Reserve Bank of Australia (RBA) governor Michele Bullock warned last week that a further deterioration in the Chinese economy could smash national income via a collapse in the iron ore price.

“Developments in China can have quite a big impact on the way our trade develops, and therefore on our growth”, Bullock told the House of Representatives standing committee on economics on Friday.

“China is really important for us because of our trade relationship … It’s our biggest trading partner, and it’s very important in particular for the prices of the commodities that we export, in particular iron ore”.

Economist Chris Richardson also warned that the “jig is up” for iron ore prices and, ergo, the federal budget.

“Spot prices for the likes of iron ore are falling, and chances are that there’s worse to come”, he told AFR Weekend.

Richardson estimates that every $US10 decline in iron prices results in a corresponding $10 billion drop in national income, with the government bearing a major portion of the cost in the form of lower taxes on mining-sector profits.

“It was never going to be a forever boost to our incomes”, he said. “China has built too much, and relied too much on debt to do so. And its government has been keen to move away from an overreliance on property to drive its growth”.

“New iron ore supplies from the rest of the world and an expectation that China will be able to shift to using its own scrap metal are reasons to expect that the glory days can’t last forever”, he said.

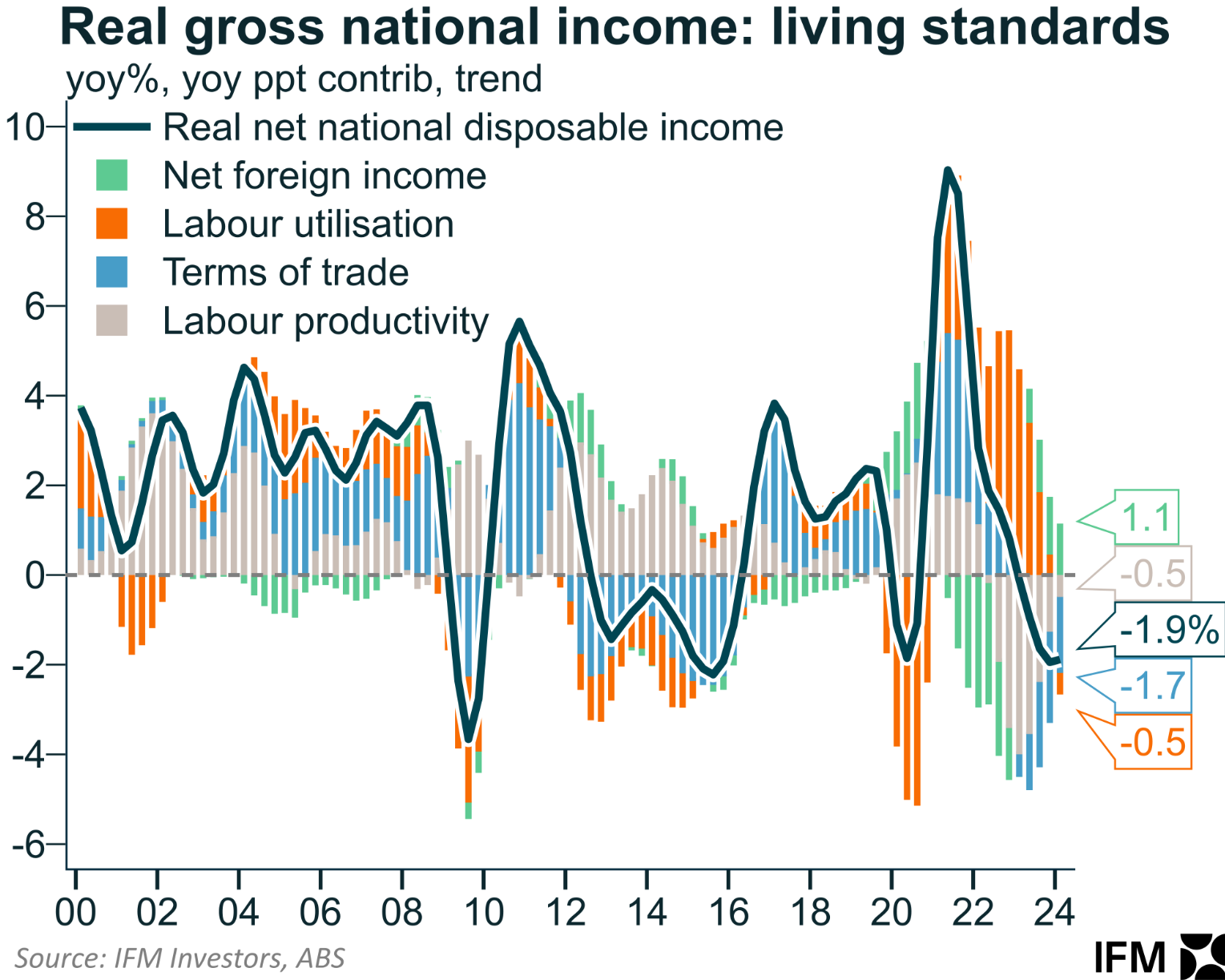

IFM chief economist Alex Joiner posted the following chart on Twitter (X) showing that “Australia has experienced a marked reversal in the terms of trade before with the unwind of the first resources price boom and the consequent fall in living standards”:

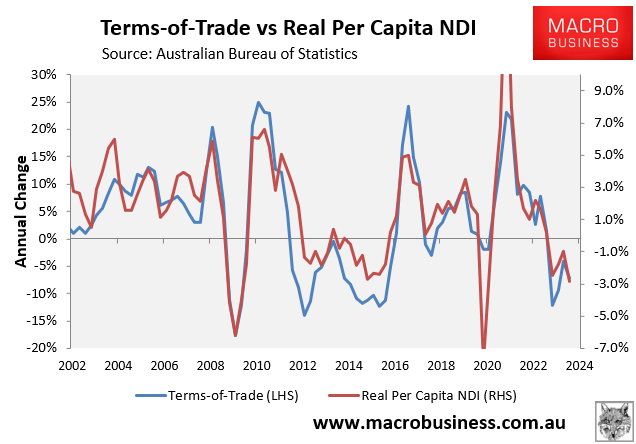

Indeed, the next chart shows that real per capita national disposable income (NDI) has tracked the change in the terms-of-trade:

The projected decline in federal tax revenue is especially problematic given that the cost of the NDIS is projected to grow from just over $40 billion currently to around $100 billion in a decade:

No doubt the federal government’s solution will be to import more migrant taxpayers.