Earlier this month, CoreLogic released data showing that large numbers of suburbs nationwide have joined the million-dollar club:

- 46% of suburbs in Brisbane boasted a median house price of at least $1 million at the end of July, compared with just 30% a year ago.

- 36% of suburbs in Adelaide have joined the ‘million-dollar club’, up from 26% at the same time in 2023.

- The share of suburbs in Perth with a median house price of $1 million has also risen from 20% to 32%.

CoreLogic research director Tim Lawless said that more suburbs will join the million-dollar club with prices still rising.

New data from Domain shows that a record 96% of residential properties nationwide are currently selling at a profit.

Nicola Powell from Domain says members of Generation X and older millennials are making the biggest profits in the housing market at present, even beating out the baby boomer generation.

“While Boomers have certainly reaped significant rewards from decades of rising home prices, it is their children who are walking away with the most profit in today’s market”, she said.

“Those in their late 30s to late 40s are well established in their careers, have equity from their current home, and have the financial capacity to upsize”.

Meanwhile, younger generations are losing out as prices rise further out of reach and borrowing costs rise.

Domain expects house prices to increase by 4% to 7% in 2024–25, while unit prices are tipped to record growth of 3% to 5%.

We’re all rich!

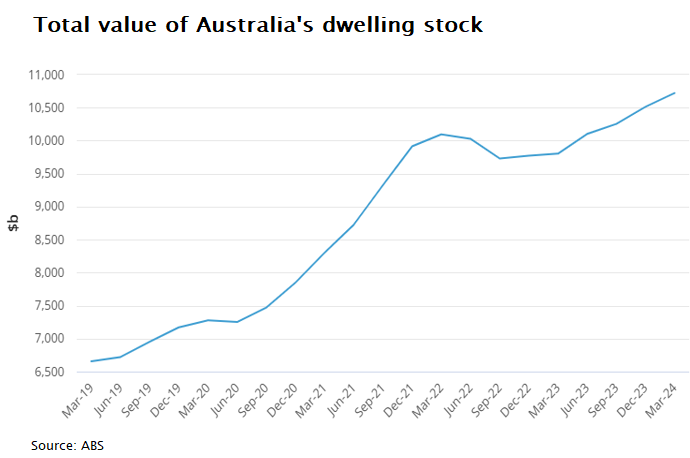

According to the Australian Bureau of Statistics, the total value of Australia’s residential dwelling stock increased to a record high of $10,721 billion in the March quarter:

This meant that the average Australian home was valued at a record high of $959,300.

Meanwhile, Australians continue to bury themselves in mortgage debt, with the average size of mortgages driving up property prices:

Is a country genuinely “wealthy” if its younger residents can’t afford to live independently without parental financial support? Because that is what is happening in Australia.

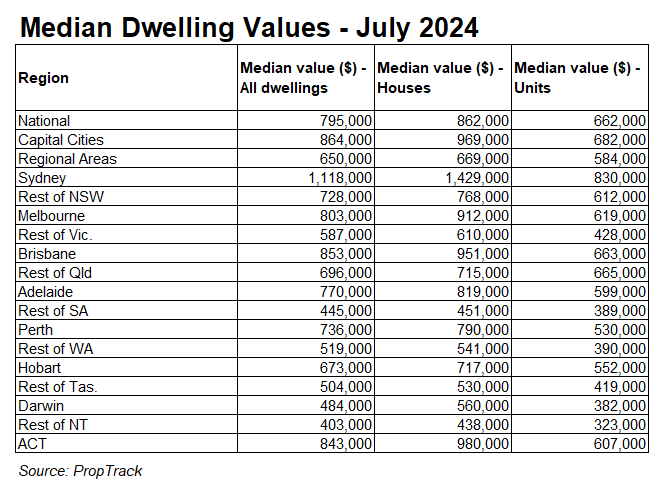

Australians would be “richer” if home values had not increased so rapidly, the median dwelling price was around $400,000 rather than $795,000, and household debt was 70% rather than 140% of income.

Australia would be a considerably more egalitarian society, and we would be financially better off if our homes were half the price they are now and we did not carry so much debt.

The escalation of Australian home values has negatively impacted our children, grandkids, and future generations, who will be required to pay considerably more for housing than they should, making them poorer over their lifetimes.

A home serves the same purpose, whether it costs $500,000, $1 million, or $5 million. Somebody who changes homes also sells and buys into the same market.

Higher housing “wealth” is thus largely meaningless to the vast majority of people who simply live in their homes and do not own investment properties.

Australia’s house price boom has created more losers than winners.

We have condemned future Australian homebuyers to a life of debt servitude or being locked in the rental market for the remainder of their lives.