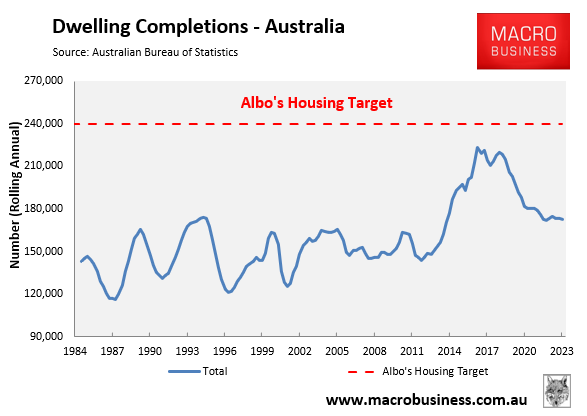

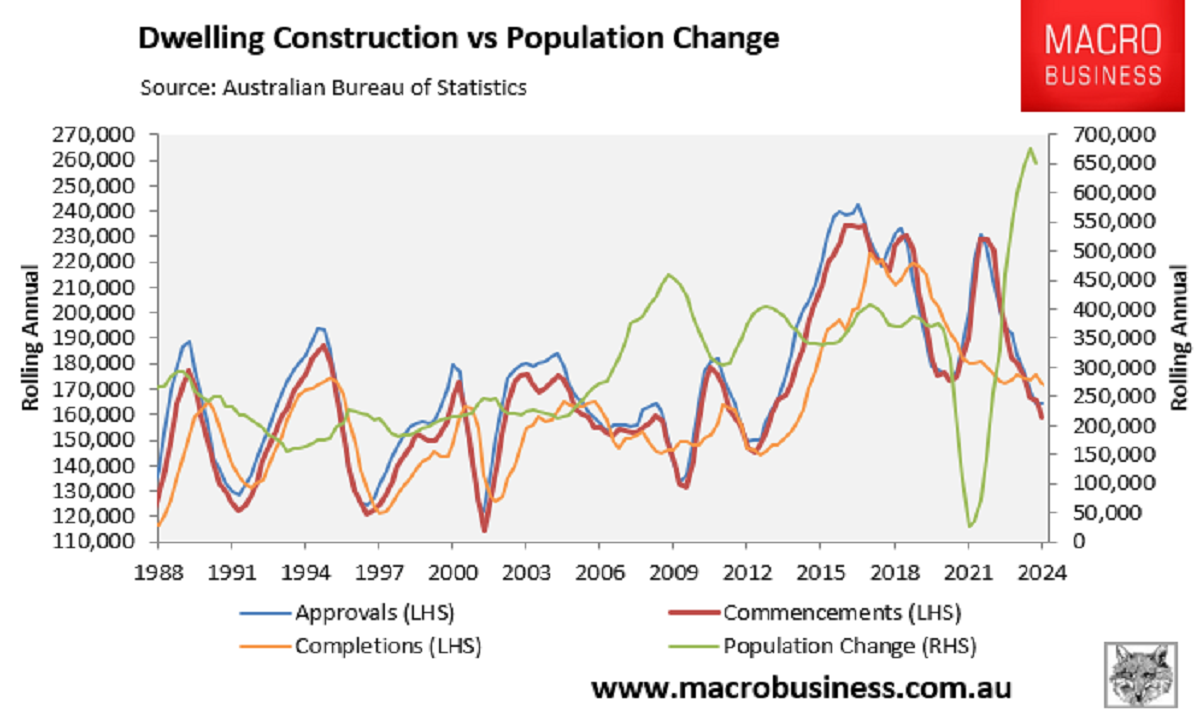

Australian housing construction indicators continue to falter, jeopardising the Albanese government’s fantastical target of building 1.2 million homes over five years.

Dwelling approvals, commencements, and completions are each tracking around decade lows, roughly one-third below the government’s target.

On Wednesday, the Australian Bureau of Statistics (ABS) released data on the value of construction work done in Q2 2024, which feeds into the quarterly national accounts.

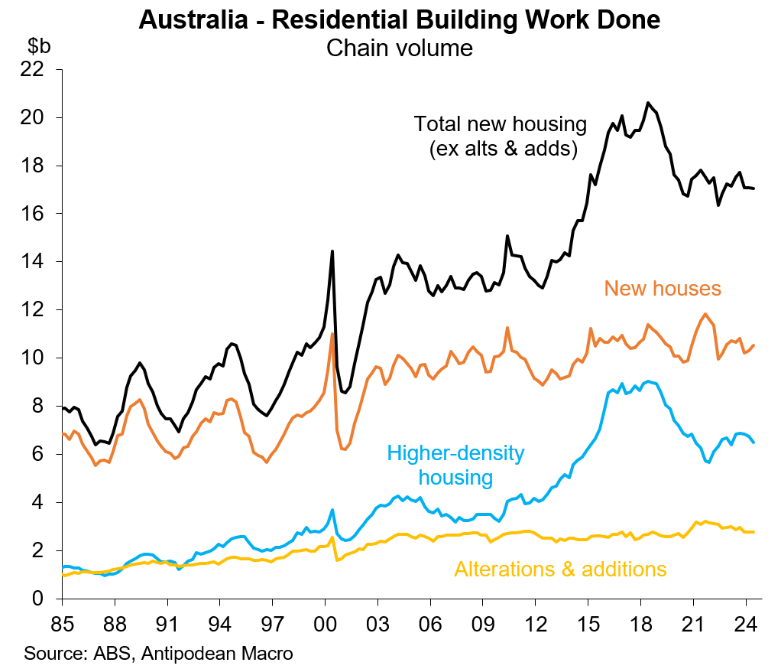

Residential construction activity fell by 0.1% over Q2 to be 2.9% lower year-on-year.

The following chart from Justin Fabo at Antipodean Macro shows that higher-density home construction (-4.2% QoQ) weakened significantly, whereas new house construction rose by 2.4% over the quarter:

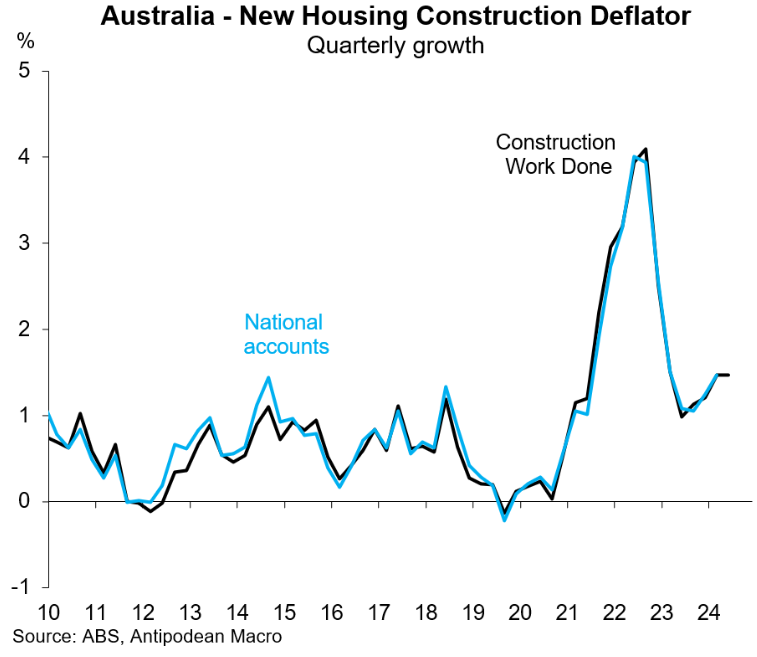

The decline in the value of housing construction work done has been less than the decline in dwelling completions because the cost of building homes has increased significantly since the onset of the pandemic:

The headwinds facing homebuilders and the Albanese government’s housing targets are well known, including:

- Interest rates are at a 12-year high, dampening buyer demand and raising developer financing costs.

- Construction costs have risen by around 40% since the onset of the pandemic.

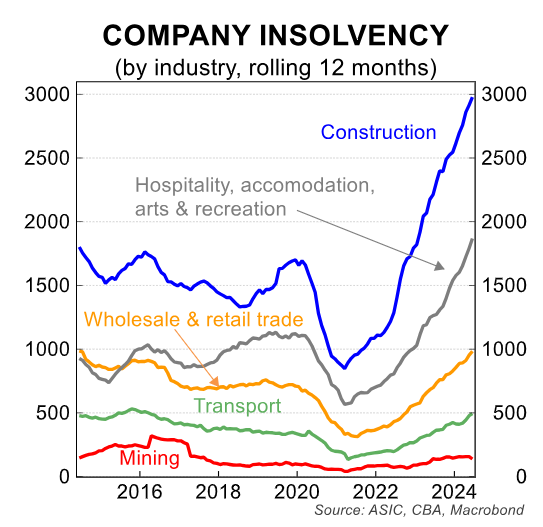

- Thousands of construction firms have gone bust, many of which were homebuilders (see below chart).

- Homebuilders are competing for materials and labour against government ‘big build’ infrastructure projects.

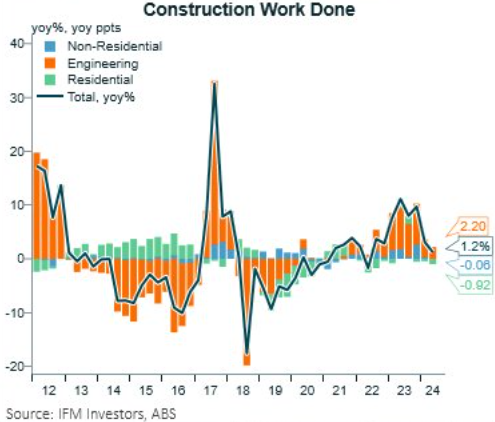

Finally, as illustrated in the following chart from Alex Joiner at IFM Investors, real residential construction will be a drag on Q2 GDP, which is looking like a very soft result:

Australia’s per capita recession will roll on with a sixth consecutive quarterly decline.