The headwinds facing Australian brick-and-mortar retailers continue to build.

The latest insolvency data from the Australian Securities and Investments Commission (ASIC) shows that 768 retailers became insolvent in the 2023–24 financial year, up from 540 in 2022–23 and 319 in 2021–22.

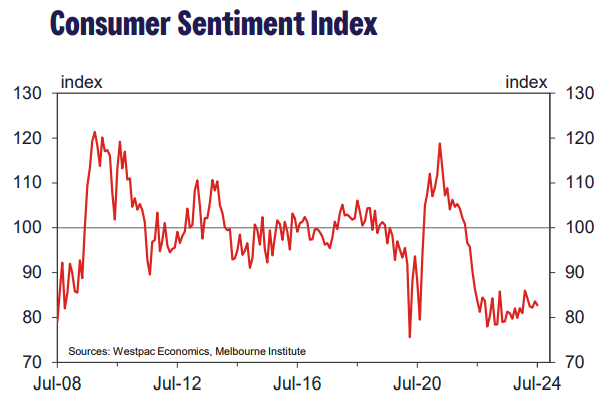

Consumer sentiment is firmly stuck at recessionary levels:

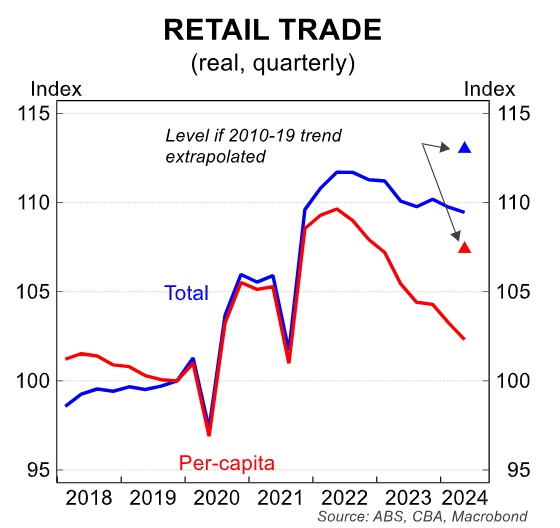

Retail sales volumes have also fallen sharply.

Wednesday’s retail sales release by the ABS showed that total retail sales volumes fell by 0.3% over the quarter to be down 0.6% year-on-year.

The annual change has now been negative for the last five quarters. Outside of the pandemic, in only four other quarters has the annual growth been negative dating back to the 1980s.

Even worse, retail volumes on a per capita basis (-0.9%) declined for an eighth consecutive quarter, down 3.0% compared to the same time last year.

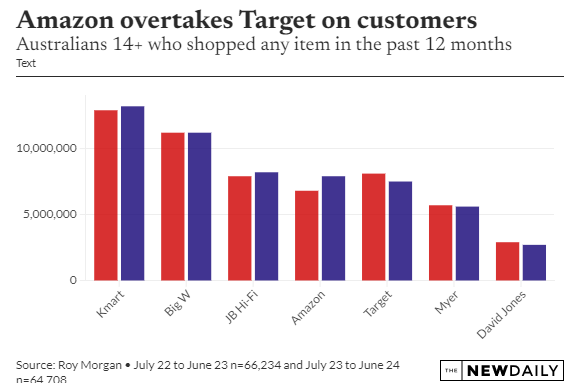

Traditional brick-and-mortar stores face increasing competition from online merchants such as Amazon and eBay, which provide better convenience and lower pricing.

Amazon entered the Australian market in December 2017 and has since expanded its footprint. It provides competitive prices and unparalleled convenience, with items generally delivered free to your door within 48 hours if you have an Amazon Prime account.

Earlier this year, Amazon announced it would expand its operations and distribution base in Australia.

New data from Roy Morgan, published in The New Daily, shows that Amazon’s customer base increased by 16% in the year ending June 2024, with 1.1 million more people utilising the platform than the previous year.

Retail Doctor Group CEO Brian Walker believes Amazon is on its way to becoming Australia’s most extensive variety retailer, alongside Kmart and Big W.

“Amazon could be [among] Australia’s largest general merchandise retailers within the next five years”, Walker said.

“You’re in the gun barrel of them if you haven’t got a competitive offer that doesn’t rely on speed, range, price or convenience”.

Walker added that some retailers, including the recently shuttered Booktopia, are already buckling under the pressure.

Amazon’s Prime program offers customers fast, free delivery after paying a low annual subscription fee, incentivising them to purchase from Amazon.

It also provides consumers access to Prime subscription television, a scaled-down version of Netflix.

From Amazon’s standpoint, the Prime subscription provides a continuous revenue stream and ensures customers do not look elsewhere, making significant investments in fulfilment centres more feasible.

Amazon currently controls American retail (together with Walmart) and will eventually rule Australia. The writing was on the wall.

Australian customers will prioritise value and convenience over anything else. And Amazon has both ingredients in spades.