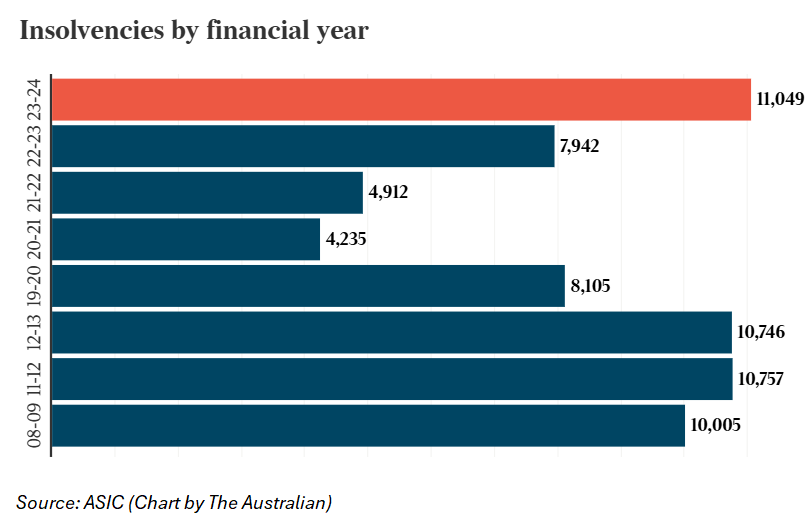

Data from the Australian Securities and Investments Commission (ASIC) revealed a record 11,049 corporate collapses in 2023–24:

Persistent inflation, high interest rates, and the Australian Taxation Office pursuing tax debts were blamed for the 40% increase in corporate insolvencies in 2023–24.

“The usual suspects of inflation, interest rates and sentiment are influencing insolvencies”, Ashurst restructuring and insolvency partner Michael Sloan said.

“SMEs are facing a more trenchant ATO which is no longer amenable to effectively financing struggling businesses”.

“Property financiers are seeing increased volumes of distressed developments. The health sector is facing its own economic malaise”.

Restructuring experts warn that insolvencies will continue to mount.

“I suspect we will see the current trend continue over the next 12 months as economic pressures impact consumer and household sentiment”, said Kathy Sozou, McGrathNicol partner and vice president of the Australian Restructuring Insolvency and Turnaround Association.

“Unless inflation is controlled and interest rates decline, with growth also starting to stall, one can confidently say that this year will continue to be busier in the number of insolvencies with more smaller businesses failing all the way through to the end of the year and into 2025”, Clayton Utz restructuring and insolvency partner Jennifer Ball said.

Meanwhile, separate data from ASIC shows that 1,424 companies appointed restructuring specialists in 2023–24. This is almost 219% higher than the previous financial year.

The data also shows that 36 companies appointed restructuring experts in the first three weeks of 2024–25, compared with just 36 for the same period in 2023–24.

Insolvency Australia director Gareth Gammon says the figures are “astonishing but not surprising”, given factors such as the cost-of-living crisis, high interest rates, and the ATO’s aggressive policy regarding the collection of outstanding debts.

“The ATO has gone into overdrive to collect debts, particularly from small businesses – and directors are faced with the ongoing cost-of-living crisis, the spectre of higher interest rates due to stubbornly high inflation, and micro- and macroeconomic and political headwinds”, he said.

“It has resulted in a surge in court-initiated windings-up, but conversely it has also prompted more directors to take action to save their businesses”.

The above is another sign of Australia’s per capita recession.

While the overall economy may still be expanding slowly amid rapid population growth (immigration), individual households and businesses are finding it increasingly tough.