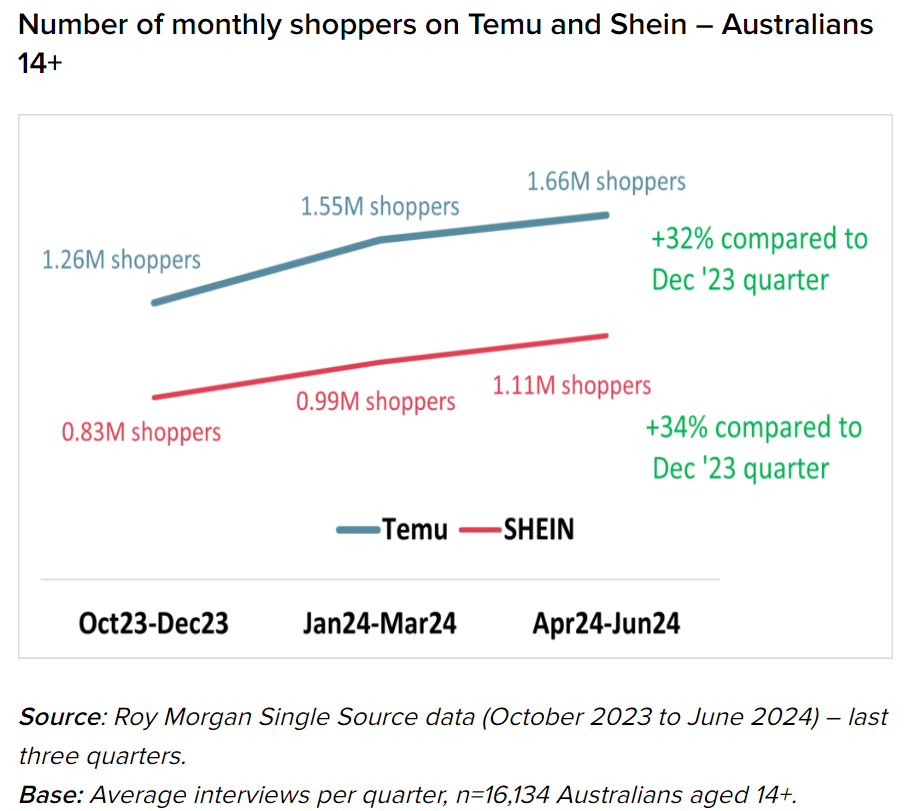

Roy Morgan has been measuring the amount of monthly shoppers on Temu and Shein since the fourth quarter of 2023.

Over this short period, the number of shoppers has continued to expand at an astonishing rate: the number of people shopping on Temu each month has increased by 32%, from 1.26 million in the Oct-Dec 2023 quarter to 1.66 million in the April-June 2024 quarter (3.8 million individuals in a 12-month period).

Meanwhile, Shein’s monthly shopper base has increased by 34%, from 830,000 to 1.11 million over the same time period.

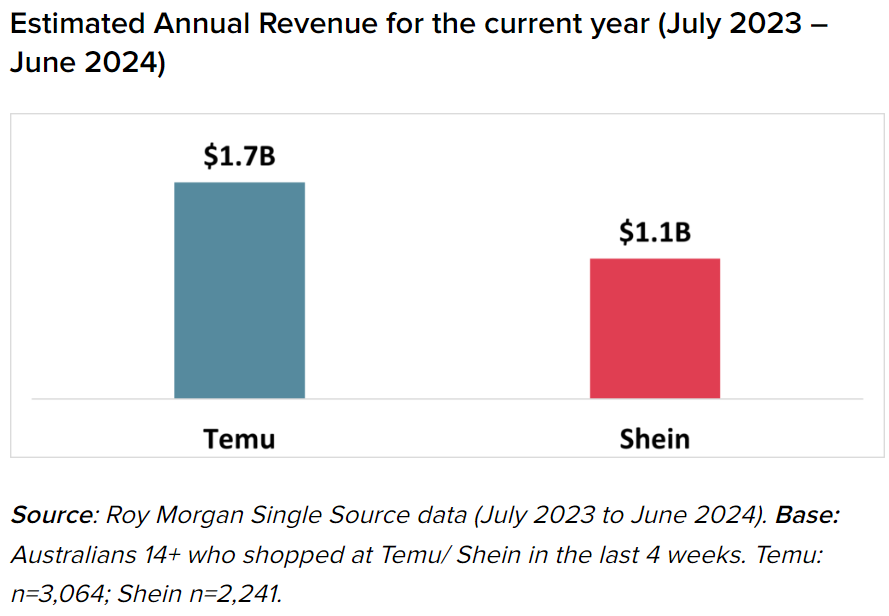

Roy Morgan believes that Temu and Shein combined had about $3 billion in yearly revenues in the 2024 financial year, with Temu accounting for $1.7 billion and Shein for $1.1 billion.

Laura Demasi, Roy Morgan’s Head of Retail Research and Social & Consumer Trends, commented:

“It’s been extraordinary to witness the continued rise of these ultra cheap platforms, especially over the last 9 months where they have enjoyed the kind of growth that Australian retailers can only dream of in this climate”.

The rise of online retailers like Amazon, Temu and Shein isn’t going to stop.

Australian customers will always prioritise value and convenience over anything else. And these online platforms have both ingredients in spades.

I would not want to be a traditional ‘bricks and mortar’ discretionary retailer. They are facing a perfect storm of deteriorating economic conditions and rising competition.