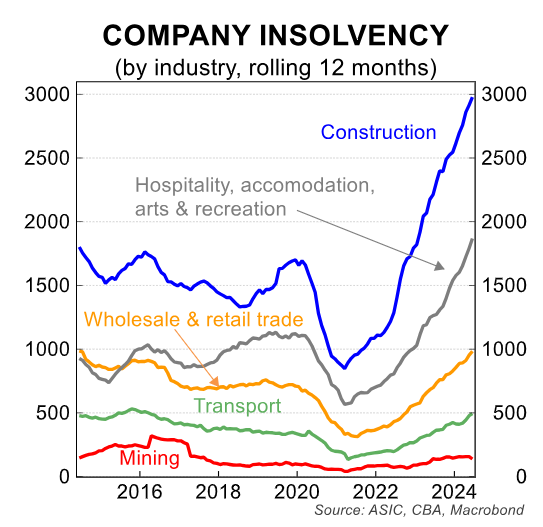

Australian Securities and Investments Commission (ASIC) data shows that nearly 3,000 construction companies failed in the 2023-24 financial year.

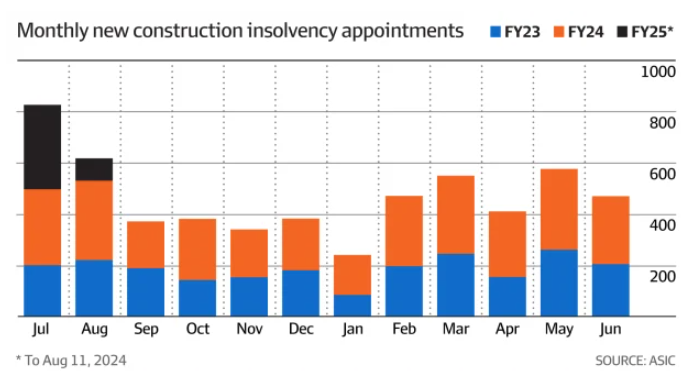

The trend has continued into this financial year, with 415 construction sector insolvencies recorded from the start of July to 11 August:

As shown above, there were 328 construction insolvencies in July, up from 295 recorded in July last year and 199 in the same month of FY23.

“Labour shortages, high costs, regulatory and compliance burdens, supply chain upheavals, overlapping layers of government bureaucracy and diminishing consumer confidence are at the heart of what construction companies are dealing with”, Ai Group CEO Innes Willox told The AFR.

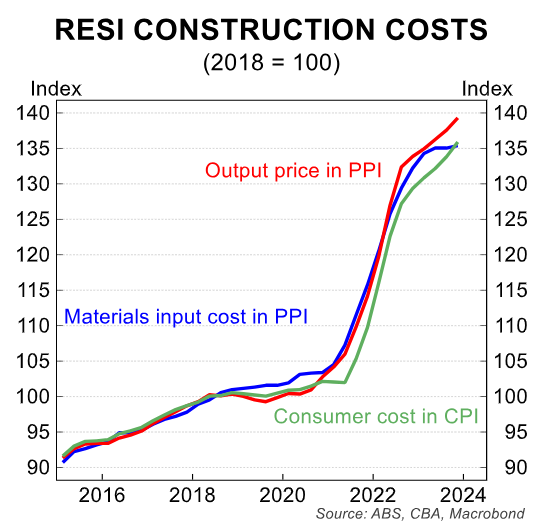

Homebuilders have been harder hit than other areas of the construction industry. Many have been caught out by fixed price contracts at the same time as costs have risen by around 40% over the pandemic.

“Builder margins have collapsed following the pandemic – from a normal rate around 8%, to only 5.6% in 2022-23”, Ai Group says.

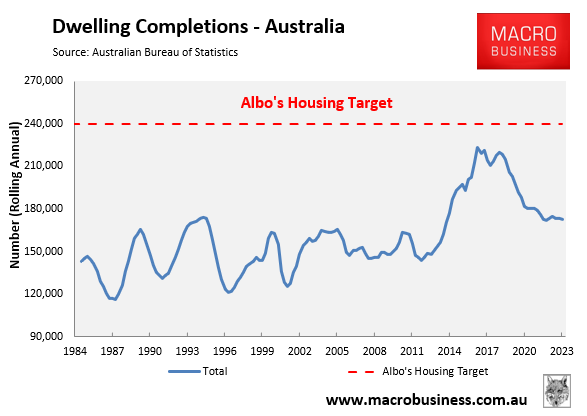

The growing number of insolvencies has come at the same time as the Albanese government has promised to build a record 1.2 million homes over five years:

Current dwelling construction rates are running behind by around one-third.

In addition to the large number of insolvencies, homebuilders are facing additional stiff headwinds, including:

- Interest rates are at 12-year highs, which is crimping buyer demand and raising financing costs for builders.

- Having to compete with government “big build” infrastructure projects for labour and materials.

- Structurally higher residential construction costs following the pandemic.

Put simply, it is a tough time to be a homebuilder in Australia, which is why so many are folding.

Macroeconomic conditions are stacked heavily against homebuilders and the Albanese government’s fantastical housing target.