DXY is melting:

AUD was fat-fingered into the abyss and then bounced. Beware a market that likes to fill the gaps:

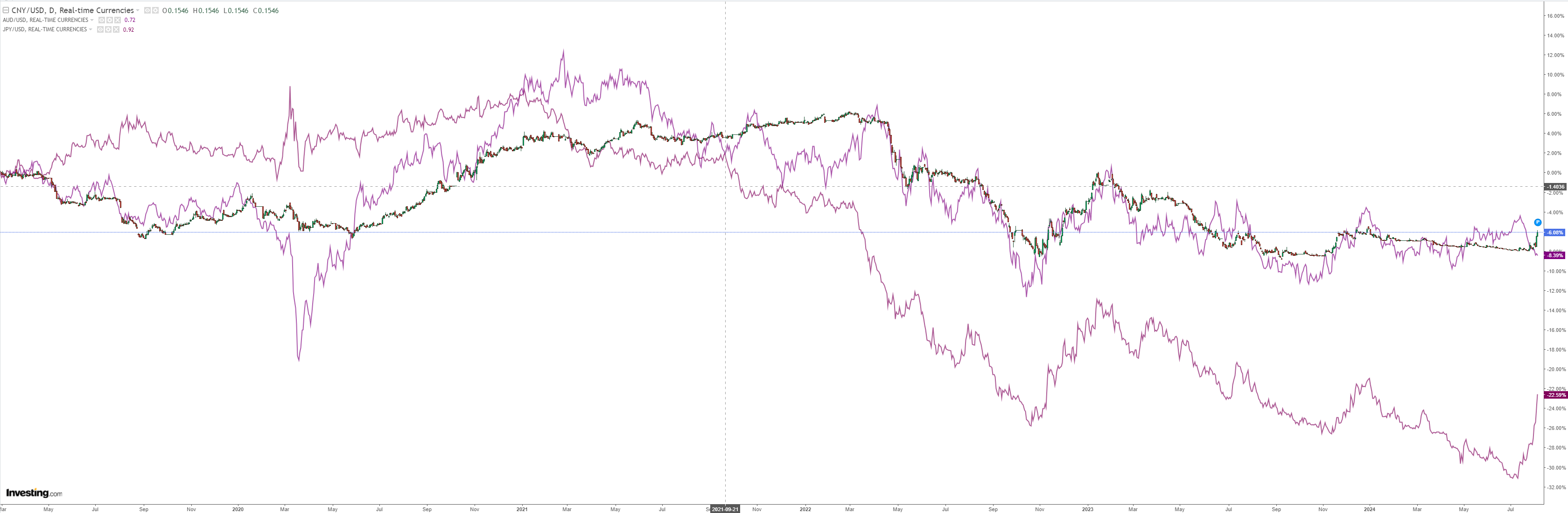

JPY is ballistic. CNY must have a carry trade:

Oil broke then recovered:

Metals just broke:

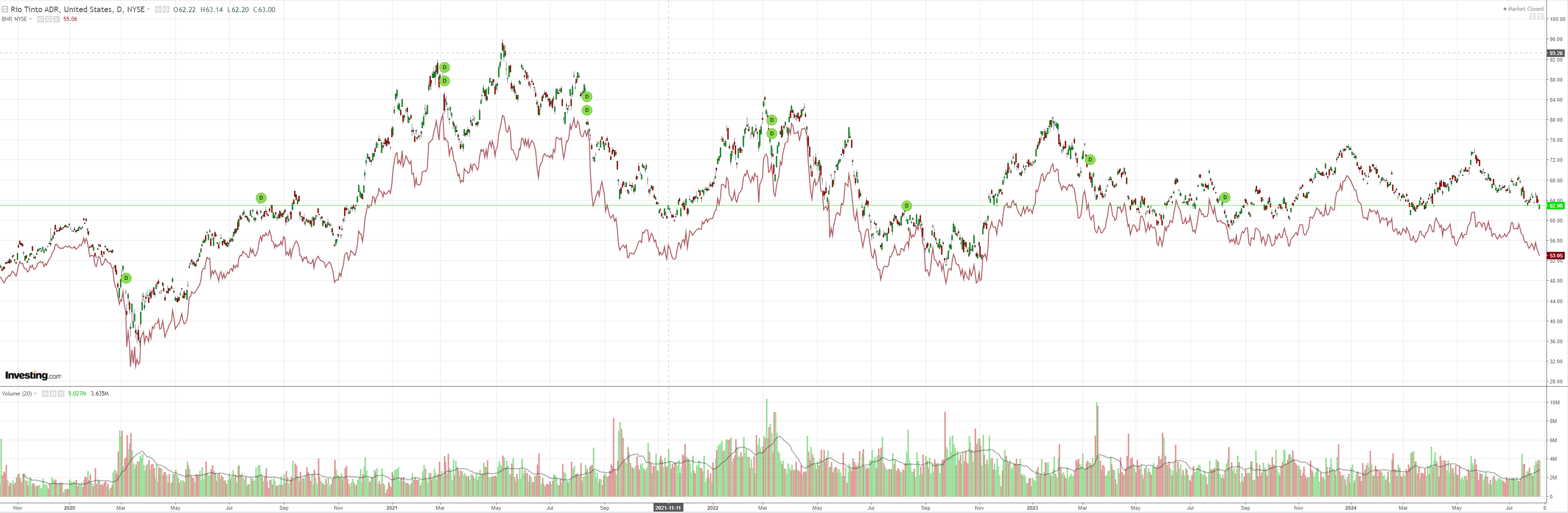

Big miners too:

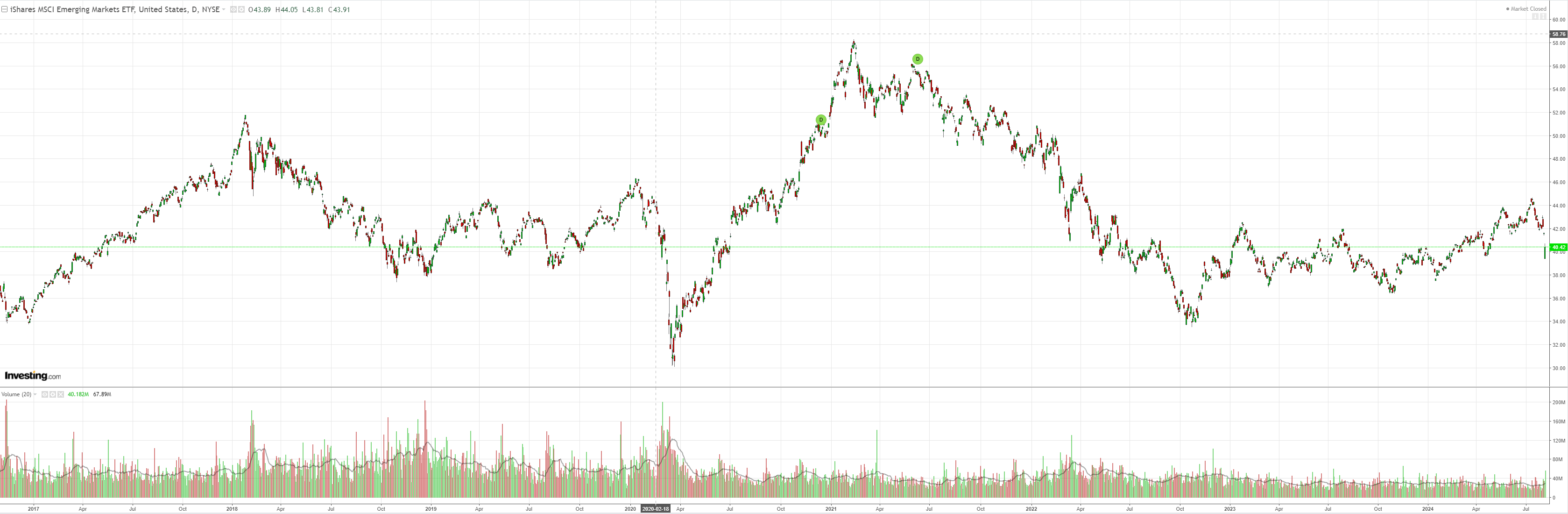

EM whoa!

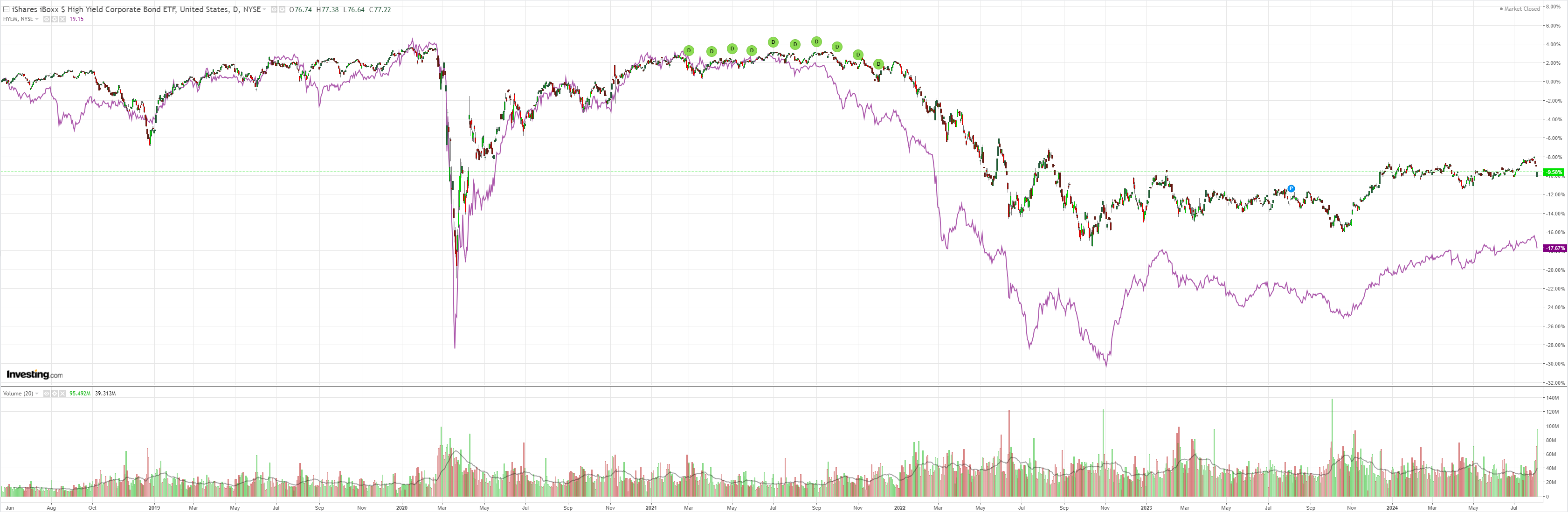

Junk snapped but it’s not recessonary…yet:

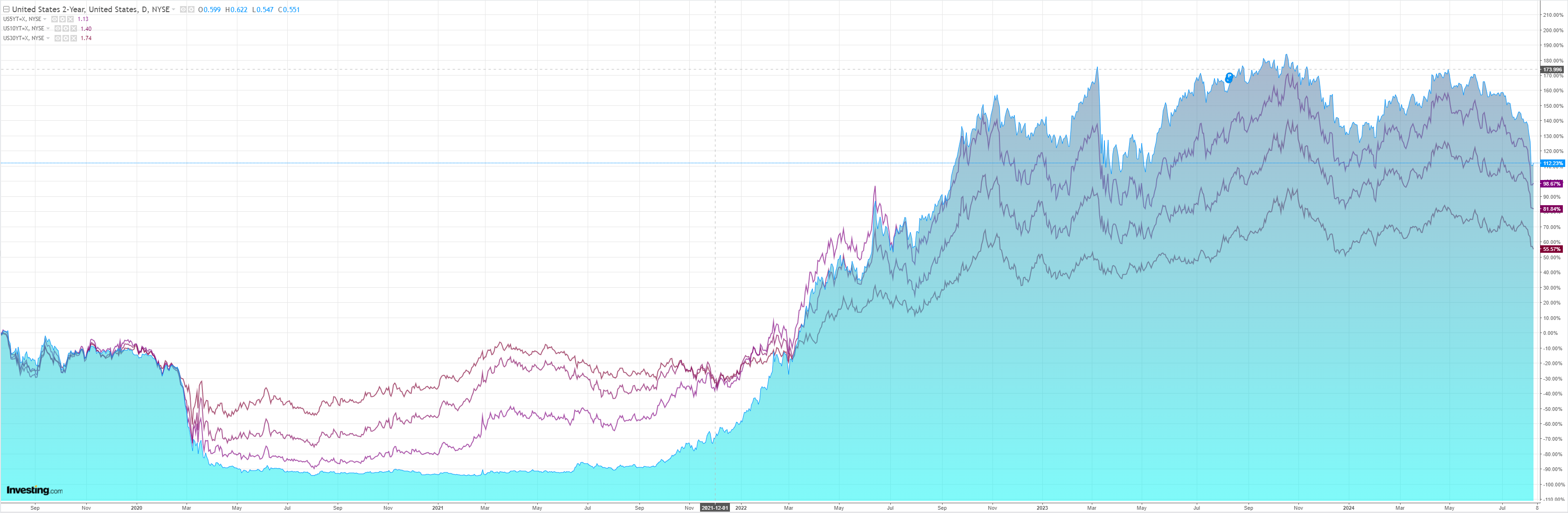

Bond boom!

Stocks bust! Erasing a mighty three months of price gains…

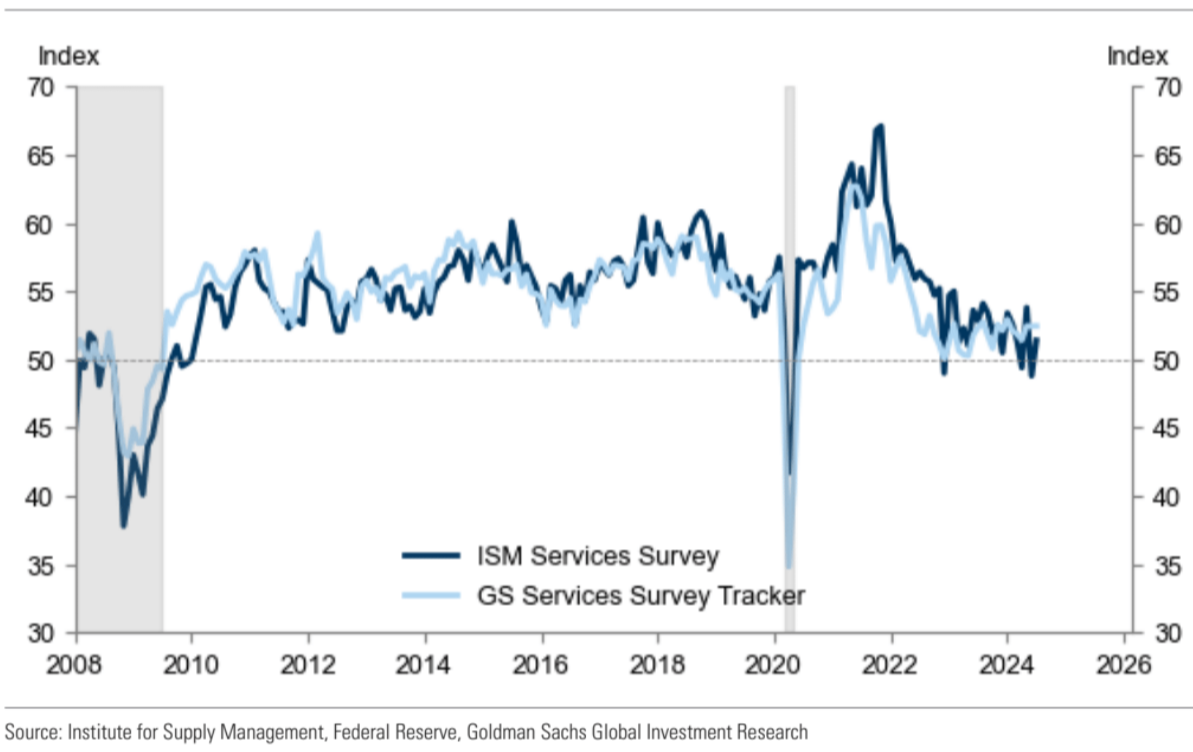

The evening’s trade might have been a lot worse had the US services ISM not come in at a reasonable 51.4:

So far, this is a garden variety vol-reversion correction driven by the uncertainty of the election, Fed cuts and Chinese crisis.

We haven’t even got a bid into DXY here so the panic is minor.

The jibber-jabber about the end of the Japanese carry trade is hysteria. Japan doesn’t owe anybody else any money and the rocketing JPY will end inflation in 3,2,1…minutes…

Nor is the volatility enough to trigger inter-meeting Fed cuts, unless or until something systemic breaks, which is always a possibility when such large positions suddenly reverse.

So far, the correction isn’t even enough to deliver a 50bps cut in September. And if the Fed wants to kill inflation stone dead, it can do it by sitting on its hands and watching oil capitulate over the next few weeks.

Which makes me wonder if markets won’t keep selling until 50bps is a certainty.

AUD be damned!